Pandemic concerns recede, while rising prices drive value-driven purchases across SE Asia – Ipsos study

- 66% of Filipinos are expecting a stronger economy in their local area for the next six months.

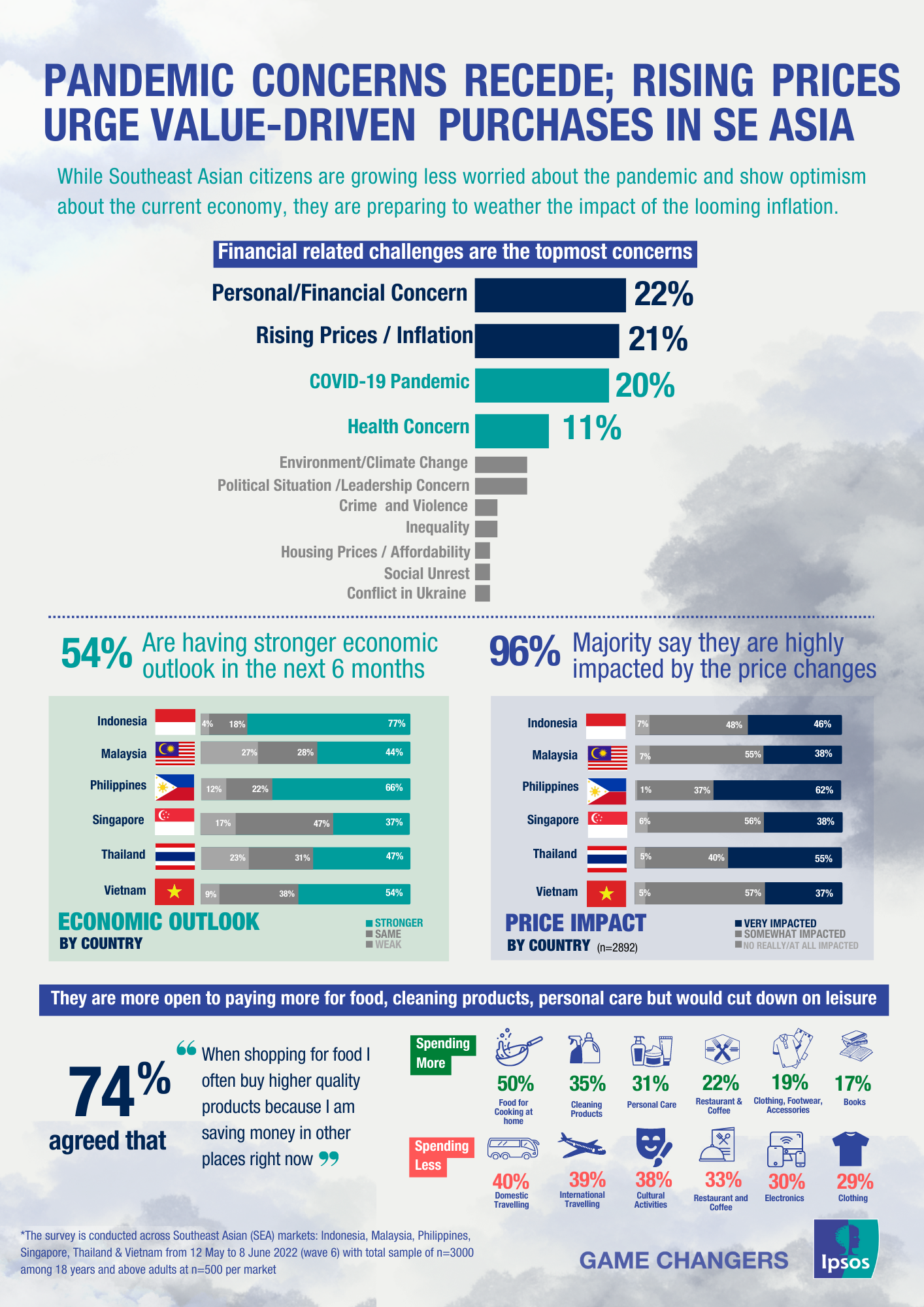

- Consumers believe the economy is in better shape compared to 2021 but inflation has overtaken COVID-19 as the biggest worry

