Canadians More Optimistic About Personal Finances (+5 pts.) and National Economy (+3 pts.) in 2013; Younger Canadians Most Optimistic

When it comes to the financial outlook for 2013, their own finances are not the only thing Canadians believe will improve. Three in ten (29%) believe the national economy will `improve' (2% a lot/27% somewhat) in 2013, compared to only 26% of Canadians who said the same thing this time last year. Four in ten (43%) say the Canadian economy will `stay the same', while three in ten (28%) believe the economy will `worsen' (5% a lot/23% somewhat).

Younger Canadians, aged 18-34, are the most optimistic when it comes to their own finances and the national economy in 2013. Half (50%) of younger Canadians are expecting to see improvements in their own financial situation, while one-third (32%) believe there will be improvement in the national economy. Four in ten (36%) middle-aged, aged 35-54, believe their financial situation will improve in 2013 while only one-quarter (25%) believe the national economy will see improvement. Older Canadians, aged 55+, are least likely to believe their own financial situation will improve (27%), but are more likely than middle-aged Canadians to believe the national economy will improve in 2013 (31%).

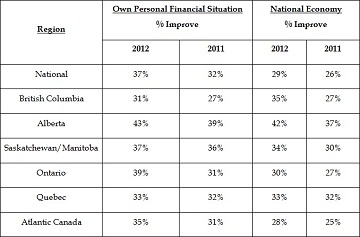

Regionally, outlook for one's own financial situation and the economy is on par or better than this time last year. The following table outlines the regional breakdown of those who believe their own personal financial situation and the national economy will improve in 2013 with a comparison to last year's results:

Canadians are also more optimistic when it comes to improvement in their local city or town's economy in 2013. Two in ten (17%) Canadians say the economy of their local city or town will `improve' (2% a lot/15% somewhat) in the next year, up 5 pts. from those who answered similarly in 2011 (12%). Nearly two-thirds (63%) believe their local economy will `stay the same', while two in ten (20%) believe it will `worsen' (4% a lot/16% somewhat) in 2013. Albertans (26%) are the most likely to believe their local economy will improve in 2013, while Ontarians (17%, up 7 pts. from 2011) show the biggest gains in expected improvement compared to last year. The following table outlines regional breakdowns of improvement in local economy for 2013, comparing it with last year's results:

Canadians are also less fearful for their own or someone in their household's job security in 2012. While the national figure (22%) of those who are worried about their own or someone in their household losing their job or being laid off is consistent with 2011 (22%), most regional figures for job anxiety have decreased in the last year. Ontarians (30%, up 4 pts.) and Atlantic Canadians (22%, up 4 pts.) are the only regions who have seen an increase in job anxiety over the last year, while job anxiety in British Columbia (17%, down 6 pts.), Alberta (15%, down 4 pts.), Saskatchewan and Manitoba (14%, down 3 pts.), and Quebec (16%, down 4 pts.) had declined since 2011.

Financial Resolutions for 2013

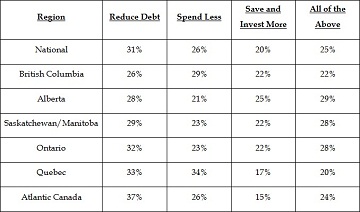

Looking ahead into the New Year, many Canadians are hoping to improve upon their financial situation in a number of ways. One-third (31%) of Canadians are planning to focus on reducing their debt in 2013. Two in ten (20%) plan on saving and investing more, while one-quarter plan on spending less (26%) or doing all of these things (25%) next year. Nearly half (44%) of Canadians report that they will spend less on big ticket items such as cars, household appliances, or vacations next year. The following table outlines in full regional figures of the financial resolutions of Canadians in 2013:

Consumer Confidence Outlook Indices - A Year in Review

The national overall RBC CCO index has continued to rise now sitting at 82, up 12 points compared to this time last year and up 2 pts. since last quarter. While the national current condition index is down 1 pt. from last quarter, currently at 94, it is up 13 pts. compared to this time in 2012. The national expectation index has also increased substantially from last year rising from 52 to 69, while the national investment index has seen the biggest gain over the past year rising from 68 this time last year to 92, where it currently sits.

These are some of the findings of an Ipsos Reid poll conducted between October 1st to 10th, 2012, on behalf of RBC. For this survey, a sample of 3,375 Canadians (540 British Columbia, 540 Alberta, 469 Saskatchewan/Manitoba, 735 Ontario, 609 Quebec, and 482 Atlantic Canada) from Ipsos' Canadian online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. A survey with an unweighted probability sample of this size and a 100% response rate would have an estimated margin of error of +/- 1.7 percentage points, 19 times out of 20, of what the results would have been had the entire population of adults in Canada been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Associate Vice President

Ipsos Reid Public Affairs

416.572.4474

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. In October 2011 Ipsos completed the acquisition of Synovate. The combination forms the world's third largest market research company.

With offices in 84 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,363 billion (1.897 billion USD) in 2011.

Visit www.ipsos-na.com to learn more about Ipsos' offerings and capabilities.