How electric vehicle incentives can charge the market

KEY TAKEAWAYS:

- Cost and convenience are the top reasons most people who don’t own an EV are concerned about getting one

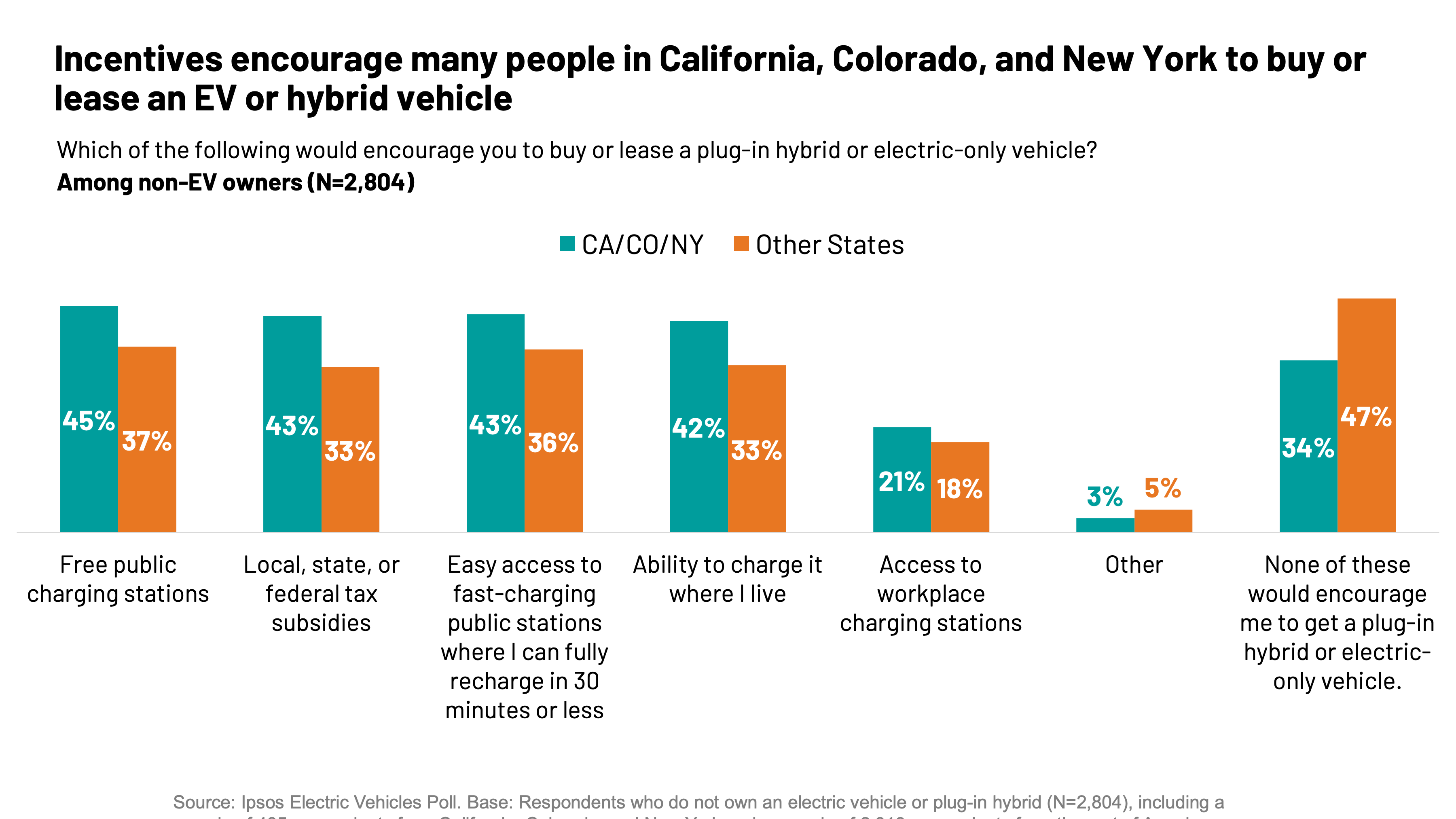

- Building out public charging infrastructure and lowering the cost of EVs encourages some Americans to consider buying these vehicles. These incentives seem especially powerful in California, Colorado, and New York.

