Most Retired (54%) and Not Yet Retired (78%) Canadians Haven't Determined the Savings Amount Needed to Allow them a Comfortable Retirement

When it comes to the amount needed for retirement, retired Canadians and those not yet retired who had determined the amount needed for retirement appear to be going in opposite directions. Canadians not yet retired have significantly reduced their retirement savings goal by more than $200,000 to an average of $564,000 in 2012 compared to $778,000 in 2011. Retired Canadians, however, have slightly raised the amount they expected to need to $347,000 in 2012, up from $339,000 in 2011.

- The gender gap has also significantly narrowed between men and women's retirement savings goals. Canadian women slightly raised their expected retirement savings amount over the last year from $452,000 in 2011 to $510,000 in 2012 (up 13%), compared to Canadian men who saw a drastic decline in their expected retirement savings amount from $732,000 in 2011 to $424,000 in 2012. This denotes a narrowing of the gender gap from a $280,000 in 2011 to just $86,000 in 2012.

Despite these fluctuations, the opinions of Canadians when it comes to how they are doing with their retirement savings have been relatively consistent over the past four years. A majority (53%) of Canadians believe they are either exactly where they need to be or well ahead of where they needs to be in terms of saving for their retirement (up 4 points from last year and the same proportion as in 2009), while a minority (47%) believe they are either somewhat short or nowhere close.

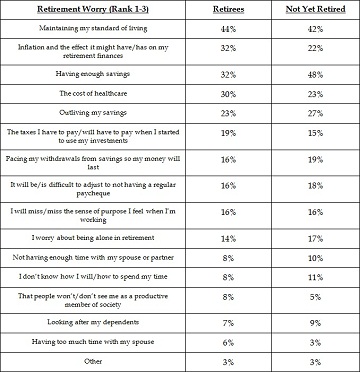

Retirement Worries

As the Canadian population ages and Canadians prepare to spend a significant portion of their lives in retirement, there are many worries that Canadians have once they step away from their careers. For one in three (32%) retired Canadians inflation and the effect it might have on their retirement finances is a top concern, compared to one in five (22%) Canadians not yet retired who feel the same. A similar proportion of Canadians retirees (30%) and those not yet retired (23%) cite the costs of healthcare as a top worry. The following table outlines in full the worries that Canadian retirees and those not yet retired have about retirement:

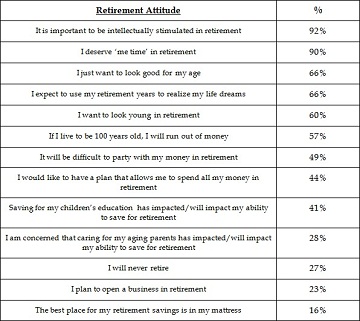

Other Attitudes About Retirement

When it comes to attitudes concerning retirement, some Canadians think retirement won't happen for them or they'll keep working even after retiring from their primary career. Interestingly, three in ten (27%) Canadians believe they will never retire, while one in four (23%) plan to open a business in retirement. The following table outlines in full Canadians views on several attitudes relating to retirement:

These are some of the findings of an Ipsos Reid poll conducted between October 24th to November 27th, 2012 on behalf of RBC. For this survey, a sample of 1,225 Canadian adults (aged 18 and over) from Ipsos' Canadian online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/- 3.2 percentage points had all Canadians adults been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Associate Vice President

Ipsos Reid Public Affairs

416.572.4474

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. In October 2011 Ipsos completed the acquisition of Synovate. The combination forms the world's third largest market research company.

With offices in 84 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,363 billion (1.897 billion USD) in 2011.

Visit www.ipsos-na.com to learn more about Ipsos' offerings and capabilities.