The Economic Pulse of the World - December 2017

Global Average of National Economic Assessment Down One Point: 46%

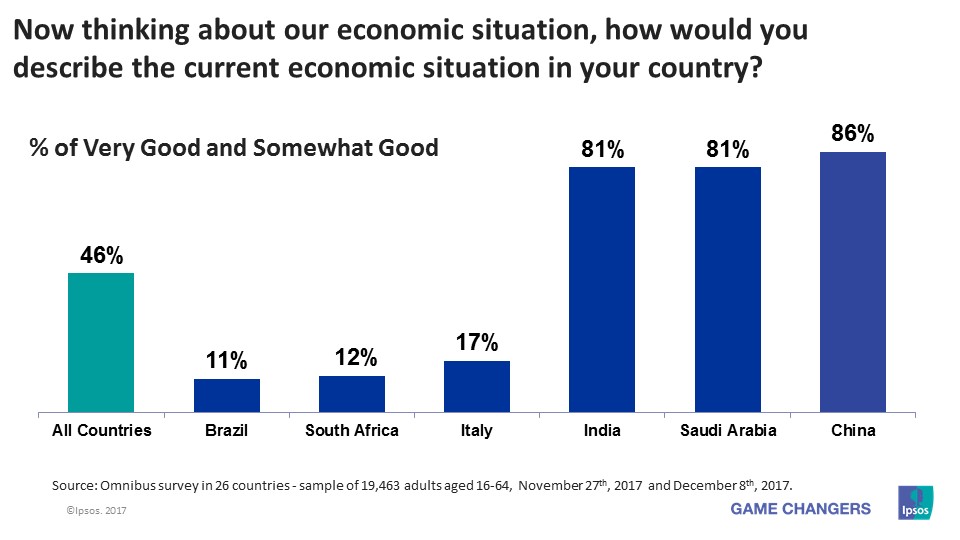

The average global economic assessment of national economies surveyed in 26 countries is down one point this wave with 46% of global citizens rating their national economies as ‘good’.

China (86%) has the top spot in the national economic assessment category again this month, followed by Saudi Arabia (81%), India (81%), Germany (80%), Sweden (77%), Canada (61%), Australia (61%), the United States (61%) and Peru (59%). Brazil (11%) is at the lowest spot in this assessment once again, followed by South Africa (12%), Italy (17%), Spain (21%), Hungary (23%), France (27%), Mexico (27%) , Argentina (28%), South Korea (30%) and Russia (34%).

Countries with the greatest improvements in this wave: India (81%, +5 pts.), Belgium (58%, +5 pts.), Serbia (37%, +4 pts.), Poland (53%, +4 pts.), South Korea (30%, +3 pts.), Sweden (77%, +2 pts.), France (27%, +2 pts.), the United States (61%, +1 pts.), Turkey (37%, +1 pts.), Saudi Arabia (81%, +1 pts.) and Australia (61%, +1 pts.).

Countries with the greatest declines: Argentina (28%, -10 pts.), Russia (34%, -10 pts.), Canada (61%, -7 pts.), Great Britain (35%, -5 pts.), Spain (21%, -5 pts.), Hungary (23%, -4 pts.), Japan (37%, -3 pts.), South Africa (12%, -3 pts.), Peru (59%, -2 pts.) and China (86%, -1 pts.).

Global Average of Local Economic Assessment (34%) Unchanged

When asked to assess their local economy, over one third (34%) of those surveyed in 26 countries agree that the state of the current economy in their local area is ‘good’. The local economic assessment remain unchanged since last sounding.

China (73%) remains the top country in the local assessment category, followed by Saudi Arabia (63%), Sweden (60%), Germany (60%), India (57%), Israel (56%), the United States (47%), Canada (41%), Australia (37%), Poland (37%) and Belgium (35%). South Africa (12%) is the lowest ranked country again in this category this month, followed by Serbia (13%), Brazil (13%), Italy (16%), Spain (17%), Japan (18%), Hungary (18%), Russia (20%), Mexico (22%), France (23%) and Argentina (23%).

Countries with the greatest improvements in this wave: Saudi Arabia (63%, +6 pts.), Israel (56%, +5 pts.), South Korea (24%, +3 pts.), India (57%, +3 pts.), France (23%, +3 pts.), Belgium (35%, +3pts.), Serbia (13%, +2pts.), Germany (60%, +2pts.) and Poland (37%, +1 pts.).

Countries with the greatest declines in this wave: Russia (20%, -9 pts.), Argentina (23%, -7 pts.), Spain (17%, -5 pts.), Australia (37%, -3 pts.), Brazil (13%, -3 pts.), Canada (41%, -3 pts.), Great Britain (26%, -3 pts.), Peru (33%, -3 pts.) and Sweden (60%, -3 pts.).

Global Average of Future Outlook for Local Economy (27%) Down One Point

The future outlook is down one point since last sounding, with over one quarter (27%) of global citizens surveyed in 26 countries expecting their local economy to be stronger six months from now.

India (63%) takes the lead at the top of this assessment category, followed by China (62%), Saudi Arabia (57%), Brazil (53%), Peru (49%), Argentina (44%), the United States (33%), South Korea (33%) and Turkey (28%). Italy and Hungary (both 8%) share the lowest future outlook score this month, followed by Great Britain (13%), France (13%), South Africa (13%), Japan (14%), (12%), Israel (14%), Serbia (16%), Sweden (16%), Australia (17%) and Russia (17%).

Countries with the greatest improvements in this wave: South Korea (33%, +9 pts.), India (63%, +7 pts.), Belgium (22%, +4 pts.), Great Britain (13%, +4 pts.), France (13%, +3 pts.), South Africa (13%, +2 pts.), Brazil (53%, +2 pts.), Turkey (28%, +1pts.) and Saudi Arabia (57%, +1 pts.).

Countries with the greatest declines in this wave: Sweden (16%, -15 pts.), Russia (17%, -8 pts.), Argentina (44%, -7 pts.), Canada (18%, -5 pts.), Australia (17%, -4 pts.), Germany (20%, -4 pts.), Hungary (8%, -4 pts.), Italy (8%, -4 pts.), Mexico (26%, -4 pts.), Poland(23%, -4 pts.) and China (62%, -2 pts.).

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)

![[Webinar] KEYS: THE MIDDLE CLASS: In Crisis?](/sites/default/files/styles/list_item_image/public/ct/event/2025-10/middle-class-family-dinner-food-carousel.webp?itok=iD1QyX8n)