Ipsos Study Reveals Lasting Impact of COVID-19 on Local Population

Latest results from the study showcase the lasting impact of Covid-19 on the Hong Kong population, in terms of everyday behaviours but also its deep financial and psychological impact.

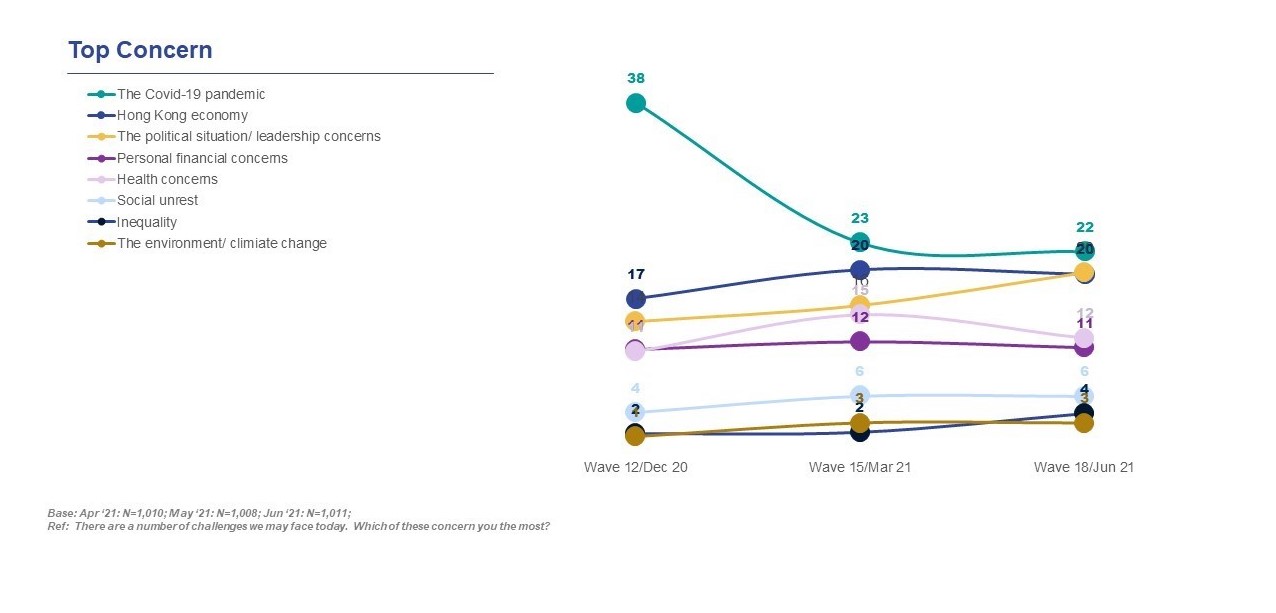

Top Concerns in Hong Kong

While less people in Hong Kong declare that Covid-19 is their main concern (22% in June 2021 against 38% in December 2020), 20% are now worried about the local economy (20%) and 11% about their personal financial concerns. Meanwhile political concerns also seem on the rise again.

Even though it may not be their main worry, 70% of Hong Kong people declare that they still “take Covid-19 risks into account when I think about where I will go, who I will meet and what I will do today” against 84% in December 2020.

Even though it may not be their main worry, 70% of Hong Kong people declare that they still “take Covid-19 risks into account when I think about where I will go, who I will meet and what I will do today” against 84% in December 2020.

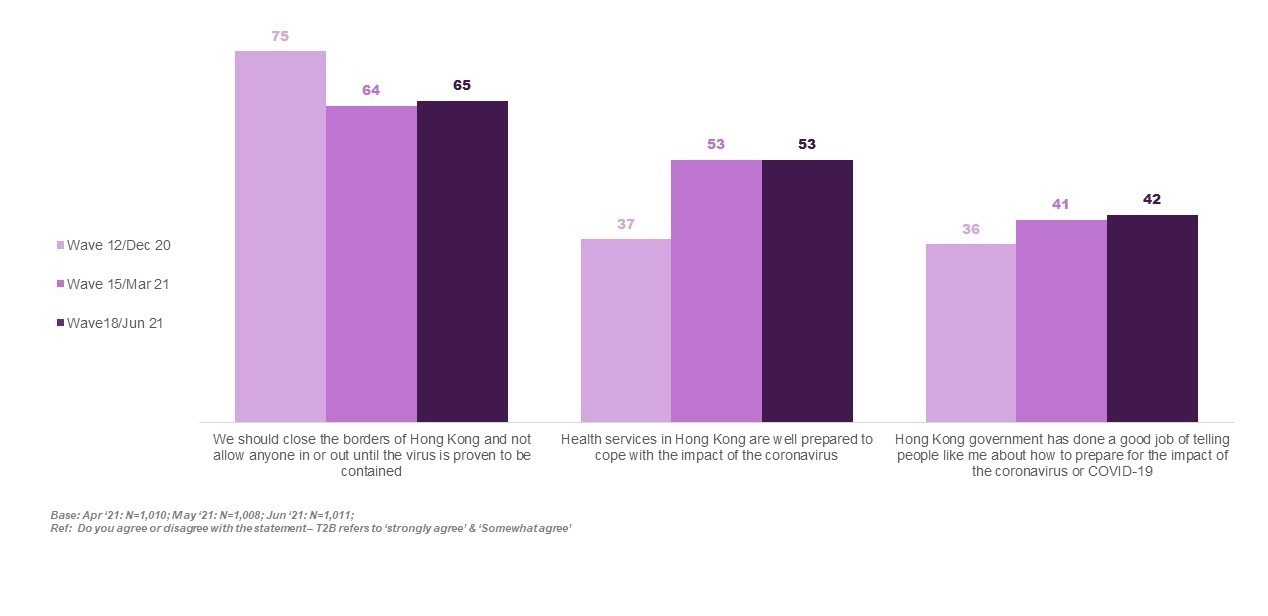

Meanwhile, two thirds of Hong Kong people still prefer to see the borders closed until the virus is fully contained, a stable figure since March. A majority (52%) now also believes that the Hong Kong health services are prepared to cope with the impact of coronavirus, while 4 in ten people now think the government has done a good job in communicating about how to prepare against the virus, a steadily rising number over the past 6 months.

