Fintech In Pakistan

Driven by the exponential growth in digital devices and connectivity, consumers are spending more of their time online. This growth of has driven the entrance of multiple players in market offering consumers financial services online.

The global investment in financial technologies is expected to reach $46 Billion by the year 2020. The impact of FinTech will be felt across all financial services such as Retail Banking, Wealth/Asset Management, Stock Markets and Exchanges, Insurance, Payments and Transactions, Lending and Finance.

While e-commerce has been the driving force behind it, this phenomenon is not limited to the it. More and more players are offering solutions to consumers myriad financial needs beyond payments and banking.

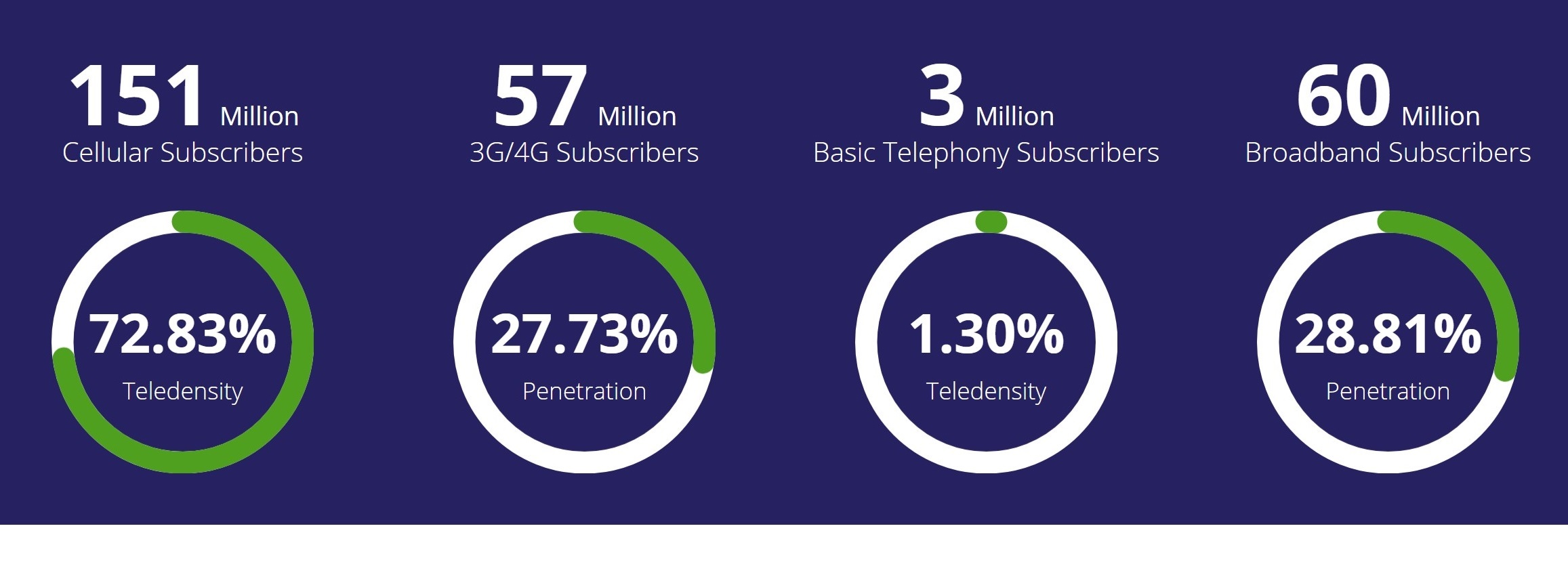

Pakistan has seen a dramatic increase in mobile broadband penetration over the past five years with internet penetration at 30%

In Pakistan’s first comprehensive study on the financial technology sector we discover consumer attitudes to this emerging sector across the following;

In Pakistan’s first comprehensive study on the financial technology sector we discover consumer attitudes to this emerging sector across the following;

1. Understanding Current Consumer Financial Habits & Needs

2. Assessing Consumer Appetite and Usage of FinTech Services

3. Assessing Consumer Perceptions and Attitudes Towards FinTech Providers

4. Measuring current perceptions towards the banking industry vs. non-traditional financial service providers.

To see these and many other findings on the FinTech sector in Pakistan subscribe to our report.

Contact:

Email: [email protected]

Phone: +92 345 822 0282