Half (45%) of Online Shoppers Plan on Taking Advantage of Discounts on American Websites by Shopping Online This Black Friday/Cyber Monday

Online shoppers in Ontario (50%) are most likely to intend to shop on American websites over Black Friday weekend, followed closely by online shoppers from the Prairie Provinces (Alberta, Manitoba, and Saskatchewan - 46%), Quebecers (43%), Atlantic Canadians (38%), and British Columbians (33%).

On average, Canadian online shoppers are expecting to spend $220 online this year between Black Friday and Cyber Monday. Men who shop online ($235) are likely to spend more than women ($208) on these online deals in 2012. Half (49%) of online shoppers likely to shop online this Black Friday weekend expect to purchase clothes and accessories, making this the most popular expected purchase of this sale weekend. Four in ten likely Black Friday online shoppers expect to buy music or movies (37%) or books/e-books (35%). The following tables outlines the complete list of anticipated purchases this year of likely Black Friday online shoppers:

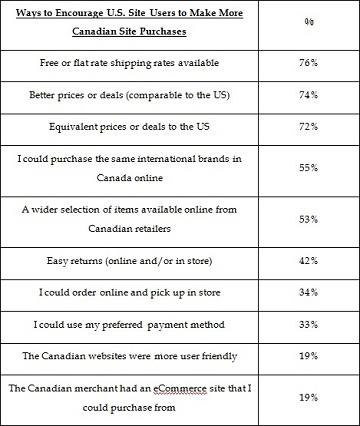

With such a substantial amount of Canadian online shoppers seeking cross-border deals, many Canadian companies may lose out on business this holiday season and could be in search of ways to get this business back. Among Canadian online shoppers who have shopped at U.S. sites, three quarters believe that having free or flat rate shipping rates available (76%), having better prices or deals (74%), or even equivalent prices or deals to the U.S. (72%) would encourage them to make more online purchases from Canadian sites rather than American ones. The following table outlines specific ways Canadian online shoppers who've made purchases from American websites could be encouraged to make more purchases from Canadian sites.

While cross-border and online shopping within Canada have made holiday shopping easier for many Canadians, there are still a sizeable portion who forego online shopping for a number of reasons. Majority (51%) of Canadians who have not made any online purchases in the last year say they've had `no need' to. Further, one-third of those who've not made any online purchases in the last 12 months are `worried about the security of paying for items online' (32%) or are `uncomfortable with not seeing items in person before purchase' (31%). The following table outlines in full the reasons why Canadians who have not made any online purchases in the past year have done so:

These are some of the findings of an Ipsos Reid poll conducted between October 23rd to 26th, 2012, on behalf of Visa Canada. For this survey, a sample of 693 Canadian online shoppers who have made an online purchase from either a Canadian or American online retailer in the past twelve months from Ipsos' Canadian online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is calculated using a credibility interval. In this case, the poll is accurate to within +/- 4.2 percentage points of all Canadian online shoppers. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Associate Vice President

Ipsos Reid Public Affairs

416.572.4474

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. In October 2011 Ipsos completed the acquisition of Synovate. The combination forms the world's third largest market research company.

With offices in 84 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,363 billion (1.897 billion USD) in 2011.

Visit www.ipsos-na.com to learn more about Ipsos' offerings and capabilities.