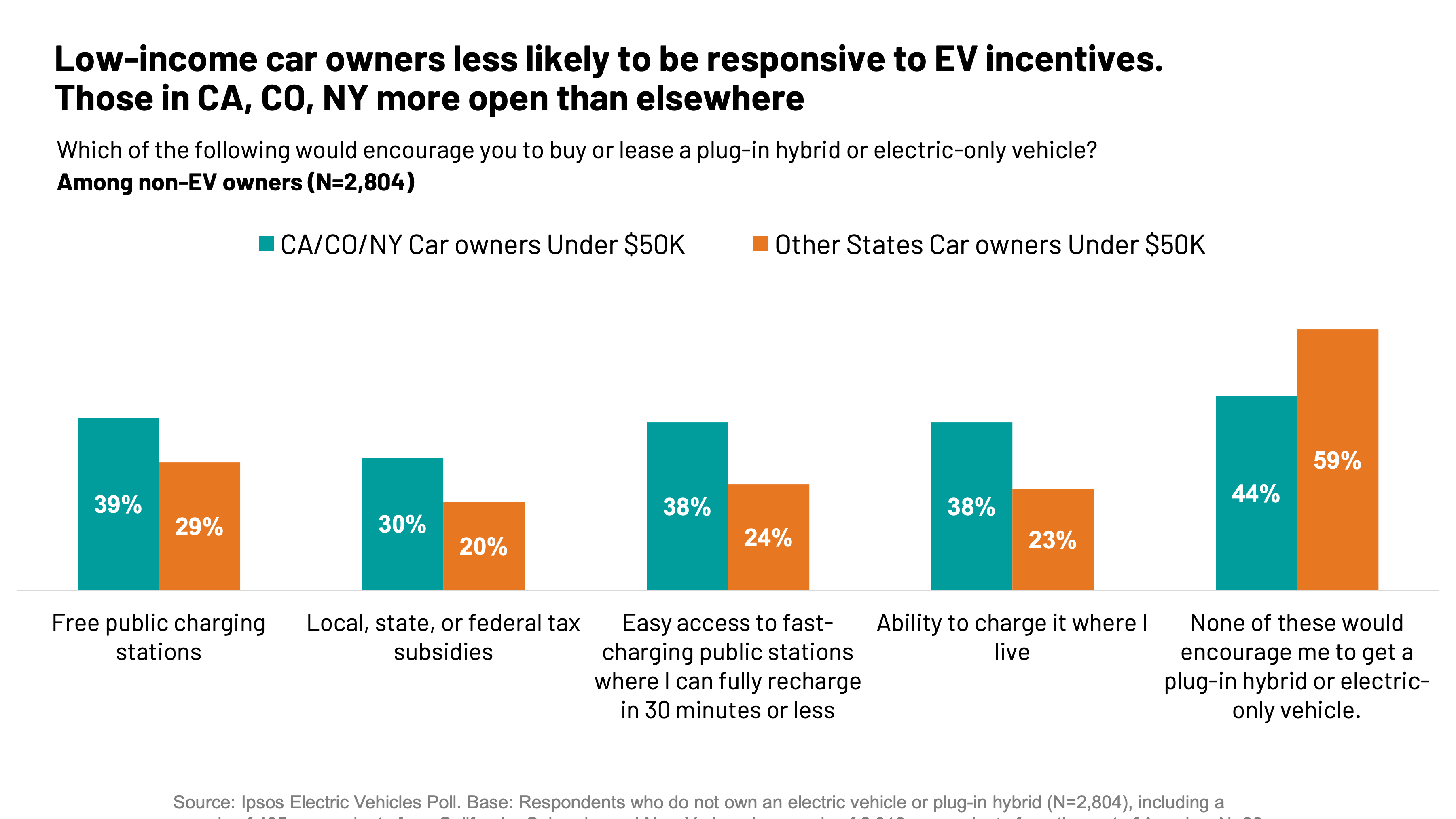

- Equitable access to the EV market is a concern. Many low-income car-owners would not consider getting an EV, regardless of the policies or incentivizes Ipsos tested, suggesting more research around this demographic is needed to create effective policies and/or educational campaigns that address their barriers of entry to the EV market.

The electric vehicle (EV) industry is set for another year of growth. The sales of passenger EVs in the U.S. is set to grow by 31% from 2023 to 2024, according to a Bloomberg estimate. While the market is expanding, sustained consumer appetite may be a problem – some vehicle manufacturers have warned that interest in EVs is beginning to slow down.

The continued growth of the EV sector will likely hinge on the ability of EV industry leaders, policymakers and government agencies to make the EV market more accessible and improve upon EV infrastructure to encourage more prospective car buyers to consider EVs. Trended Ipsos research finds that EV ownership in the U.S. continues to be dragged down by two familiar foes: cost and convenience.

What can legislators and EV industry officials do to make EV ownership more cost-effective and convenient? What perks could push prospective EV buyers toward EV ownership? What can policymakers due to inform the public about existing incentives and benefits? And what, if anything, can we learn from the most forward-thinking states when it comes to EV infrastructure?

Public infrastructure and state incentives may help the public adopt EVs, as Ipsos tracking data suggests. Looking closer at California, Colorado and New York – states that the American Council for Energy Efficient Economy (ACEEE) considers leaders in the key facets of developing an EV market – it is clear how important public infrastructure is in supporting EV growth. Yet, the barriers and perceptions of cost and convenience remain an issue both nationally and in these select states. These incentives help, but perceptions about cost and convenience remain problematic especially among key groups like low-income car owners.

Where is the EV landscape and how has it changedsince 2022?

Broadly speaking, electric vehicle ownership remains relatively low and unchanged since 2022. Combined, around 5% of respondents report owning an electric vehicle (4%) or plug-in hybrid (2%), compared to 3% ownership in 2022, a difference that is not statistically significant. These numbers remain highest among respondents with an income of $100k or more (6%), those aged 35-59 (6%), and those living in suburban (4%) or urban (4%) areas.

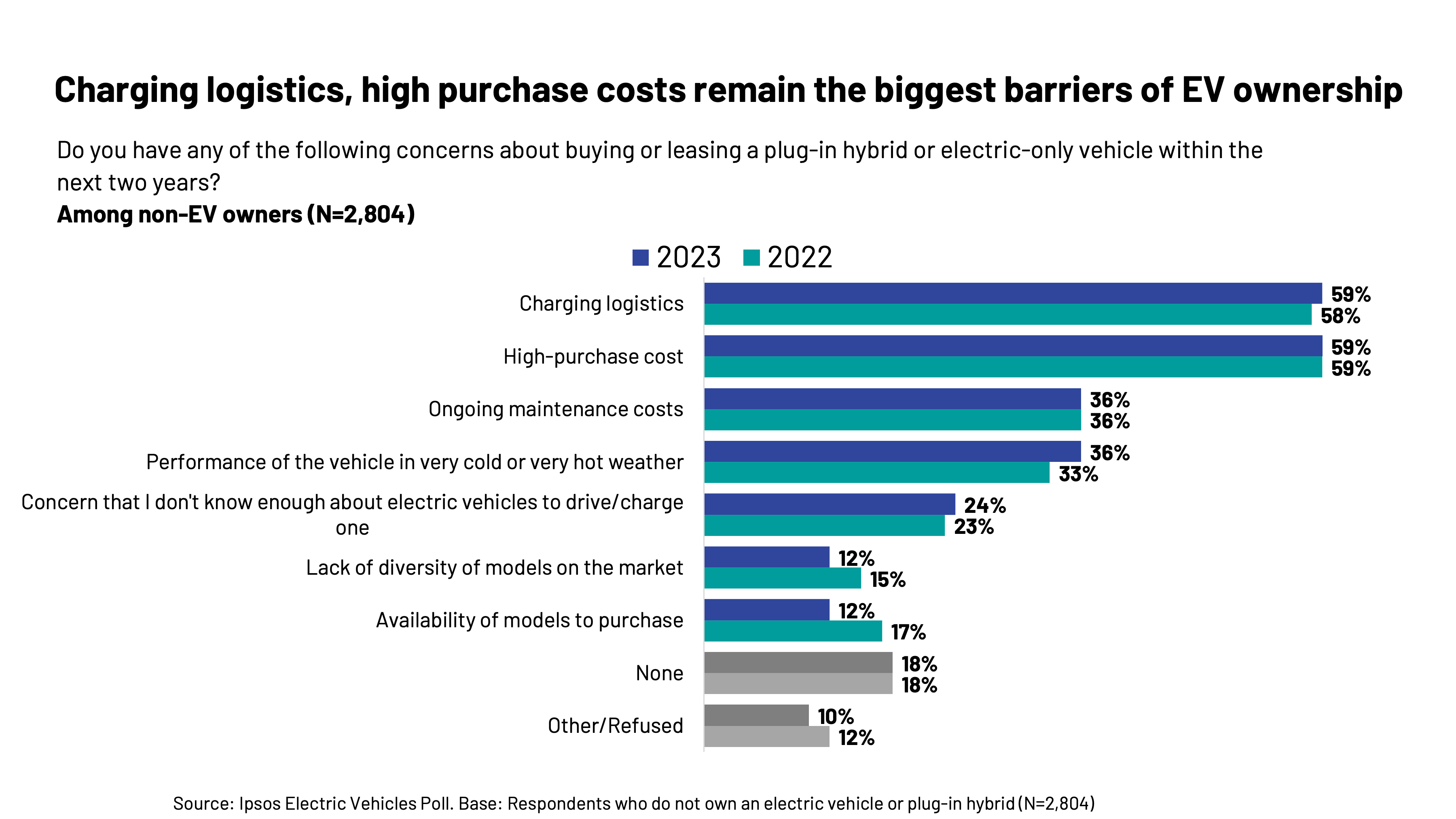

The biggest barriers that consumers report to EV ownership remain the same too. Charging logistics (59%) and high purchase costs (59%) are the biggest concerns that non-EV owners have when it comes to buying an EV, unchanged from 2022.

But, for Americans who don’t currently own an EV, subsidies and public infrastructure may help encourage them to consider this type of vehicle, an assessment in line with what policy experts view as the biggest hurdles and opportunities for growth in the EV market.

