Confidence in UK housing market stuck at lowest level in five years

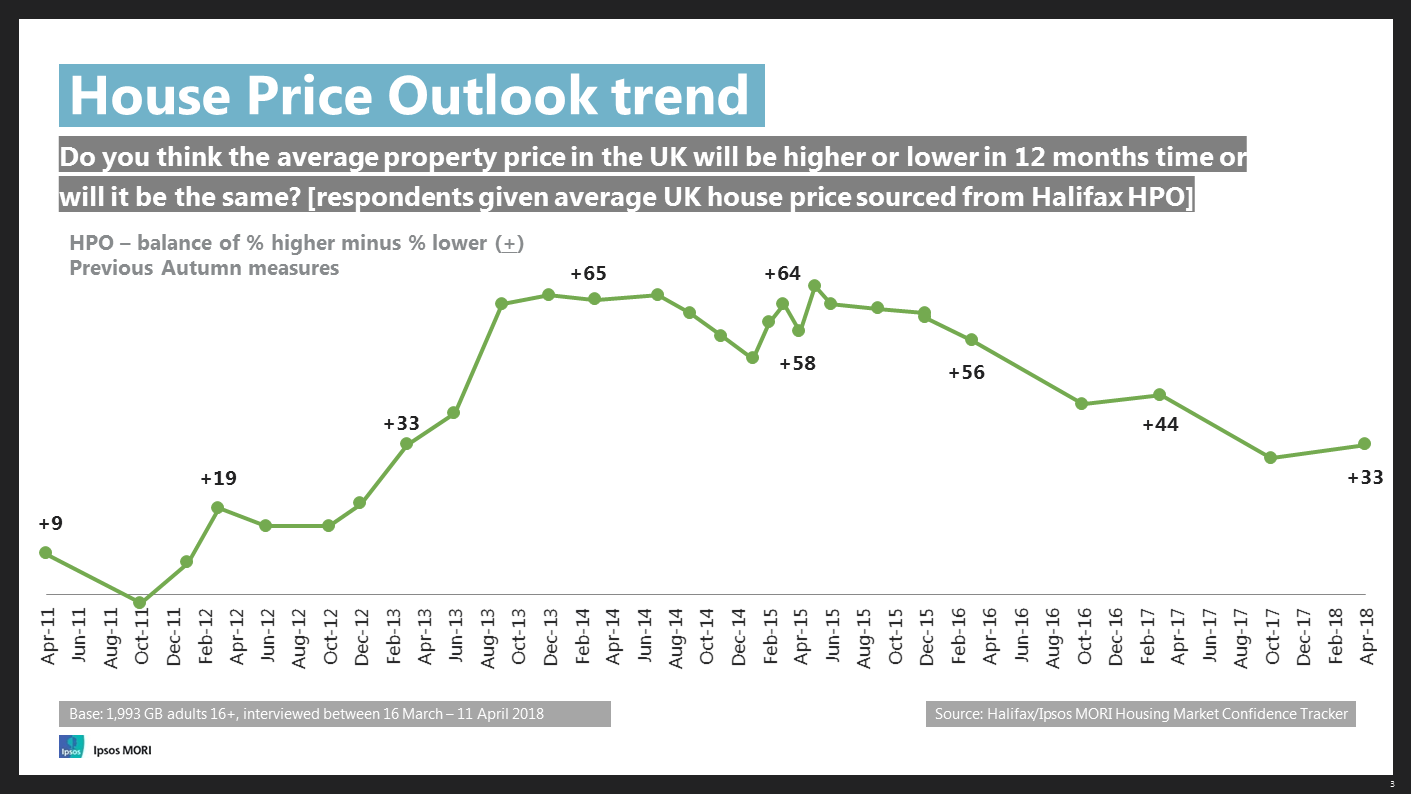

The latest Halifax Housing Market Confidence Tracker (HMCT) shows only a small improvement on the steep decrease in the House Price Outlook (HPO) found in autumn 2017.

In October 2017 HPO - consumer sentiment on whether average house prices will be higher or lower in a year’s time - was +30, down from +44 in March 2016 and less than half its peak in May 2015.

HPO is now +33. Half expect house prices to rise over the next year, the same as autumn 2017 and remaining at the lowest level since April 2013 (45%). However, fewer people are now negative about the housing market, with 17% predicting a fall in prices over the next year, down from 20% six months ago, with 26% expecting prices to stay flat.

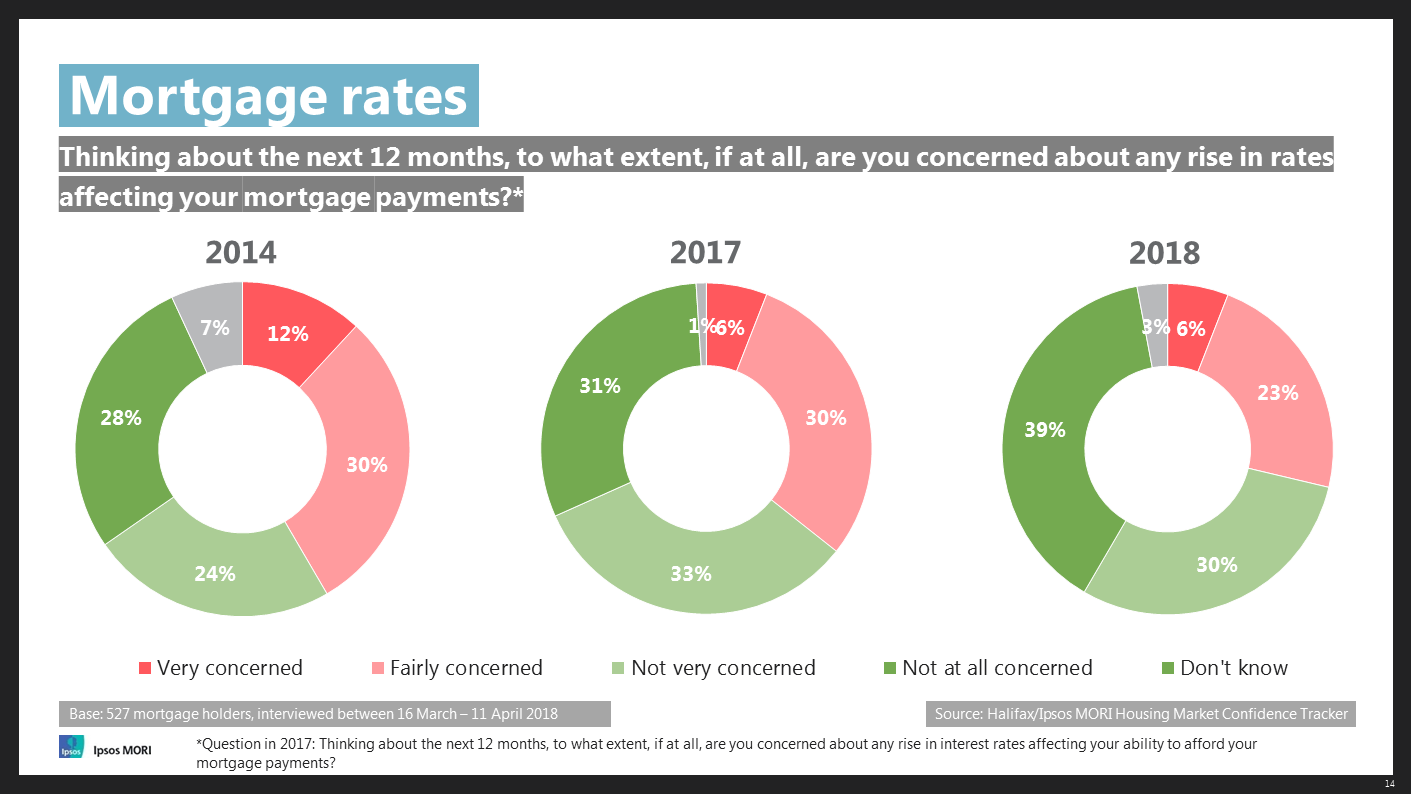

Less than a third of existing mortgage borrowers (29%) are concerned about the possibility of rising interest rates affecting their ability to meet their monthly repayments. This has fallen from 42% in 2014 and, despite the base rate increase in November 2017, compares with 36% expressing concern about affordability six months ago.1

On being asked how much monthly mortgage payments would have to increase by before they would struggle to meet them, almost half (47%) said above £150 or that they would face no difficulties. Only 5% felt that an increase of £24 or less a month would be an issue, with a quarter point increase on the average mortgage (£156,000) equating to around a £17 rise in average monthly payment.2

Similarly, interest rates are not considered a major obstacle by those surveyed when it comes to buying a home. Instead, the ability to raise a deposit continues to be the main issue buyers face, followed by job security and rising property prices.

Technical note

Ipsos interviewed 1,968 British adults, including 527 mortgage holders, aged 16+ face-to-face, between 22nd September and 1st October 2017. Data have been weighted to the known population profile.

1 Question asked in 2014 and 2018: Thinking about the next 12 months, to what extent, if at all, are you concerned about any rise in rates affecting your mortgage payments

Question asked in 2017: Thinking about the next 12 months, to what extent, if at all, are you concerned about any rise in interest rates affecting your ability to afford your mortgage payments?

2 Average advance data from UK Finance Q4 2017 (sourced by Halifax)