How financial companies can build on the trust they gained during the pandemic

Take a stand. Be authentic. Showcase fair treatment of customers and positive impact on society. These are some of the strategies that the financial industry can implement to create an action plan to help both employees and customers trust them.

While the past 13 years have seen an onslaught of scandals that have eroded trust in the financial sector, the COVID-19 pandemic has—surprisingly—provided the industry with a much-needed opportunity to regain trust. In our latest paper, we share recent research insights and detail ways that the financial industry can capitalize on that opportunity.

KEY TAKEAWAYS:

- Continue to build on the financial industry’s trust rebound during the pandemic

- Take a stand, but align your words with appropriate actions

- Use top trust drivers to craft a strategic business and communications plan for the pandemic and moving forward

After losing trust over the past 13 years, the financial industry has just started to see an upturn during the COVID-19 pandemic, thanks to providing support to consumers and businesses during this tumultuous time.

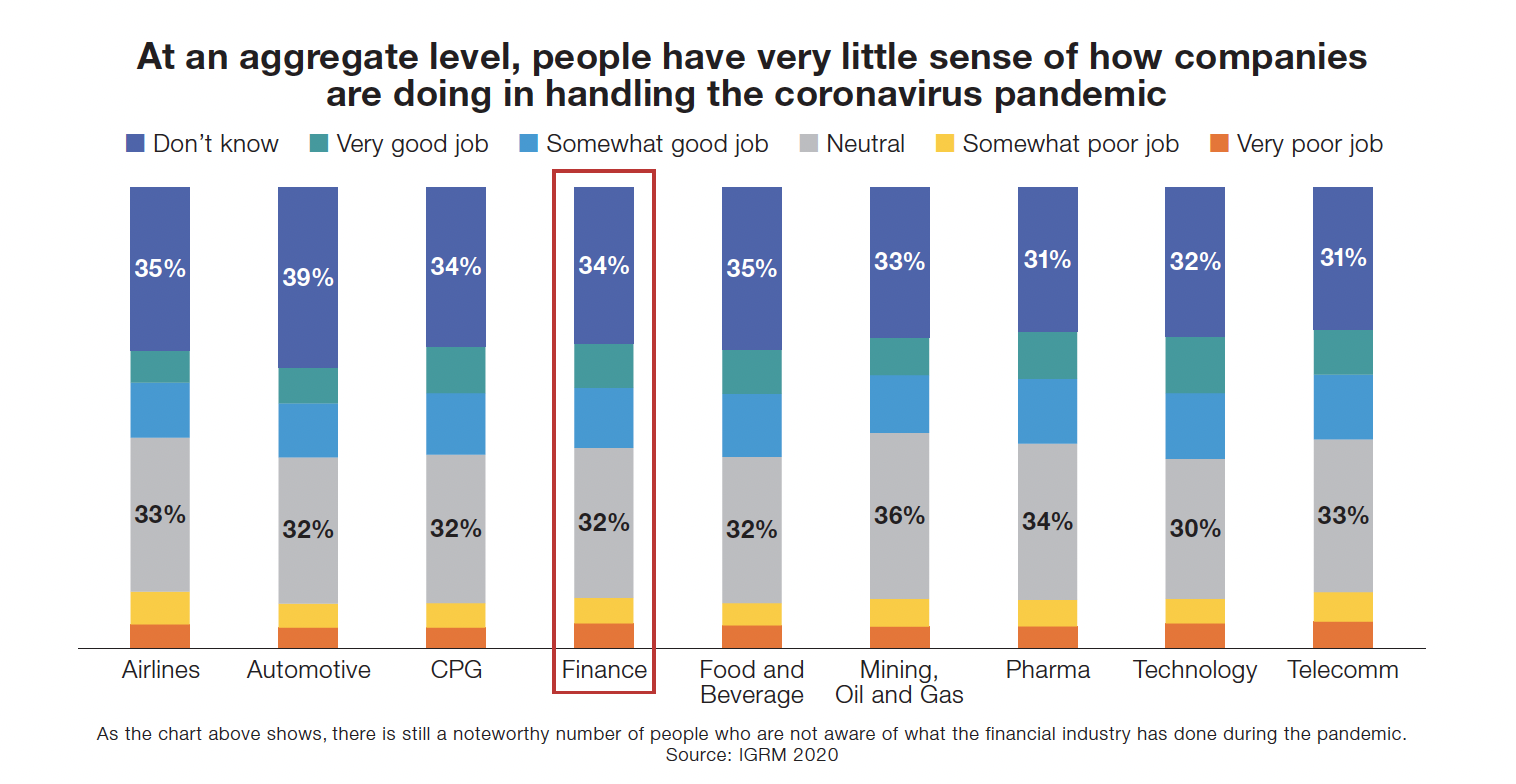

However, the sector isn’t out of the woods yet, and it’s important to combat negative perceptions through targeted and thoughtful actions, initiatives and communications.

