What Worries Thailand? October 2025

Data from the latest Ipsos What Worries the World survey highlights a significant divergence in Thai public sentiment: long-standing concerns regarding governance and economic equity persist, even as short-term Thai consumer confidence registers a substantial month-over-month increase.

The October 2025 findings suggest that while structural national anxieties remain, the implementation of targeted government economic policies and a reduction in geopolitical risk have successfully elevated near-term outlooks on personal finances and the country's economic trajectory.

Structural Concerns Lead Public Anxiety

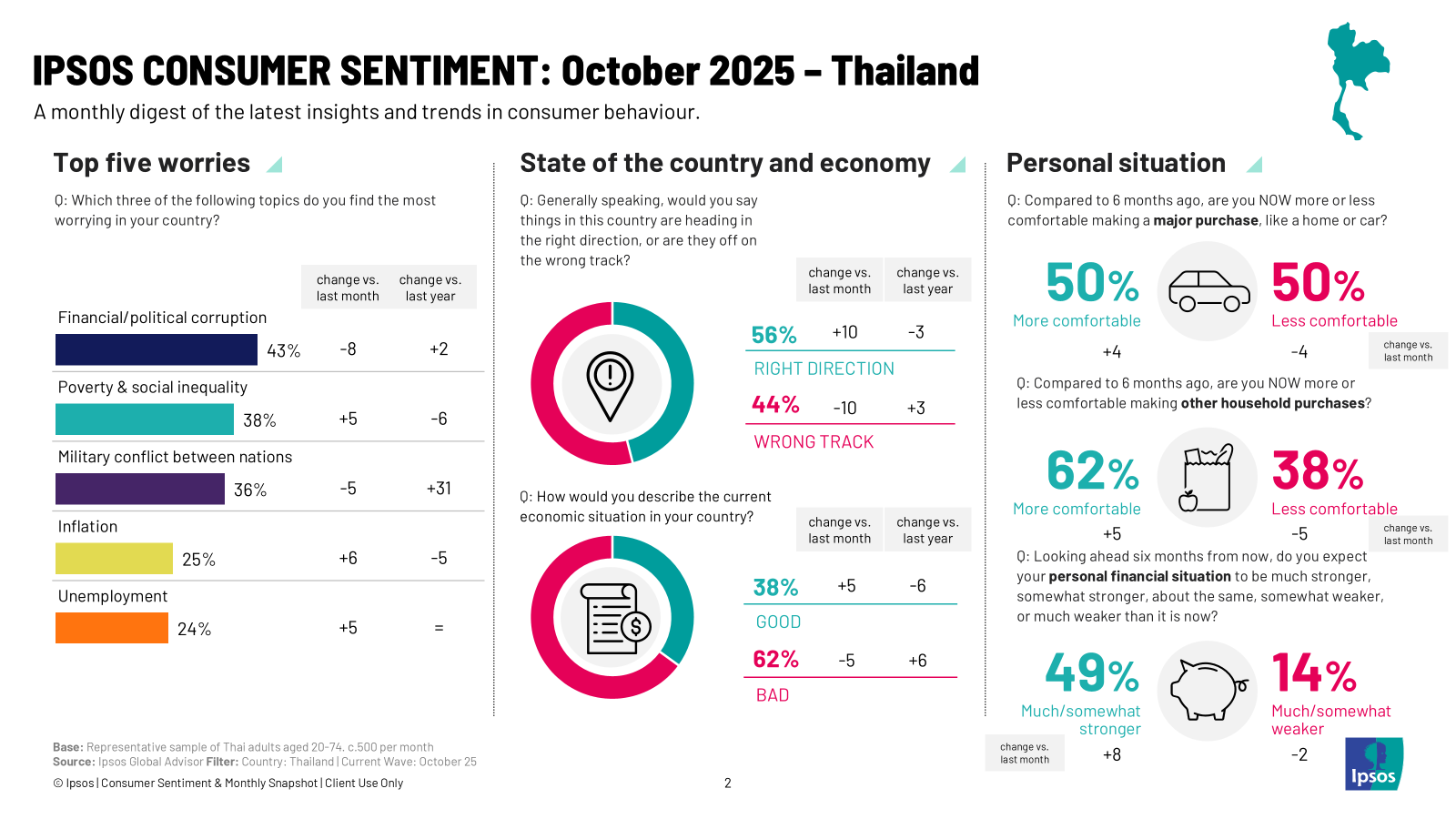

The persistence of Financial/Political Corruption (43%) and Poverty & Social Inequality (38%) at the top of the "What Worries Thailand" list, despite a near-term consumer sentiment uplift, points to significant challenges in governance and economic structure.

- Financial/Political Corruption (43%): The sustained high ranking of corruption suggests that public concern goes beyond isolated incidents and reflects systemic issues.

- Poverty & Social Inequality (38%): Cited by 38% of the population, concerns over Poverty and Social Inequality track closely behind corruption, driven by deeply entrenched economic disparities

Military Conflict Recedes

Military conflict between nations recorded a sequential drop in concern, suggesting that the public perceives a measurable easing of regional and global tensions that had peaked earlier in the year.

The Consumer Sentiment Uplift: A Shift in Near-Term Outlook

The most significant movement in the October data is the sharp improvement in Thai economic sentiment, demonstrating a reversal from the pessimistic trends observed mid-year.

More Confidence in the National Direction

Right Direction Jump: The proportion of Thais who perceive the country is moving in the "Right Direction" increased by +10 points month-over-month, reaching 56%. This marks a decisive improvement in the national mood regarding the overall state of the country.

Personal Financial Outlook

- Stronger Personal Finances: 49% of Thais now anticipate their personal financial situation will be "much stronger or somewhat stronger" in the coming six months—a substantial +8 point increase from the September reading.

- Comfort in Spending: Aligned with the improved outlook, 62% of Thais report feeling more comfortable making routine household purchases, up +5 points month-over-month.

Government Stimulus and Economic Support

The jump in consumer confidence is closely linked to the timely rollout of targeted economic interventions by the Thai government in the final quarter of 2025: Khon La Krueng Plus and Tiew Dee Mee Kuen. These measures aim to directly stimulate consumption and alleviate household financial pressures. Both the Bank of Thailand and the Ministry of Finance estimate that the combined effect of the Khon La Krueng Plus and Tiew Dee Mee Kuen programmes is projected to contribute an additional 0.2% to 0.4% to GDP growth in the fourth quarter of 2025.

While the structural concerns of corruption and social inequality remain critical issues requiring long-term governance solutions, the demonstrated policy effectiveness in stabilizing prices and delivering direct financial relief has fostered a short-term atmosphere of economic hope.