Ipsos assisted Zhonggan Communication (Group) Holdings Limited to successfully IPO in Hong Kong (2545.HK)

On July 3, 2024, Zhonggan Communication (Group) Holdings Limited (referred to as "Zhonggang Communication"), was successfully listed on the main board of the Hong Kong Stock Exchange (stock code: 2545.HK). The company, headquartered in Jiangxi Province, PRC, is a well-regarded integrated service provider and software developer specializing in Telecommunications Infrastructure Services and Digitalisation Solution Services. Since its founding, the Group has established long and stable business relationships with the key players in the telecommunications industry in the PRC, including the Big Three, the three largest telecommunications network operators in the PRC and the largest telecommunications tower infrastructure service provider in the PRC. With a market share of approximately 3.1%, Zhonggan Communication ranked third in Jiangxi Province based on its 2023 revenue.

Zhongtai International Capital Limited was the sole sponsor for the listing process, and Zhongtai International Securities Limited acted as the Sole Overall Coordinator and Sole Global Coordinator. Zhongtai International Securities Limited and CCB International Capital Limited, BOCOM International Securities Limited, CMB International Capital Limited, ABCI Capital Limited, ICBC International Securities Limited, CMBC Securities Company Limited, First Shanghai Securities Limited and China Sunrise Securities (International) Limited served as joint book runners for the listing.

Ipsos Asia Limited (referred to as "Ipsos") provided exclusive industry consulting services for Zhonggan Communication’s IPO application.

