Indonesia's Growing Automotive Aftermarket Landscape

Significant opportunities exist for Indonesia’s growing aftermarket landscape, with over 11 million PVs (~77% of total PV population) to be out of warranty by 2020, with an out of warranty population CAGR of 9.7% from 2015-2020. In our latest industry guide we explore the Implications for foreign and new market players seeking to capture Indonesia’s aftermarket opportunity.

With the largest economy in ASEAN, Indonesia expects passenger vehicle growth at a CAGR of 7.4% to 2020. The commercial vehicle sector should also enjoy solid growth.

With the largest economy in ASEAN, Indonesia expects passenger vehicle growth at a CAGR of 7.4% to 2020. The commercial vehicle sector should also enjoy solid growth.

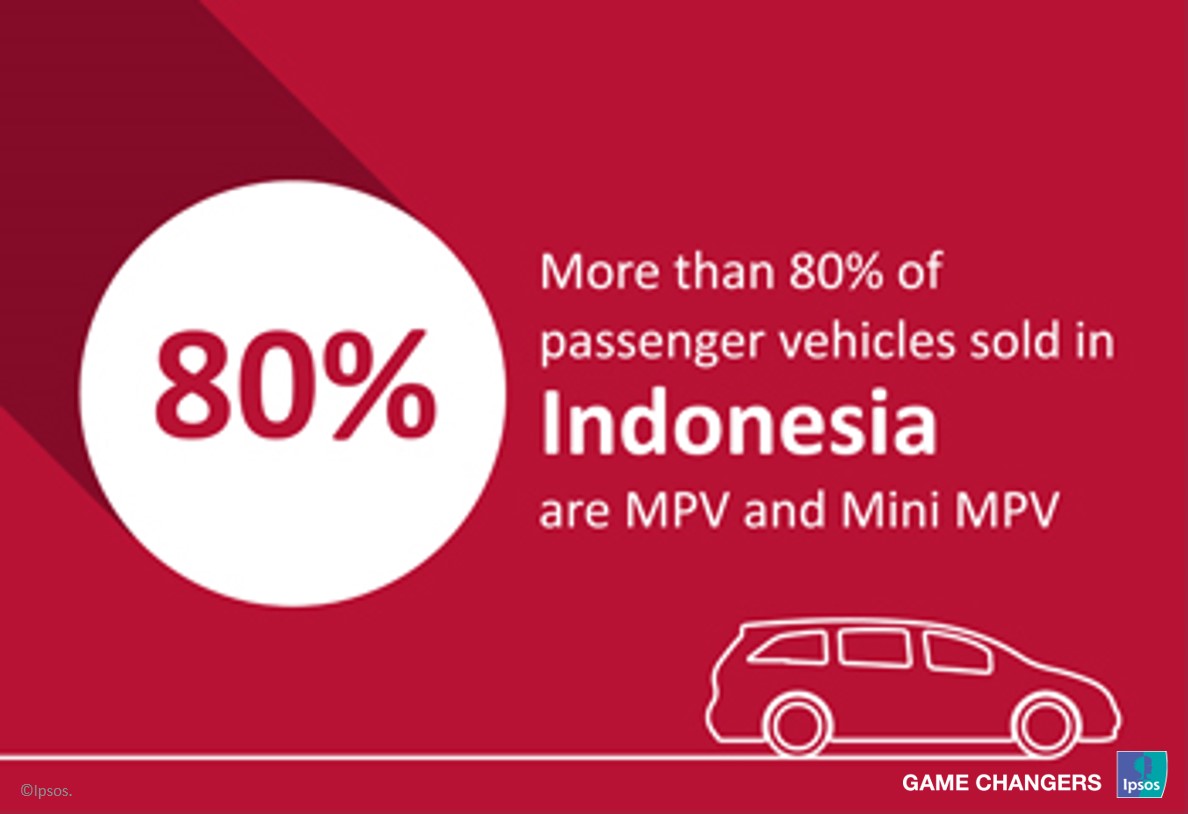

The Indonesian growth story is not just about Jakarta and Java Island. The 76.2 million motor cycles and 8.3 million passenger vehicles in Indonesia are widely spread across the nation, with the top 4 cities accounting for only 11% of the motorcycle population and 26% of the passenger car population. With this high level of fragmentation, you might want your initial focus to be on Jakarta, due to its higher concentration of vehicles and attractive growth prospects for segments such as MPV as well as “value” vehicles.

While Jakarta is expected to maintain its contribution to national passenger vehicle growth, less developed provinces such as Kalimantan and Sulawesi, have been growing at a faster pace due to demand from first-time owners.

Our latest paper on the Indonesian Automotive industry presents information that is needed for the development of a Go-to-Market strategy in Indonesia:

- Indonesia automotive aftermarket industry landscape

- Indonesia automotive aftermarket distribution channel structure

- End channel service and product offering

- End user purchasing behaviour