Australians most nervous globally about AI

Australians are the most nervous about AI of any country globally, Ipsos’ new Global Advisor survey has revealed.

The survey, which examined responses to AI across 31 countries, showed Australia was the top country worldwide to be worried about AI, with 69% of respondents saying they felt nervous about the technology.

Globally, more than half the respondents (52%) said they were nervous about AI – a significant increase on the previous Ipsos survey, conducted 18 months ago.

Just 40% of Australians said they were excited about AI, well below the global average of 54%.

Majorities in all 31 countries expect AI-powered products and services to profoundly change their daily life in the coming years. While there is optimism about time management and entertainment options, there is also widespread concern about negative impacts on employment.

The sentiment is similar in Australia: nearly a third of Australians think AI will replace their current job, while only a quarter of people think AI will be good for the economy; even less (20%) think it will be good for the job market.

Despite a surge in new AI applications, the percentage of Australian adults who say they know or understand the types of products and services that use AI remains well-below the international figures.

Globally, half of respondents said they know what products and services use AI; Australians fell well below that at 38%. Additionally, two in three Australians (59%) said they had a good understanding of AI, which was also below the global average of 67%.

However, one constant across the board is the divide between generally AI-enthusiastic emerging markets and AI-wary high-income countries. Trust and excitement about AI also tends to be higher among younger generations, especially Gen Z, and among those with a higher income or education levels.

In Australia, only 44% of respondents said they trusted AI, and only 38% think it will protect their personal data.

Ipsos Australia Director, David Elliott, said: “Australians are overwhelmingly nervous about the rapid evolution of AI and the impact it will have in the coming years on the domestic economy and the job market. AI has long had an image problem in Australia – people are generally afraid of it, don’t understand it and how it works, and are worried about the safety and security of their personal data. There’s a need for mass education around the technology, particularly its potential in increasing workplace efficiencies and improving day-to-day life.”

These are some of the findings of a survey of 22,816 adults under the age of 75 conducted between May 26 and June 9, 2023, on the Ipsos Global Advisor online survey platform in 30 countries and mostly face-to-face in India. The survey results shed light on the evolving perceptions and expectations of AI among consumers worldwide, revealing both excitement and apprehension about its potential impact on various aspects of life.

Detailed findings

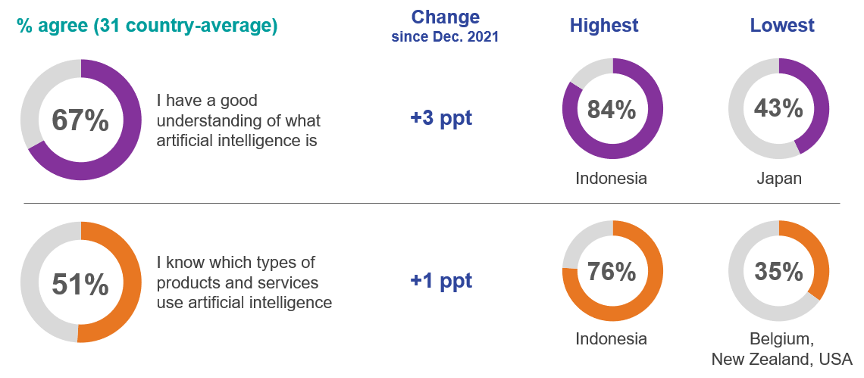

Understanding of AI is still lagging

On average across the 31 countries surveyed, two-thirds (67%) say they have a good understanding of what AI is, but only half (51%) say they know which products and services use AI.

Knowledge of what products and services use AI is higher among younger adults, men, those who are employed, more educated, and/or more affluent. In a typical pattern, familiarity with AI-powered products and services ranges from over 70% in Indonesia and Malaysia to just 35% in Belgium, New Zealand, and the United States.

Reported understanding of AI has increased slightly over the past 18 months, but familiarity with which products and services use AI has barely changed since Ipsos’ previous global survey on AI in December 2021. This suggests that, while AI is becoming more prevalent, there hasn't been a corresponding increase in consumer awareness of the role AI plays in different technologies they use daily.

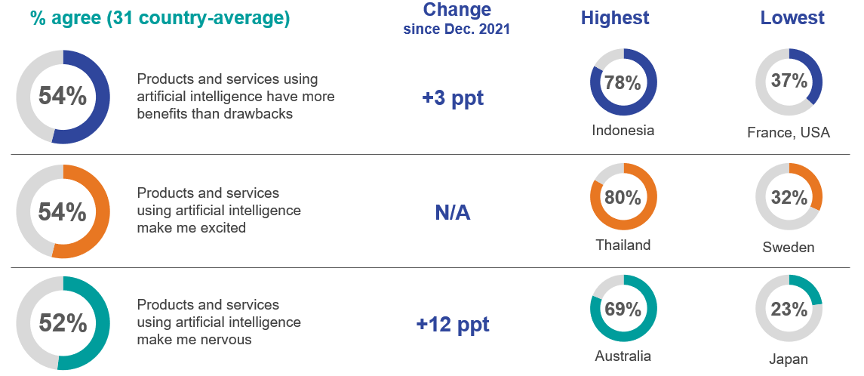

Mixed feelings and increased nervousness

On average across the 31 countries, only about half of respondents agree that AI-based services have more benefits than drawbacks (54%) and are excited about them (also 54%).

However, about the same number (52%) are nervous about AI-based products and services. Across the 24 countries included in both the previous and new surveys, this represents an average increase of 12 percentage points. This suggests that the global public is increasingly concerned about being negatively impacted by AI technology as it evolves.

Excitement about AI is highest in emerging markets and lowest in Europe and North America; it is also higher among Gen Zers and Millennials, as well as the college-educated.

Nervousness is highest in all the predominantly English-speaking countries. It is lowest in Japan, South Korea, and Eastern Europe.

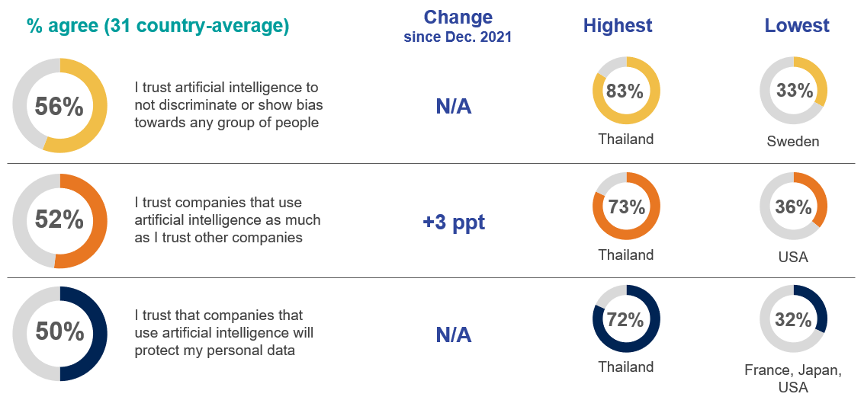

Wide geographic differences in trust

Trust in AI varies widely by region, generally being much higher in emerging markets and among people under 40 than in high-income countries and among Gen Xers and Boomers.

People's trust that companies using AI will protect their personal information ranges from 72% in Thailand to just 32% in France, Japan, and the United States. The percentage of people who trust that AI will not discriminate against groups of people shows an even wider spread across countries.

Just half say AI has impacted their life in the past few years…

Globally, just half (49%) say AI-based products and services have significantly changed their daily lives in the past three to five years, about the same percentage as in December 2021.

In South Korea and across Southeast Asia, the percentage feeling this way is about 35 to 40 percentage points higher than in most countries in Northwestern Europe and North America.

It is also, on average, at least 20 points higher among Gen Zers and Millennials than among Boomers.

…but two in three expect it will soon change it profoundly

On average, 66% agree that AI-powered products and services will significantly change their daily life in the next three to five years, including majorities in all countries (from 82% in South Korea to 51% in France) and all demographic groups (but especially among the more affluent and those with a college education).

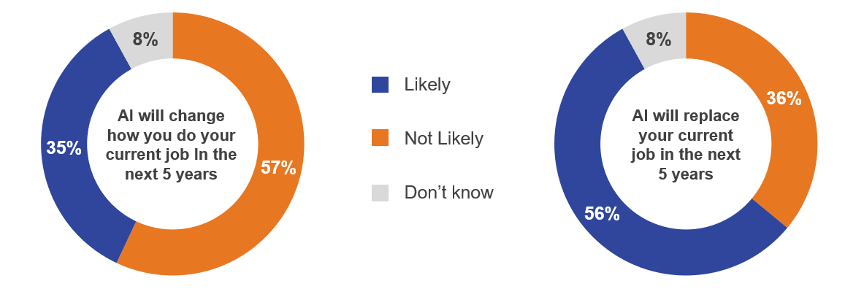

Among workers, 57% expect AI to change the way they do their current job and 36% expect it to replace their current job.

