The economic implications of the coronavirus: views and fears of online South Africans

South Africa has implemented a 5-staged approach, whereby a gradual reintroduction of full-scale activity, at different stages, will be introduced. Yet, millions of South Africans are still facing restrictions to return to their places of work. The South African economy has faced several destabilising factors over the past couple of months, which include the devastating effect of the coronavirus, the downgrade to junk status and the lasting effects of state capture and failing state-owned enterprises.

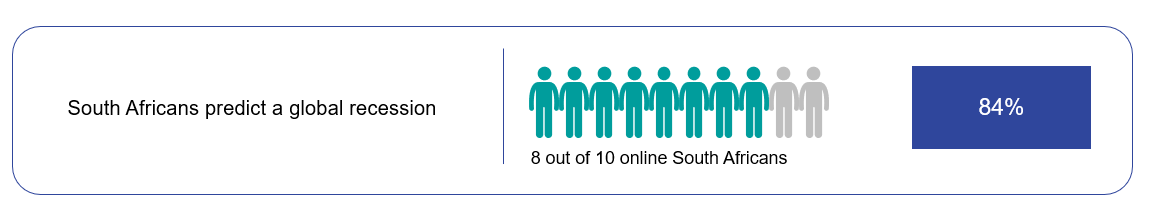

The majority of online South Africans (92%) express the view that the coronavirus pandemic will have a lasting effect on the country’s economy, whilst 84% of online South Africans believe that a global recession is likely. Based on these factors, 90% of online South Africans fear that the coronavirus pandemic will have a financial impact on them, as well as their families.

These are some of the findings in the most recent Ipsos South Africa Covid-19 online tracker. Fieldwork was conducted from 20-22 April 2020, with 1,000 adult South Africans from the Ipsos I-say panel, who have internet access at home or on their mobile phones.

The lasting impact of the coronavirus on the economy

The coronavirus pandemic has caused unprecedented shifts in global markets and created extreme fluidity all over the world. Therefore, new trends are not yet fully established, but there is a notion that the “new normal” will be very different from the past.

