December 2024: Consumer confidence down globally for the second consecutive month

Ipsos’ Global Consumer Confidence Index is down 0.7 point since last month and sits at 47.9. The index has declined for the second consecutive month and is now 1.5 points lower than its reading to begin 2024.

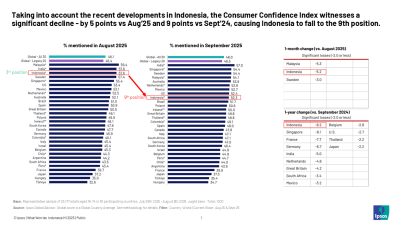

Among 29 economies measured, just two countries show significant gains in consumer sentiment, while eight countries show a notable decline.

Based only on the “legacy 20 countries” tracked since March 2010, the Index would read at 45.8, down 0.7 point since November.

The Current and Investment indices both show significant declines for the second consecutive month. The Expectations index is also down, while the Jobs index shows stability this month.

Sentiment is generally down among European countries. Germany (-3.9 points) and France (-3.7 points) show the largest declines among all countries this month. Belgium (-3.3 points), Great Britain (-2.8 points), and Poland (-2.7 points) also show significant losses.

In contrast, consumer confidence is mixed in Asia. Malaysia (-3.4 points) and South Korea (-2.1 points) are down significantly this month, while sentiment is up in Indonesia (+2.2 points).

The Global Consumer Confidence Index is the average of all surveyed countries’ Overall or “National” indices. This month’s installment is based on a monthly survey of more than 21,000 adults under the age of 75 from 29 countries conducted on Ipsos’ Global Advisor online platform. This survey was fielded between November 22 and December 6, 2024.

Consumer sentiment in 29 countries

Among the 29 countries, Indonesia (66.5) holds the highest National Index score. Indonesia and India (60.3) are the only countries with a National Index score of 60 or higher.

Eight other countries now show a National Index above the 50-point mark: the U.S. (57.6), Mexico (56.2), Singapore (55.4), Thailand (55.2), Malaysia (53.5), Sweden (53.3), the Netherlands (51.9), and Brazil (51.9).

In contrast, five countries now show a National Index below the 40-point mark: France (38.5), Japan (38.5), South Korea (38.0), Hungary (34.0), and Türkiye (31.6).

Of note, consumer confidence in France has fallen to its lowest point since November 2020.

Compared to 12 months ago, twelve countries show a significant drop in consumer sentiment. In contrast, eight countries show a significant increase from December 2023, most of all in Argentina (+8.0), Malaysia (+7.4), and South Africa (+7.4).

Trends

Ipsos’ Global Consumer Confidence Index (based on all 29 countries surveyed) currently reads at 47.9, down 0.7 point since November. Based only on the “legacy 20 countries” tracked since March 2010, it would read at 45.8.

The Current sub-index, reflecting consumers’ perceptions of the economic climate and their current purchasing, jobs, and investment confidence, shows the largest drop among the sub-indices for the second consecutive month (-1.1 points) and is now at 38.0. Just three countries show a significant month-over-month gain (at least 2 points) in their Current sub-index, while nine countries show a significant loss.

The Investment sub-index, indicative of consumers’ perception of the investment climate, is down significantly for the second consecutive month (-1.0 point) and now sits at 40.5. In total, only four countries show a significant gain in their Investment sub-index this month, while ten countries show a significant loss.

The Expectations sub-index, indicative of consumer expectations about future economic conditions, is down 0.8 point and is now at 56.3. Just three countries show significant gains in their Expectations sub-index, compared to eleven countries show a significant loss.

The Jobs sub-index, reflecting perceptions about jobs security and the jobs market, is the only sub-index to not show a loss this month (+0.1 point) and is now at 58.0. Five countries show significant gains in their Jobs sub-index, while four countries show a significant loss.

Of note, Germany shows significant losses (of at least 2 points) across all four sub-indices. In contrast, no countries show significant month-over-month gains across all four sub-indices.

Countries experiencing notable gains and losses since November