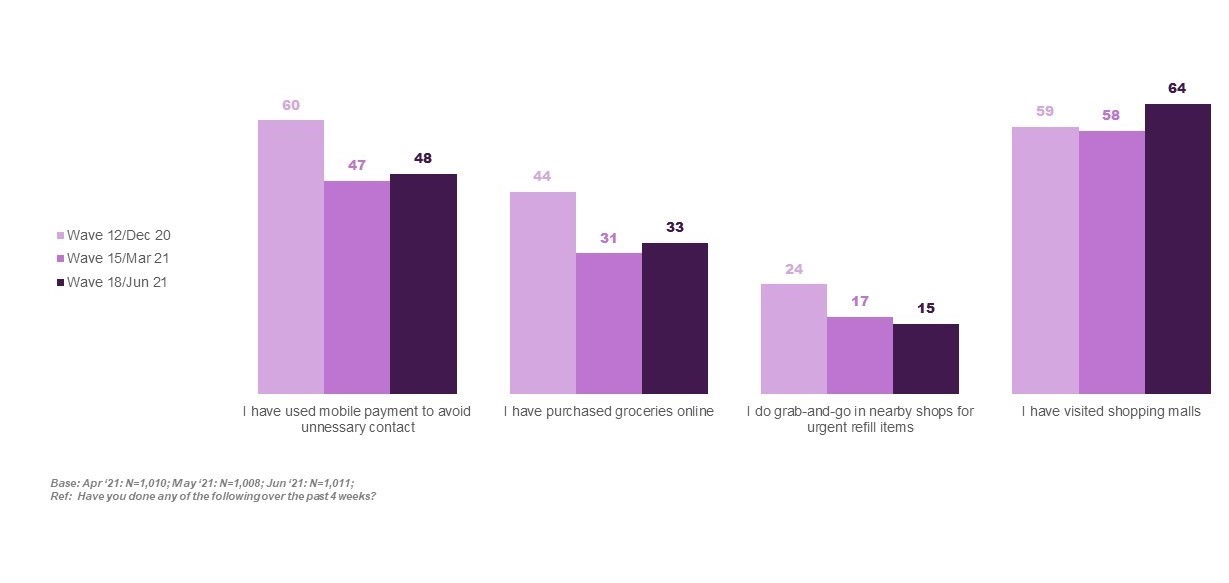

Changing consumption patterns

Looking at consumption trends, we see that a slowly increasing number of people (now 48%) declare using mobile payments to avoid unnecessary contacts (a stabilizing trend after a December 2020 peak) while a third now declare having purchased groceries online in the past month.

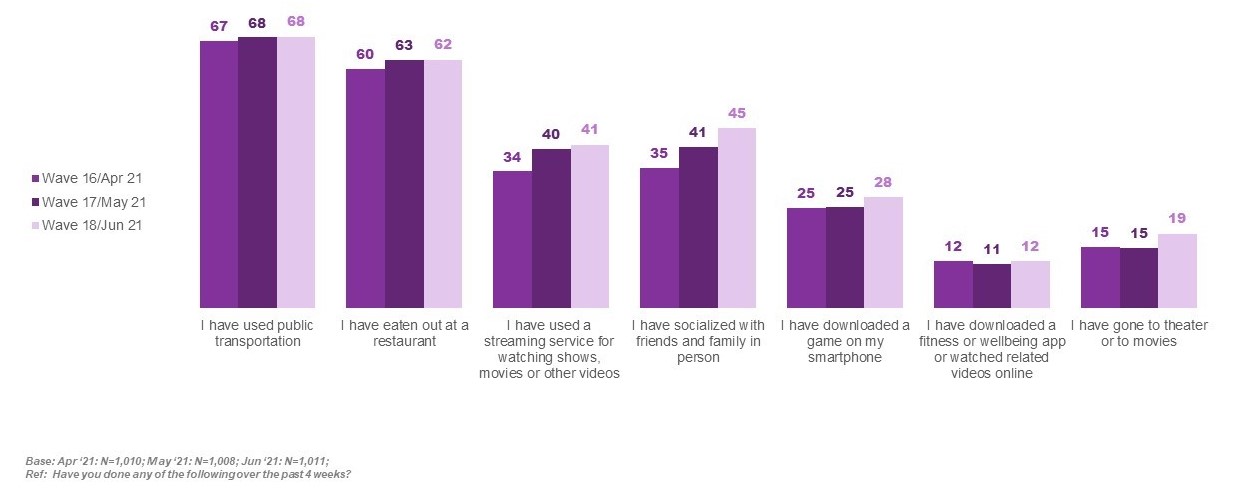

Over two in three meanwhile declare having visited a shopping mall (64%) and 62% have eaten out at a restaurant in the past four weeks.

Meanwhile 45% declare having socialized with friends and family in person in the past month, up from 35% in April and 41% in May. 19% have also gone to the theatre or movies in June (against 15% in May).

Meanwhile 45% declare having socialized with friends and family in person in the past month, up from 35% in April and 41% in May. 19% have also gone to the theatre or movies in June (against 15% in May).

