40% Urban Indian Purchase Intenders more likely to buy a new or a used car - happy tidings for automotive industry reeling under slowdown & shutdown: Ipsos COVID 19 Impact on Auto Global Study

Ipsos COVID 19 Impact on Auto Global Study shows there are likely to be happy tidings on the anvil, especially for India. At least 40% of purchase intenders said they are more likely to buy a new or a used car, after Corona Virus crisis and 31% purchase intenders will have no change in purchase intention and are likely to purchase same as before. Though 29% are riding on caution and are less likely to purchase a new or a used car.

While, the safety and protection a personal vehicle supplies, is the main force driving Intenders, who are more likely to purchase now; Intenders who are now less likely to buy are looking to tighten their belts due to financial concerns.

“COVID-19, given the nature of the disease (highly communicable), has led to self-imposed safety measures – and is shifting the focus back to usage of personal vehicles vis-à-vis public transportation. Once the restrictions are lifted, we are likely to see consumers exercising precautions and self-distancing and choosing personal vehicles for mobility and more number of purchase intenders choosing to buy personal vehicles, and it is something which consumers will do to safeguard their own health and safety,” says Balaji Pandiaraj, Executive Director, Automotive and Mobility Development, Ipsos India

Interestingly, Intenders in China are now significantly more likely to buy, while those in Italy, Spain, and Brazil are less likely to purchase.

So, what are the key drivers of heightened Purchase Intent?

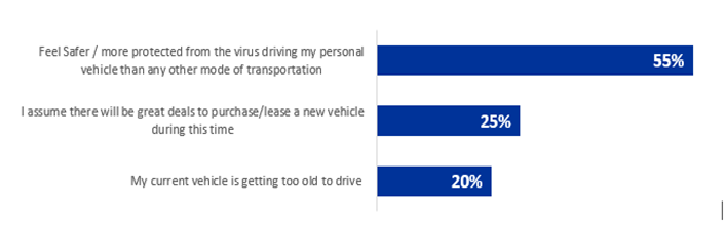

Globally, safety, great deals and vehicle replacement (of old vehicle) are some of the top reasons emerging.

Top Reasons to Maintain/ Increase Purchase Interest

n=2,784, globally all countries combined

“Safety in automotive purchase has always been a key factor in decision making; but clearly, this is a shift towards safety by social distancing instead of sharing crowded public transportation. This key insight into the consumer mindset should play heavily in upcoming and future automotive marketing messages,” added Pandiaraj.

For other major markets, over riding view is of Purchase Intention remaining same as before corona virus outbreak – and this sentiment is seen to be more pronounced in Germany (57%), France & UK (55%) and the US (52%).

While the Intenders less likely to buy (29%) are likely to tighten their purse strings due to financial constraints, or due to the concern about the economy and the uncertainty. And some are awaiting slash in prices of passenger vehicles.

Virtual Dealerships & Shopping Options Shift imperative for Automotive Industry

“Another shift the automotive industry should be making immediately is towards developing and expanding its virtual and digital shopping options. If consumers cannot come to the dealership, the dealership must come to them, and provide a life-like experience for consumers to test and enjoy. This virtual shopping experience is something the automotive industry has been experimenting with, but the COVID-19 crisis has created an environment where virtual reality is the reality,” emphasized Pandiaraj.

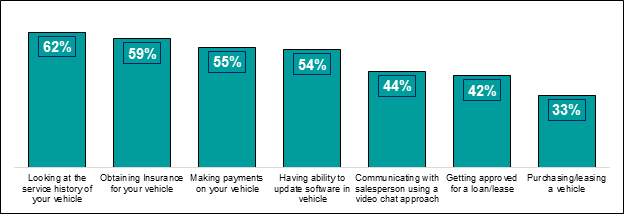

Interest in Completing Entirely Online

n=11,000, globally all countries combined

The study shows the COVID-19 pandemic will likely shift the status quo on how vehicles will be purchased, it could change the landscape in terms of more digital purchases, much more online/ virtual shopping and less dealership visits for test drives. Auto manufactures will need to add a full virtual shopping process for attracting more buyers. Contactless shopping could be the norm until the virus is tackled.

“Despite the pandemic, consumers are still reluctant, but will consider purchasing vehicles online; manufacturers are trusted and can help their dealers do a more effective job of communicating with customers during this unclear period,” commented Pandiaraj.

The Ipsos COVID-19 Impact on Auto Global Study will provide further insights in which automotive insiders can immediately use to capitalize on new consumer behaviors such as shift in public transportation/riding hailing usage, preferences on how to purchase a vehicle plus their expectations at a dealer to navigate the post-pandemic world.

“The entire report is up for grabs at a reasonable price for automotive players and key stakeholders,” added Pandiaraj.

About the Study

For this syndicated survey, Ipsos interviewed a total of 11,000 adults aged 18-74 in the United States of America, China, Japan, Brazil, France, Germany, Italy, Spain, Great Britain, Russia and India.

Intenders are defined as those planning to purchase or lease a vehicle in the next 18 months.

Data collected are weighted so that each country’s sample composition best reflects the demographic profile of the adult population according to the country’s most recent census data. Data collected are also weighted to give each country an equal weight in the total “global” sample. Online surveys can be taken as representative of the general working age population in France, Germany, Great Britain, Italy, Japan, Spain, and the United States. Online samples in Brazil, mainland China and India are more urban, more educated and/or more affluent than the general population and the results should be viewed as reflecting the views of a more “connected” population.