A Car That Keeps Up With Canadians:

Top Features Canadians Deem Important While Cruising Include Reasonable Cost, Fuel Efficiency and a

Car That's Great for Canadian Winter

First and foremost, nearly all (95%) Canadians claim that reasonable cost is an `important' (68% very/26% somewhat) feature when cruising in a car, while a similar proportion (93%) of Canadians say that great fuel efficiency is `important' (66% very/27% somewhat). Nine in ten (90%) Canadians claim that warranty coverage is an `important' (57% very/32% somewhat) feature and so is a quiet ride (41% very/48% somewhat).

The infamous Canadian winter can be treacherous on the roads, and so it's no surprise that 93% of Canadians feel that it's `important' (58% very/35% somewhat) that their car is great for a Canadian winter, and nine in ten (89%) say a car with a high crash test safety rating is important to them (49% very/41% somewhat). Lots of airbags for safety is a feature that 83% of Canadians claim is `important' (39% very/45% somewhat) to have.

Most (86%) Canadians also look for roominess as a feature and say it is `important' (35% very/51% somewhat) when cruising in their car. Four in five (84%) Canadians need a spacious trunk and say it is `important' (32% very/52% somewhat) that they have plenty of cargo space.

Canadians want both form and function: four out of five (82%) Canadians reveal that cruising in a car that is fun to drive is `important' (34% very/49% somewhat) to them. Three quarters (76%) of Canadians want an attractive interior design as they feel it is an `important' (21% very/54% somewhat) feature. Two thirds (66%) of Canadians say that a car that drives like a luxury vehicle is an `important' (21% very/45% somewhat) feature. Another two thirds (66%) of Canadians say that an excellent sound system is `important' (20% very/46% somewhat) when cruising in a car.

Roadside support system is a feature that almost two thirds (63%) of Canadians say is `important' (25% very/38% somewhat). Three in five (62%) Canadians feel that a sleek exterior style is `important' (17% very/45% somewhat) while a similar proportion (61%) say that the colour of the car is `important' (18% very/43% somewhat). Almost half (46%) of Canadians deem child friendly features `important' (17% very/29% somewhat) while 45% of Canadians say that leading edge technology integration such as MP3 players, USB sticks and an iPad are an `important' (11% very/33% somewhat) feature when cruising in a car.

The same proportion (45%) of Canadians feel that the vehicle being a compact car is `important' (11% very/34% somewhat). An important feature to fewer Canadians include having smart phone connectivity via mobile applications as one third (34%) deem it `important' (8% very/25% somewhat).

Different Gears for Different Years...

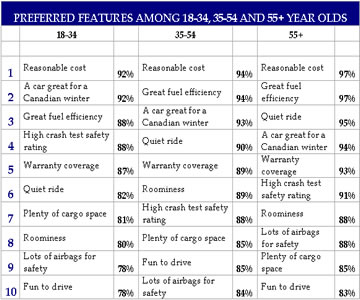

While some features rise to the top, different people prefer different vehicle features and it is interesting to see how Canada's demographics stack up against one another. In particular, attitudes towards various features vary by age:

- Older Canadians (95%) are looking for a quiet ride while middle aged (90%) and younger (85%) Canadians less so.

- Middle aged Canadians (85%) are more likely to look for a vehicle that is fun to drive than older (83%) and younger (78%) Canadians.

- Not surprisingly, younger Canadians (60%) are more likely to say that leading edge technology integration is important in comparison to middle aged (45%) and older (31%) Canadians.

- Younger Canadians (38%) say smart phone connectivity via mobile applications is an important feature compared to 33% of middle aged and 30% of older Canadians.

Preferences Shift by Region, Gender, Other Demos...

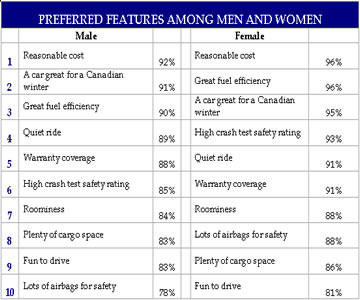

Canadians attitudes towards important car features also vary by gender. Below are some examples:

- Women (93%) are more likely than men (85%) to want a car that has a high crash test safety rating.

- Virtually all (98%) British Columbians say great fuel efficiency is an important feature while residents of Quebec (89%) are the least likely to say it is important.

- Residents of Saskatchewan and Manitoba (94%) are the most likely to say they want a vehicle that is fun to drive followed by residents of Atlantic Canada (88%), British Columbia (87%), Alberta (85%), Quebec (81%) and Ontario (78%).

- A sleek exterior style is more important to residents of Saskatchewan and Manitoba (75%) in comparison to residents of British Columbia (67%), Alberta (65%), Ontario (65%), Atlantic Canada (57%) and Quebec (52%).

- Road side support systems are more important to women (70%) than men (57%).

- Canadians with kids (39%) are more likely than those without (33%) to say that smart phone connectivity is an important feature.

- Not surprisingly, Canadians with kids (86%) are twice as likely to feel that a child friendly car is important than those without (41%).

- Canadians with less than a high school education (70%) are most likely to say that a car that drives like a luxury vehicle is important compared to those with post secondary (67%), high school (66%) and university (62%) education.

- Canadians who earn over $60,000 per year (70%) are more likely to find a feature such as an excellent sound system important in comparison to those who earn between $30-60 thousand (66%) and those who earn less than $30,000 (58%).

Men and women rated their top ten most important features in a car when cruising and here is how they match up:

(Click to enlarge image)

(Click to enlarge image)

These are some of the findings of an Ipsos Reid poll conducted between November 18 to 23, 2010 on behalf of GM Canada. For this survey, a national sample of 1,021 adults from Ipsos' Canadian online panel was interviewed online. Weighting was then employed to balance demographics and ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. A survey with an unweighted probability sample of this size and a 100% response rate would have an estimated margin of error of +/-3.1 percentage points 19 times out of 20, of what the results would have been had the entire population of adults in Canada been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Senior Research Manager

Ipsos Reid

Public Affairs

(416) 572-4474

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is a leading global survey-based market research company, owned and managed by research professionals. Ipsos helps interpret, simulate, and anticipate the needs and responses of consumers, customers, and citizens around the world.

Member companies assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media. They measure public opinion around the globe. Ipsos member companies offer expertise in advertising, customer loyalty, marketing, media, and public affairs research, as well as forecasting, modeling, and consulting. Ipsos has a full line of custom, syndicated, omnibus, panel, and online research products and services, guided by industry experts and bolstered by advanced analytics and methodologies. The company was founded in 1975 and has been publicly traded since 1999. In 2009, Ipsos generated global revenues of e943.7 million ($1.33 billion U.S.). .

Visit www.ipsos-na.com to learn more about Ipsos offerings and capabilities.

Ipsos, listed on the Eurolist of Euronext - Comp B, is part of SBF 120 and the Mid-100 Index, adheres to the Next Prime segment and is eligible to the Deferred Settlement System. Isin FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP