To Tell the Truth: Only Half (49%) of Canadians are Always Truthful About Their Financial Situation;

Others Tell `White Lies' (45%), or Blatantly Lie (6%)

Only one half (49%) of Canadians say `always tell the truth' when it comes to discussing their finances with others, including their partner/spouse, friends, family and co-workers. On the other hand, 45% maintain that they're `mostly truthful but do tell some small white lies or omissions'. Some Canadians, however, admit to `not being very truthful and exaggerate or lie to make themselves look better' (4%), or confess that they're `not truthful at all and will lie and tell people they are in great financial shape when they are not' (2%).

Taking a look at those who are not wholly truthful all the time, those most willing to tell financial fibs include:

- British Columbians (61%), ahead of Ontarians (52%), Albertans (50%), Quebecers (49%), Prairies residents (48%), and Atlantic Canadians (36%)

- Men (54%) compared to women (47%)

- Middle-aged Canadians, ages 35-54, (54%) ahead of seniors, ages 55+, (51%), and younger Canadians, ages 18-34, (46%)

Given a list of different financial responsibilities, Canadians also indicate their level of truthfulness when it comes to discussing them with other people and the results reveal that Canadians are most willing to at least bend the truth when it comes to their savings or ability to manage a financial emergency (51% not vs. 49% always truthful). The full breakdown of financial responsibilities and truthfulness is as followed:

- Savings/ability to manage a financial emergency (51% not vs. 49% always truthful)

- Retirement plan (48% not vs. 52% always truthful)

- Lifestyle, Entertainment, Vacation affordability (47% not vs. 53% always truthful)

- Credit Cards (46% not vs. 54% always truthful)

- Child's Education Savings, among parents (44% not vs. 56% always truthful)

- Bills/Monthly expenses (43% not vs. 57% always truthful)

- Home/Mortgage payments (42% not vs. 58% always truthful)

- Student/Previous debt (39% not vs. 61% always truthful)

Among Canadians who identify as not being always truthful regarding above financial responsibilities, the top reason for bending the truth is that they want to protect their loved ones from stress or worry (36%). Other reasons include their pride or feeling like a failure (22%), parental or family expectations (18%), the pressure to keep up appearances (18%), culture or learned behaviours (16%), denial (7%), lack of financial literacy (7%), or some other reason (23%).

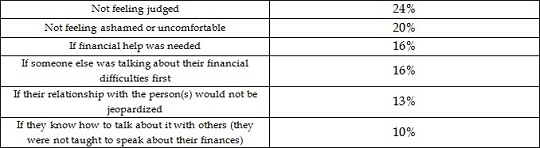

Most Canadians who aren't wholly truthful about their financial situation say that there are things that could be done to help them talk more openly and honestly with friends and family about their financial situation, most notably if the following were to happen:

These are some of the findings of an Ipsos Reid poll conducted between February 5th to 10th , 2015, on behalf of BDO Canada Ltd. For this survey, a sample of 1,003 adults was interviewed via the Ipsos I-Say online panel. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within +/ - 3.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

For more information on this news release, please contact:

Sean Simpson

Vice President

Ipsos Reid

Public Affairs

(416) 572-4474

[email protected]

About Ipsos Reid

Ipsos Reid is Canada's market intelligence leader, the country's leading provider of public opinion research, and research partner for loyalty and forecasting and modelling insights. With operations in eight cities, Ipsos Reid employs more than 600 research professionals and support staff in Canada. The company has the biggest network of telephone call centres in the country, as well as the largest pre-recruited household and online panels. Ipsos Reid's marketing research and public affairs practices offer the premier suite of research vehicles in Canada, all of which provide clients with actionable and relevant information. Staffed with seasoned research consultants with extensive industry-specific backgrounds, Ipsos Reid offers syndicated information or custom solutions across key sectors of the Canadian economy, including consumer packaged goods, financial services, automotive, retail, and technology & telecommunications. Ipsos Reid is an Ipsos company, a leading global survey-based market research group.

To learn more, please visit www.ipsos.ca.

About Ipsos

Ipsos is an independent market research company controlled and managed by research professionals. Founded in France in 1975, Ipsos has grown into a worldwide research group with a strong presence in all key markets. Ipsos ranks third in the global research industry.

With offices in 86 countries, Ipsos delivers insightful expertise across six research specializations: advertising, customer loyalty, marketing, media, public affairs research, and survey management.

Ipsos researchers assess market potential and interpret market trends. They develop and build brands. They help clients build long-term relationships with their customers. They test advertising and study audience responses to various media and they measure public opinion around the globe.

Ipsos has been listed on the Paris Stock Exchange since 1999 and generated global revenues of e1,712,4 million (2 274 M$) in 2013.

Visit www.ipsos.com to learn more about Ipsos' offerings and capabilities.