SMME’s - Understanding the impact of Covid-19

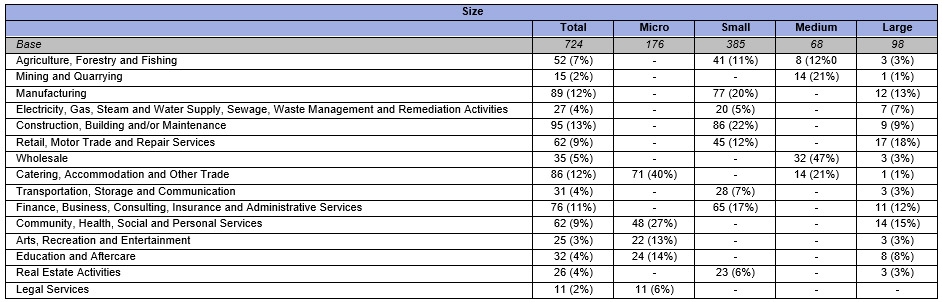

In an online survey conducted by Ipsos South Africa in September 2020, 55% of SMME business owners stated that they experienced greater uncertainty around the sustainability of their businesses. A total of 724 Owners, CEO’s, MD’s and Directors of different SMME enterprises participated in this survey. We appreciate that every organisation has a different definition for the classification of SMME businesses into Micro, Small, Medium, and Larger Enterprises, and to simplify this, we have defined these splits using the annual turnover of the SMME businesses:

- Micro Enterprises: Total Annual turnover of less than R5 million (176 interviews)

- Small Enterprises: Total Annual turnover above R5 million and less than R10 million (385 interviews)

- Medium Enterprises: Total Annual turnover above R10 million and less than R20 million (68 interviews)

- Larger Enterprises: Total Annual turnover of more than R20 million (98 interviews)

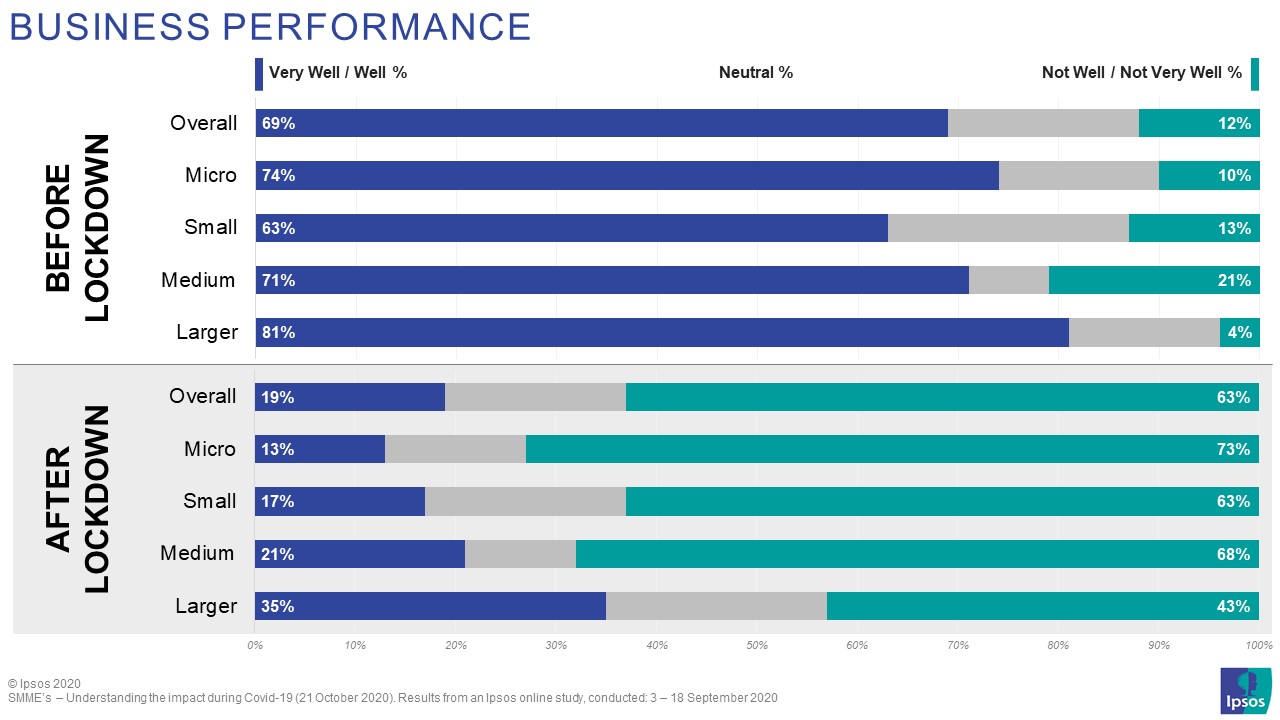

The impact of the pandemic and subsequent lockdown on business performance have been significant, with 63% of SMME’s stating that they are performing "Not Well" or "Not Very Well" after lockdown, while larger enterprises are seemingly more resilient, with a third (35%) stating that they are still performing "Well" or "Very Well" after lockdown.