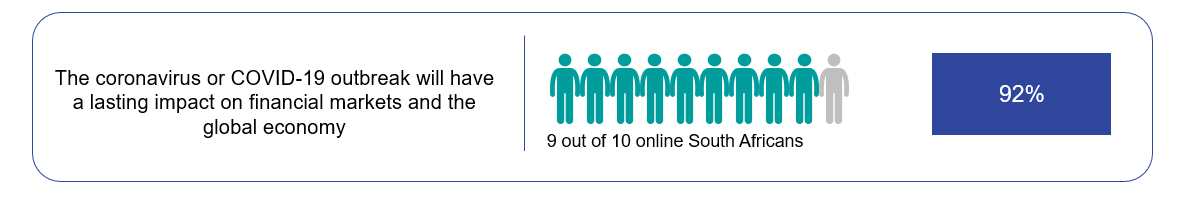

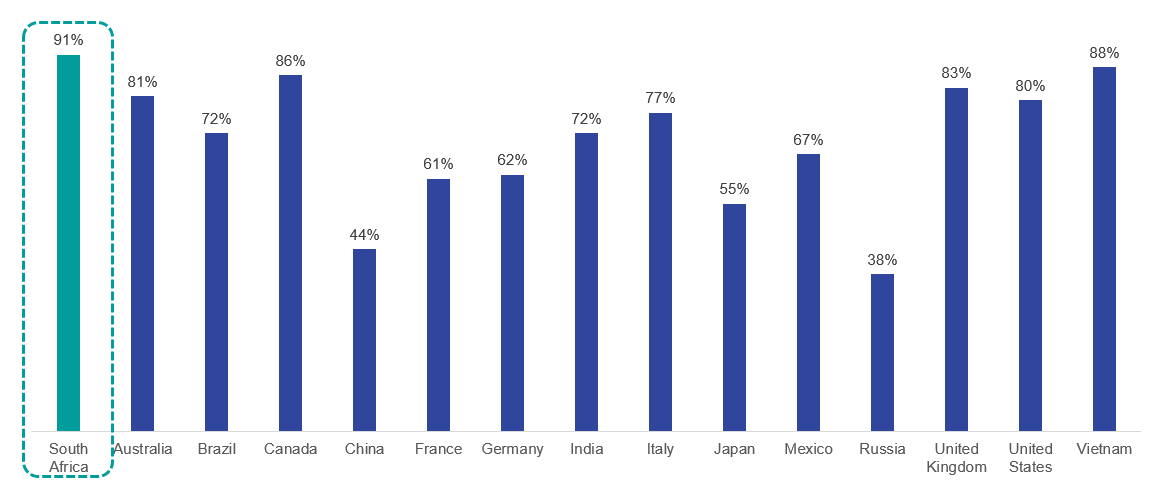

Respondents were asked how strongly they agree or disagree with the following statement: “The coronavirus or COVID-19 outbreak will have a lasting impact on financial markets and the global economy.” Possible answer categories were “strongly disagree”, “disagree”, “neither disagree nor agree”, “agree” and “strongly agree”.

As illustrated below, 9 out of every 10 (92%) online South Africans agree or strongly agree that the coronavirus pandemic will have a lasting impact on financial markets and the global economy.

Citizens from various countries shared a similar sentiment. Italians supported this notion the strongest with 96% who either “agreed” or “strongly agreed” with the statement. Despite the reported significant number of job losses and unemployment claims in the United States, only 81% of Americans “strongly agreed” or “agreed” with this statement.

Predicting a global recession

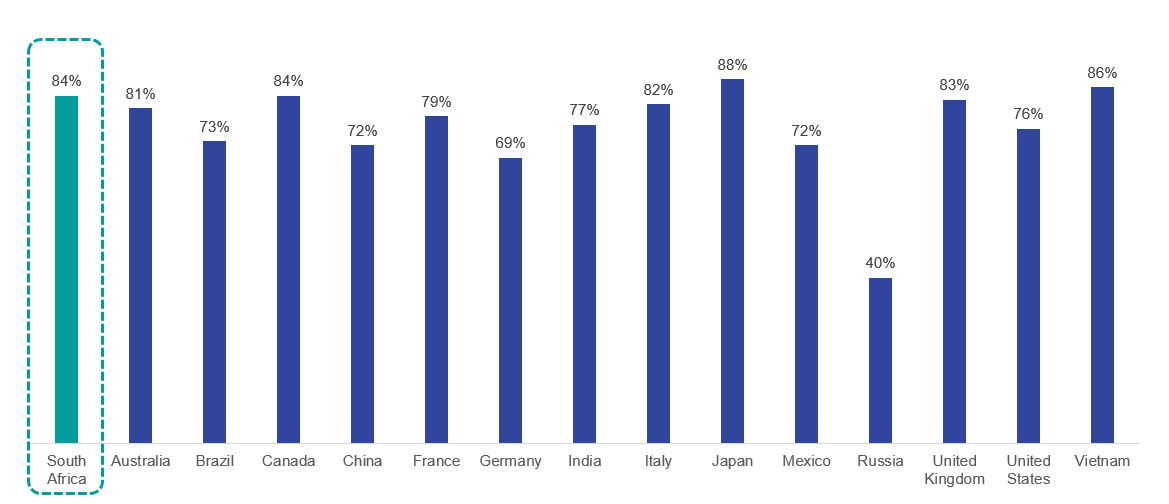

With many advanced economies expected to enter a recession this year based on the decrease in GDP, South Africa is faced with a predicted GDP shrinkage of at least 6.4% that will inevitably plunge South Africa’s economy into a recession.

