Steady Confidence, Shifting Concerns: Asia-Pacific Balances Optimism and Unease

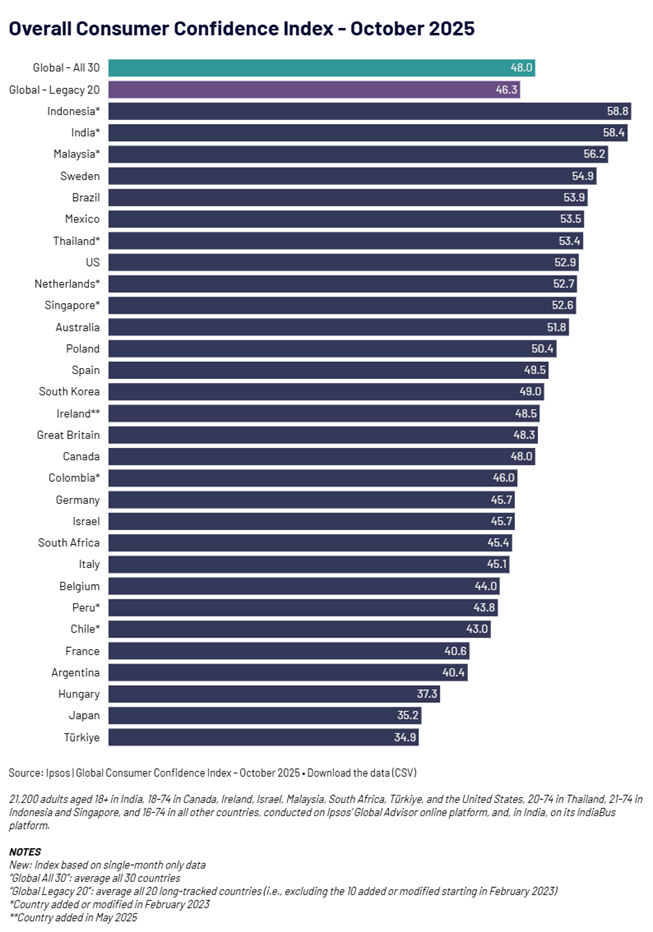

Consumer confidence across Asia-Pacific held firm in October, with the regional index at 49.3, unchanged for the fourth consecutive month, compared to a global average of 48.0.

The region remains one of the world’s steadiest, even as global sentiment softens. On the surface, the stability suggests calm, but the story beneath it tells a different one: confidence is holding, yet the balance of optimism and caution is shifting across markets.

Southeast Asia’s optimism is built based on steady employment and domestic demand, while mature economies like Japan and Australia, remain cautious despite stable fundamentals. Therefore, while growth is shared, its benefits are felt unevenly.

1-Month Changes (vs. September 2025)

Significant losses (-2.0 or less) | Significant gains (+2.0 or more) | ||

| Australia | -2.1 | Indonesia | +6.5 |

| Japan | -2.0 | Thailand | +3.6 |

| South Korea | +2.6 | |

| Malaysia | +2.1 | |

A Region Moving in Three Directions

Data from the Global Consumer Confidence Index (Oct 2025) shows Asia-Pacific moving in three directions at once. Indonesia and South Korea are surging ahead, while Thailand and Malaysia are consolidating, and Japan and Australia are softening. The region looks steady on paper, but sentiment is clearly split between confident in recovery, cautious in its staying power.

Indonesia’s rebound (+6.5) came after months of unrest and policy reshuffling, in line with the government’s efforts to strengthen national economic stability. South Korea’s +8.2 rise year-on-year — the largest worldwide — signals renewed belief in a system that Is finding balance again after years of uncertainty.

Thailand and Malaysia show quieter momentum. Their progress is steady, grounded in jobs, spending, and normalcy returning. Meanwhile Japan and Australia sit at the other end. Both are stable, yet sentiment remains muted. Japan’s low 35.2 reflects fatigue with slow change, while Australia’s decline suggests inflation relief has yet to reach households.

