Global consumer sentiment growth has nearly halted

Washington, DC, August 20, 2021 — Ipsos’s Global Consumer Confidence Index is now reading at 48.5, up just 0.2 point from last month. The August reading is the first since March not to show a significant month-on-month growth. Global consumer sentiment growth has slowed to a near halt as it regained its level of the days before the World Health Organization declared the coronavirus a global pandemic in March 2020.

The Global Consumer Confidence Index is the average of 24 countries’ National Indices. It is based on a monthly survey of more than 17,500 adults under the age of 75 conducted on Ipsos’ Global Advisor online platform. This survey was fielded between July 23 and August 6, 2021.

The world’s two largest economies display a significant decline in consumer confidence as the United States’ National Index dropped by 2.3 points since July and China’s by 1.7 points. Only three of the 24 countries surveyed show significant growth in their National Index over the last month: Spain (+2.0), India (+2.0), and Poland (+1.7).

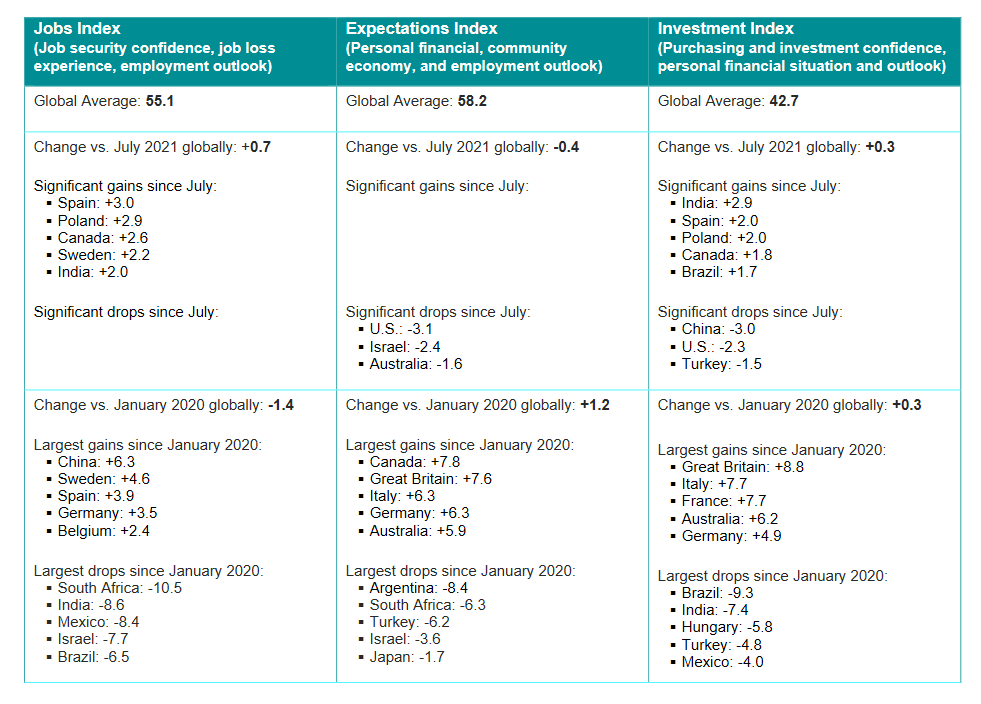

At a global level, the Jobs Index continues to see a significant level of month-on-month growth (+0.7 point), but the Investment Index is up by only 0.3 point and the Expectations Index is down by 0.4 point.

National Index Trends

Nearly unchanged from last month (+0.2 point), the Global Consumer Confidence Index reads at 48.5 — exactly the same level as in March 2020 and 0.1 point less than in the early days of January 2020 before COVID-19 had spread across the globe.

- This month, 9 countries have a National Index above 50: China (71.6), Saudi Arabia (64.5), Sweden (59.7), the U.S. (59.7), Germany (58.5), Great Britain (55.8), Australia (54.9), Canada (54.4), and India (52.9).

- Turkey (28.7) and South Africa (34.1) are the only countries with a National Index below 35.

- Spain (+2.0) and India (+2.0) display the most growth from last month, though Spain remains below the average of 48.5 by two points. The only other country to see a significant gain is Poland (+1.7), but it also remains below the global country average by 2.9 points.

Jobs, Expectations, and Investment Index Trends

The global Jobs Index is up by 0.7 point from July while the Expectations Index is down by 0.4 point and the Investment Index is barely changed (+0.3 point). No country shows a significant increase or decrease (at least +/- 1.5 points) across all three sub-indices. However, the U.S. shows significant drops in both its Expectations and Investment indices, while four countries (Canada, India, Poland, Spain) see significant gains in both their Jobs and Investment indices.

- The global Jobs Index is up 0.7 point from July 2021 and currently sits at 55.1. This is the eighth consecutive month of growth in global sentiment about employment security and outlook, but it is still below the March 2020 reading (57.0), and it remains 1.4 points below its reading of January 2020 (56.4). Spain, Poland, Canada, Sweden, and India display the largest gains, while no country shows a significant month-over-month loss in the measure.

- After three months of significant gains, the global Investment Index currently sits at 42.7 (+0.3 since July 2021). India, Spain, Poland, Canada, and Brazil see significant month-on-month gains while China, the U.S., and Turkey see a significant drop from last month.

- The global Expectations Index sits at 58.2 (-0.4 from July 2021). Expectations in the U.S., Israel, and Australia are down significantly since last month while no country shows any significant month-on-month gain. Expectations remain significantly lower than their January 2020 level in six countries: Argentina, South Africa, Turkey, Israel, Japan, and India.

About the Study

These findings are based on data from Refinitiv/Ipsos’ Primary Consumer Sentiment Index (PCSI) collected in a monthly survey of consumers from 24 markets via Ipsos’ Global Advisor online survey platform. For this survey, Ipsos interviews a total of 17,500+ adults aged 18-74 in the United States of America, Canada, Israel, Turkey, South Africa; and age 16-74 in all other markets each month. The monthly sample consists of 1,000+ individuals in each of Australia, Brazil, Canada, China (mainland), France, Germany, Italy, Japan, Spain, Great Britain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Hungary, India, Israel, Mexico, Poland, Russia, Saudi Arabia, South Africa, South Korea, Sweden, and Turkey.

Data collected each month are weighted so that each country’s sample composition best reflects the demographic profile of the adult population according to the country’s most recent census data. Data collected each month are also weighted to give each country an equal weight in the total “global” sample. Online surveys can be taken as representative of the general working-age population in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, Poland, South Korea, Spain, Sweden, and the United States. Online samples in Brazil, mainland China, India, Israel, Mexico, Russia, Saudi Arabia, South Africa, and Turkey are more urban, more educated, and/or more affluent than the general population and the results should be viewed as reflecting the views of a more “connected” population.

Sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error. The precision of the Refinitiv/Ipsos online surveys is measured using a Bayesian Credibility Interval. Here, the poll has a credibility interval of +/- 2.0 points for countries where the 3-month sample is 3,000+ and +/- 2.9 points for countries where the 3-month sample is 1,500+. Please click here for more information.

The publication of these findings abides by local rules and regulations.

The results reported each month in the Refinitiv/Ipsos’ Primary Consumer Sentiment Index are based only on that month’s data (hence, the base for each country is 500+ or 1,000+) and comparisons are made against results from other months which are also each based on one month’s data. In contrast, the results reported any given month in Ipsos’s Global Consumer Confidence at-a-Glance are based on data collected not only that month, but also during the two previous months and consist of past 3-month “rolling averages”. This technique allows for tripling the sample size for each metric. Hence, the base for any country ranges from 1,500+ to 3,000+. This increases the reliability of the findings and the statistical significance of reported variations over time, However, to heighten the freshness of the findings reported any given month, the data from the same month is given a weight of 45%, the data from the previous month a lesser weight of 35%, and the data from the earliest of the three months an even lesser weight of 20%.

The Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of local economies, personal finance situations, savings, and confidence to make large investments. The PCSI metrics reported each month for each of the 24 countries surveyed consist of a “Primary Index” based on all 11 questions below and of several “sub-indices” each based on a subset of these 11 questions. Those sub-indices include an Expectations Index; Investment Index; and, Jobs Index.