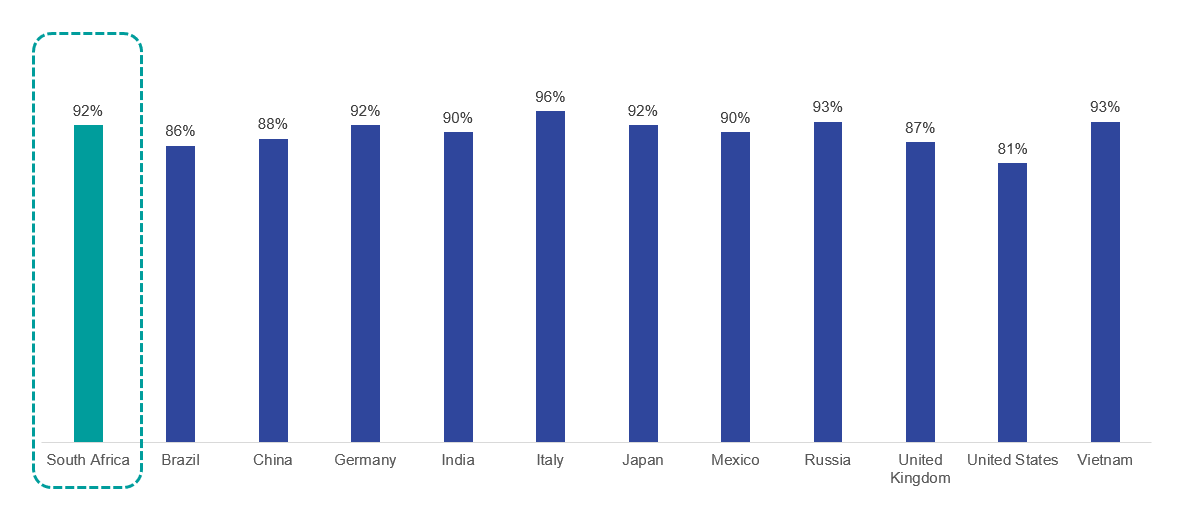

Respondents were asked how likely or unlikely, in their opinion, a global recession is to occur as a result of the coronavirus or Covid-19. Response categories were: “very unlikely”, “somewhat unlikely”, “neither likely nor unlikely”, “somewhat likely” and “very likely”. More than 8 out of every 10 (84%) online South Africans predict a global recession as somewhat or very likely.

This sentiment was shared strongly amongst respondents from Japan (88%), Vietnam (86%), Canada (84%), the UK (83%), Italy (82%) and Australia (81%). Even though only 40% of online Russian respondents indicated the likelihood of a recession, a large proportion of Russians were unsure about the possibilities of a worldwide recession, with 44% choosing the “neither likely nor unlikely” option.

Expectations of job losses

22-million job losses have been confirmed in the United States, with the expectation that this number will increase over the next few weeks. The South African National Treasury last week predicted expected job losses in South Africa to range between 3 and 7 million!

Respondents were asked how strongly they agree or disagree with the statement: “I expect significant layoffs and job losses in my country.” On a 5-point scale the possible answers were “strongly disagree”, “disagree”, “neither disagree nor agree”, “agree” and “strongly agree”.

9 out of every 10 (91%) online South Africans expect significant job losses in the country over the next couple of months because of the coronavirus.

Online South Africans have much higher expectations of job losses compared to the rest of the world.

In the light of South Africa’s unemployment rate pre-lockdown, the downgrade of South Africa to junk status, the low consumer confidence index and the national lockdown as well as government information on which sectors will be allowed to operate at which level of lockdown, it is not surprising that South Africans are very concerned about the sustainability of their employment.

This concern is shared to a relatively high degree by citizens from Vietnam (88%), Canada (86%), the United Kingdom (83%), Australia (81%) and the United States (80%), whilst online respondents from China (44%) and Russia (38%) seem more unsure whether their countries will face the same magnitude of possible job losses.

Expectation of business closure

Many South African businesses are at risk of closure due to the profound disruptions brought about by the spread of the coronavirus on businesses. As a result of the lockdown, businesses in South Africa reported a downturn in annual turnover which resulted in more employees being at risk of retrenchment.

