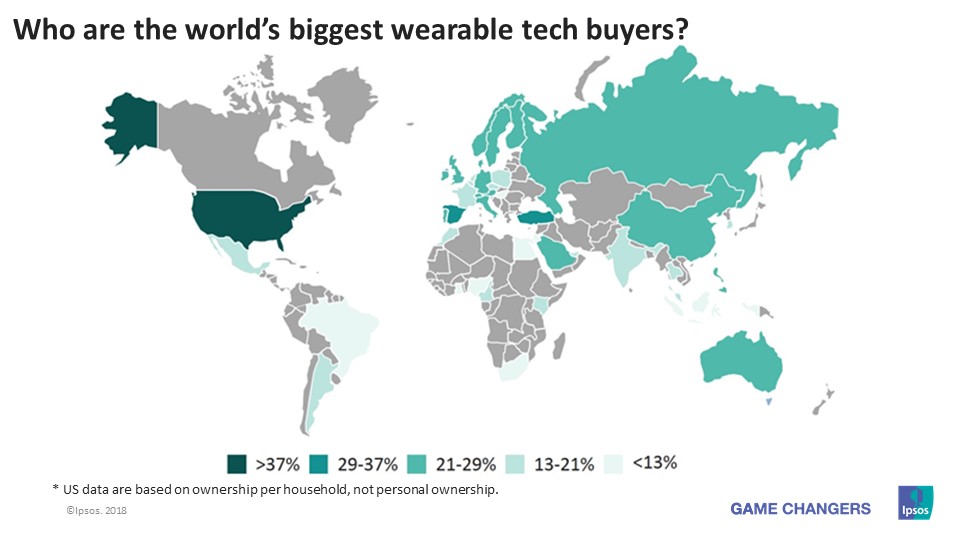

Who are the World’s Biggest Wearable Tech Buyers?

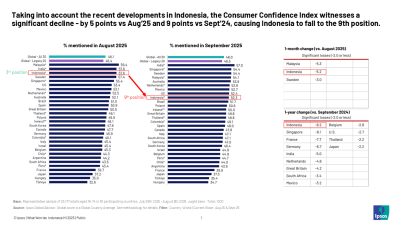

Increased adoption of fitness trackers and smartwatches is greatest in Western markets. Rapidly developing countries such as China (28,1%) and Russia (23,8%) offer opportunities for wearables producers and app developers.

| Top 5 Markets for wearable tech | Top 5 Markets with greatest sales potential | |

|---|---|---|

|

USA Spain Turkey Singapore Switzerland |

1 2 3 4 5 |

Jordan South Africa Kuwait Indonesia Egypt |

Globally, the USA ranks first in terms of wearable tech penetration, 35,5% of Affluent Americans have a fitness tracker in their household, such as the Garmin Vivofit or the Fitbit. Another 15,5% of Affluent Americans own a smartwatch like the Samsung Gear or Apple Watch.

The Spanish Affluent rank second worldwide, a fitness tracker is the most popular wearable tech device: 19.5% personally owns one or more.

In Turkey, which has the third highest penetration, Affluent are most likely to own a smartwatch.

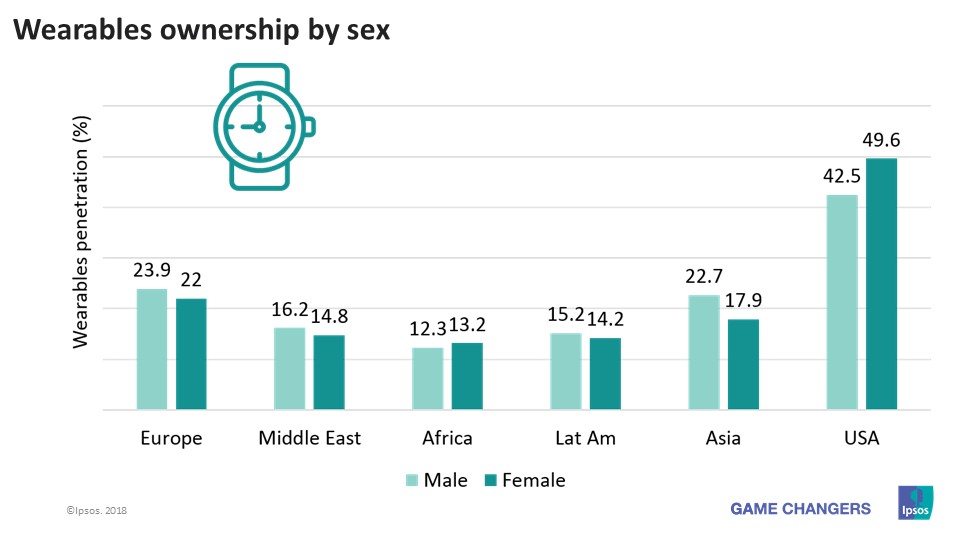

Wearable tech owners: not who you might expect

You might expect that smartwatches and fitness trackers are mostly bought by male, tech-savvy millennials – you would be wrong!

While, the gender gap in most countries is relatively small; men are more likely to own smart watches and fitness trackers are more popular amongst women.

In Europe, the USA, Asia and Latin America, adoption and ownership of smartwatches and fitness trackers is biased towards Affluent millennials. In the Middle East and Africa penetration is higher among consumers aged 35 and over.

Did you know that in Europe, fitness trackers are most popular amongst women aged 35 to 44? And that 20,3% of the European Affluent is planning to buy a wearable device in the next twelve months?

The Ipsos Affluent Survey contains data about Affluent’s adoption of wearables, smartphones and many other personal electronics in 41 countries worldwide, providing you with deep insights in the buying habits of the world’s most influential consumers.