Holiday Shopping 2022: Mixed feelings as consumers are anxious but eager to celebrate

In our second annual Holiday Shopping study, we widen our view to see mixed emotions when it comes to how consumers are feeling about the economy and what they hope to give and receive as gifts in different regions around the globe. Like last year, our study is powered by a Synthesio dashboard tracking English language social media mentions, along with an expanded FastFacts survey on Ipsos.Digital conducted with 10,000 respondents across 12 markets: Australia, Brazil, Chile, France, Germany, Italy, Romania, Spain, Singapore, Philippines, UK and US. Plus, for the first time, we applied our artificial intelligence (AI)-powered Topic Modeling trend discovery engine to analyze and visualize online conversations as well as open-ended survey responses.

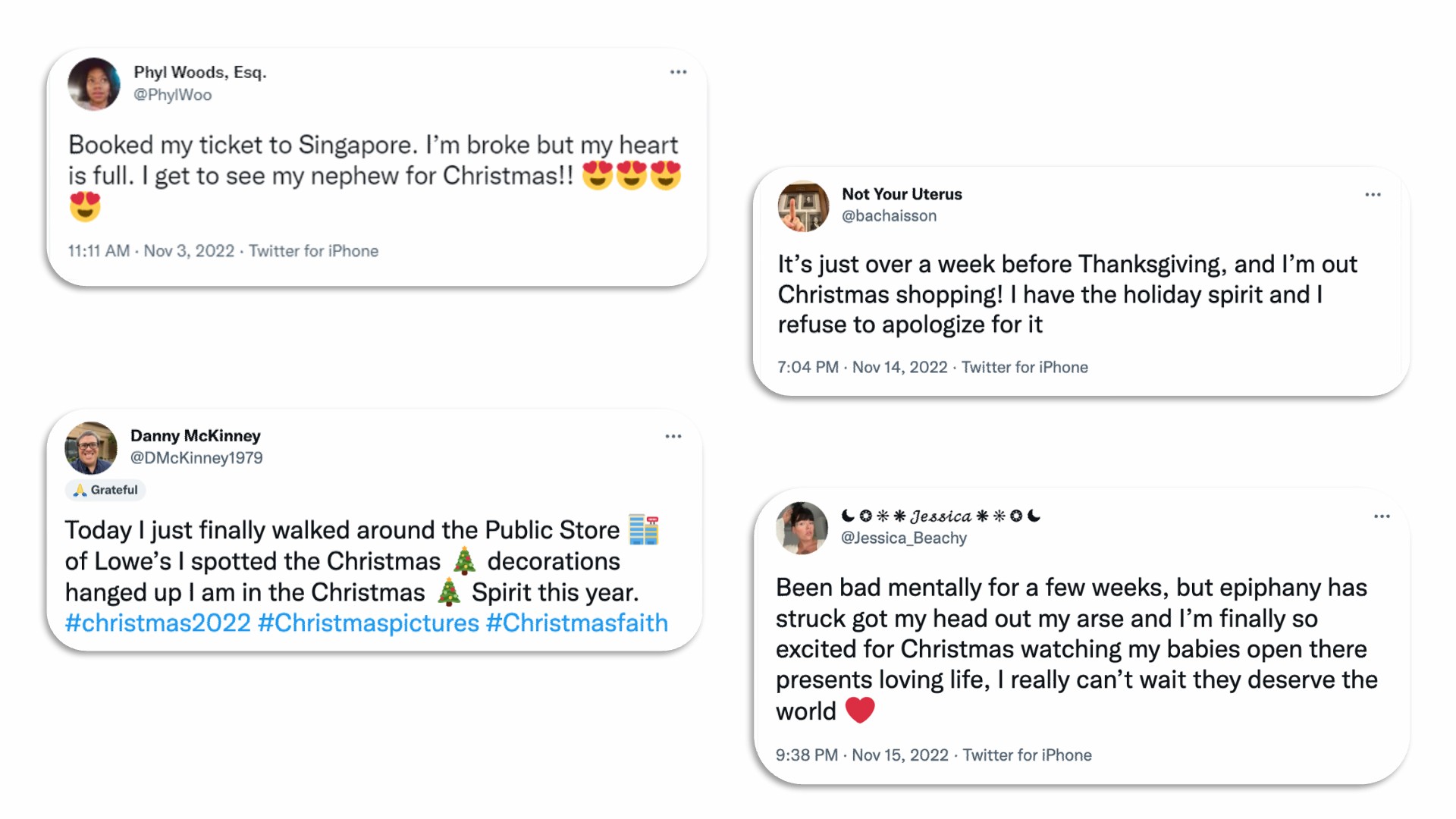

Despite global uncertainty, consumers look to get in the holiday spirit

Compared to 2021 when we saw shoppers starting early and showing stress around delivery delays and shortages, the mood in 2022 can be summed up in two words: anxiety and anticipation. Consumers are anxious because of global uncertainty and rising prices. Yet, they are also anticipating getting back out after COVID, attending family gatherings, and even seeing decorations and getting a great deal.

