Hong Kong’s Gen Z: Bruised but not Beaten

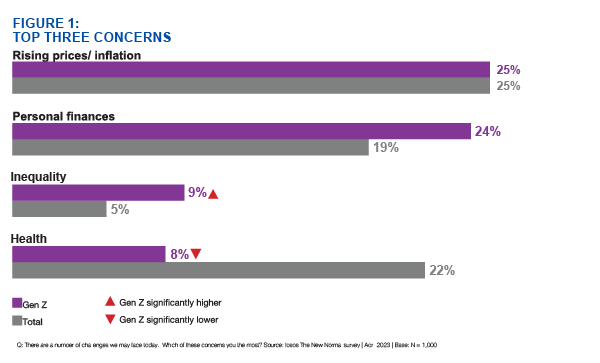

Our latest New Normal* data show that, like everyone else in Hong Kong, the cost of living is the main concern for Hong Kong’s Gen Z. Unlike everyone else, though, this generation worries more about personal finances and inequality (see Figure 1). This is because the combination of covid-19 and other macro factors has had a particularly detrimental impact on this young cohort: While 72% of Hong Kong’s residents have seen their incomes stabilise over the previous three months, only 60% of Gen Z can say the same. In fact, three in 10 Gen Z are earning less now than they did three months ago, compared to just over two in 10 Hong Kongers. Underpinning this is the fact that Gen Z are twice as likely to be working part-time than other Hong Kongers (16% vs. 7%).

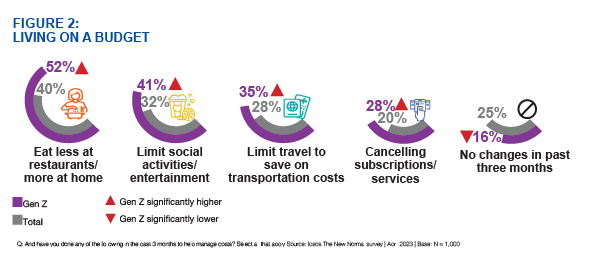

This is making Gen Z more cautious about spending than their older counterparts. They are more likely to cut down on eating out and social activities, transportation and subscriptions (see Figure 2). Only 16% of Gen Z do not feel in need to make adjustments to their lifestyle to save money, compared to 25% among the general population.

And to continue with today’s prevailing Gen Z narrative, this is a group who are often made out to be obsessed about ‘brand purpose’ and climate change – but it’s actually older people that are more likely to boycott brands. Meanwhile, our Ipsos Global Trends research tells us that all age groups are equally worried about climate change. What young people are more worried about are those very immediate issues like low incomes and housing.

All this said, Gen Z are more optimistic about their future: 21% believe their

disposable income will rise over the course of the year, vs. 14% for Hong Kong’s

general population. In line with this, 15% of Gen Z also believe their standard of

living will improve, vs. 10% of the general population. How will Gen Z achieve

this? By looking for new jobs: they are almost twice as likely as other people (28%

vs.15%) to look for a new job over the course of the year.

This should provide food for thought for businesses and policymakers. From a

public policy standpoint, what can be done to support this younger cohort and make

them feel more empowered, particularly during this difficult economic period? From

a business perspective, whether a brand is trying to sell its products or services to

Gen Z, or is seeking to recruit and retrain them as part of its workforce, it is worth

thinking about Gen Z’s expectations, the context in which they life their lives, and

how it can engage them with empathy.

(*) Ipsos Hong Kong New Normal Tracker monitors changes in consumer sentiment and behaviour in response to the dynamic environment of Hong Kong SAR. Data were collected monthly between April 2020 and June 2021, and quarterly thereafter. Additional markets/ questions available upon request.