Strong upturn in consumer sentiment in January 2024: Refinitiv-Ipsos PCSI India

The new year has taken off with happy tidings and a strong bounce back. According to the Refinitiv-Ipsos Primary Consumer Sentiment Index (PCSI) for January 2024, consumer confidence surged by a robust 2.2 percentage points. Further, recovery was seen across all the four sub-indices.

The monthly PCSI result, is driven by the aggregation of four weighted sub-Indices. The monthly survey shows the PCSI Current Personal Financial Conditions (“Current Conditions”) Sub-Index is up 2.0 percentage points; the PCSI Investment Climate (“Investment”) Sub-Index has moved up 2.5 percentage points; the PCSI Economic Expectations (“Expectations”) Sub-Index is up 2.5 percentage points and the PCSI Employment Confidence (“Jobs”) Sub- Index is significantly up 3.7 percentage points.

Amit Adarkar, CEO, Ipsos India, elucidating on the findings said, “There is a marked upturn in consumer sentiment in the new year. Sentiment around jobs has seen a major rebound, with hiring looking up in recent times. Consumers are also bullish about spending and there is positive sentiment seen for the economy. It is heartening to see the momentum continuing post the festival season. With this upturn, India tops the chart globally in terms of consumer sentiment. India is on a growth path and hopefully the upcoming budget will provide further impetus to the growth agenda. For now, inflation around essential commodities (esp. food items) is in check, providing room for discretionary spends for urban Indians.”