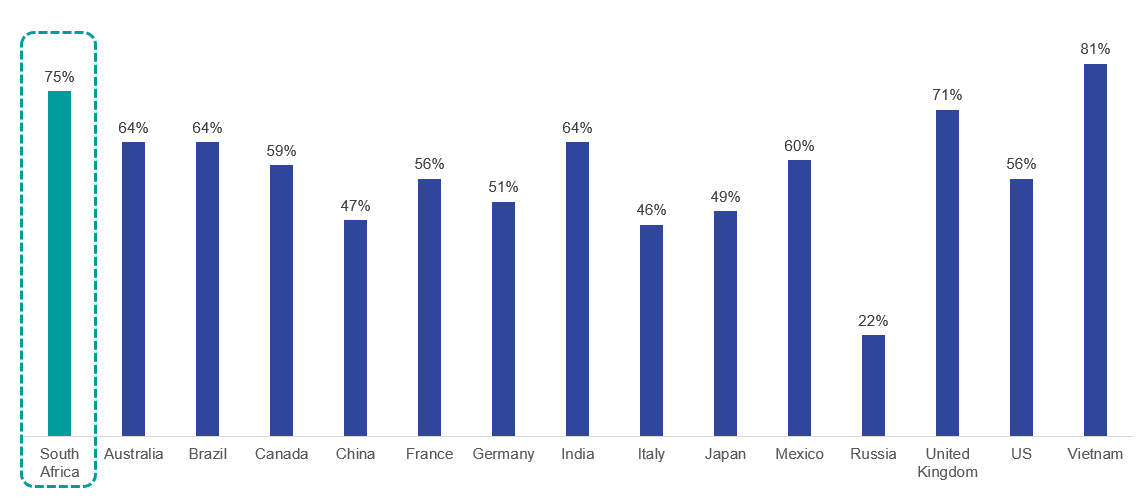

Respondents were asked how strongly they agree or disagree with the following statement on a 5-point scale ranging from “strongly disagree”, “disagree”, “neither disagree nor agree”, “agree” and “strongly agree”: “A major employer in South Africa will go out of business.”

Three-quarters (75%) of online South Africans strongly agree or agree that a major employer in South Africa will go out of business as a result of the coronavirus.

On a global level, online respondents in China (47%) and Russia (22%) are less concerned about a major employer going out of business. Citizens from Vietnam (81%) and the United Kingdom (71%) share the concerns of South Africans.

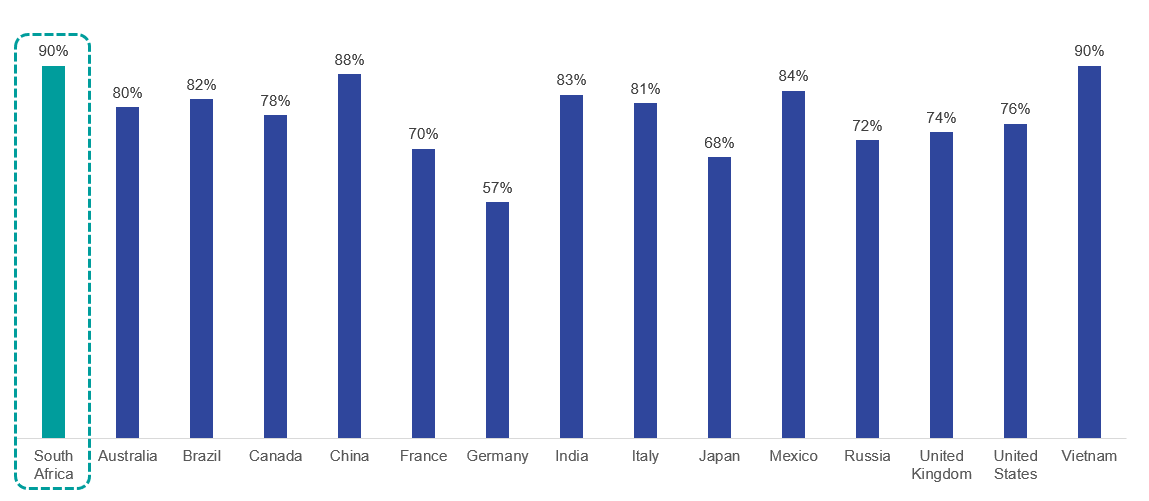

Personal financial impact

Millions of South Africans’ livelihoods have been disrupted because of the coronavirus. The scale and impact of the national lockdown have caught many South Africans off-guard, not allowing enough time to adequately plan. Consequently, online South Africans feel very strongly (90%) when it comes to the question of: “The coronavirus pandemic will have a financial impact on me and my family.” As before, answer categories were “strongly disagree”, “disagree”, “neither disagree nor agree”, “agree” and “strongly agree”.

It can be argued that developing markets will probably suffer a more negative effect based on the unintended consequences of the coronavirus pandemic. On this issue, the same proportions of Vietnamese and online South Africans agreed or strongly agreed that the outbreak will have a financial impact on themselves and their families. On the other hand, only 57% of Germans indicated that either them personally, or their families might potentially be impacted.

The role of government

The South African Government has implemented various strategies to support businesses during the national lockdown. These measures include tax relief, debt relief, finance schemes, a business growth/resilience facility and the tourism relief fund. In addition, added support has been made available to employees of companies that have been negatively influenced by the national lockdown. During this period, permitted informal traders could trade.

In this regard respondents were given a few statements and had to indicate their level of agreement by using the 5-point scale of “strongly disagree”, “disagree”, “neither disagree nor agree”, “agree” and “strongly agree”.

| Statement | Agree / Strongly agree % |

| Government must support small businesses | 95 |

| Government should pay the salaries for people who cannot work during this period because their company or business has temporarily closed | 87 |

| Government must support informal traders | 83 |

All three these possible measures of business support from the side of the government for struggling businesses or individuals are very popular amongst online South Africans.

About the Study

- In South Africa the online survey was conducted via the Ipsos i-Say panel between the 20th and 22rd of April 2020.

- A sample size of n=1,000 online respondents aged 18-65 years old participated in the survey. The data was weighted and projected to South Africans who have internet access at home or on their smartphones.

- The Global study used to compare with South African results is Wave 6 of the Ipsos Global Covid-19 Tracker, conducted on the Ipsos Global Advisor online platform among 28,000 adults aged 18-74 in Canada and the United States and 16-74 in Australia, Brazil, China, France, Germany, Italy, India, Japan, Mexico, Russia, Vietnam and the United Kingdom.

- Globally, at the start of Wave 4 of the international study, sample sizes were adjusted from 1,000 to 2,000 per country, with the exception of Vietnam staying at 1,000 interviews, the same as South Africa

- The samples in Australia, Canada, France, Germany, Italy, Japan, the U.K. and the U.S. can be taken as representative of these countries’ general adult population over age 16 or 18 (as above) and under the age of 75. The sample in South Africa, Brazil, China, India, Mexico, Russia, and Vietnam is more urban, more educated and/or more affluent than the general population and should be viewed as reflecting the views of the more “connected” segment of the population. The data is weighted so that each market’s sample composition best reflects the demographic profile of the adult population.

- In South Africa, Ipsos weighted and projected the results to the online population: those who have access to the internet at home or on their smart phones.

- Where results do not sum to 100 or the ‘difference’ appears to be +/-1 more/less than the actual, this may be due to rounding, multiple responses or the exclusion of don't know or not stated responses. The precision of Ipsos online polls is calculated using a credibility interval with a poll of 1,000 accurate to +/- 3.5 percentage points. For more information on the Ipsos use of credibility intervals, please visit the Ipsos website (www.ipsos.com).

For more information on this news release, please contact:

|

Stella Fleetwood |

Ezethu Mandlelize |

About Ipsos

- Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

- Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide the true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5,000 clients across the world with 75 business solutions.

- Founded in France in 1975, Ipsos is listed on Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

- ISIN code FR0000073298, Reuters IPSOS.PA, Bloomberg IPS: FP www.ipsos.com