Almost four in every ten business owners (38%) estimate that it will take more than a year for their businesses to recover, whilst nearly three in every ten (28%) state that they do not know how long the recovery period will be, as things are still too uncertain. 8% of current business owners are convinced that their businesses will not be able to recover after the pandemic and that they are therefore considering closing their doors.

There are however some “green shoots”, and since the gradual lifting of lockdown restrictions almost half (49%) of business owners state that they have managed to bring in new orders or new business, but that it is much slower than what it used to be before the pandemic.

The business impact of the pandemic

More than half (55%) of business owners say that customers are spending less than before, with the owners of Micro businesses experiencing this the most (61%). 30% of Micro businesses say that orders were reduced and 32% say their orders were cancelled during the pandemic.

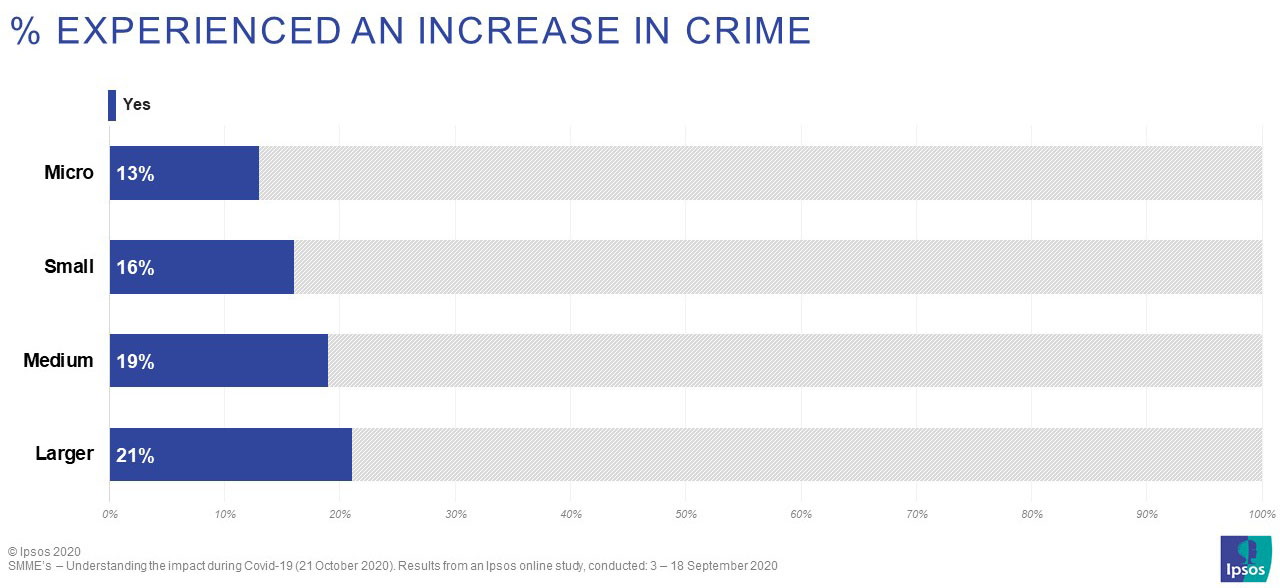

Apart from customers spending less, more than four in every ten business owners (44%) also say that input costs from suppliers have increased and 16% have experienced an increase in crime. Interestingly, the larger the business the higher the proportion experiencing crime.

Still looking at the larger SMME businesses, a third (32%) experienced a disruption of logistics in running their businesses and 21% mentioned shortages of supplies and/or goods.

All these external factors have resulted in almost seven out of every ten (69%) SMME business owners registering cashflow problems. This is mainly attributed to a delay in client payments (37%), or clients simply not paying accounts (33%), as well as the unexpected additional PPE expenditure (32%).

All the changes contributed to the fact that about a third (31%) of SMME business owners were not able to pay employees’ salaries, with the result that a quarter (26%) had to let some employees go. Medium sized SMME’s were hit hardest, with 38% of these business owners saying they had to let staff go.