Lasting Financial Impact

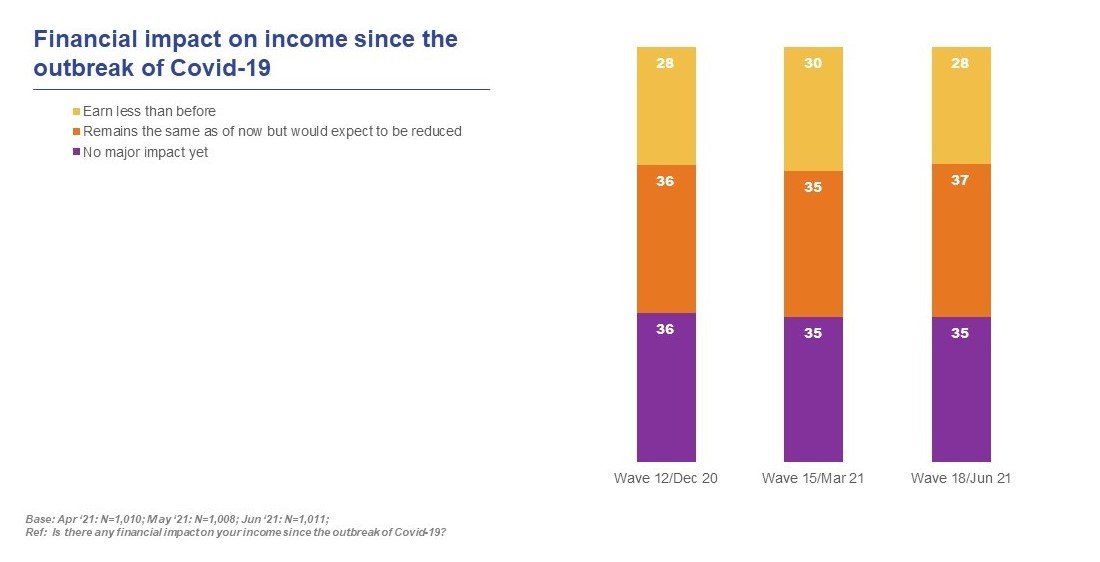

The Financial impact of Covid-19 remains important: 28% say they earn less than before, a stable number since December 2020, with only 35% unaffected.

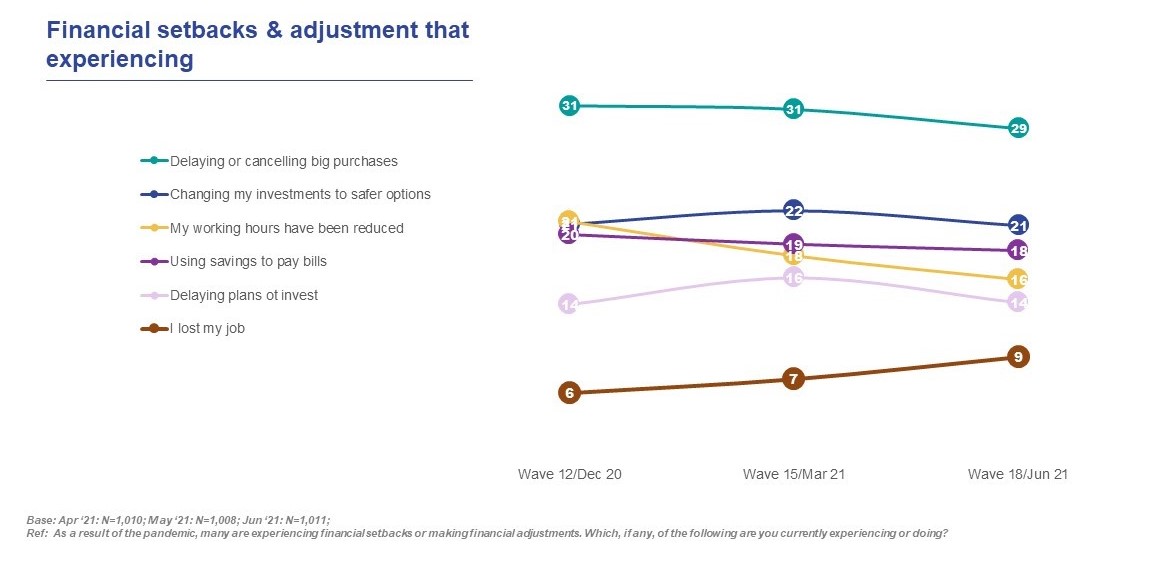

29% said in June that they still considered delaying or cancelling big purchases, getting back to December levels (30%) after a small improvement in March (26%).

16% say they working hours have been reduced, while 9% say they have lost their job, the highest level in six months. 18% declared using their savings to pay their bills, a stable number since March.

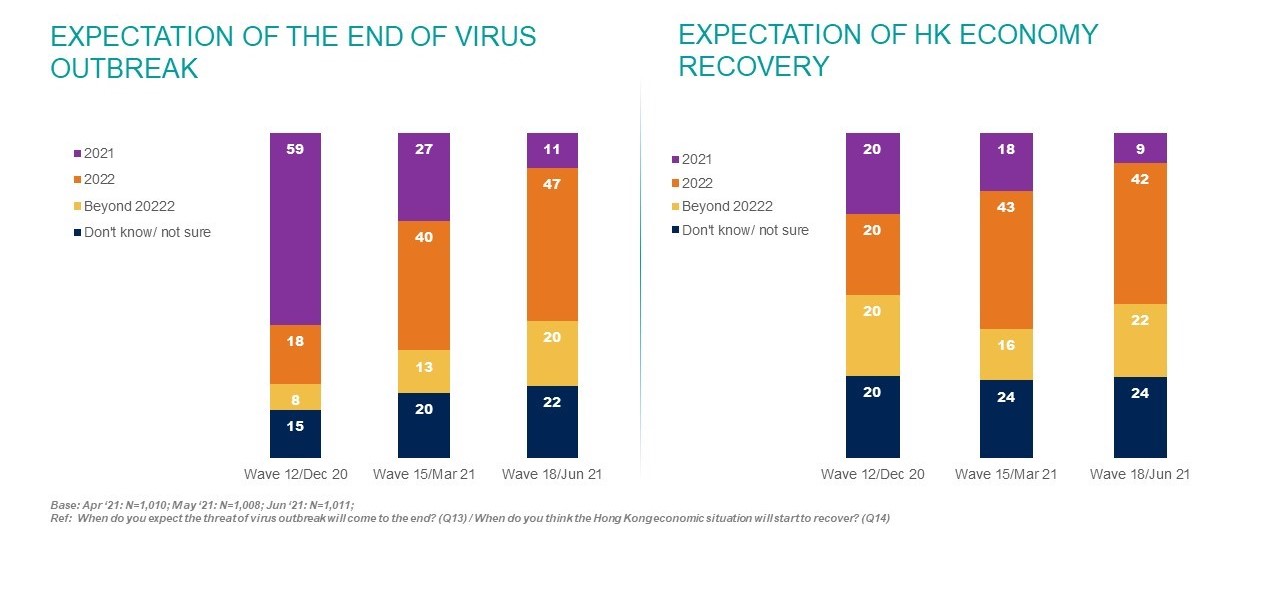

Expectations regarding the end of Covid-19 and economic recovery remain rather pessimistic. Only 11% foresee an end of the epidemic in 2021, against 47% expecting it in 2022 and 20% even beyond that.

By contrast, back in December 2020, 59% thought the epidemic would end in 2021. Meanwhile only 9% expect an economic recovery in Hong Kong this year, with 42% expecting in 2022 and 22% beyond that.

About this survey

The Hong Kong New Normal Tracking Study measures changes in consumer behavior across multiple categories, in reaction to the COVID-19 pandemic. The Study is in field monthly since March 2020. June 2021 wave administered in Hong Kong via online survey of 1,000 people representative of the general adult population, from 25 to 28 June 2021.