The percentages of workers expecting each type of disruption are highest in Southeast Asia and lowest in Northern Europe (with differences of up to 50 points) and are also much higher among those who are younger and/or decision makers than among those who are not.

Not all changes are expected to be for the better

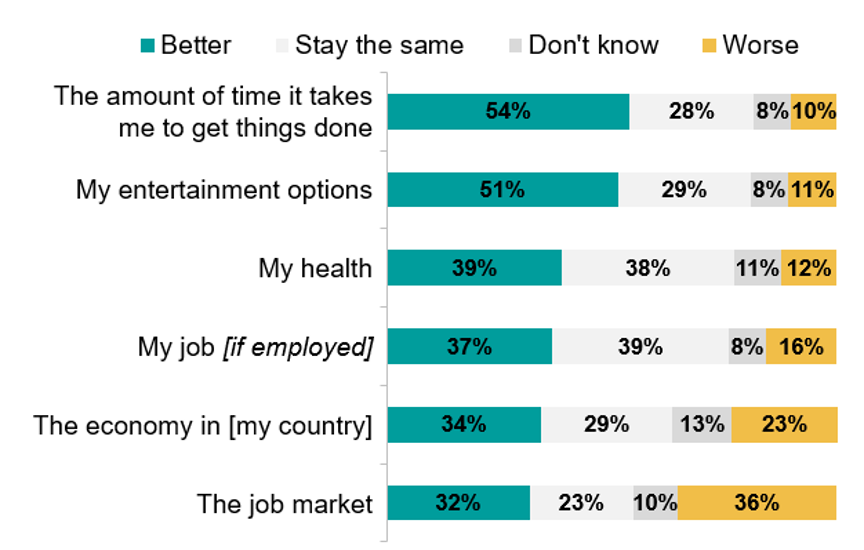

Globally, slightly more than half expect that increased use of AI will give them more time to get things done and improve their entertainment options.

Only one in three or slightly more say it will improve their health, their job, and their country's economy.

More say it will make the job market worse than better.

Again, optimism about AI is much higher in the global South than in high-income countries, and among younger and highly educated adults than among those who are older or have no college education.

About the study

These are the findings of a 31-country Ipsos survey conducted on Ipsos’s Global Advisor online survey platform and, in India, on its hybrid IndiaBus, May 26 – June 9, 2023, among 22,816 adults aged 18 and older in India, 18-74 in Canada, the Republic of Ireland, Malaysia, New Zealand, South Africa, Turkey, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in 20 other countries.

Each country’s sample consists of ca. 1,000 individuals in each of Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, New Zealand, Spain, and the U.S.; and ca. 500 individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Ireland, Malaysia, Mexico, the Netherlands, Peru, Poland, Romania, Singapore, South Africa, South Korea, Sweden, Thailand, and Turkey. The sample in India consists of approximately 2,200 individuals, of whom ca. 1,800 were interviewed face-to-face and 400 were interviewed online.

The samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, New Zealand, Poland, South Korea, Spain, Sweden, and the U.S. can be taken as representative of these countries’ general adult population under the age of 75.

The samples in Brazil, Chile, Colombia, Indonesia, Malaysia, Mexico, Peru, Romania, Singapore, South Africa, Thailand, and Turkey are more urban, more educated, and/or more affluent than the general population. The survey results for these markets should be viewed as reflecting the views of the more “connected” segment of their population.

India’s sample represents a large subset of its urban population – socio-economic classes A, B, and C, in metros and tier 1-3 town classes across all the country’s four zones.

The data is weighted so that each market’s sample composition best reflects the demographic profile of the adult population according to the most recent census data.

The “global country average” or “31-country average” reflects the average result of all the countries where the survey was conducted. It has not been adjusted to the population size of each country or market and is not intended to suggest a total result.

Where results do not sum to 100 or the ‘difference’ appears to be +/-1 more/less than the actual, this may be due to rounding, multiple responses or the exclusion of don't knows or not stated responses.

The precision of Ipsos online polls is calculated using a credibility interval with a poll of 1,000 accurate to +/- 3.5 percentage points and of 500 accurate to +/- 5.0 percentage points. For more information on Ipsos’s use of credibility intervals, please visit the Ipsos website.

The publication of these findings abides by local rules and regulations.