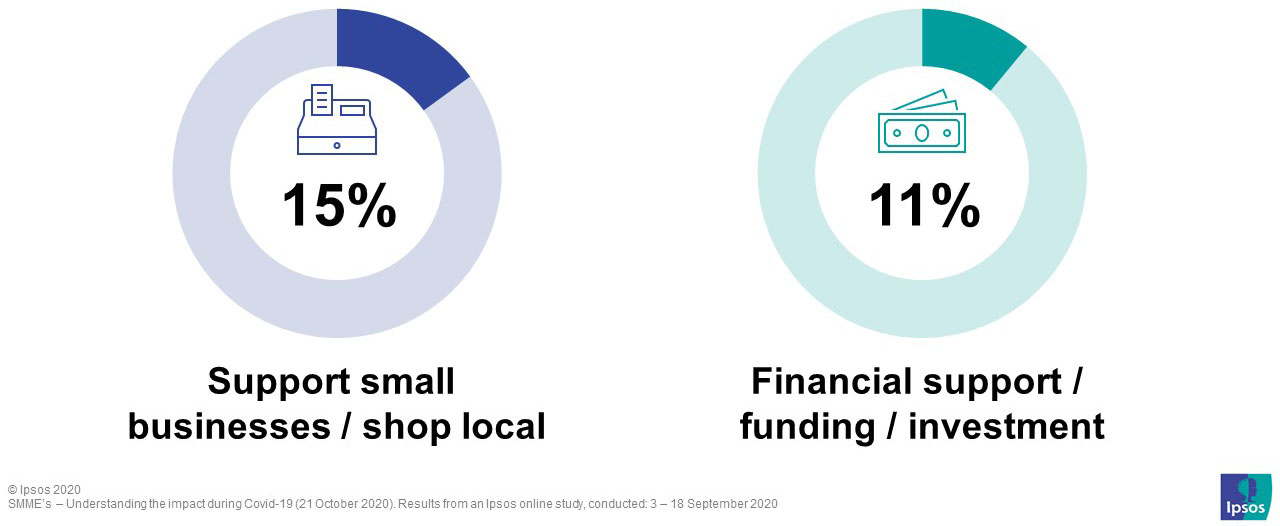

When asked what government or larger organisations could do to help make their businesses successful after the easing of lockdown, the top 2 mentioned items were:

Most business owners (54%) say they used their savings to keep businesses running and about one in every five (23%) applied for a loan during this time.

But what about the packages Government put in place?