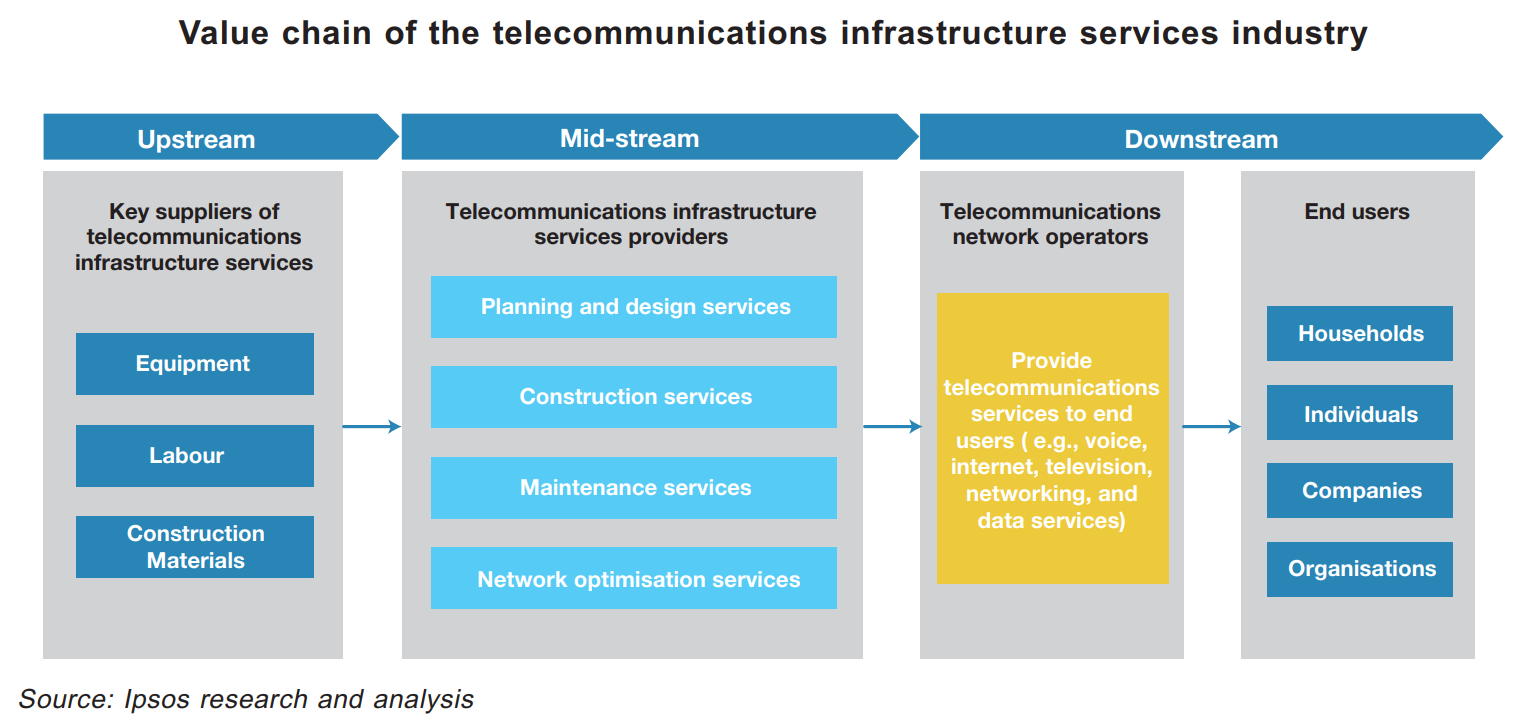

Overview of the telecommunications infrastructure services industry in the PRC.

The telecommunications industry in the PRC is dominated by the three telecommunications network operators, China Unicom, China Telecom, and China Mobile (collectively the ‘‘Big Three’’), and the telecommunications tower infrastructure service provider, China Tower.

The telecommunications infrastructure services encompass (i) planning and design services, (ii) infrastructure construction services, (iii) maintenance services, and (iv) network optimisation. Within this industry, some companies specialise in one or two specific services, while others provide a comprehensive range of services to the Big Three and China Tower.

Zhonggan Communication specialised in Infrastructure Construction and Maintenance services. The company has established strong and stable business relationships with the key players in the PRC’s telecommunications industry, including the Big Three and China Tower. Zhonggan Communication has expanded its operations to 25 provinces, municipalities, and autonomous regions across the PRC.

Market Value and Competitive Landscape

Driven by the demand for 5G infrastructure, the telecommunications infrastructure services industry has experienced substantial growth. The market value rose from approximately RMB226.2 billion in 2019 to approximately RMB282.6 billion in 2023, at a CAGR of approximately 5.7%. The upward trajectory is projected to continue, with the market expected to reach RMB368.2 billion by 2028 at a CAGR of approximately 5.5%. The steady growth is driven by the continuous development of telecommunications infrastructure for both commercial and governmental applications, expedited by advanced technologies like 5G and the Industrial Internet of Things IIoT.

In 2023, there were approximately 246 companies certified with Communications Project Implementation General Contracting Enterprises Qualification(通信工程施工總承包資質)Class 1, Class 2, or Class 3 qualifications that had won at least one telecommunications infrastructure project in Jiangxi Province and considered active player.

Based on 2023 revenue, Zhonggan Communication the Group ranked third amongst all telecommunications network infrastructure construction and maintenance services providers in Jiangxi Province, with a market share of approximately 3.1%.