As inflation remains the top global concern according to the Ipsos What Worries the World survey, we see it impacting purchases and even celebrations in multiple ways - but to different degrees by region, as we will discuss below. In our survey we also see that excitement about celebrations is still strong , and in countries where citizens had more COVID restrictions last year, there is eagerness to celebrate and socialize, especially among younger generations. Overall, compared to last year’s end of year celebrations 34% say they expect excitement about celebrating to increase vs 15% who say it will decrease, even though more say their budget for gifts will decrease (29%) vs increase (26%).

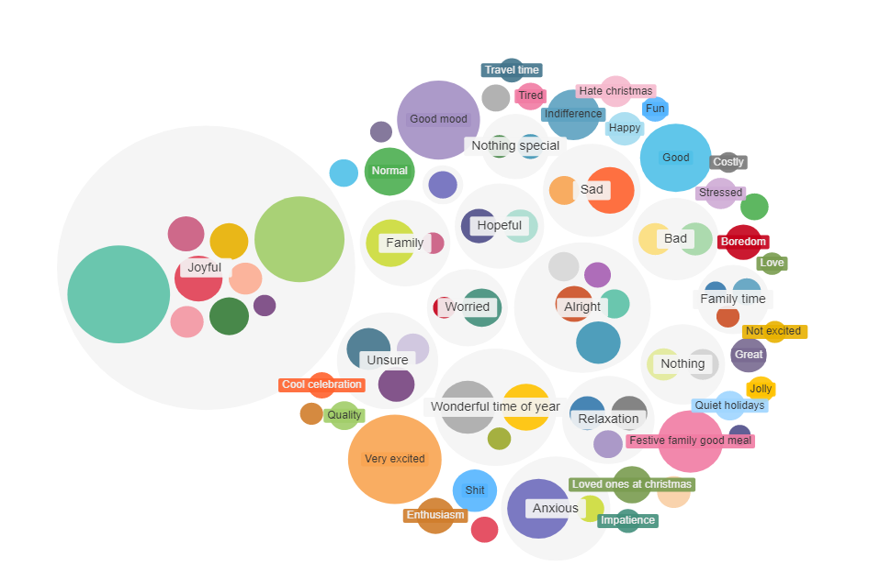

When looking at open ended survey responses with Topic Modeling, we see conversation clusters not only around being “Joyful” (the largest cluster) but also “Anxious” (fourth largest). This anxiety certainly applies to retailers as well, with more offering holiday deals starting in October, some still struggling to find workers, and a few still adjusting to a “convergent commerce” world where consumers purchase similar items both online and in store and expect channels and experiences to be both connected and seamless.

Inflation is impacting shopping behavior and even some traditions

It is not surprising to see that 87% of people feel stressed about rising costs, and 55% on average are even more stressed than last year. The word inflation is everywhere and impacts all sectors. And the consequence on holiday purchases and even some traditions is immediate: 47% see costs significantly impacting their holiday shopping and 43% their celebrations.

Using social listening, we see that conversations around inflation related to holiday shopping have increased by 35% in one month. Across online media, many say inflation is causing them to change holiday habits, and our Topic Modeling reveals top concerns like “Inflation during the holiday season” and “Can’t afford Christmas presents.” Some are also mentioning they are shopping earlier this year given a fear that inflation will get worse, with 44% declaring that they have either started, are almost done, or have finished their shopping.

To compensate for rising costs, consumers in all regions are going to make some budget cuts with many reducing spend on holiday decorations, food and beverages, gifts and even charitable donations. Fifty-six percent say they will seek the best prices and deals this holiday season. Online, our social analytics confirms that “discounts” are the most-correlated purchase factor in conversations about holiday shopping retail categories - particularly in Electronics and Food.

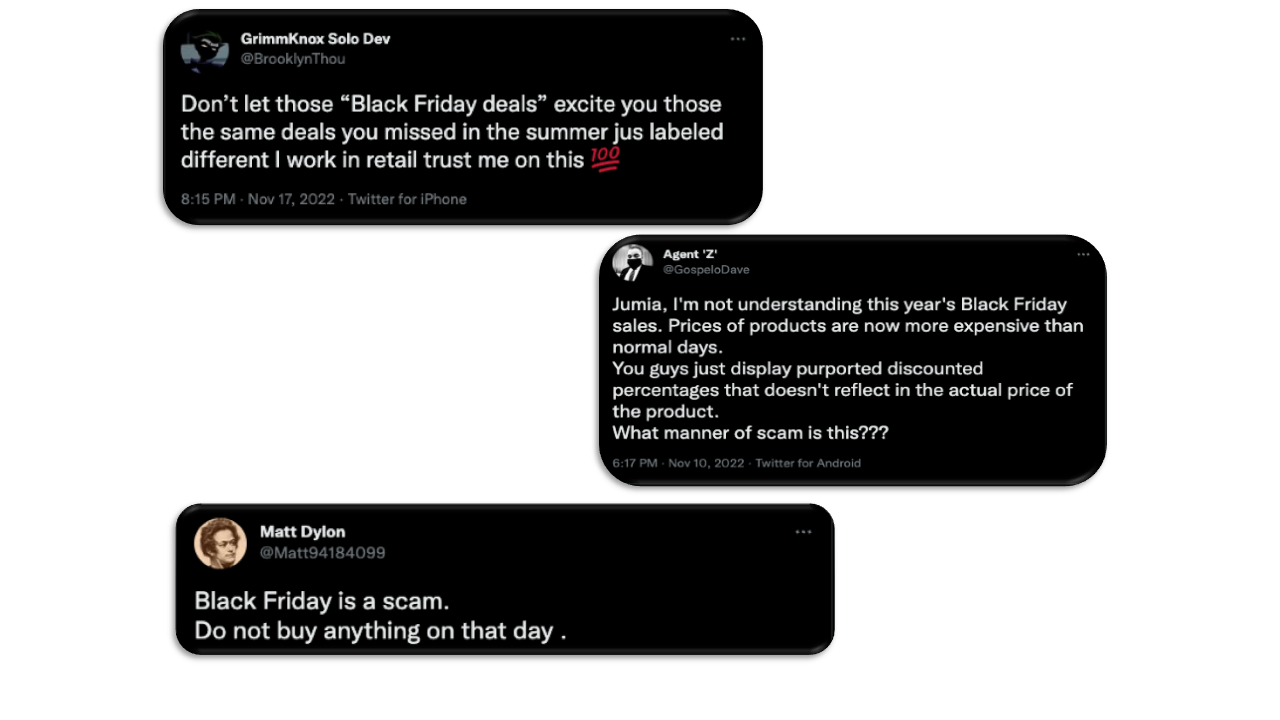

Deal-related days like “Black Friday” or Amazon’s “Prime Day” continue to be part of the shopping conversation, with one-third of consumers viewing Black Friday as part of their solution to fight against price increases. Yet, we also observe an increasing number of negative conversations around Black Friday, with more social media users starting to question the supposed deals or even getting annoyed by the hype.

However, while higher prices are taking their toll, it is good to note that inflation will not impact many consumers’ enthusiasm or desire to celebrate (and spend). 85% feel excited about celebrations and one-third on average feel more excited than last year. For many the party must go on, with Germany, the US, and the UK leading the way in saying rising costs will have no impact on their celebrations.

More consumers are planning to increase their in-store shopping

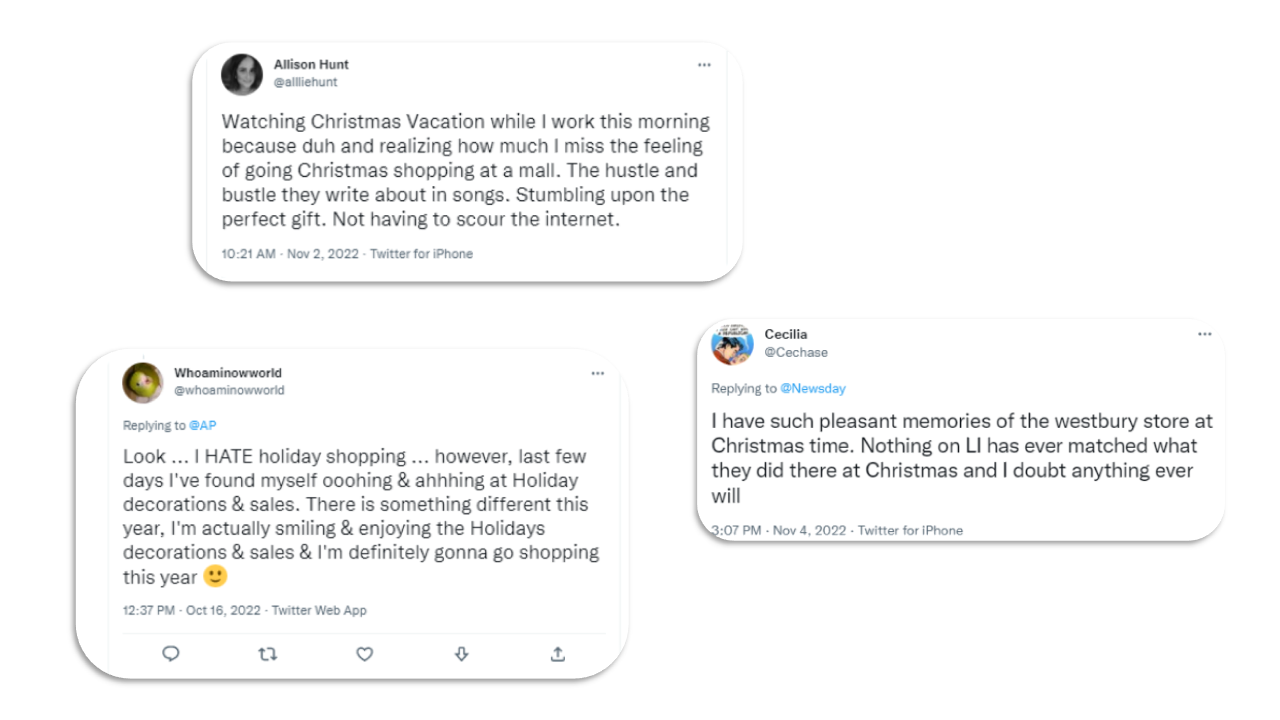

Coming out of COVID, it is not a surprise to see more consumers looking forward to going out and celebrating their favorite traditions. In countries that are more enthusiastic about end of year celebrations, we observe an increase in in-store shopping plans as well - led by consumers in the Philippines (44%), Brazil (37%), Spain (34%), and Singapore (31%). Overall, across all 12 countries surveyed, 23% said they are planning to increase their in-store shopping vs 17% who will decrease their purchases in store.

In online conversations, feelings about in-store shopping are mixed. Some are excited and nostalgic about seeing Christmas decoration displays, holiday music, and annual trips to the mall. While others are dreading crowds or not yet ready to get into the holiday spirit. In a Topic Modeling study of in-store conversations, we see these clusters (named by our AI): “Wonderful indoor Christmas decorations” and “Christmas music in stores,” as well as “Despise the shopping frenzy” to illustrate this point.

Gift categories such as Experiences (event tickets etc.), Electronics, and Books are more likely to be purchased online than in store, although in France, Books are as likely to be purchased in a bookstore as online.

Meanwhile, products that consumers touch, or try-on are more likely to be purchased in store,especially Groceries, Food and Beverage items (85% in store vs 31% online), Home goods (66% vs 57%) and Fashion and Apparel (67% vs 59%). Fashion is a category where regional habits particularly stand out, with countries such as Italy, Spain, Australia, Chile, and Brazil favoring in-store purchases for their fashion items, while in the UK and Germany online shopping is still the first choice.

What’s trending: fashion, food, and gift cards

This holiday season, Fashion and Apparel (45%) remains the top gift of choice in most countries, followed by Toys and Games (35%), and Beauty items (32%). Groceries, Food and Beverages (30%) is the #4 gift category this year, perhaps indicating a preference for practical gifts or people expecting to entertain more or attend more parties. Gift cards and Electronics both remain popular as well, and each are tied for the #5 most popular gift at 28%.

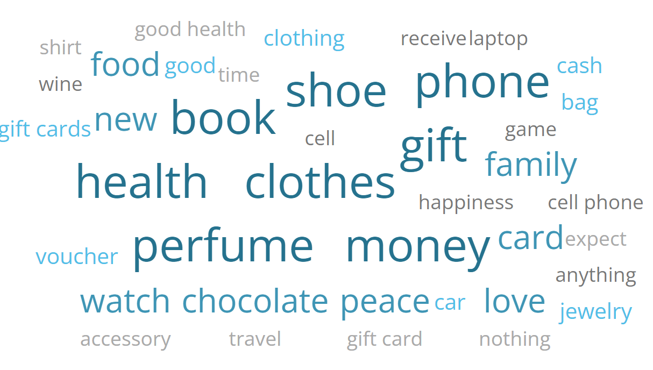

Q: What are the top 3 gifts you hope to receive for end of year/Christmas celebrations? (Open ended)

Fashion and Apparel gifts remain especially popular in Latin countries, with more than 50% of respondents in Brazil, Romania, Spain, and Chile as well as the Philippines saying they expect to offer or receive items like clothes, shoes, leather goods or jewellery. As we have studied, fashion is an online phenomenon, driven by marketplaces and deal sites, as well as Gen Z fashion lovers and influencers sharing social posts and reviews. For these reasons we see this category at the leading edge of both social and convergent commerce. Plus, as Fashion is among the sectors most impacted during inflationary periods, this holiday season is an opportunity for consumers to stock up on clothing items.

Money and Gift cards remain on many shopping and wish lists, but gift cards are a polarizing choice as people express their hesitancy giving this item. In certain countries or among older shoppers, gift cards are viewed as too impersonal and lacking thought. Yet in the most economically developed countries, Gift cards are the second most popular item (US: 43%, France: 40%, Australia: 39%, Germany: 38%). Gift cards eliminate the guesswork of finding the perfect present (and risk of wasting money) - and provide a convenient alternative to offering money. For brands and retailers, the popularity of Gift cards presents a significant opportunity.

Online gift card conversations still focus on categories like Electronics, Food, Toys, and Fashion, yet this year we also see Books and Experiences mentioned alongside gift cards, with both categories in the top 5 in terms of conversation volume. Yet, whether delivered in plastic, online, or physical cash, Money in all its forms remains in fashion as a gift to give and receive in 2022.

On social media, Electronics remains the most-discussed retail category. Like 2021, our emotion analysis reveals that “fear” is more associated with Electronics and Tech than any other retail category. But this year, shoppers are stressed for different reasons. Conversations have shifted from product availability, chip shortages, and delivery delays to “affording electronics” this year. “Discount prices” are the most-mentioned purchase factor in social conversations, which is significant for such a price-sensitive sector.

Similar to last year, the Books category varies the most across countries, with responses ranging from 15% to 42% planning to place books under their Christmas tree. The top 5 countries include France (42%), Spain (35%), UK (32%), Brazil (32%) and Italy (30%). Unlike Gift cards, gifting Books is a budget-friendly option that can be personal and thoughtful.

Joy wins out!

For many, 2022 has been a challenging year. People around the globe are worried about not just inflation, but also poverty & social inequality, unemployment, and other concerns. Yet even with multiple reasons to be anxious, many are still eager to celebrate, visit with friends and family, go out to markets and malls, and even help those less fortunate.

In online conversations, “Joy” is the top emotion related to the holidays, with a slight uptick in joy-related mentioned in 2022 vs. 2021 (from 15.7% to 18.2%). And when we revisit the open-ended survey responses, 4 of the 5 largest conversation clusters are positive (Joyful, Alright, Wonderful time of year, Good mood).

Despite global stressors, consumers are still (mostly) optimistic about the holiday season. For brands and retailers, this means more opportunities help get shoppers get in the holiday spirit by providing more value and better deals.

Want more consumer insights to help you prepare for 2023 and stay ahead of changing shopper behaviors? Request a demo of Synthesio’s AI-enabled consumer intelligence platform to see how you can turn online data into actionable insights. And, request a demo of Ipsos.Digital FastFacts to see how you can get fast answers to your business questions with a self-service survey platform.

About this study

This research was conducted by Ipsos with Ipsos.Digital and Synthesio. The FastFacts survey was conducted from November 10, 2022 to November 14, 2022 with national representative samples of ~10,000 respondents across 12 markets. Synthesio’s platform collected and analyzed 10 millions of public online posts about Christmas/holiday shopping from October 2020 to November 2022. Sources include top social networks like Facebook, Instagram, Twitter, Reddit and popular review sites, forums, and blogs.