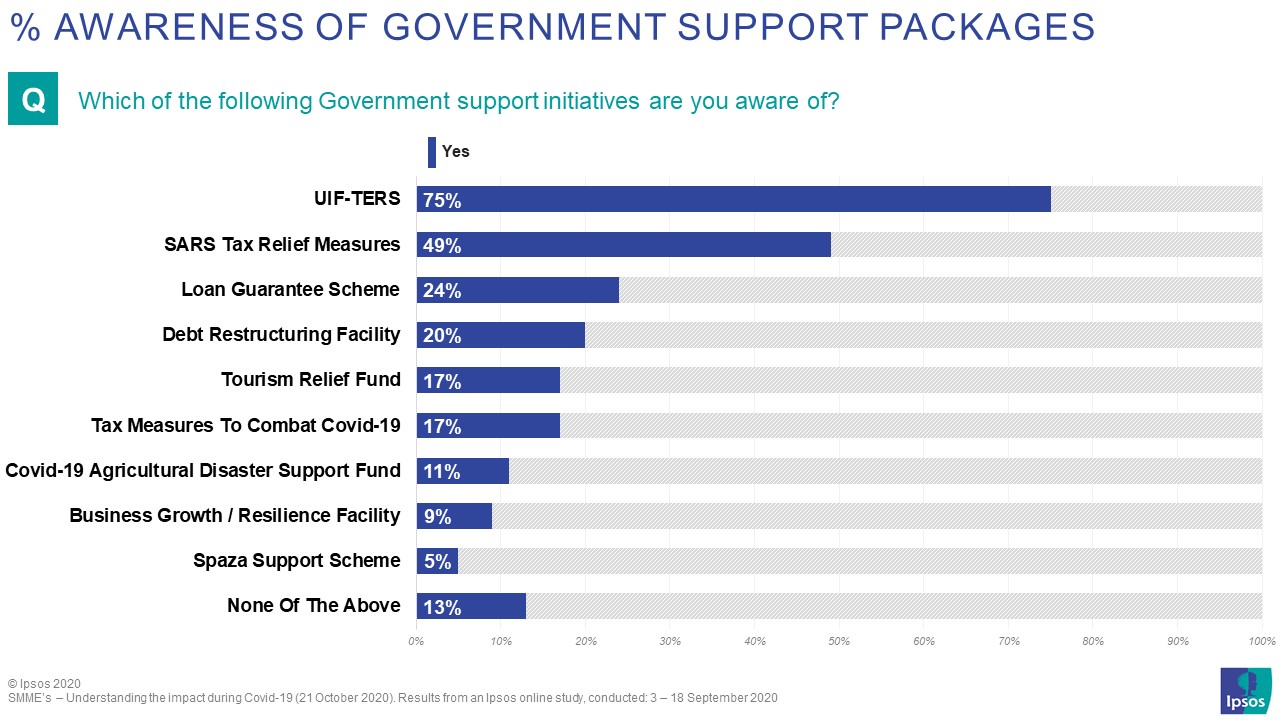

When asked specifically about the support packages put in place by government during lockdown, the awareness levels varied depending on the package.

However, awareness did not necessarily result in actual applications, with a quarter (26%) of business owners stating that they did not apply for any of the available support packages, while almost two-thirds (63%) applied for the UIF-TERS fund, with 70% of those who applied, affirming that they did receive compensation.

So why did so many not apply?

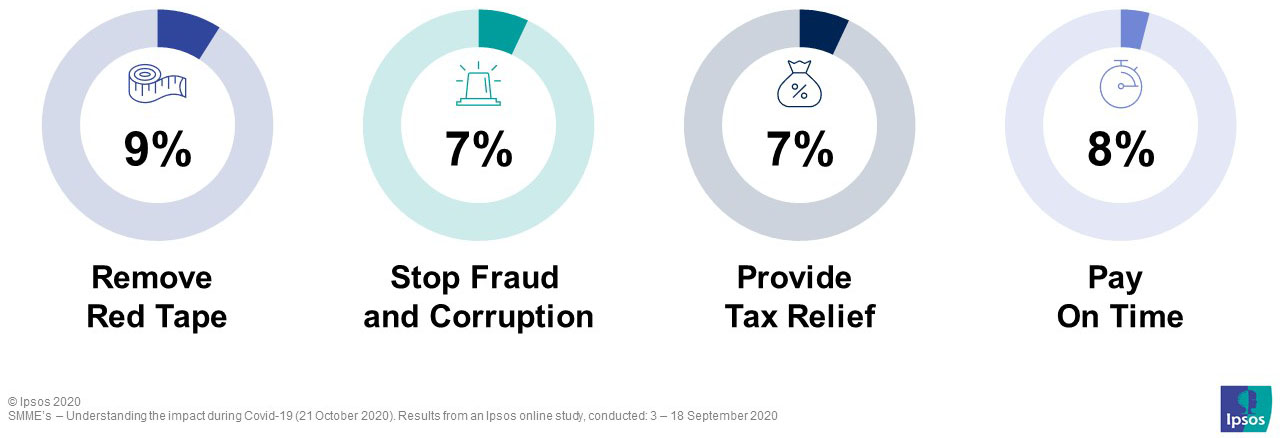

Of those businesses that did not apply, a third of them say they did not know if their company qualifies, whilst 26% say that they found the process too complicated. Aside from the top two mentioned items (Support small businesses / shop local; Financial support / funding / investment), business owners also called out for government to:

Some of the remarks made by owners of SMME businesses on these 4 topics:

Remove red tape:

- "The government must not interfere and overregulate the private sector and the way to do business. Labour laws to be revisited and scrapped. Too much trade union interference and strikes. The government to make it safe to do business operations and farming."

- "Make access to smaller companies more accessible. Cut red tape."

Stop fraud and corruption:

- "Government must stop corruption and using incompetent officials. Get law and order. Sort Eskom out."

- "Eliminating corruption will provide more funds to people who really need it. Be more effective in what they are doing - currently effectiveness is way below world standard"

Provide tax relief:

- "Tax breaks would be ideal. We pay a huge amount to tax and see very little in return."

- "Lower the tax burden. SMME's are funded and financed from personal savings 98% of the time. Make it regulations that large companies are not allowed to enforce payment terms of more than 30 days to SMME's. Remove the BBBEE criteria for SMME's, as it requires private funding to be put at risk, in the hands of others just to be able to take part in trade. Those risks should be carried by government and not private individuals’ savings. By paving the way for new enterprises to establish and grow, government will reap from a healthy economy to the benefit off all vs regulating everyone to death during start-up."

Pay on time:

- "Government to pay us on time and be serious about it, this is one the contributing factors to our cash flow problem. Late payments"

- "Early / timely payment of invoices to small business. The government should also make the Loan Guarantee Scheme more inclusive."

What changes have they made and what do they need for the future?

Some operational changes were made by SMME’s:

- More than a third (36%) revised their company spending.

- One in every ten (11%) invested more in additional telecoms and internet infrastructure.

- 9% say they have digitised their business.

- Interestingly, 7% say that they are looking at switching suppliers, predominantly driven by a lack of supply (46%), affordability (44%) and poor service received (10%).

Four in every ten (42%) agree that the main lesson learnt from the pandemic is to have an emergency fund / savings for their business. Other lessons include operations optimisation (34%), employing fewer but more experienced employees (30%) and making use of e-commerce or selling online (17%).

Even though this sector still heavily relies on word-of-mouth (72%) for marketing, there has been significant shifts in terms of increased usage of digital platforms. The largest increase being in using websites (increased by 12% percentage points) comparing pre- to post-lockdown.

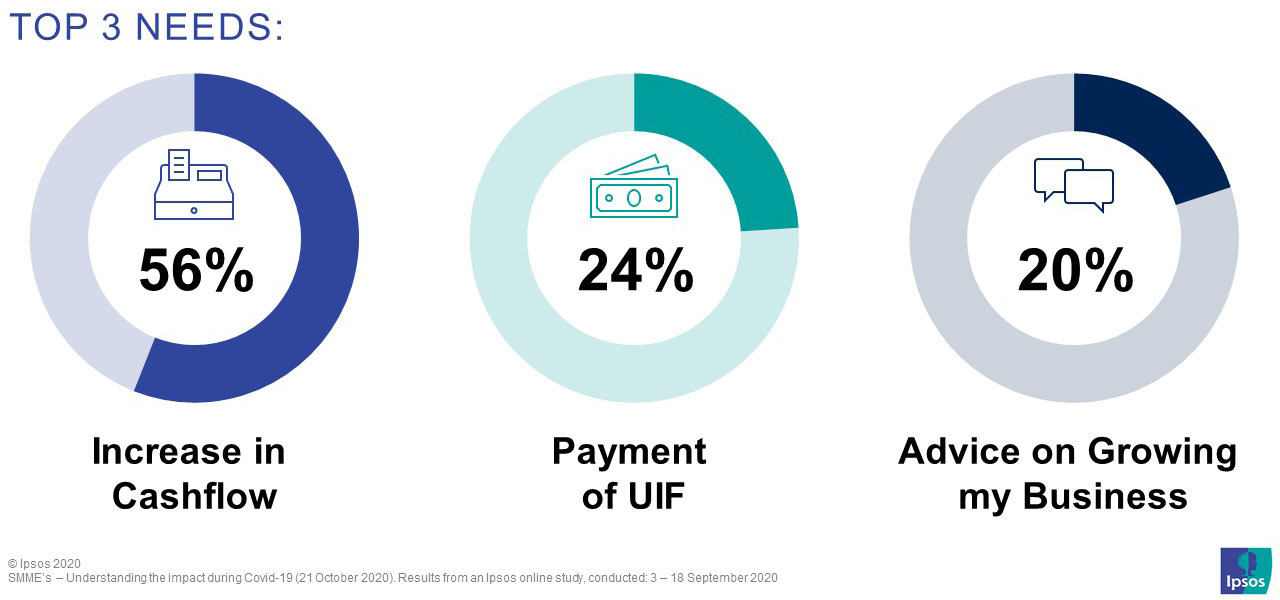

When asked what support they currently need for their business, the following 3 areas were called out as the top areas:

For more information on this news release, please contact:

Elzette Correia

Client Officer, Ipsos South Africa

Mobile: +27 (0)78 272 9222

[email protected]

Technical Details:

- Ipsos interviewed 724 businesses within the SMME sector with the aim to understand the business impact that the C-19 pandemic had on their businesses. The interviews were completed via an online survey from the 3 to 18 September 2020. Respondents included the Owners, CEO’s, MD’s, and Directors of the SMME businesses.

- As the project is syndicated and sponsored by various corporate organisations, the sponsor organisations provided lists of SMME businesses who were invited to participate in the survey.

- As mentioned at the start of this press release, we appreciate that every organisation has a different definition for the classification of SMME businesses into micro, small, medium, and larger enterprises. For simplicity, we have defined these splits using the annual turnover of the SMME businesses.

- Micro Enterprises – Total Annual Turnover of less than R5 million

- Small Enterprises – Total Annual Turnover between R5 million and R10 million

- Medium Enterprises – Total Annual Turnover between R10 million and R20 million

- Larger Enterprises – Total Annual Turnover of more than R20 million

- The total sample is broken down as (Q6. Thinking about your main business, in which sector is your company operation in?):