Open Banking Series IV │ Which Financial Institutions in China are More Expected by Clients in the Environment of Open Banking?

Open banking mainly aims to realize the financial data sharing, which is the exploratory application of new technologies in the financial circle. Implementation of the service needs not only the professional guidance from the financial institutions but also the technical supports, so the choice of service providers is no longer limited to the professional financial companies, and the types of service providers are more diversified. Based on the expectation and trust of clients for various institutions, Ipsos carried out surveys and provides 7 categories of institutional service providers, including the traditional banks, financial technology companies, digital payment companies, newer banks, well-known credit card brands, companies that specialize in mobile tech and scientific and technical companies, and clients express different attitudes towards such institutions.

Traditional banks are highly expected

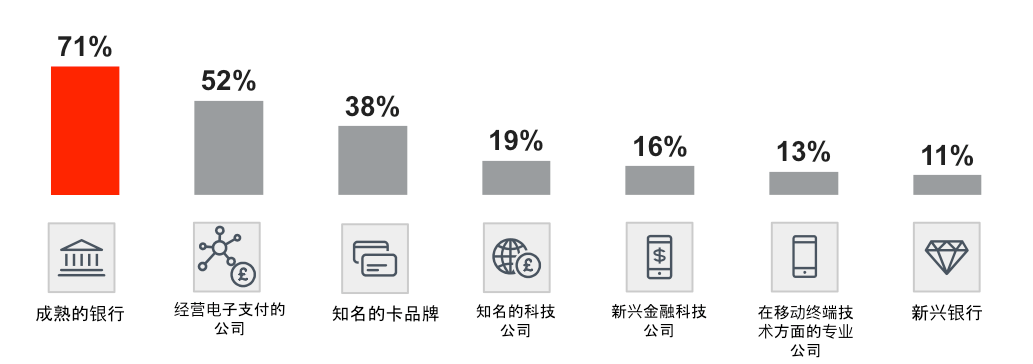

Among these institutions, clients have the highest expectations for traditional banks, and over 70% of clients expect to be served by the traditional banks. Traditional banks have their unique advantages in shared financial data as they serve clients all the year round and clients highly trust them in processing the personal financial data. In surveys in the international market, over a half of clients hope their banks can provide the service, and 49% of clients will continue to choose the bank if this service is provided. With the advantages of the brand, influence and financial license, banks after transformation can provide more abundant products and services with more diversified sources of income, and by doing this, the stickiness of clients and the banks’ volume of business can be enhanced.

Chinese clients’ expectations for all institutions

Except the traditional banks, Chinese clients also have high expectations for companies that manage digital payments and well-know credit card companies, with little difference in expectations for other financial institutions. In the international market, however, people’s expectations for well-known credit card brand companies and the newer banks are higher than companies that manage digital payments, which may relates to the popularization of the digital payment methods such as Alipay and WeChat in recent years, and the proportion of Chinese clients’ expectations for the digital payment companies is 2 times of the global average proportion.

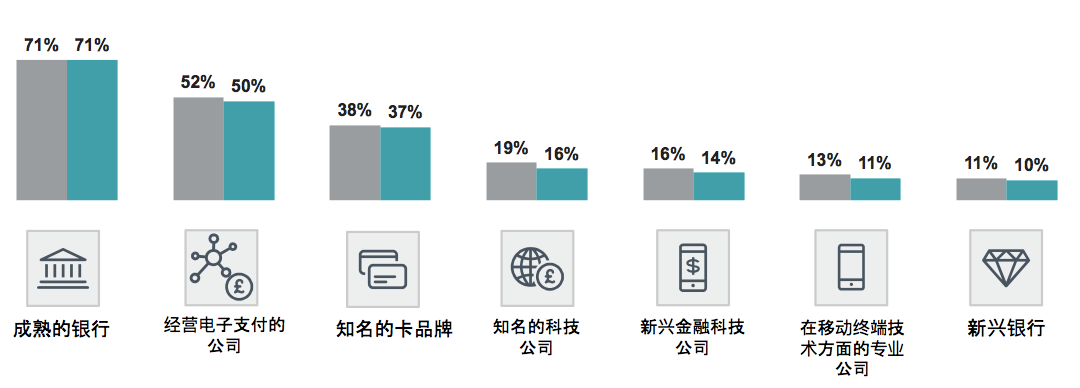

Clients in Chinese market are anxious about all institutions

Although clients express their expectations for these institutions, they still feel anxious as for the sense of trust. In survey, except the same expectation value and trust value for the traditional banks, clients’ trust value for other institutions is lower than the expectation value; clients still doubt about the sharing financial data.

Chinese clients’ expectation and trust values for all institutions

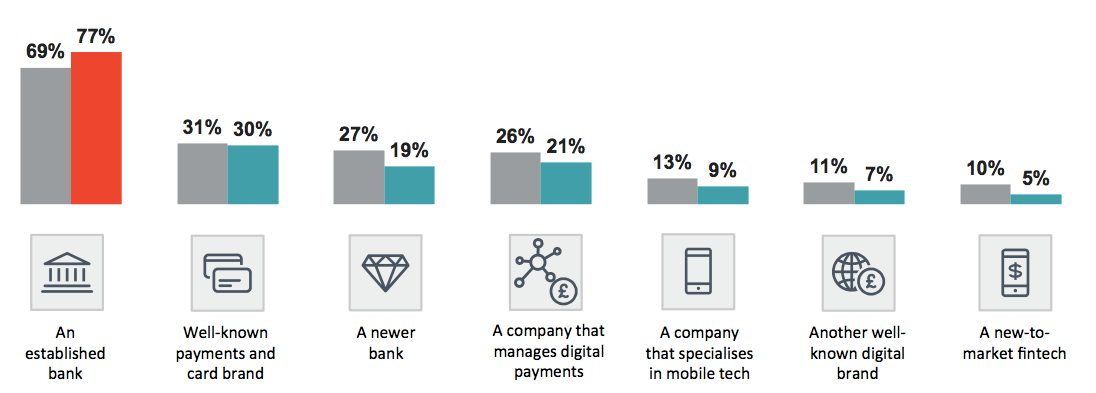

This is different from the data of clients in the global market. In the survey of the international market, the clients’ degree of trust (77%) for the traditional banks is higher than the expectation value (69%); in this context, the authority and safety established by Chinese banking industry for clients shall be improved.

Global clients’ expectation and trust values for all institutions

Global clients’ expectation and trust values for all institutions