Greater consumer confidence is encouraging spend again

Data from our ‘New Normal’ tracker shows that the proportion of people who saw their incomes decline as a result of the pandemic dropped from 42% in May last year to 35% in May this year. At the same time, the proportion of Hong Kong residents reporting an increase in income has gone from 10% to 15% over the same period. Importantly, more people (37% in May vs. 32% in February) feel the threat of COVID-19 will be over sometime between the end of this year and Q.2 2023.

Q: Comparing your income of 2022 (Jan to May) to that of 2021, is there any financial impact on your income under the 5th wave of Covid-19 outbreak?

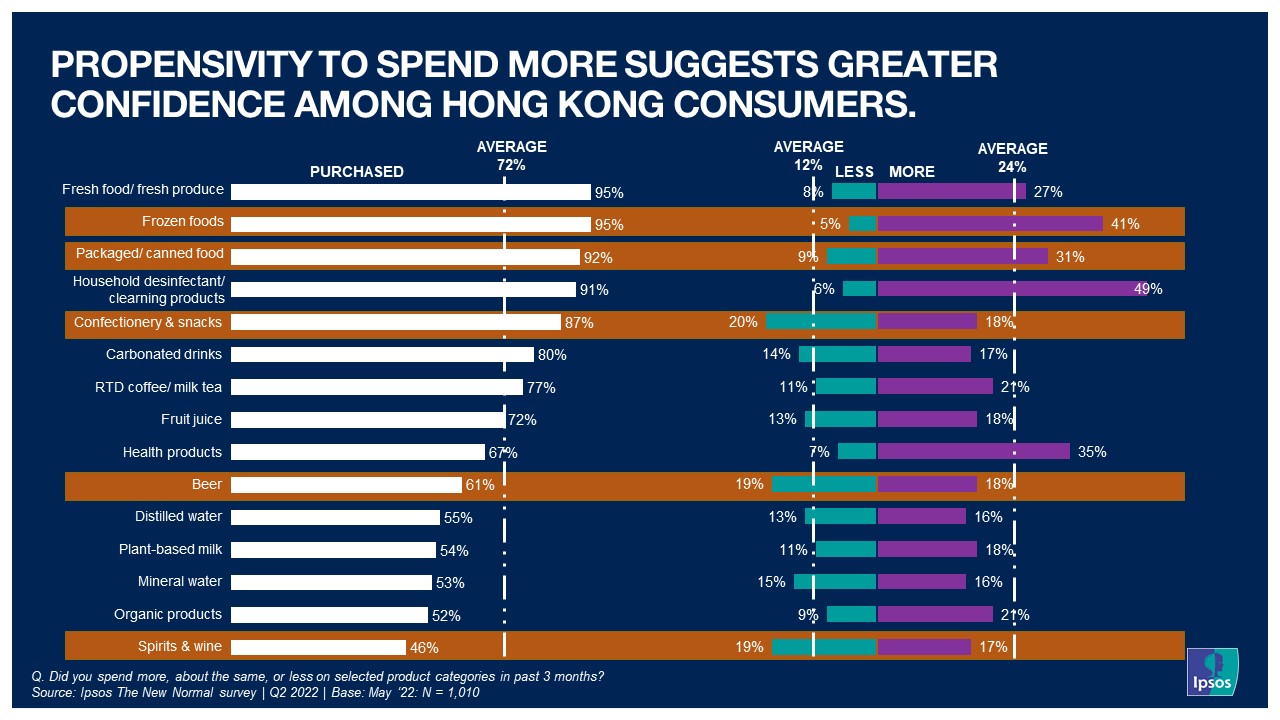

This along with an overall more positive state of mind reported in a previous post translates in greater consumer confidence. While nearly two-thirds (64%) of Hong Kong consumers are spending the same as they used to across a number of daily product categories, twice as many claim to be spending more than claim to be less (24% vs. 12%).

Q. Did you spend more, about the same, or less on selected product categories in past 3 months?

Alcoholic beverages are a category where consumption has been below average in the past three months. This is also a category where consumers are spending less than before, probably because of the restrictions imposed on dining out during the 5th Wave of COVID-19. Heightened health consciousness induced by the pandemic may also contribute to this decline in spend in alcoholic drinks, as people think more carefully about what they drink and eat. While nearly 9 in 10 Hong Kong consumers bought confectionery and snacks in the past three months, 20% of such consumers claimed to have spent less on such products than they did before. On the other hand, frozen and packaged/ canned food has enjoyed greater consumer spending, probably because this category has longer shelf life and therefore allows consumers to stock up without having to worry about expiry dates. Unsurprisingly, disinfectant and cleaning products as well as health products have also seen a significant increase in consumer spend. In sum, the perceived lower risk associated with COVID-19 and a more positive outlook among Hong Kong consumers is making them more willing to spend. However, not all product categories are benefiting to the same extent. Products delivering benefits relevant to the pandemic (e.g., protection, health) are the main beneficiaries of consumers’ renewed confidence. This said, it remains to be seen what impact inflation and the rising cost of living might have on consumer spending.

Related article:

Money does not buy you happiness but it gets you close to it