Two in Five (39%) Canadians Drivers Likely to Buy a Car in Next Two Years

- 3 months - 8% likely vs. 92% not likely

- 6 months - 11% likely vs. 89% not likely

- 1 year - 24% likely vs. 76% not likely

- 2 years - 39% likely vs. 61% not likely

- 3+ years - 61% likely vs. 39% not likely

With a substantial proportion of Canadian drivers looking to buy a new car within the next three years or less, it has many prospective buyers looking at their own financial situation to see if they could manage making such a purchase. Half (50%) of drivers are confident that they'll be able to manage their personal finances if they purchase/lease a car and won't go into debt, while one in four (24%) think they'll be ok but can't confidently say they'd be able to manage their finances, and one in five (17%) are just keeping their head above water and buying or leasing a car would definitely put them in debt. One in ten (9%) don't know the full extent purchasing or leasing a car will have on their personal finances.

Once Canadian drivers are ready to buy, nearly three in five (57%) plan to finance all or a portion of their next vehicle purchase or lease. One quarter (25%) will trade-in and finance the remaining total, while one in five will fully finance with loan (17%) or produce a big down payment to reduce monthly payments, and then finance the rest (15%). Another one in five will use cash from savings (19%) or trade-in plus cash for the remaining total (16%), while one in ten (8%) say there's no need to finance.

Those who plan to finance plan on doing so through a number of different avenues, but most plan on using their financial institution in some fashion. Three in five plan to finance via their financial institution either prior going to the dealership (32%), while one in five (25%) will do so while at the dealership. Half (48%) will finance with dealership/manufacturer financing, while 4% will borrow from family or friends and 3% will borrow from some other source.

For Canadians wanting to finance a new vehicle, there are many considerations to think about although most look at affordability as the most important factor. A majority (52%) cite their budget to be the most important factor when it comes to their financing decision. One in five indicate that the monthly payment (19%) or the interest rate (18%) are the most important factor, while one in ten (7%) say it's the trade-in value of their current car. 3% believe the term of loan is the most important factor for their financing decision, while 1% say it's the lender choice/availability/approval.

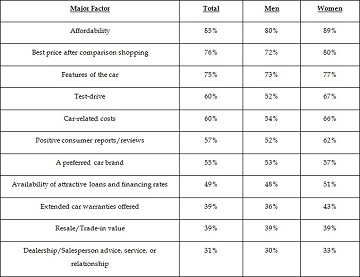

Decisions about financing aren't the only thing Canadian drivers factor into their car-buying decision, as Canadians need to weigh a variety of options when figuring out exactly what kind of car to buy and the data reveals some interesting contrasts between men and women in the car buying or leasing habits. As was the case for their financing decision, affordability of the car (85%) is the most mentioned major factor when considering what kind of car to buy, with women (89%) believing it's more of a major factor than men (80%). The following table outlines the extent to which each of the following are factors into Canadian's, as well as Canadian men and women's, decisions on what kind of car to purchase.

Canadian car owners and those in the looking to buy often have to decide which is more important: paying off a car loan quickly or having low monthly payments. Three in five (62%) believe that paying off the loan quickly is more important, compared to two in five (38%) who indicate that low monthly payments are more important.

Sources for Advice

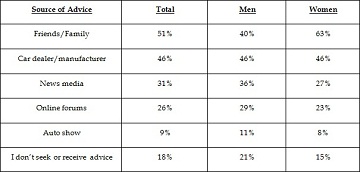

With so many sources out there to turn to, Canadians looking to purchase a car have many outlets which they can seek advice from. Half (51%) seek car-buying advice from their family and friends, with women (63%) doing so more often than men (40%), while half (46%) seek advice from car dealers or manufacturers, with men (46%) and women (46%) equally as likely to seek out this source. The following table outlines in full the different sources that Canadians, both men and women, seek out when looking for car-buying advice:

These are some of the findings of an Ipsos Reid poll conducted between March 6th to 12th, on behalf of RBC. For this survey, a sample of 1,559 Canadians, including 1,351 current or prospective car owners/leasers, from Ipsos' Canadian online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/- 2.8 percentage points had all Canadians adults been polled and within +/- 3 percentage points of all current or prospective Canadian car owners or leasers. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Associate Vice President

Ipsos Reid Public Affairs

416.572.4474

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. In October 2011 Ipsos completed the acquisition of Synovate. The combination forms the world's third largest market research company.

With offices in 85 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,789 billion (2.300 billion USD) in 2012.