Is the public really engaged with the Sharing Economy?

Over the last few years the top Sharing Economy companies - Uber, Airbnb and others- have become household names. Given the number of column inches dedicated to the Sharing Economy you’d be forgiven for thinking the world goes nowhere, stays nowhere, and buys nothing without using these products and services.

However, research conducted by the Ipsos Reputation Centre suggests that awareness and usage of Sharing Economy sites is much lower than might be expected.

In our survey of the Great British general public, we gave participants a brief introduction to the Sharing Economy before asking them a series of questions to assess their awareness of the industry and some of the brands within it;

We defined the ’Sharing Economy’ as a new types of business model that allows individuals and groups to make better use of their own resources, assets, or skills. For example, a car owner may allow someone to rent out their vehicle while they are not using it, or a home owner may rent out their home or a room while they are on holiday.

Despite this introduction, fewer than one in ten (8%) say they know at least a fair amount about the Sharing Economy, and only half (50%) said they have heard about it.

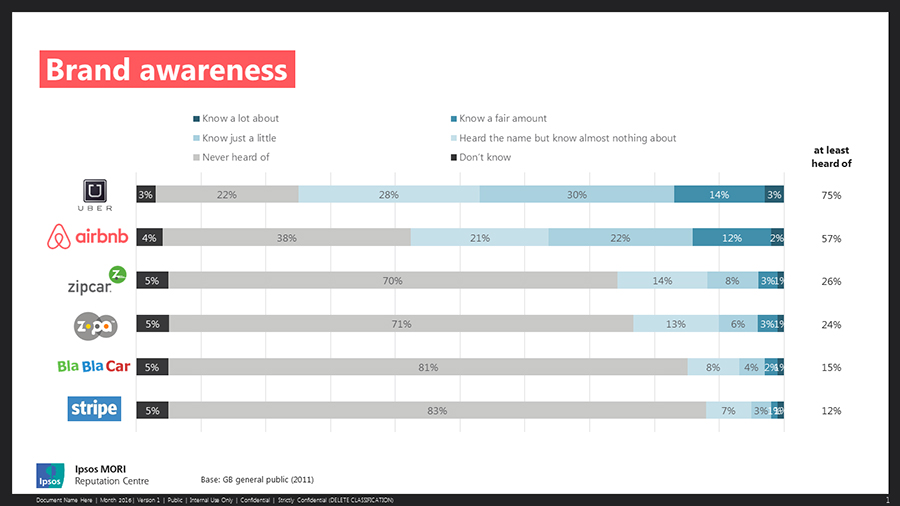

When we asked about a number of specific companies, awareness remained low. Only a quarter (26% and 24% respectively) have heard of Zipcar and Zopa, and still fewer (15% and 12% respectively) have heard of Blablacar or Stripe. Awareness is higher for the bigger players in the sector, Uber and Airbnb; at 75% and 58% respectively.

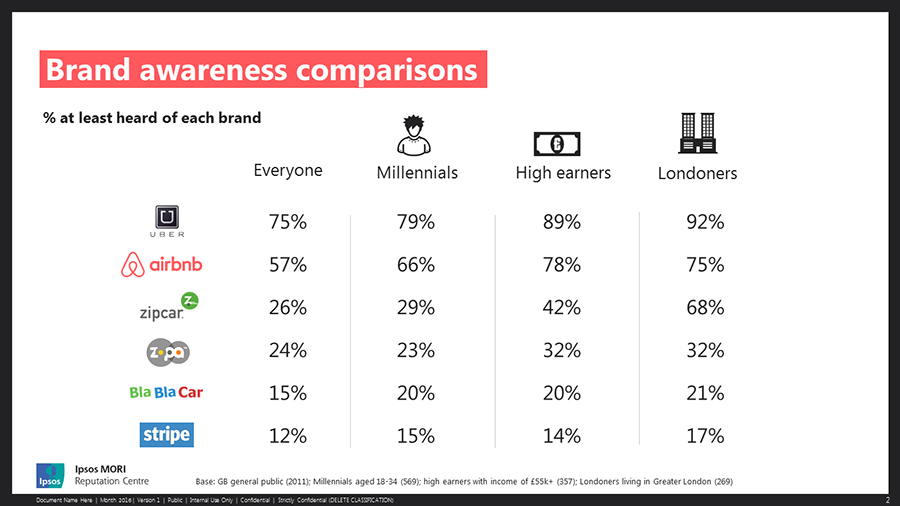

Perhaps unsurprisingly, awareness of the Sharing Economy as a concept is highest amongst Millennials; half (50%) have at least heard of it. Awareness of the brands is also higher amongst this group – eight in ten (79%) have heard of Uber and two-thirds (66%) Airbnb.

