Consumer sentiment rebounds for personal finances & investments: LSEG-Ipsos PCSI January 2025 India Report

Consumer sentiment has rebounded for personal finances and investments in January 2025, providing citizens with confidence around their daily, day to day spends to run their homes and confidence also seeing an upturn for investments – for savings and purchase of big ticket items. This bodes well both for the Indians economy as well as marketers, as consumers are willing to spend and are flush with funds for discretionary spends as well.

The LSEG-Ipsos PCSI maps consumer sentiment month on month to gauge the consumer sentiment of urban Indians which is mapped using 4 sub indices. In January, while the overall consumer sentiment has shown a minor dip of -0.3 percentage points, consumer sentiment for personal finances and investments has seen a major bounce back: the PCSI Current Personal Financial Conditions sub index (Current Conditions) is up +2.4 percentage points, the PCSI Investment Climate (“Investment”) sub-index has moved up +0.8 percentage points; the PCSI Economic Expectations (“Expectations”) Sub-Index is down -4.0 percentage points; and the sentiment for the PCSI Employment Confidence (“Jobs”) sub-index, has shown no change over the previous month, and is stable.

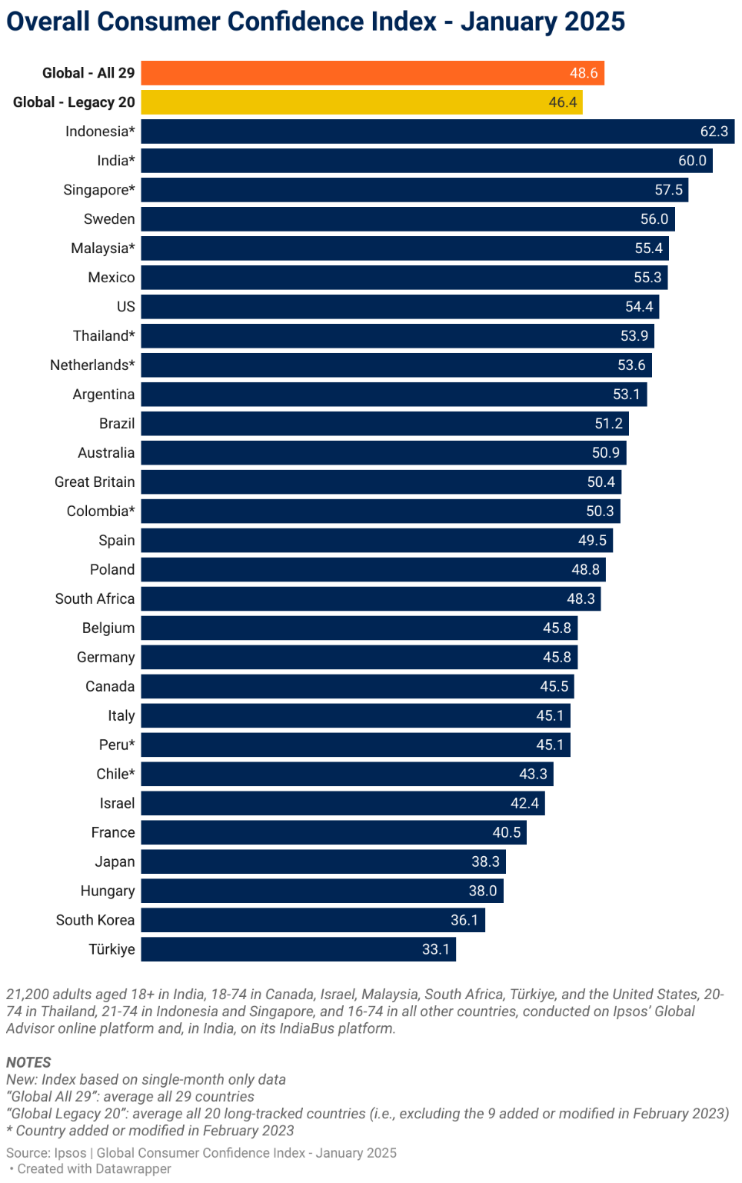

The Global Consumer Confidence Index is the average of all surveyed countries’ Overall or “National” indices. This month’s installment is based on a monthly survey of more than 21,000 adults under the age of 75 from 29 countries conducted on Ipsos’ Global Advisor online platform. This survey was fielded between December 20, 2024, and January 3, 2025.

