Consumer sentiment up for jobs; India ranks No.2 on National Index Score: LSEG-Ipsos PCSI August 2024

New Delhi, August 30, 2024: The August 2024 wave of the LSEG-Ipsos Primary Consumer Sentiment Index shows confidence around jobs has improved and India was placed 2nd in the pecking order on the National Index Score across the 29 markets covered in the survey.

However, overall, the sentiment was seen to be down -2.9 percentage points.

The LSEG-Ipsos PCSI maps consumer sentiment on 4 sub-indices and sentiment around the PCSI Employment Confidence (“Jobs”) sub-index, has seen an uptick of +0.9 percentage points, the PCSI Current personal financial conditions sub-index (Current Conditions) was down -6.5 percentage points; the PCSI Investment Climate (“Investment”) sub-index has lowered -6.5 percentage points; and the PCSI Economic Expectations (“Expectations”) Sub-Index was down 2.0 percentage points.

Amit Adarkar, CEO, Ipsos India elucidating on the findings said: "The sentiment around jobs has improved with some sectors hiring in H2 and also with the government announcing new initiatives for job creation in the budget. Some consumers are feeling the pinch of high cost of living in terms of strain on personal finances for day-to-day running of households and lack of disposable incomes for savings and buying of big ticket items and discretionary spends. The sentiment is also down around the economy. Global factors continue to bog down our economy also with the rupee weakening against the dollar at Rs. 84/$, with the wars in Ukraine and Gaza continuing."

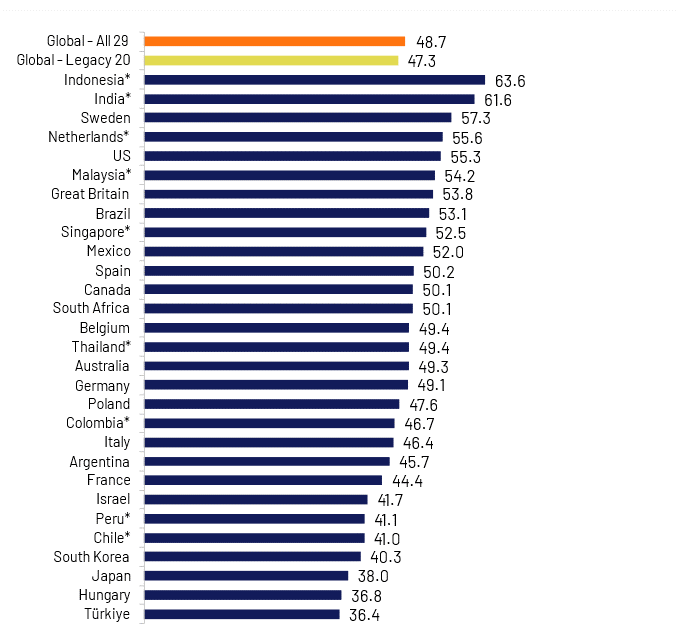

Consumer sentiment in 29 countries

Among the 29 countries, India has now moved to the 2nd spot, preceded by Indonesia (63.6) which now holds the highest National Index Score. Indonesia and India (61.6) are the only countries with a National Index score of 60 or higher.

Eleven other countries now show a National Index above the 50-point mark: Sweden (57.3), the Netherlands (55.6), the U.S. (55.3), Malaysia (54.2), Great Britain (53.8), Brazil (53.1), Singapore (52.5), Mexico (52.0), Spain (50.2), Canada (50.1) and South Africa (50.1).

In contrast, just three countries show a National Index below the 40-point mark: Japan (38.0), Hungary (36.8), and Türkiye (36.4).

“India continues to be one of the most resilient markets despite all the global turbulence and tough macro conditions. We have good monsoons and that should bring down food inflation,” added Adarkar.

About the Study

These findings are based on data from a monthly 29-country survey conducted by Ipsos on its Global Advisor online survey platform and, in India, on its IndiaBus platform. They are first reported each month by LSEG as the Primary Consumer Sentiment Index (PCSI).

The results are based on interviews with over 21,200 adults aged 18+ in India, 18-74 in Canada, Israel, Malaysia, South Africa, Türkiye, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in all other countries.

The monthly sample consists of 1,000+ individuals each in Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Israel, Malaysia, Mexico, the Netherlands, Peru, Poland, Singapore, South Africa, South Korea, Sweden, Thailand, and Türkiye. The sample in India consists of approximately 2,200 individuals of whom 1,800 were interviewed face-to-face and 400 were interviewed online.

Samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, South Korea, Spain, Sweden, and the U.S. can be considered representative of their general adult populations under the age of 75. Samples in Brazil, Chile, Colombia, Indonesia, Israel, Malaysia, Mexico, Peru, Singapore, South Africa, Thailand, and Türkiye are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their populations. India’s sample represents a large subset of its urban population — social economic classes A/B/C in metros and tier 1-3 town classes across all four zones.

The data is weighted so that the composition of the sample in each country best reflects the demographic profile of the adult population according to the most recent census data.

The global indices and averages reported here reflect the average result for all the countries and markets in which the survey was conducted. They have not been adjusted to the population size of each country or market and are not intended to suggest “total” results.

Sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. The precision of Ipsos online surveys is calculated using a Bayesian credibility interval with a survey of N=1,000 being accurate to +/- 3.5 percentage points and a survey of N=500 being accurate to +/- 5.0 percentage points. For more information on credibility intervals, visit this page.

The LSEG/Ipsos Primary Consumer Sentiment Index (PCSI), ongoing since 2010, is a monthly survey of consumer attitudes on the current and future state of their local economy, personal financial situation, savings, and confidence to make major investments. The PCSI metrics reported each month for each of the countries surveyed consist of a “Primary Index” based on all 10 questions below and of several “sub-indices” each based on a subset of these 10 questions.

The publication of these findings abides by local rules and regulations.