Worries About Cost Of Living Remain High As End Of 2023 Draws Near

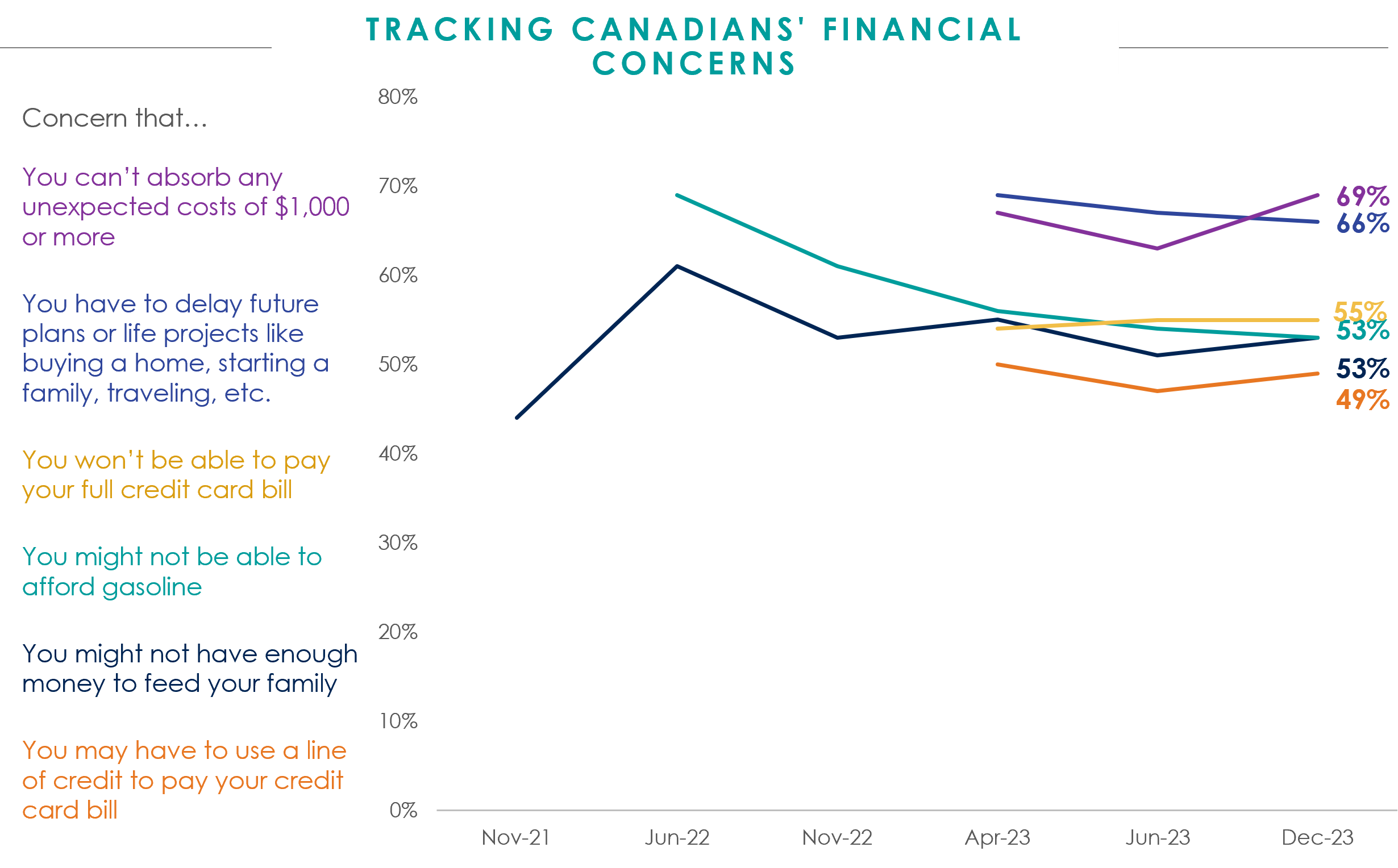

Continued high interest rates and the rising cost of living made 2023 a difficult year for many Canadians. Seven out of ten (69%) now say they are concerned that they can't absorb any unexpected costs of $1,000 or more, a figure that has increased by two points from April and six points from September. Two-thirds (66%) are worried they will have to delay future plans or life projects, a concern that has slowly declined since April 2023. Amidst the holiday season, about half are anxious they won't be able to pay their credit card bill (55%), that they might not be able to afford gas (53%), that they might not have enough money to feed their family (53%), or that they may have to use a line of credit to pay their credit card bill (49%). The fact that these figures have remained relatively consistent since April 2023 underscores the sustained stress this year has imposed on Canadians' finances. Political leaders are being urged to act, as 47% of Canadians say that inflation and the cost of living should be the top priority for Canada's political leaders in 2024.