Consumer sentiment in 29 countries

Among the 29 countries, Indonesia (62.3) holds the highest National Index score. Indonesia and India (60.0) remain the only countries with a National Index score of 60 or higher.

Twelve other countries now show a National Index above the 50-point mark: Singapore (57.5), Sweden (56.0), Malaysia (55.4), Mexico (55.3), the U.S. (54.4), Thailand (53.9), the Netherlands (53.6), Argentina (53.1), Brazil (51.2), Australia (50.9), Great Britain (50.4), and Colombia (50.3).

In contrast, four countries now show a National Index below the 40-point mark: Japan (38.3), Hungary (38.0), South Korea (36.1), and Türkiye (33.1).

Summarizing on the findings of the survey, Amit Adarkar, CEO, Ipsos India said, "Clearly, there is an upturn in consumer sentiment around both personal finances and investments, which should keep the wheels of the economy well-oiled as consumers will be willing to splurge, save and invest, leading to increased spends around essentials and discretionary spends. In January, we also see a lot of stability around jobs. Some torrid sentiment is seen around the economy which is more to do with global forces in terms of uncertainty. It will be a bit immature to predict whether the wars will end soon, whether we will witness more global collaboration between the US and China in the Trump govt. This year could finally be the year of recovery from the pandemic and wars and foster greater global collaboration. In India, we are already seeing our leaning towards global south economies for new collabs. Even with the Indonesian President Prabowo Subianto, who is in India for a four-day visit, and the chief guest for the Republic Day celebrations and is here to further strengthen bilateral ties and cooperation between the two strong economies. Indonesia and India are highest on the national index score in our January report."

About the StudyThese findings are based on data from a monthly 29-country survey conducted by Ipsos on its Global Advisor online survey platform and, in India, on its IndiaBus platform. They are first reported each month by LSEG as the Primary Consumer Sentiment Index (PCSI). The results are based on interviews with over 21,200 adults aged 18+ in India, 18-74 in Canada, Israel, Malaysia, South Africa, Türkiye, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in all other countries. The monthly sample consists of 1,000+ individuals each in Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Israel, Malaysia, Mexico, the Netherlands, Peru, Poland, Singapore, South Africa, South Korea, Sweden, Thailand, and Türkiye. The sample in India consists of approximately 2,200 individuals of whom 1,800 were interviewed face-to-face and 400 were interviewed online. Samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, South Korea, Spain, Sweden, and the U.S. can be considered representative of their general adult populations under the age of 75. Samples in Brazil, Chile, Colombia, Indonesia, Israel, Malaysia, Mexico, Peru, Singapore, South Africa, Thailand, and Türkiye are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their populations. India’s sample represents a large subset of its urban population — social economic classes A/B/C in metros and tier 1-3 town classes across all four zones. The data is weighted so that the composition of the sample in each country best reflects the demographic profile of the adult population according to the most recent census data. The global indices and averages reported here reflect the average result for all the countries and markets in which the survey was conducted. They have not been adjusted to the population size of each country or market and are not intended to suggest “total” results. Sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. The precision of Ipsos online surveys is calculated using a Bayesian credibility interval with a survey of N=1,000 being accurate to +/- 3.5 percentage points and a survey of N=500 being accurate to +/- 5.0 percentage points. For more information on credibility intervals, visit this page. The LSEG/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of their local economy, personal financial situation, savings, and confidence to make major investments. The PCSI metrics reported each month for each of the countries surveyed consist of a “Primary Index” based on all 10 questions below and of several “sub-indices” each based on a subset of these 10 questions. The publication of these findings abides by local rules and regulations. About LSEG LSEG is one of the world’s leading providers of financial markets infrastructure and delivers financial data, analytics, news and index products to more than 40,000 customers in over 170 countries. We help organisations fund innovation, manage risk and create jobs by partnering with customers at every point in the trade lifecycle: from informing their pre-trade decisions and executing trades to raising capital, clearing and optimisation. Backed by more than three centuries of experience, innovative technologies and a team of 25,000 people in over 60 countries, we are driving financial stability, empowering economies and enabling you to grow sustainably. About Ipsos Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing over 20,000 people. Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques. Our tagline "Game Changers" sums up our ambition to help our 5,000 customers move confidently through a rapidly changing world. Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120 and Mid-60 indices and is eligible for the Deferred Settlement Service (SRD).ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com. |