The Metaverse Economics

The interest in digital ownership, such as cryptocurrencies and digital lands, has also been making headlines. For example, news of millions of dollars worth of non-fungible tokens (NFTs) sold on OpenSea drove interest in the digital/virtual environment and the need for digital goods, products and services.

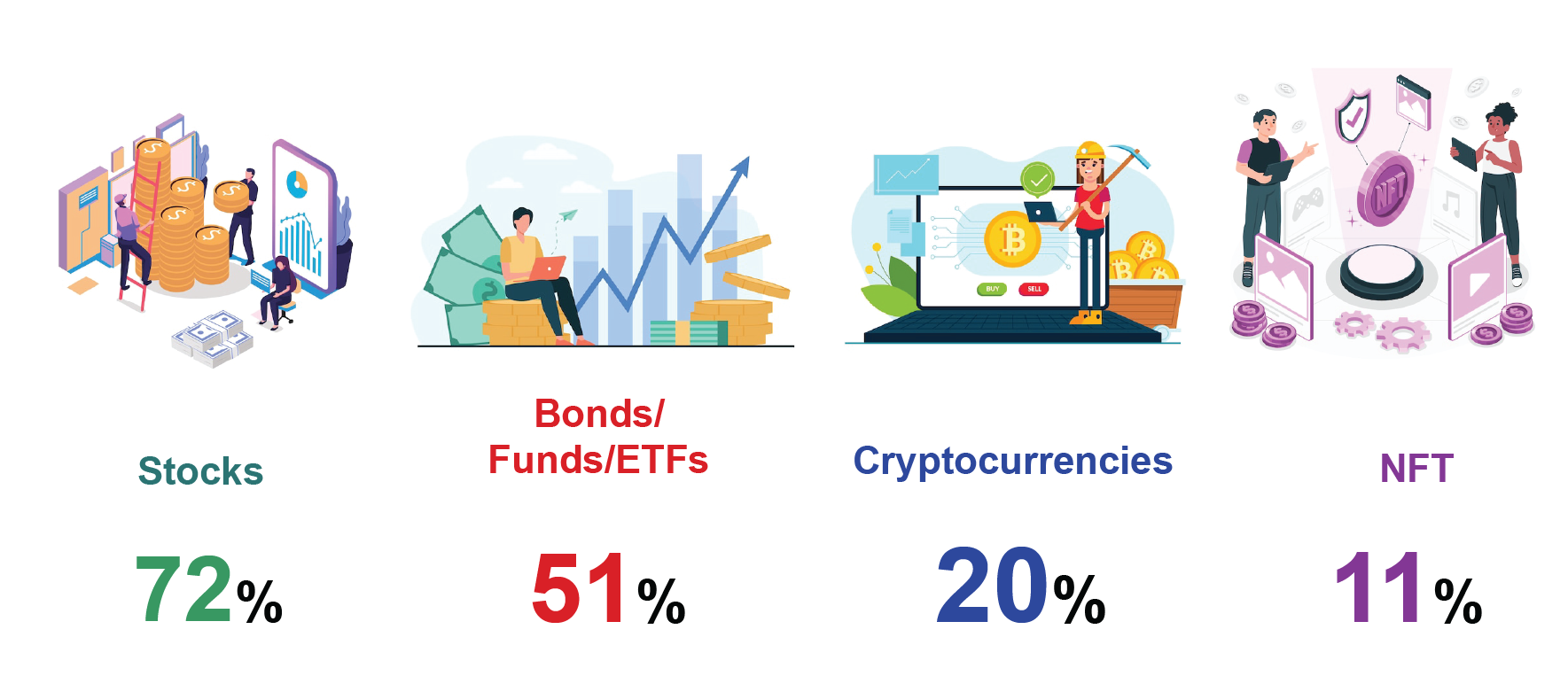

Ownership of cryptocurrencies and NFTs investments remains low compared to traditional investments

Hong Kongers are becoming more accepting of the higher risks from Metaverse-related investments. However, Metaverse-related investments still significantly lack behind traditional investments. According to our survey,

Demographics amongst these investment products differ greatly. According to our findings, those ages 30 and above are much more likely to be invested in stocks; but those ages 39 and below are more likely to be invested in cryptocurrencies and NFTs.

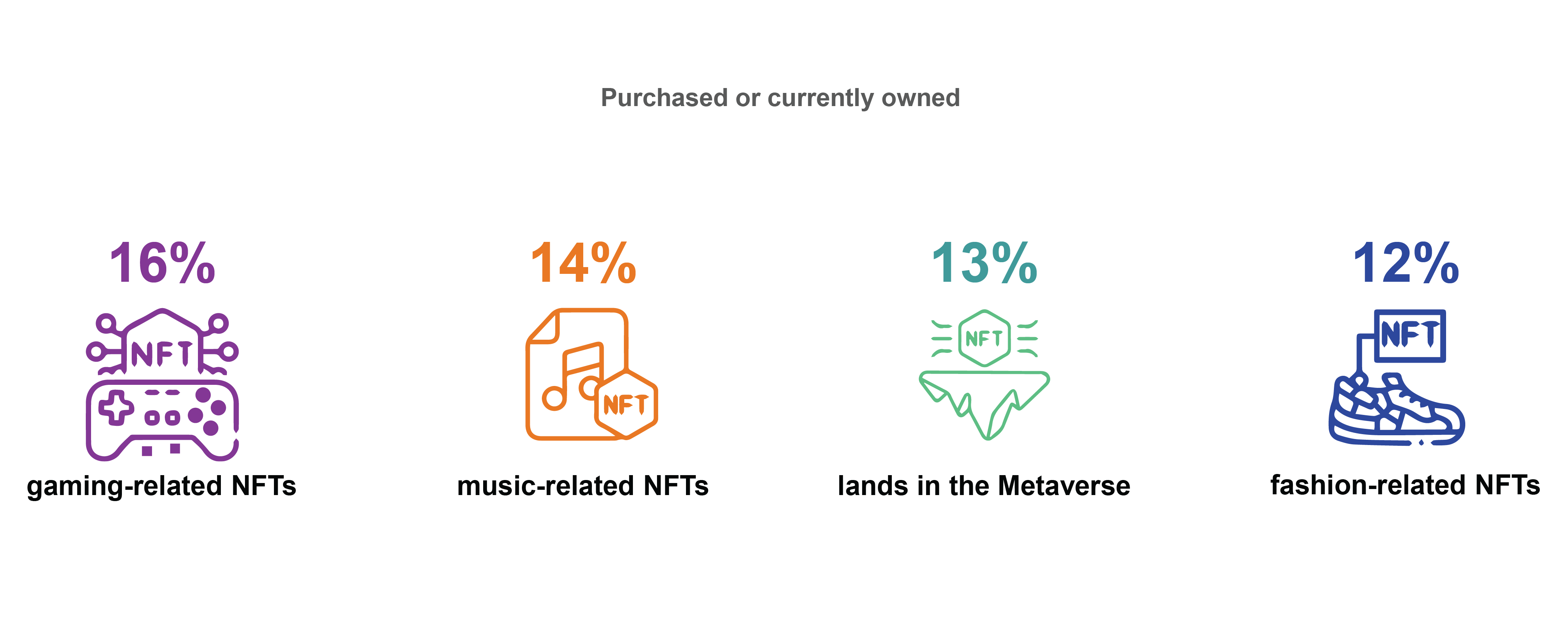

Ownership of Gaming-related NFT ranks the highest amongst NFT digital assets

The concept of NFT enables the tokenisation of assets defining ownership. NFTs can represent real-world items, such as artwork and real estate, or digital items, such as music, virtual clothes and digital lands. The popularity of NFTs has soared in recent years, with NFTs selling at thousands and millions of US dollars and subsequent falling in prices recently along with the broader market.

While NFT ownership is comparatively lower than ownership of stocks and cryptocurrencies, a surprisingly moderate percentage of respondents have purchased or currently owned some NFTs.

Among the top NFTs are gaming-related NFTs, music-related NFTs, digital land NFTs and fashion-related NFTs. Many of these NFTs rides on the Play-to-Earn concept to drive engagement and adoption. For example, gaming-related NFTs such as characters in Axie Infinity and Star Ships in Star Atlas incentivise NFTs to make purchases and “Play” to “Earn”. Some, of course, focus on the preferences of personalisation. This includes Sandbox’s Marketplace providing custom user-generated avatars, skins, and objects for sale.

Although the ownership of Metaverse-related investments is still relatively low compared with traditional investments, the interests in Metaverse-related stocks or ETFs were surprisingly high. Owing mostly to the hype of NFTs and limited collectables by offered well-known brands, the interest in investing and trading digital NFTs and collectables over the next five years ranks the highest at 45%.

High interest for Hong Kongers in investing and trading metaverse-related Digital Assets

Although the ownership of Metaverse-related investments is still relatively low compared with traditional investments, the interests in Metaverse-related stocks or ETFs were surprisingly high. Owing mostly to the hype of NFTs and limited collectables by offered well-known brands, the interest in investing and trading digital NFTs and collectables over the next five years ranks the highest at 45%.

Although relatively close in interests, the interests among digital NFTs/collectables over the next five years are not the same. Virtual objects such as virtual arts and virtual furniture for personalising virtual estates have the highest interest, followed by virtual fashion and accessories to personalise digital avatars, digital lands and prefabricated buildings/homes in the metaverse.

If you are interested to learn more about the state of awareness, engagement and preferences of the Metaverse in Hong Kong or more details on the survey results, please contact us.

Related article:

The Metaverse Perception for Hong Kong

About this study

About 1,000 online interviews were conducted between September 9-16, 2022, among adults aged 18-64 Hong Kong general population.