Canadians Expect 2016 Will See Their Debt Decrease,

Net Worth Increase

Focusing on their overall debt levels, half (49%) believe it will be better (13% much/35% somewhat) by the end of 2016, compared to just 11% who think their level of debt will be worse (2% much/9% somewhat). Four in ten (40%) forecast no change in their level of debt.

When it comes to their net worth, four in ten (44%) think it will be better (10% much/33% somewhat) by the end of the year, compared to just 13% who expect it to be worse (3% much/10% somewhat). Four in ten (43%) don't believe their net worth will change by the end of the year. Those aged 18 to 34 (50%) are most optimistic that their net worth will increase this year.

Despite the optimism, experts have identified rising interest rates as a possible challenge to many who might be over-extended on their debt. Thinking about the direction of interest rates in Canada in 2016, a majority (51%) expects them to increase (6% a lot/45% a little), compared to just one in ten (10%) who believe rates will decrease (1% a lot/9% a little). Four in ten (39%) believe rates will hold steady through 2016.

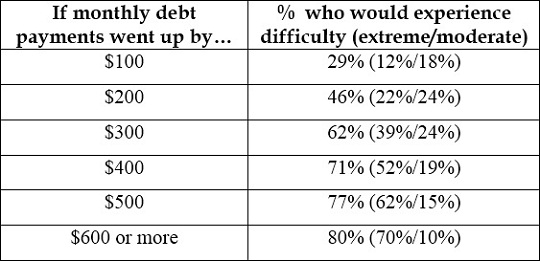

Assuming that interest rates went up and it resulted in an increase in debt payments, many Canadians say that they would experience difficulty paying their bills and balancing their budget, even if their debt payments went up by as little as $100 or $200. The table below outlines the proportion of Canadians who say paying bills and balancing their budget would be difficult if their debt payments went up by the corresponding amount.

Resolving To Improve Their Finances...

Fully one quarter (24%) of Canadians say that they've made a New Year's Resolution related to their finances, with Canadians under the age of 35 (37%) and Quebecers (38%) being particularly likely to have made a resolution of this nature. The most often-mentioned resolutions pertain to saving more (79%) or spending less money (76%), followed by reducing credit card debt (44%), reducing loans, such as car loans or student loans (27%), reducing a line of credit (25%), paying down the mortgage more quickly (20%), or some other resolution (29%).

Regardless of whether or not they've made a resolution, in order to meet their financial goals in 2016, half (49%) of Canadians will seek out some sort of financial resource to help them, chief among them being advice from a financial advisor (29%). Other tools include online budgeting and debt reduction information (12%), online tools like debt calculators (9%), complimentary, community-based financial management seminars (4%), complimentary web-based seminars (3%) or some other resource (11%). The other half (51%) of Canadians won't seek out any resources to help them stay on track to achieve their goals in 2016.

Identifying Challenges to their Financial Health...

Thinking about what could derail their finances, Canadians have assessed the degree to which certain life events would be challenging to their financial health. A long-term injury or illness was identified by 70% of Canadians as something that would be challenging (37% very/34% somewhat) to their financial health, making it the number-one challenge. Not far behind is if they or a family member lost a job (63% challenging - 38% very/25% somewhat). Other challenges to their financial health include retirement (53%- 23% very/29% somewhat), separation or divorce (46%- 27% very/19% somewhat), paying for post-secondary education (44%- 21% very/23% somewhat), and the birth of a child (41% -- 22% very/20% somewhat).

Interestingly, those aged 35 to 54 are more likely than others to suggest that retirement, separation or divorce would be challenging to their financial health, while younger adults are more likely to say that paying for education or the birth of a child would be challenging.

These are some of the findings of an Ipsos Reid survey conducted between January 5 and 8, 2016, on behalf of BDO. A sample of 1,007 Canadians from Ipsos' Canadian online panel were interviewed. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population of Canada according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online surveys is measured using a credibility interval. In this case, the Canadian sample is accurate to within +/-3.5 percentage points had all Canadians been surveyed. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Vice President

Ipsos Public Affairs

416.572.4474

[email protected]

About Ipsos in Canada

Ipsos is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos' marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. Ipsos ranks third in the global research industry.

With offices in 86 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,669.5 ($2,218.4 million) in 2014.

Visit ipsos.com to learn more about Ipsos' offerings and capabilities.