Health: The Great Divide Between Lower and Higher Income Canadians

Income level is a significant factor in this regard. Of those with household incomes of less than $30,000 a year, nearly half (46%) `agree' (17% strongly/29% somewhat) that as a result of the economic downturn they have spent less time, energy and money sustaining their health, a stark difference compared to nineteen percent among those earning $60,000 or more a year (7% strongly /12% somewhat). Education also plays a significant role. Those with a high school education or less are nearly twice as likely as those with a university education to have spent less time, energy, and money sustaining their health as a result of the economic downturn (35% agree - 10% strongly, 25% somewhat vs. 19% agree - 7% strongly, 12% somewhat among those with a university education).

In terms of region, residents of Quebec are most likely to report having spent less time, energy, and money sustaining their health as a result of the economic downturn (32% agree - 12% strongly/20% somewhat), while those in Saskatchewan/Manitoba (13% agree - 7% strongly/6% somewhat), Alberta (19% agree - 5% strongly/14% somewhat), and the North (20% agree - 5% strongly/15% somewhat) are the least likely to have done so.

GROWING DISPARITY BETWEEN LOWER AND HIGHER INCOME CANADIANS ON SEVERAL KEY HEALTH INDICATORS...

This gap between those with lower and higher levels of income has widened on a number of key health measures compared to 2009.

- When it comes to describing one's health as `excellent' or `very good' the gap between those earning less than $30,000 a year (39%) and those earning $60,000 or more (68%) has increased by 12 percentage points compared to 2009 ( a 29 vs. 17 percentage point gap in 2009).

- In 2009, lower and higher-income Canadians were the same in terms of whether they accessed health care services within the past month. This year, the gap between the two groups has increased significantly (to 16 percentage points), with six in ten (59%) Canadians who earn less than $30,000 a year having accessed health care services within the past month, compared to only four in ten (43%) among those earning $60,000 or more.

- While 2009 showed no difference between lower and higher income Canadians in terms of perceptions that they are `very/somewhat overweight', and showed only a four percentage point gap in terms of having `very/somewhat overweight children', this year, four in ten (38%) Canadians earning less than $30,000 a year say they are `very/somewhat overweight' compared to 32 percent among those earning $60,000 a year or more (amounting to a six-point gap compared to 2009). In terms of having overweight children, this year, the gap between lower and higher income Canadians has also increased (13 vs. 5 percentage point gap in 2009).

- Another area in which the gap has increased significantly is delaying or stopping the purchase of prescription drugs. This year, one quarter (24%) of Canadians earning less than $30,000 a year say they delayed or stopped buying prescription drugs, compared to only 3% of those earning $60,000 or more, resulting in a much higher gap compared to 2009 (21 vs. 13 percentage points in 2009).

While the income gap persists on many health measures, with lower income Canadians experiencing higher negative health impacts as a result of the economic downturn, the level of disparity in some areas has held steady compared with 2009. For example, the gap between lower and higher income Canadians has generally remained the same in terms of each of the following: feeling stressed or overwhelmed (a 16 vs. 17 percentage point gap in 2009), sleeping less than normal (10 vs. 11 in 2009), and skipping meals (19 vs. 17).

RATING THE QUALITY OF HEALTH CARE IN CANADA...

The CMA 2012 report card reveals that views towards the quality of health care in the future remain relatively unchanged. Looking ahead to the next two or three years, about four in ten (36%) think that health care services in their community will get `better' (3% much/33% somewhat), down two points from 2011 (38%). Half (48%) think that these services will get `worse' (14% much/34% somewhat), showing no change from last year, and about two in ten (16%) aren't sure which way health care services will head in the next two to three years, up two points from the previous year (14%).

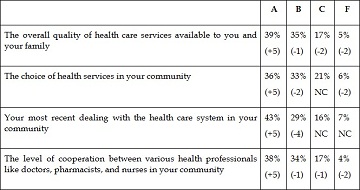

Quality of Services

This year, three in four Canadians give `the overall quality of health care services available to you and your family' an `A' or `B' grade (39% `A'/35% `B'), which has increased compared to 2011 (34% `A'/36% `B'). In fact, the proportion of Canadians providing the health system with an `A' grade in each of the following areas has increased compared to 2011:

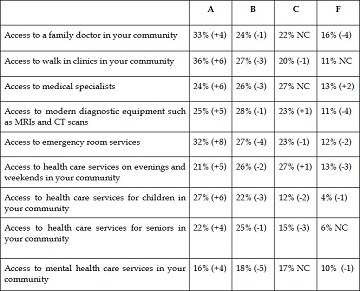

Access to Health Care Services

Access to various health care services also show signs of improvement compared to 2011. Most notably, one in three give access to emergency services an `A' (32%, up eight points from 2011), one in four give access to medical specialists an `A' (24%, up six points), one in three give access to walk-in clinics in one's community an `A' (36%, up six points), and three in ten give access to health care services for children in one's community an `A' (27%, up six points). As shown below, the proportion of Canadians assigning each an `A' grade has increased compared to 2011.

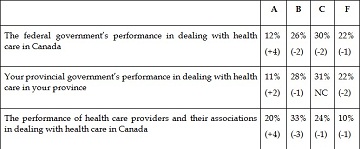

Government Performance

Canadians are also more likely to hold a more favourable view in terms of government performance, as the proportion of `A' grades has also increased compared to 2011. As shown below, overall, half (53%) of Canadians give `the performance of health care providers and their associations in dealing with health care in Canada' either an `A' (20%) or `B' (33%) grade, while four in ten do so in terms of their provincial (39%) or federal (38%) government's performance.

These are some of the findings of Ipsos Reid polls conducted between July 23 to 30 (online) and July 25 to 30, 2012 (telephone) on behalf of the Canadian Medical Association. For these surveys, a sample of 1,004 (July 23-30) adults from Ipsos' Canadian online panel were surveyed online; the survey conducted from July 25-30 was conducted over the phone among a nationally representative sample of Canadians using random digit dialing (n=1,200). Weighting was employed in all cases to balance the sample to that of the Canadian adult population according to Census data, and to provide results intended to approximate the sample universe. A survey with an unweighted probability sample of n=1,200 size and a 100% response rate has an estimated margin of error of +/-2.8 percentage points, 19 times out of 20, of what the results would have been had the entire population of adults in Canada been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Mike Colledge

President

Ipsos Reid Public Affairs

613.688.8971

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. In October 2011 Ipsos completed the acquisition of Synovate. The combination forms the world's third largest market research company.

With offices in 84 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,363 billion (1.897 billion USD) in 2011.

Visit www.ipsos-na.com to learn more about Ipsos' offerings and capabilities.