Switzerland is highly regarded for the appeal of its businesses

New York, July 2, 2020 – The COVID-19 pandemic has had a significant economic impact worldwide. Ipsos research shows that Global Consumer Confidence sharply declined to record lows in 2020; and as nations around the world cautiously lift restrictions imposed at the height of the pandemic, in an effort to restart their economies, it is still largely unknown if it will be possible to recapture the economic momentum of recent years.

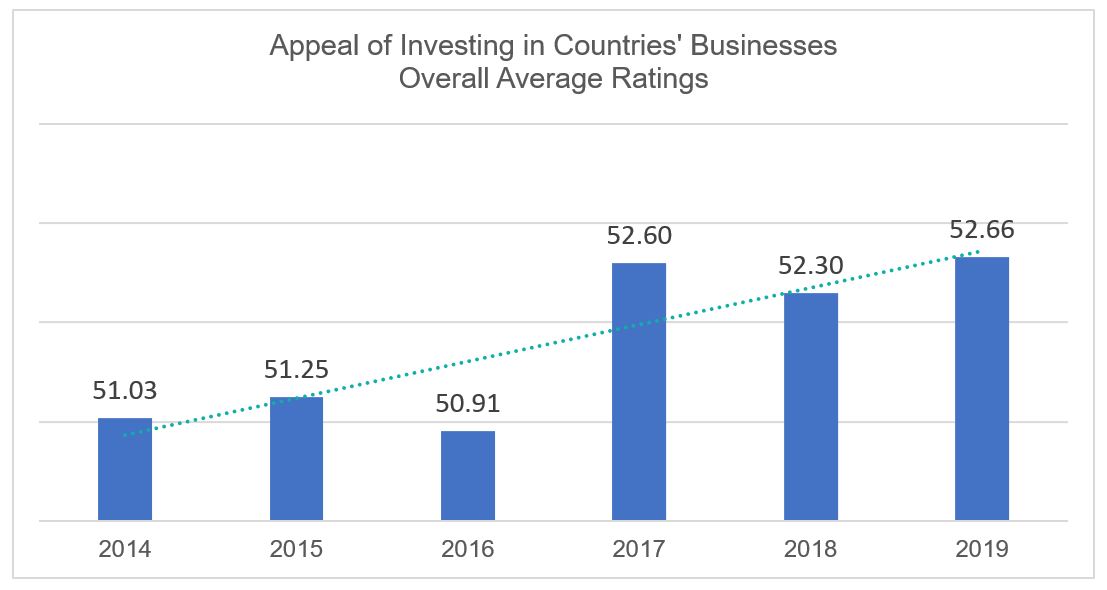

A longitudinal analysis of the 50 Nation Brands Index (NBI) countries between 2014 and 2019 demonstrates that while there has been an overall increase in the appeal of investing in businesses from countries around the world, opinion on the matter is somewhat mercurial. The business-investment appeal of countries at the global level observed a notable increase in 2017, and opinions have remained relatively stable since.

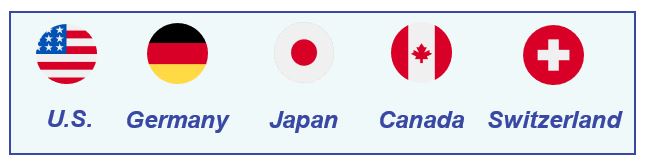

Responses of 120,000 global citizens in 20 different nations indicate that the top-five countries with the most attractive businesses of the last five years have been:

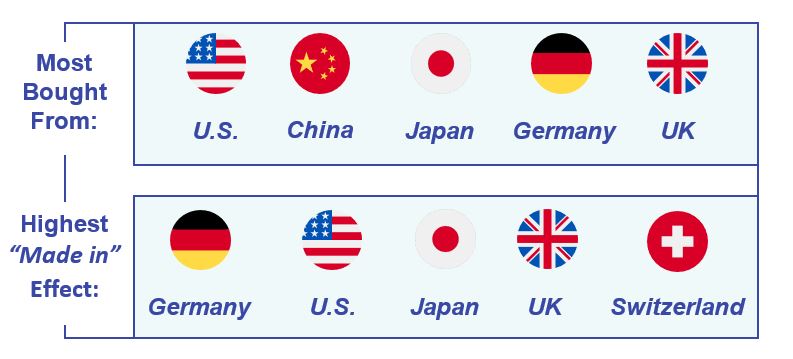

With the exception of Japan, the top-five countries perceived to have the most attractive business environment of the last five years come from North America and Europe. Furthermore, we observe a similar pattern when it comes to purchasing behaviors and sentiment – or the “made in” effect:

Global citizens feel most good when purchasing products made in Germany, the United States, Japan, and the United Kingdom; however, the list of countries from where most global citizens report ever buying a product differs slightly in its order – and includes China instead of Switzerland.

