APAC in 2025: Regional Optimism Meets Economic Strains, Trade Shifts, and AI Job Fears

These findings are drawn from the ninth edition of the Ipsos Global Trends report, “The Uneasy Decade: reshaping society, technology, and the global economy”. Based on a 43-country study, the report tracks nine major forces shaping the world: from Globalisation Fractures and Technowonder to Climate Convergence, The Power of Trust, and Escape to Individualism.

Among these, three trends stand out for their visibility and impact across Asia Pacific — Technowonder, Splintered Societies, and Globalisation Fractures. Together, they reveal how the region’s optimism coexists with growing pressures around fairness, trade, and technology as we reach the midpoint of the decade.

Technowonder: AI optimism grows, but job concerns persist

70% in APAC consider AI a positive force (vs 58% global). Optimism is strongest in China (83%) and Vietnam (81%), but lower in Australia (40%) and Japan (53%). Alongside optimism, concern about the potential for technology to disrupt lives remains present in APAC, highlighting uneven perceptions of AI’s impact.

Lower enthusiasm in Japan and Australia reflects a more cautious stance toward AI adoption compared to markets such as China and Vietnam. Across the region, the balance between optimism and anxiety underscores how technology is viewed both as a driver of progress and a potential source of disruption.

Splintered Societies: Questions on economic fairness fuels unrest in APAC

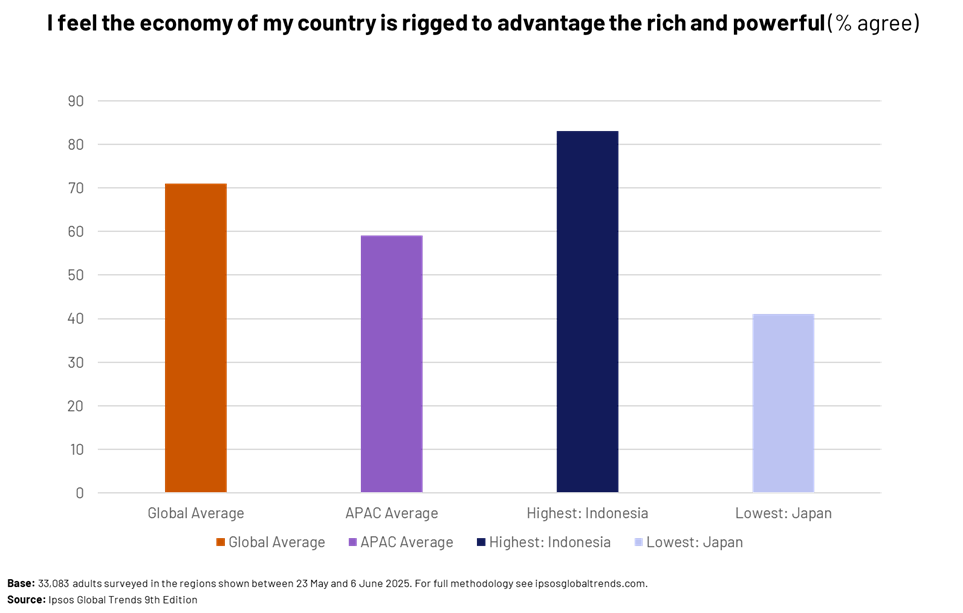

Protests in Indonesia and the Philippines highlight how fairness concerns spill into the streets. The survey reflects these pressures: 59% in APAC believe the economy is rigged to advantage the rich, down from 70% in 2024 and below the global 71%. This notable 11-point drop suggests perceptions of inequality may be easing slightly at a regional level, even as local protests reveal continuing frustration in some markets.

Japan’s score fell sharply from 62% in 2024 to 41% in 2025, suggesting declining engagement with economic fairness debates. In contrast, Indonesia rose slightly from 80% to 83%, underlining how strongly inequality and governance issues continue to resonate. Together, these results show that while regional averages have improved, APAC remains marked by deep national contrasts in how citizens perceive fairness and opportunity.

Globalisation Fractures: China accelerates its turn to protectionism

Global instability and renewed tariff pressures from the Trump administration are reshaping attitudes to trade. In APAC, 75% view globalisation positively (vs 64% global), yet protectionist sentiment is diverging. Indonesia shows the highest support for trade barriers (92%), followed by Malaysia (71%) and India (63%). India’s stance is reinforced by its high average tariff rate of around 50%, underscoring both policy and public alignment toward economic self-reliance. China, by contrast, sits at 42%, while Japan remains among the lowest at 35%.

The 2025 Global Trends findings confirm that Asia Pacific remains more optimistic than the global average, yet this optimism is far from uniform. Pressures around fairness, trade, and technology show how quickly attitudes can shift, with significant differences across markets. For organisations, these shifts do more than signal change, they shape the narratives people believe in, the choices they make, and the strategies needed to succeed in a complex and dynamic world.