MNP Consumer Debt Index Steady in 2025, Challenging 2026 Ahead

Toronto, ON, Jan 12, 2026 — The latest MNP Consumer Debt Index shows a modest one-point uptick since last quarter to 87 points, continuing the 2025 trend of relative stability. Canadians have adopted a wait-and-see approach to their finances, as economic signals remain mixed and the future remains uncertain heading into 2026.

While Canadians express pessimism about what may come in 2026, there is some cause for optimism: the index has never improved in December, and so this recent uptick – albeit a small one – bucks the trend of deteriorating debt sentiment heading into the winter months. Moreover, the average amount of money that Canadians have at the end of the month after all bills are paid is up to $907, an increase of $163 per month over last quarter. While Canadians report some financial relief at the end of 2025, Canadians see the year ahead as challenging, with a majority believing that 2026 will be worse.

Although the Bank of Canada held interest rates at 2.25% during the survey period, 64% (+1) of Canadians say they desperately need rates to go down. Even if rates decline, 48% (+4) remain concerned about their ability to repay debt, and 44% (+2) worry that the eventuality of rising rates (which is much more likely now than it was 3 months ago) could push them toward bankruptcy.

Insolvency Risk and Month-End Finances Tick Up Amid Low Debt Situation Ratings

Four in ten Canadians (41%) are within $200 of not being able to pay their bills each month (financial insolvency), down seven points from the previous quarter and the lowest we’ve measured in the post-pandemic era. The average amount left after monthly expenses has risen by $163, now sitting at $907. Women, younger Canadians aged 18–34, and middle-income earners experienced the steepest inclines, with women reporting $741 left at month-end and those earning between $60K–$100K averaging $990. Only 47% of Canadians report having six months of emergency savings, with men (51%) and those aged 55+ (56%) far better prepared than women (42%) and young adults (39%).

Canadians’ net personal debt rating (positive assessments subtract negative) fell by merely one point to +17, the most positive December score since 2022. Only 37% (unch.) rate their debt situation as “excellent,” while 20% (+1) describe it as “terrible.”

Outlook Brightens Slightly as Canadians Pursue Interest Rate Relief

Looking back, 29% (+1) feel that their debt situation is better than it was five years ago, while 24% say they are worse off compared to five years ago. The five-year outlook is similarly optimistic, with optimism rising (39%, up 3 points) and concern falling somewhat (13%, down 2 points).

And when rates do eventually rise, Canadians' ability to handle rate increases of 1 percentage point has maintained previous levels (22%,-2). Canadians may take some consolation in the fact that rates remain stable, but for how long, and in which direction will they head?

Canadians Carry Negative Perceptions Heading into 2026

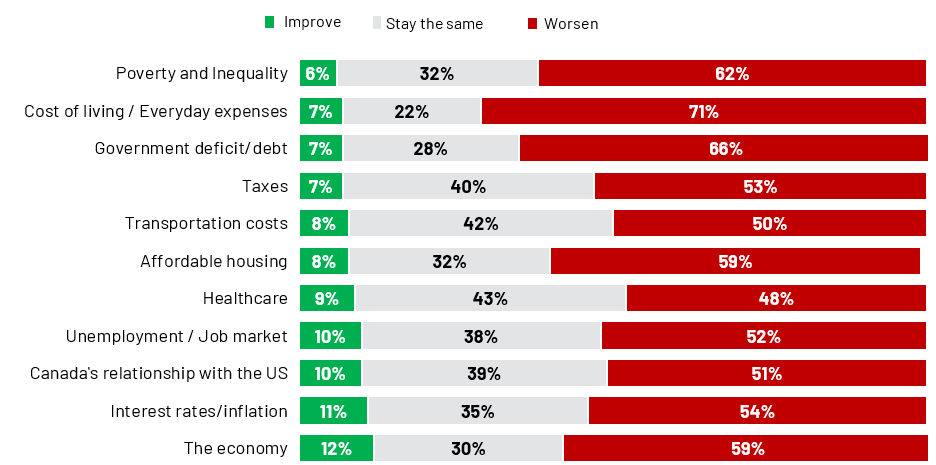

Looking ahead, while pessimism generally prevails overall as more Canadians expect most aspects of daily life to worsen rather than improve, Canadians are slightly more optimistic about their debt outlook.

Healthcare (43%) and taxes (40%) are the most likely to remain unchanged while cost of living (71%), government deficit/debt (66%), and poverty (62%) will likely worsen in 2026. Only men and younger Canadians (18-34) significantly believe all the following issues will improve in 2026. A mere 29% expect their debt situation to improve in the next year, while 14% expect it to worsen, and just 39% expect improvement over five years, both up three points. Moreover, women and older Canadians in particular foresee rising cost of living (women, 74% & 55+, 77%), poverty and inequality (women 65% & 55+ 64%), taxes (both 56%), and healthcare (53% & 54%) worsening this year. Residents of British Columbia and Alberta (71% and 70%) and older Canadians (73%) are united on government deficit being an issue that worsens in 2026.

AI Employment Concerns

In addition to financial stress, Canadians are increasingly worried about the impact of artificial intelligence on employment. Four in ten Canadian (44%) expressed concern that AI could negatively affect their job or income. This sentiment is strongest among younger Canadians, with 52% of those aged 18–34 and 48% of those aged 35–54 expressing concern, compared to just 34% of those aged 55 and older. Lower-income groups are also more likely to be worried, with 49% of those earning under $40K expressing concern, compared to 38% of those earning $100K or more.

Lifestyle Adjustments and Financial Stress

As financial pressures intensify, Canadians primarily respond with a 'fight' mentality (59%), while many opt to flee (32%) or freeze (15%). Women especially chose the fight response (62%) predominantly by adjusting their budgets (46%). Unsurprisingly, younger Canadians and lower earners lean towards fleeing (18-34: 51%, <$40K: 34%) or freezing (18-34: 23%, <$40K: 18%).

As a fight response, Canadians adjusted their budgets (43%), attempted to consolidate debt (12%), and sought advice from a financial professional (11%). Canadians who took a flight response relied on credit cards to cover necessary expenses (17%), avoided discussions about financial matters with family or professionals (15%), and avoided any kind of thinking about financial responsibilities (12%), Alternatively, Canadians froze, unsure where even to begin (15%). Avoidance of discussions about financial matters with family or professionals and remained paralyzed was especially strong among younger Canadians aged 18-34 (22%).

About the Study

These are some of the findings of an Ipsos poll conducted between November 28 to December 1, 2025, on behalf of MNP LTD. For this survey, a sample of 2,001 Canadians aged 18 years and over was interviewed. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.7 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information about the MNP Consumer Debt Index, please visit mnpdebt.ca/CDI.

For more information on this news release, please contact:

Sean Simpson

Senior Vice President, Canada, Public Affairs

[email protected]

Raymond Vuong

Senior Account Manager, Canada, Public Affairs

[email protected]

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing nearly 20,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 business solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques.

“Game Changers” – our tagline – summarizes our ambition to help our 5,000 clients navigate with confidence our rapidly changing world.

Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120, Mid-60 indices, and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP