92% Indians concerned about the environment; misplaced awareness emerged for impactful actions: Ipsos India Sustainability Segmentation Survey 2024

A new survey by Ipsos on Sustainability, in the backdrop of heightened emphasis on ESG and the quest to save the environment from further damage shows deep concern among Indians for the environment with at least 92% of those polled stating they are concerned and further two thirds believing that our planet was at risk.

Impactful actions – awareness misplaced

Interestingly, the survey revealed, consumers’ actions while well intended were not the actions needed for greater impact. 7 in 10 claimed to know the actions needed to tackle climate change, but they were wrong.

Urban Indians held the view that less packaging, buying fewer items and recycling would be the best actions for saving the planet, but they were seen to be low in impact. On the contrary some of the actions perceived to be low in impact by urban Indians, were seen to be the actions most impactful, but awareness and the implications of those actions had low perception among Indians, particularly for living car free, efficient cooking and efficient housing. Adopting renewable electricity was high on perception and impact.

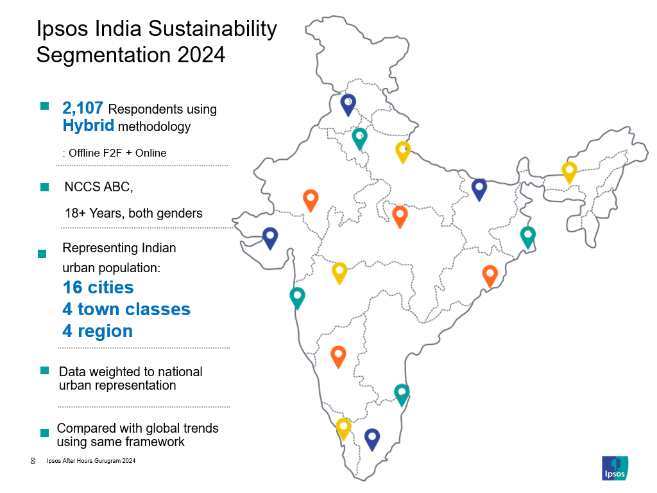

The survey was done using the Ipsos IndiaBus platform, which is a monthly omnibus study, which runs multiple surveys for clients (the details are provided below).

Activists, busy bystanders and disengaged denialists segments.

The survey classified Indians among 3 segments basis their level of concern and actions they are taking to mitigate their impact on environment.

The largest group of Indians emerged as Busy Bystanders (41%), who held the view that climate change was over blown; they were too caught up in their daily life and environment came out to be a low priority area. The 2nd segment was of Disengaged Denialists (24%), believing environment was not that big a concern and were less inclined to taking any environmental action. And the 3rd segment was of Activists (23%), with the belief that environment is at a critical stage and the world must act now.

Parijat Chakraborty, Group Service Line Leader, Public Affairs, Corporate Reputation, ESG and CSR said, “Our survey shows that Indians mostly do lip service towards their concern for the planet and the environment. So, while they say they are concerned, when we assessed them on their concern vs actual action, most of them were seen to fizzle out. In fact only the segment of consumers named Activists were the torchbearers of planet saviours. Busy Bystanders and Disengaged Denialists were seen to be the disinterested segments with low affinity for environment actions.”

What can marketers do to engage with these 3 cohorts?

The survey also revealed insights on how marketers could engage with the 3 segments of consumers.

“Given Activists’ high sustainable consciousness, they are best suited for all sustainable brand options and choices. EVs, sustainable clothing and brands with sustainability in their DNA. Disengaged Denialists who were less interested in environment actions could be wooed by providing products with sustainability as a co-benefit. Also by pulling in the sustainability discourse into the things they like or like to do. Busy Bystanders are the working class with sheer paucity of time and also, they carry some bit of guilt of zilch action on environment. So brands that conserve energy, use recycled packaging or local sourced ingredients will appeal to this cohort,” stated Deepti Chandna, Executive Director, Ipsos India.

About Ipsos IndiaBus

Ipsos IndiaBus is a monthly pan India omnibus (which also runs multiple client surveys), that uses a structured questionnaire and is conducted by Ipsos India on diverse topics among 2200+ respondents from SEC A, B and C households, covering adults of both genders from all four zones in the country. The survey is conducted in metros, Tier 1, Tier 2 and Tier 3 towns, providing a more robust and representative view of urban Indians. The respondents were polled face to face and online. We have city-level quota for each demographic segments that ensure the waves are identical and no additional sampling error. The data is weighted by demographics and city-class population to arrive at national average. The data collection is done in every month and the results are calculated on two-months rolling sample.