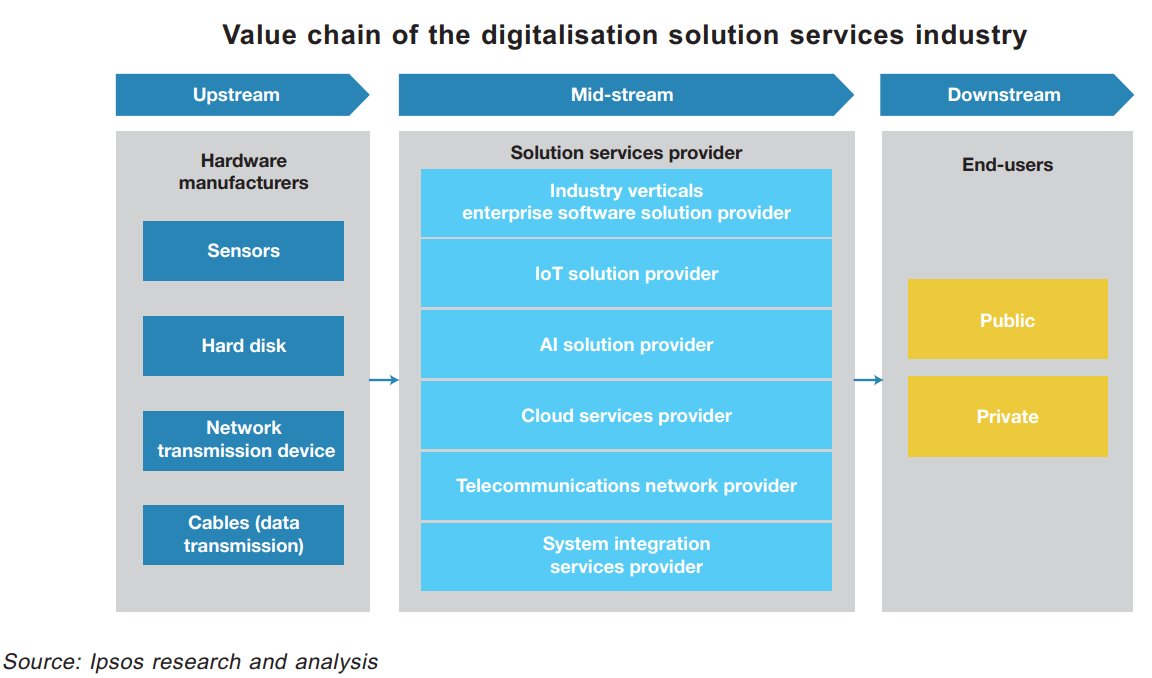

Overview of the digitalisation solution services industry in the PRC

The increasing adoption of smart cities, as well as the growth of the digital economy, has largely boosted the demand for digitalisation solution services. The opportunity becomes the key growth engine for Zhonggan Communication, of which the sector contributed over 17.5% of the company’s total revenue in 2023.

Digitalisation solution services encompass a comprehensive package that includes planning, developing, installing, and optimizing hardware and software. These services make use of both traditional technologies such as digitalization, information and communication technology (ICT), and cutting-edge technologies like the Internet of Things (IoT), cloud computing, and Artificial Intelligence (AI). Their purpose is to design systems that interconnect various infrastructures for data collection and operation, as well as to enable real-time data collection, incident response, rapid analytics, and automated decision-making.

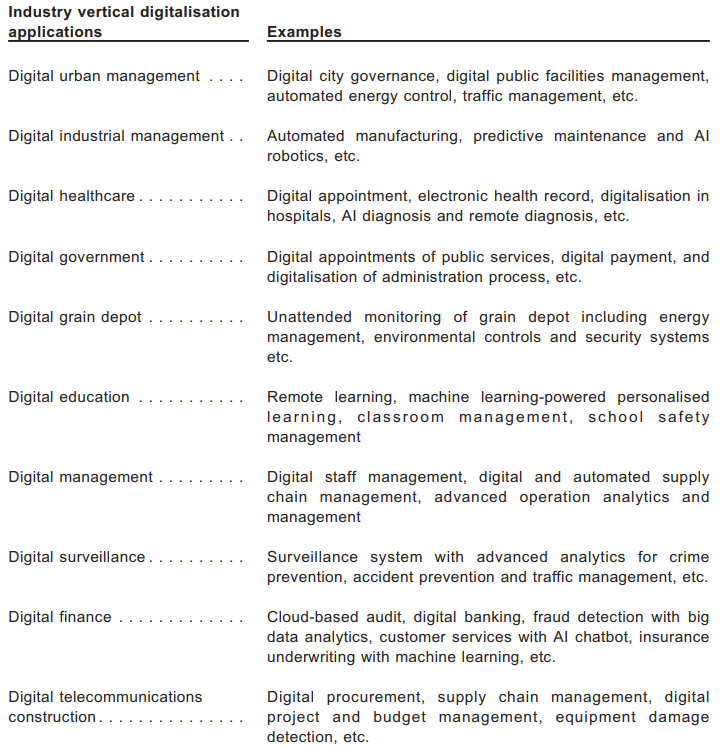

Digitalisation applications can generally be categorised into the following scenarios:

Sources: Ipsos Research and analysis

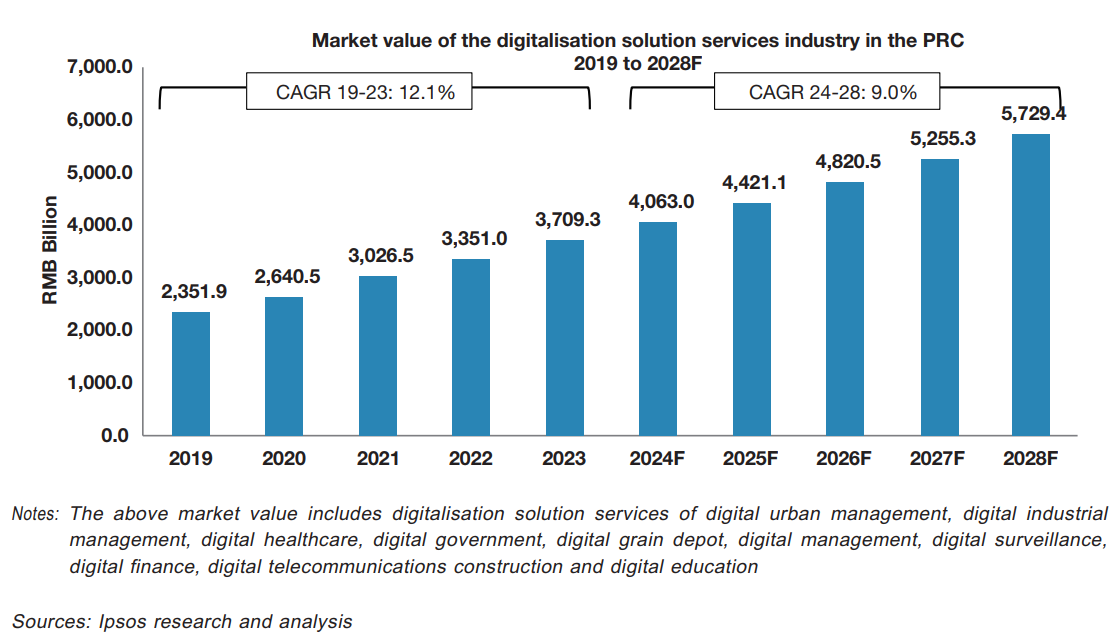

Market Value and Future Outlook

The digitalisation solution services industry in the PRC is expected to achieve a CAGR of approximately 9.0% from 2024 to 2028. The 14th Five-year Plan for National Informatisation(‘‘十四五’’國家信息化規劃) aims to accelerate the development of city infrastructure digitalisation applications such as public transport, healthcare, and education by 2025.

China’s 14th Five-Year Plan (2021-2025)(‘十四五’’規劃 (2021-2025)) prioritised establishing the PRC as a self-reliant technological powerhouse. The plan focuses on supporting the research and development of midstream manufacturers and the development of smart cities, smart communities, and smart homes. These policies have encouraged digitalisation solution services companies to increase their R&D investments, driving innovation in digitalisation solutions.

Ipsos played a crucial role in Zhonggan Communication's successful listing on the Hong Kong Stock Exchange. The company provided comprehensive support, including drafting the industry overview for the prospectus, conducting an objective analysis of Zhonggan Communication's strengths and weaknesses to determine its market position, and ensuring effective communication between the issuer, investment banks, intermediaries, the Stock Exchange of Hong Kong, and investors.

Link to the prospectus: https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0621/2024062100099.pdf

For further information and/or new engagement, please contact ([email protected]) or Adrian Lo - Partner, Strategy 3 ([email protected]); Anthony Chu - Senior Engagement Manager, Strategy 3 ([email protected])