[Press Release] What Worries Indonesia 2025

Indonesian Consumer Confidence Weakens: Corruption, Unemployment, and Social Inequality Top Public Concerns

Jakarta, 31 October 2025 – Ipsos, a leading global market research company, has released its latest report titled Ipsos What Worries Indonesia H1 2025, revealing growing public concern about Indonesia’s economic and social conditions amid global uncertainty. The report highlights corruption, unemployment, and social inequality as the three main issues most concerning Indonesians in the first half of the year.

Based on a survey of more than 25,000 respondents across 30 countries, 68% of Indonesians cited financial and political corruption as their top concern, followed by unemployment (55%) and social inequality (47%). These levels are significantly higher than the global average.

“Indonesians remain more cautious about the economy and the job market, reflecting declining optimism regarding their personal financial situation,” said Hansal Savla, Managing Director of Ipsos Indonesia. “However, Indonesians continue to demonstrate resilience and optimism that remains higher than the global average.”

Economic Optimism Declines, Financial Anxiety Grows

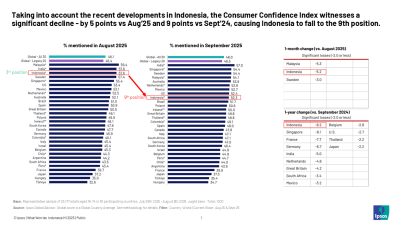

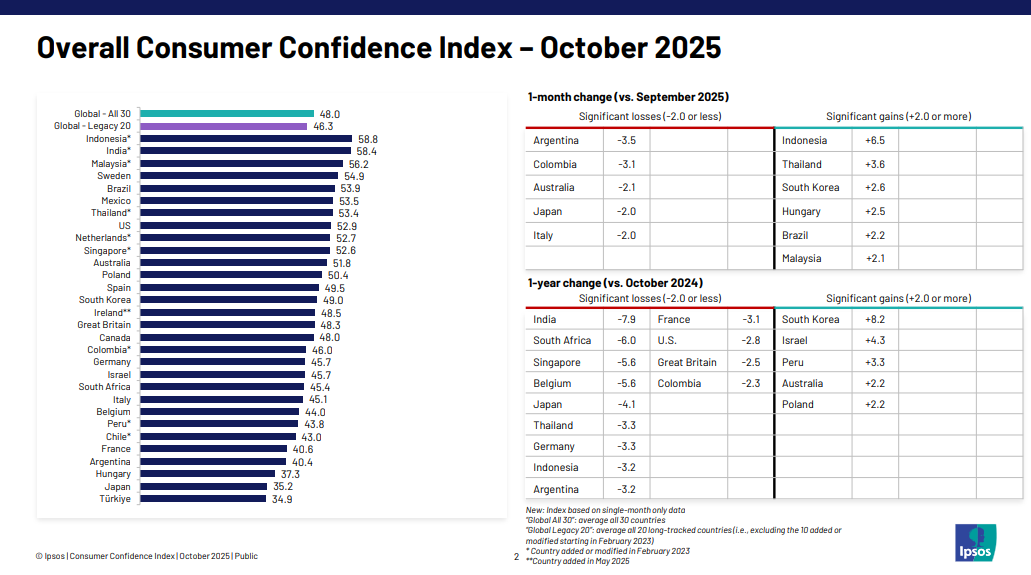

The decline in public optimism toward the country’s economic conditions has been evident over the past two months, with Indonesia’s Consumer Confidence Index (CCI) dropping 9.6 points compared to the previous period. However, in October 2025, the trend began to show signs of recovery, with a 6-point increase, in line with the government’s efforts to strengthen national economic stability.

Through various fiscal and stimulus policies, the government has sought to maintain household purchasing power and restore confidence in the economy. One of these initiatives includes a Rp200 trillion incentive package aimed at bolstering the real sector, creating jobs, and driving household consumption. In addition, the recent cabinet reshuffle has been viewed by both market players and the public as a positive signal—reflecting efforts to enhance coordination and the effectiveness of upcoming economic policies.

Ipsos’ findings show a decline in positive perceptions of the national economy across all age groups. Only 48% of millennials and 34% of Gen Z respondents consider the current state of Indonesia’s economy as “good,” while 53% of millennials and 66% of Gen Z view it as “bad.” Nearly half of respondents (49%) also expressed uncertainty about whether their personal financial situation would improve within the next six months.

Social Inequality and Value Tensions Intensify

Half of Indonesians (52%) believe that “society is currently in a fragile state,” with income inequality between the rich and poor (80%) identified as the biggest source of tension, followed by differences in liberal and traditional values (61%). Gender equality also remains a prominent topic. Seventy-three percent of respondents said gender equality is personally important to them, while 56% of men and 64% of women believe corporate gender equality initiatives have had a positive societal impact. Overall, 63% of Indonesians believe that opportunities for women are now relatively equal across various sectors.

Inflation and Taxation Remain in Focus

In the economic domain, 69% of Indonesians expect inflation to rise, 63% are concerned about higher interest rates, and 54% anticipate an increase in taxes this year. Discussions around tax and inflation have also gained significant attention on social media, accounting for around 13% of public conversations.

Hansal Savla added, “The combination of economic pressures and social dynamics shows that Indonesians are seeking stability—both financially and emotionally. For businesses, this is a critical moment to build trust through transparent communication, relevant value offerings, drive core innovation and a strong commitment to social responsibility.”

Implications for Businesses

Ipsos notes that rising economic concerns are driving consumers to be more selective and focused on value for money. Brands that clearly communicate their value, maintain transparency, offer flexible options, and focus on essential needs will gain stronger consumer trust. Furthermore, businesses that emphasize trust, innovation, inclusivity in their approach will stand out amid the current climate of uncertainty.

Methodology

The What Worries Indonesia H1 2025 report is part of Ipsos’ global What Worries the World study, conducted online among over 25,000 adults aged 16–74 across 30 countries, including Indonesia. Fieldwork was carried out between July and August 2025, using nationally representative samples in each country. The Indonesian sample consisted of approximately 1,000 respondents, adjusted to reflect the demographic profile of the national population for accurate representation.