Those from Greater London were also more likely to be aware of Sharing Economy brands; over nine in ten (92%) have heard of Uber and 75% Airbnb. Results are similar for those on higher incomes; 78% have heard of Airbnb and 89% Uber.

When it comes to usage, 7% of those interviewed said that they had used Uber in the last 12 months, 5% Airbnb, 2% Zopa, 1% Zipcar and 1% Stripe.

Looking at Uber, a 7% national usage rate for a company that’s had a UK presence for less than five years has to be seen as a success. Similarly, while Airbnb has been around longer, the idea that 5% of the public have used it this year is striking, and lends credence to those worried that the business model could pose a threat to rental prices, or the viability of some hotels.

With the caveat that less than 10% of the population claim to have used the likes of Uber and Airbnb in the last 12 months, there are nonetheless some conclusions we can draw about the profile of these users.

Let’s look at Airbnb first. Overall, 5% of the of the adult GB population claim to have used Airbnb in the last year, which rises to 10% of 25-34 year olds, 10% of those who earn £55,000 per annum or more, 9% of those with a university degree and 10% of London residents. Still not massive penetration into these groups, but these are still statistically significant differences from the population as a whole, and these differences represent tens of thousands of people. Furthermore, only 2% of those who earn £19,000 or less per annum and 3% of those who did not go to university have used Airbnb.

Unsurprisingly Uber’s customer profile is pretty similar. Compared to 7% nationwide, fully 14% of 25-34 year olds and 13% of those who earn £55,000 or more per annum have used Uber in the last year. More striking still is the fact that 19% of London residents say they have used the service in the last year – a staggering number given the level of competition from taxi and black cab suppliers in the capital. In line with Airbnb, it is the over 55s (3%) and those who earn £19,000 or less per annum (4%) who are the least likely to have used Uber.

What this seems to suggest is that either the wealthier, more urban parts of society are more willing to adopt new products and service offers and/or are more willing to adopt technology led innovation.

How does this customer profile compare to that of Amazon, one of the established giants of the tech world? Well firstly there is much less variation by age Amazon’s customer profile; only the over 55’s standout from the other age groups – with a 79% claiming to have used Amazon this year compared to 83% overall. There is also a marked difference in usage between those on £19,000 per annum or less (77% having used Amazon) and the those taking home £55,000 or more per annum (91%).

If you are looking for a parallel to Uber and Airbnb in profile of their customer base across demographic groups, then Starbucks is a better comparator than Amazon. Of course its customer base is much larger than either Uber or Airbnb (it’s a high-street brand that’s been in the UK since 1998) with 32% of the UK population saying they have used the brand in the last year. But overall, but the pattern of usage is similar. Both of the two youngest age groups, 18-24 (44%) and 25-34 (41%) are much more likely to have been customers of Starbucks in the last year than older age groups, as are those with an income of £55,000 or more per annum (47%) and London residents (40%) when compared to people with lower incomes or who live outside of London. A similar pattern to the one we saw with Uber.

What differentiates Starbucks, Uber and Airbnb from Amazon? Market share is the obvious factor. Amazon is now such a dominant presence in the retail sector and it stocks such a wide variety of goods that it has something to offer nearly every consumer who visits. With the other three companies discussed – the regular purchase of coffee, the use of taxis and the use of relatively niche holiday options – it pretty much boils down to income and lifestyle choices that are more likely to exist amongst younger and urban (London) based people.

This all raises an interesting question about the momentum and growth potential of Uber and Airbnb going forward, and how regulators approach them. If they continue to occupy market share among affluent, urban early adopters – then their market share will remain small, and growth will depend on local, organic growth and international expansion. If so, then Regulators will likely treat them as a disruptive player in a varied market and will be unlikely to look to closely at their activities. But if they’ve got their sights set on something bigger and more prolific then their regulatory battles have only just begun.

- This article was written by Carl Phillips and Becky Writer-Davies.