The pandemic has provided an opportunity for financial companies to provide much-needed business support and focus on strategic communications to gain trust

While the past 13 years have seen an onslaught of scandals that have eroded trust in the financial sector, the COVID-19 pandemic has—surprisingly—provided the industry with a much-needed opportunity to regain trust. Here’s how the financial industry can capitalize on that opportunity.

Global trust in the banking sector has grown from 2018 to 2021, according to the Ipsos Global Trustworthiness Monitor—a promising upward trajectory that can and should be built upon.

This positive trajectory can likely be attributed to the financial sector’s response to COVID-19, when banks served as a valuable lifeline connecting businesses and individuals to crucial government loans and other assistance programs. The Trustworthiness Monitor found that corporate value attributes such as “it does what it does with the best of intentions” rose five percentage points since 2018 and “it behaves responsibly” rose four percentage points.

So, what does this mean for the finance industry?

There is a ripe opportunity to accelerate this reputational rebound and use the current momentum to continue to grow the gains made. We are still not out of the woods with the pandemic. With omicron being the latest in a series of COVID-19 variants—and no clear sense of new possible variants to come—we need to accept that the pandemic might be our “new normal” for the foreseeable future and simultaneously arm ourselves with an action plan for when we are out of the pandemic.

There are several strategies that the financial industry can employ to create an action plan to make sure that both employees and customers trust them. Whether it’s in the pandemic or out of it, companies should make sure to:

- Take a stand: Consumers expect companies to voice their opinion on sociopolitical issues. We are seeing active corporate responsibility on the rise—which means that companies that take a stand are more likely to be viewed as trustworthy and responsible. This is especially important during the pandemic, where consumers are on the lookout to see how companies are handling various critical issues such as vaccination requirements. Financial institutions sit at the center of modern society, and their actions here resonate far outward.

- Be authentic: Consumers are looking for companies’ responses during the pandemic. But at the same time, it’s crucial to be authentic in that response. It’s important that responses align with your corporate values and help consumers better understand your company’s purpose through both actions and words. It will be essential for financial firms to demonstrate alignment between messages being pushed outwards and what is actually being done. This is a large driver of whether or not consumers will invest their money or time, so it’s important that it is well thought through.

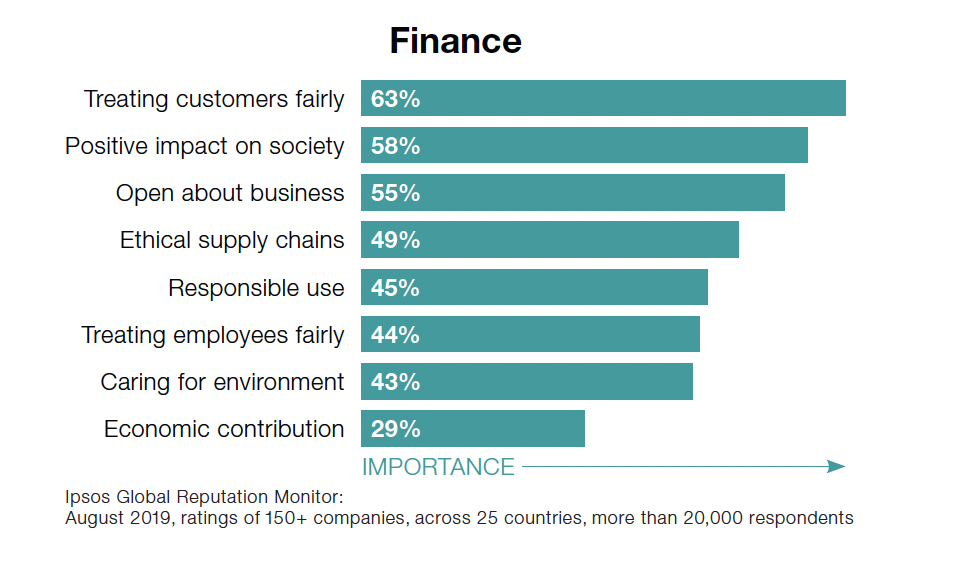

- Showcase fair treatment of customers and positive impact on society: Each industry has drivers of corporate responsibility that are unique to them. For the financial sector, top drivers are “treating customers fairly,” “having a positive impact on society,” and “being open about business operations.” These can be woven into communications that speak to what is happening during the pandemic to maximize impact.

Better understanding not only the overarching drivers for responsibility and trust in the financial sector, but the specific drivers of trust for your firm, can make the difference between communications that get lost in the crowd and communications that are authentic, align with your company’s values, showcase the initiatives and actions your firm is taking, and break through the noise. Creating a strong business and communications plan that is tailored for different generations’ needs should be navigated carefully and thoughtfully.

![[Webinar] KEYS: Global Trends - The Uneasy Decade](/sites/default/files/styles/list_item_image/public/ct/event/2025-10/Global%20Trends%20-%20Listing%20image%20-%20918%20x%20750.png?itok=DPdg1J3P)