The similarities in all three lists demonstrates, that for the most part:

- These nations have a strong reputation when it comes to their business environment

- Many global citizens have ever purchased products from these countries, and most importantly that

- Many consumers feel good about purchasing products from these nations

However, the slight discrepancies between the lists denote that:

- While Switzerland’s business environment is highly regarded for the appeal of its businesses, not nearly as many people have ever purchased a product made in Switzerland, as they have for other countries like the United States, China, Japan, Germany, and the United Kingdom, and that

- While most global citizens report ever purchasing products from China, the “made in” effect is not nearly as strong as it is for other nations like Germany, the United States, Japan, and the United Kingdom

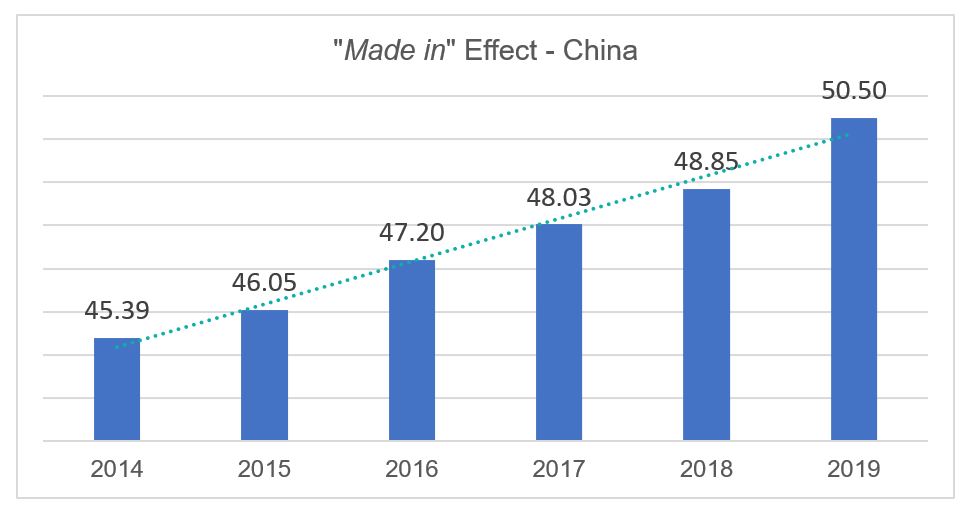

Over the past half-decade, the number of global citizens who reported having ever purchased a product from Switzerland has remained generally unchanged; however, there has been a notable improvement on the “made in” effect for products originating from China. Since 2014, positivity in buying products from China has improved the most, and at a faster rate, than for any other measured NBI nation.

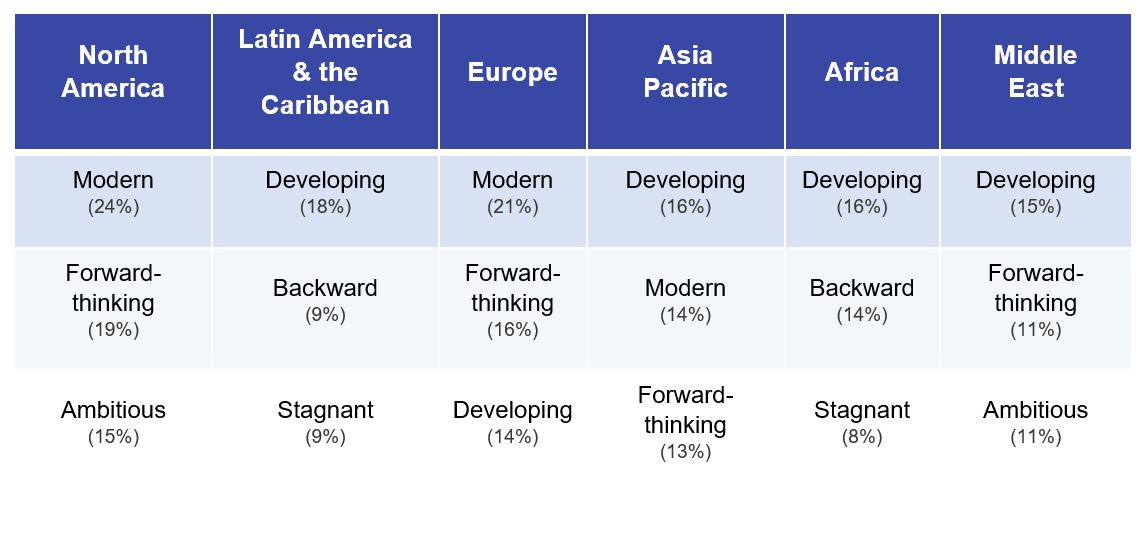

Similarly, global citizens generally default to contrasting descriptors like “modern” or “developing” when describing the economic and business conditions of the measured NBI nations. These associations tend to align with the business appeal results: economies in North America and Europe are mostly perceived to be “modern,” while those in Latin America and the Caribbean, Asia Pacific, Africa, and the Middle East are still considered to be “developing.”

Future Research

The full extent of the impact that the COVID-19 pandemic will have on global business flows is still largely unknown – with some key prevailing questions being:

- How will response strategies impact the investment appeal of businesses in different countries?

- How are nation brands benefiting or hurting depending on the strengths and vulnerabilities of their economies?

- Will supply chain restructuring and diversification impact global citizen’s purchasing habits? Will there be a stronger emphasis on domestic or international product consumption?

- Will global consumers’ sentiment towards buying products from other nations change? Will there be higher positivity when purchasing domestic or international products?

In an effort to provide more clues to the questions above, and to better understand the broader effect of the COVID-19 pandemic on nation brands, Ipsos’ NBI 2020 will evaluate the impact healthcare crises, such as the current COVID-19 pandemic, have on perceptions of countries around the globe.

These findings, along with NBI 2020 ratings, will provide critical insight to nations working to manage their brands and restore their business sector quickly after the pandemic. Having a deep understanding of current perceptions, in the global context and in these turbulent times, can help guide future communications and marketing efforts for greater likelihood of campaign success.

For more information on this news release, please contact:

Jason McGrath

Senior Vice President, US

Corporate Reputation

[email protected]

Uri Farkas

Account Manager, US

Corporate Reputation

[email protected]

About the Study

The Anholt-Ipsos Nation Brands Index (NBI), collects over 20,000 interviews online in 20 panel countries with adults aged 18 or over each year. Data are weighted to reflect key demographic characteristics including age, gender, and education of the online population in that country each year. Additionally, race/ethnicity has been used for sample balancing in the U.S., UK, South Africa, India, and Brazil. Fieldwork was conducted from July through August every year.

The total nations measured by the survey between 2014 - 2019 are as follows, listed by region:

North America: Canada, U.S.

Europe: Austria, Belgium, Croatia, Czech Republic, Denmark, Finland, Flanders, France, Germany, Greece, Hungary, Ireland, Italy, Netherlands, Northern Ireland, Norway, Poland, Russia, Scotland, Spain, Sweden, Switzerland, Turkey, United Kingdom, Ukraine

Asia-Pacific: Australia, China, India, Indonesia, Japan, Description, Kazakhstan, New Zealand, Singapore, South Korea, Taiwan, Thailand

Latin America and the Caribbean: Argentina, Brazil, Chile, Colombia, Cuba, Ecuador, Jamaica, Mexico, Peru, Puerto Rico

Middle East: Iran, Qatar, Saudi Arabia, Turkey, United Arab Emirates

Africa: Botswana, Egypt, Kenya, Nigeria, South Africa

About Ipsos

Ipsos is the world’s third largest market research company, present in 90 markets and employing more than 18,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. We serve more than 5000 clients across the world with 75 business solutions.

Founded in France in 1975, Ipsos is listed on the Euronext Paris since July 1st, 1999. The company is part of the SBF 120 and the Mid-60 index and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com

About Simon Anholt

Simon Anholt designed and launched the Nation Brands Index in 2005. Since 1998, he has advised the presidents, prime ministers and governments of 56 countries, helping them to engage more imaginatively and effectively with the international community. He is recognized as the world’s leading authority on national image. Professor Anholt also publishes the Good Country Index, a survey that ranks countries on their contribution to humanity and the planet, and is Founder-Editor Emeritus of the Journal of Place Branding and Public Diplomacy. He was previously Vice-Chair of the UK Foreign Office Public Diplomacy Board. Anholt’s TED talk launching the Good Country Index has received 6 million views, and his more recent one launching the Global Vote, over a million. He has written five books about countries, cultures and globalization and is an honorary Professor of Political Science at the University of East Anglia. His latest book, The Good Country Equation, will be published in August 2020.