The region’s steadiness hides diverging realities, with emerging markets lifted by visible progress, while developed ones by expectation gaps. Confidence now depends less on growth itself, and more on whether people believe progress still has meaning.

What Worried Asia in October

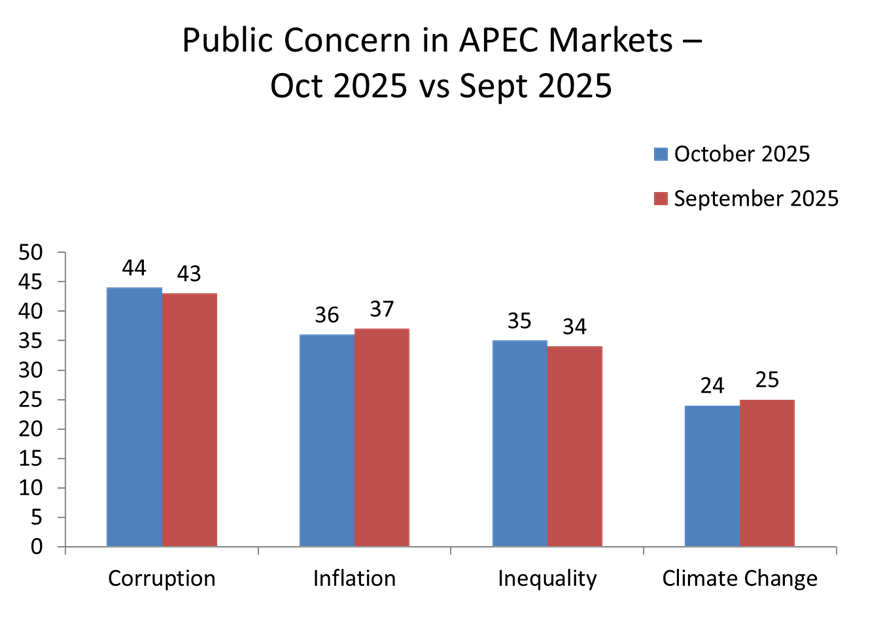

Findings from Ipsos’ What Worries the World (October 2025) reveal the emotional undercurrent behind this steady confidence. Across Asia, optimism coexists with unease: a quiet tension between economic resilience and social concern.

Inflation remains one of Asia’s top concern but has eased from last year. Globally 30% cite it as a top issue, compared to 62% in Singapore, 46% in India and 30% in Malaysia. Even as inflation cools, affordability continues to shape how secure people feel day to day.

Concerns around corruption and inequality have increased. In Indonesia, corruption is cited by 68% and inequality by a record 53%, up seven points year-on-year. In Malaysia, corruption remains high at 54%, signaling persistent frustration with governance despite improving economic indicators.

Climate change has become a defining issue in developed Asian markets, even as concern has softened slightly month-on-month. 30% in Japan and 21% in South Korea cite it as a top worry, both well above the global average of 13%, though each down three points from September. This easing may reflect seasonal factors, with climate concern typically peaking during summer months before attention shifts to more immediate social and financial issues.

Data from What Worries the World shows that while the region is economically stable, it is socially restless. Worries about inflation are easing, yet concern about fairness, integrity and long-term security remains high, showing that economic recovery alone no longer defines progress.

The Confidence–Concern Paradox

Taken together, the Consumer Confidence Index and What Worries the World report reveals Asia’s defining paradox. Optimism and anxiety are not opposites, they move in parallel. In Japan and Australia, confidence is low even as reflecting ongoing pressures on households .

Understanding this duality is crucial. Economic optimism may lift spending, but social trust determines whether optimism lasts. To connect with people meaningfully, leaders and brands must address both the optimism about tomorrow and the unease that overshadows it.

Looking Ahead

What Worries the World reports point to Asia’s economies being resilient, but reassurance and not just growth will define the next phase.

Asia’s confidence endures, but the region is now measuring progress as much by stability and fairness as by growth itself.

See Global What Worries the World See Global Consumer Confidence Index