- More than half of the Southeast Asians surveyed are optimistic about the economy

- 96% of SEA citizens claim to be heavily impacted by price changes

31 August 2022—The majority (71%) of Southeast Asian (SEA) consumers are less concerned about COVID-19, however, inflation has overtaken the pandemic as their biggest worry despite most economies performing better compared to 2021, a new Ipsos survey reveals. The Ipsos SEA Ahead survey ran across the SEA markets of Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam during May and June.

SEA has experienced strict and lengthy lockdowns, low vaccination rates, and a disrupted supply chain for the past two years. But now, SEA citizens are more eager to socialize with increasing vaccination numbers and the tourism rebound. The majority have expressed confidence in dining in restaurants (74%), visiting family/friends (77%), and participating in cultural gatherings/events (77%). In the Philippines, 70% were comfortable dining in restaurants, 77% visiting family/friends, and 46% participating in gatherings.

While most citizens start to revert to their pre-pandemic ways, some behaviors adopted during the pandemic persist including being more health conscious and using online shopping. Across SEA (87%) proactively manage their health and wellness through food and beverage choices, while 85% buy products that support their physical and mental health and wellbeing. For example, 40% are using less e-cigarettes and 35% consuming less alcohol. In Vietnam, 51% are consuming less alcohol after recovering from the Covid-19. More people are also shopping online, with 39% saying they shop at a supermarket/hypermarket once a week or more and in the Philippines the figure was 43%.

In line with the rest of the world, concerns have shifted away from the pandemic in Southeast Asia. The COVID-19 pandemic now ranks third in consumers’ top concerns, with personal finances and rising prices or inflation now ranked as the top two concerns. In the Philippines the top three concerns were: personal finances, COVID-19 pandemic, and rising prices or inflation. .

Despite this, the economic outlook remains positive (54%), and consumers seem hopeful that their personal finances will be better (56%).

“Inflation is yet another hurdle we are facing. While Filipinos have exhibited resilience and optimism over the years, it is apparent that both the COVID-19 pandemic and Inflation are points of concern all must address. As Filipinos adapt to the supply chain disruptions and rapidly evolving market, there is a call for both Government and private sectors to work on their empathy muscle and develop a true understanding of Filipino’s needs to better support them and bounce back as one,” said Vicky Abad, Country Manager – Ipsos in the Philippines.

Three in four SEA consumers say rising prices are having a significant impact on their lives. Filipinos say they are “very impacted’ by price increases. Despite this, they continue to spend on necessities such as food, cleaning products, and personal care products and are saving money in other ways. In the Philippines, savings are being made in food, gasoline, and personal care.

Suresh Ramalingam, Ipsos Chief Executive Officer – Southeast Asia, said: “With most of Southeast Asia transitioning to an endemic phase of COVID-19 and coping with inflation, it is more important than ever that leaders exercise resilience and longer-term foresight to adapt to rapid, complex change. Inflationary times are indeed challenging—how are we going to innovate? Adjust pricing strategies? Rethink brand differentiations? Amidst the uncertainties, the way forward requires determining what is right for your consumers, balancing short-term gains and long-term risks, and most importantly, building your empathy muscle to create real connections with them and take relevant actions.”

About the Study

These are some of the findings of 6th Wave of Ipsos SEA Ahead conducted between May 12 and June 3, 2022, across the 6 Southeast Asian Markets: Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam. For this survey, a sample of 500 per market or a total of 3000 for all 6 markets aged 18+ was interviewed. Quotas and weighting were employed to ensure that the sample’s composition reflects that of the respective country’s population according to census parameters. The precision of Ipsos online surveys is measured using a credibility interval. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.