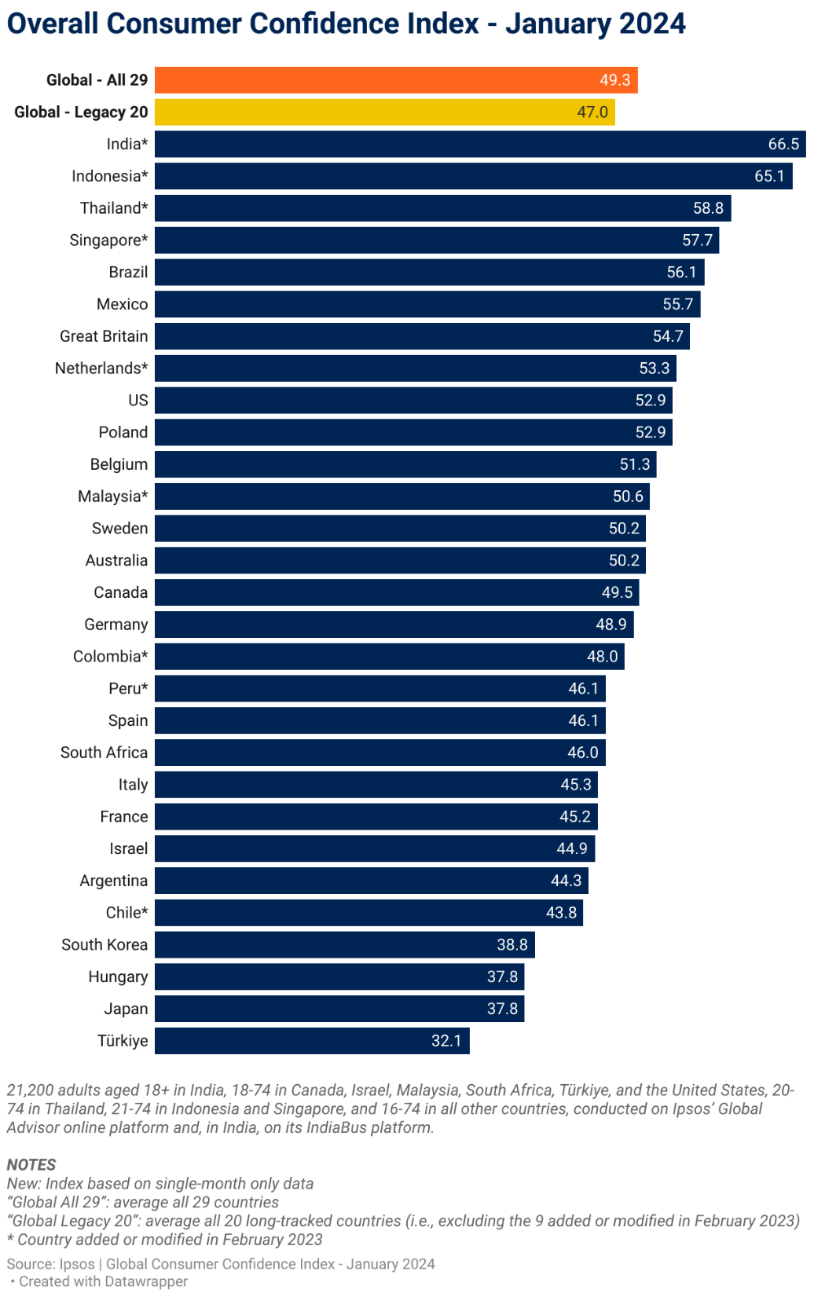

Consumer Sentiment in 29 Countries – January 2024

Among the 29 countries covered in the survey, India (66.5) holds the highest National Index score this month. Indonesia (65.1) is the only other country with a National Index score of 60 or higher.

Twelve other countries now show a National Index above the 50-point mark: Thailand (58.8), Singapore (57.7), Brazil (56.1), Mexico (55.7), Great Britain (54.7), the Netherlands (53.3), the U.S. (52.9), Poland (52.9), Belgium (51.3), Malaysia (50.6), Sweden (50.2), and Australia (50.2).

For Belgium, this month’s score is the country’s highest since tracking began in 2010. Also, this month’s score is the highest for Great Britain since August 2021.

In contrast, just four countries show a National Index below the 40-point mark: South Korea (38.8), Hungary (37.8), Japan (37.8), and Türkiye (32.1).

Compared to 12 months ago, Australia and Israel are the only countries to show a significant drop in consumer sentiment. Ten countries show significant increases, most of all in Poland (+16.4) and Great Britain (+13.1).

About the Study

These findings are based on data from a monthly 29-country survey conducted by Ipsos on its Global Advisor online survey platform and, in India, on its IndiaBus platform. They are first reported each month by LSEG as the Primary Consumer Sentiment Index (PCSI).

The results are based on interviews with over 21,200 adults aged 18+ in India, 18-74 in Canada, Israel, Malaysia, South Africa, Türkiye, and the United States, 20-74 in Thailand, 21-74 in Indonesia and Singapore, and 16-74 in all other countries.

The monthly sample consists of 1,000+ individuals each in Australia, Brazil, Canada, France, Germany, Great Britain, Italy, Japan, Spain, and the U.S., and 500+ individuals in each of Argentina, Belgium, Chile, Colombia, Hungary, Indonesia, Israel, Malaysia, Mexico, the Netherlands, Peru, Poland, Singapore, South Africa, South Korea, Sweden, Thailand, and Türkiye. The sample in India consists of approximately 2,200 individuals of whom 1,800 were interviewed face-to-face and 400 were interviewed online.

Samples in Argentina, Australia, Belgium, Canada, France, Germany, Great Britain, Hungary, Italy, Japan, the Netherlands, Poland, South Korea, Spain, Sweden, and the U.S. can be considered representative of their general adult populations under the age of 75. Samples in Brazil, Chile, Colombia, Indonesia, Israel, Malaysia, Mexico, Peru, Singapore, South Africa, Thailand, and Türkiye are more urban, more educated, and/or more affluent than the general population. The survey results for these countries should be viewed as reflecting the views of the more “connected” segment of their populations. India’s sample represents a large subset of its urban population — social economic classes A/B/C in metros and tier 1-3 town classes across all four zones.