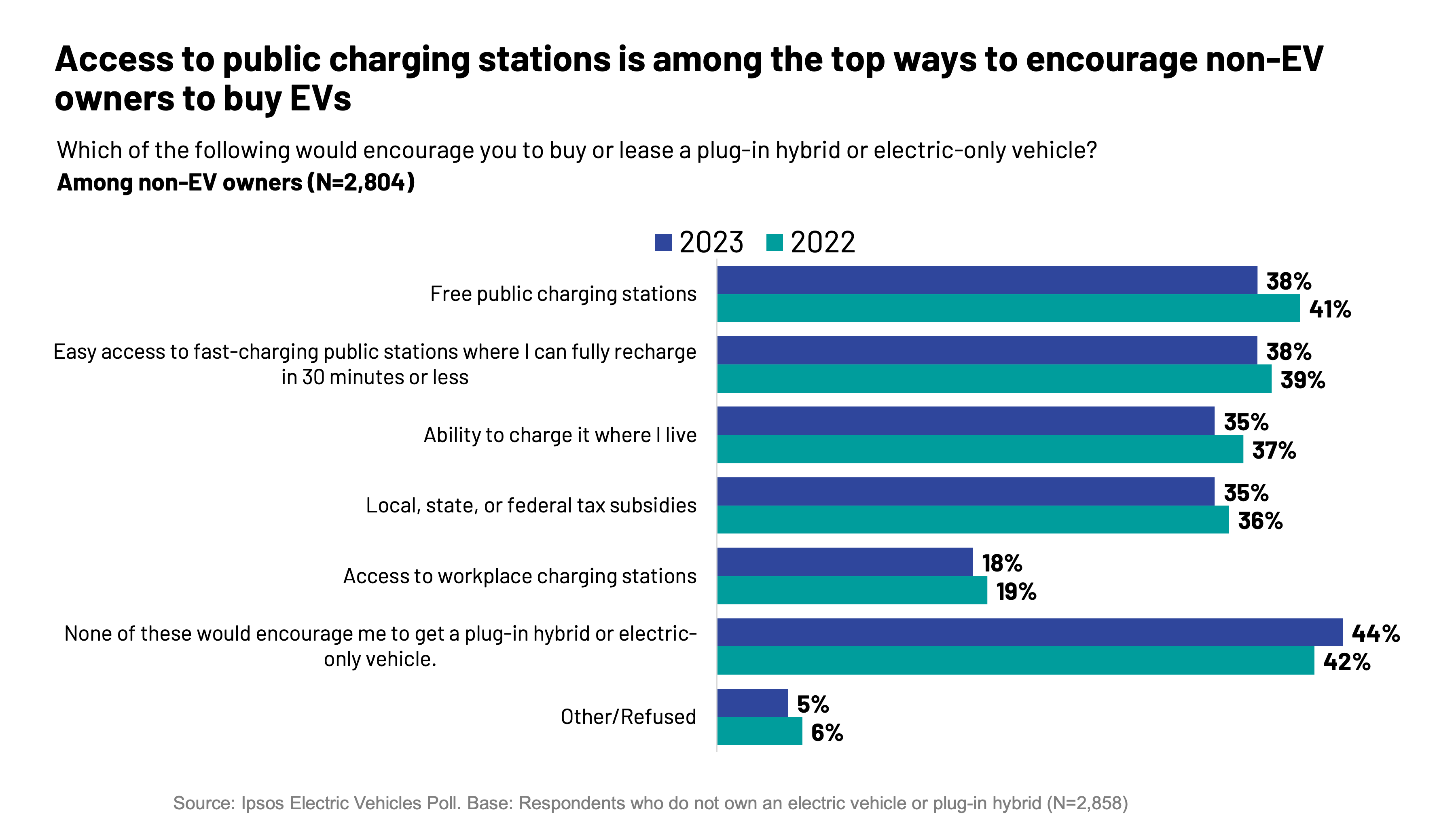

Vehicle-owning Americans say that free public charging stations (38%) and easy access to fast-charging public stations (38%) are the two biggest factors that could encourage them to buy an EV, slightly ahead of the ability to charge a car where they live (35%). Some non-EV owners also say that local, state, or federal tax subsidies (35%) could encourage them to consider getting an EV.

Without these incentives and nudging, few non-EV owners are completely certain that they will get this type of vehicle. Among respondents who say they will or might buy or lease a vehicle within the next two years, only 5% say they are “definitely buying or leasing a plug-in hybrid or electric-only vehicle.”

Even as few people are completely certain, many are open to considering this type of car. Roughly half of prospective car buyers (49%) are in the gray area of either seriously considering (17%) or potentially considering (33%) buying or leasing a plug-in hybrid or EV-only vehicle within the next two years. This suggests the continued growth of the EV industry will hinge on its ability to push these middle-ground car buyers to go electric.

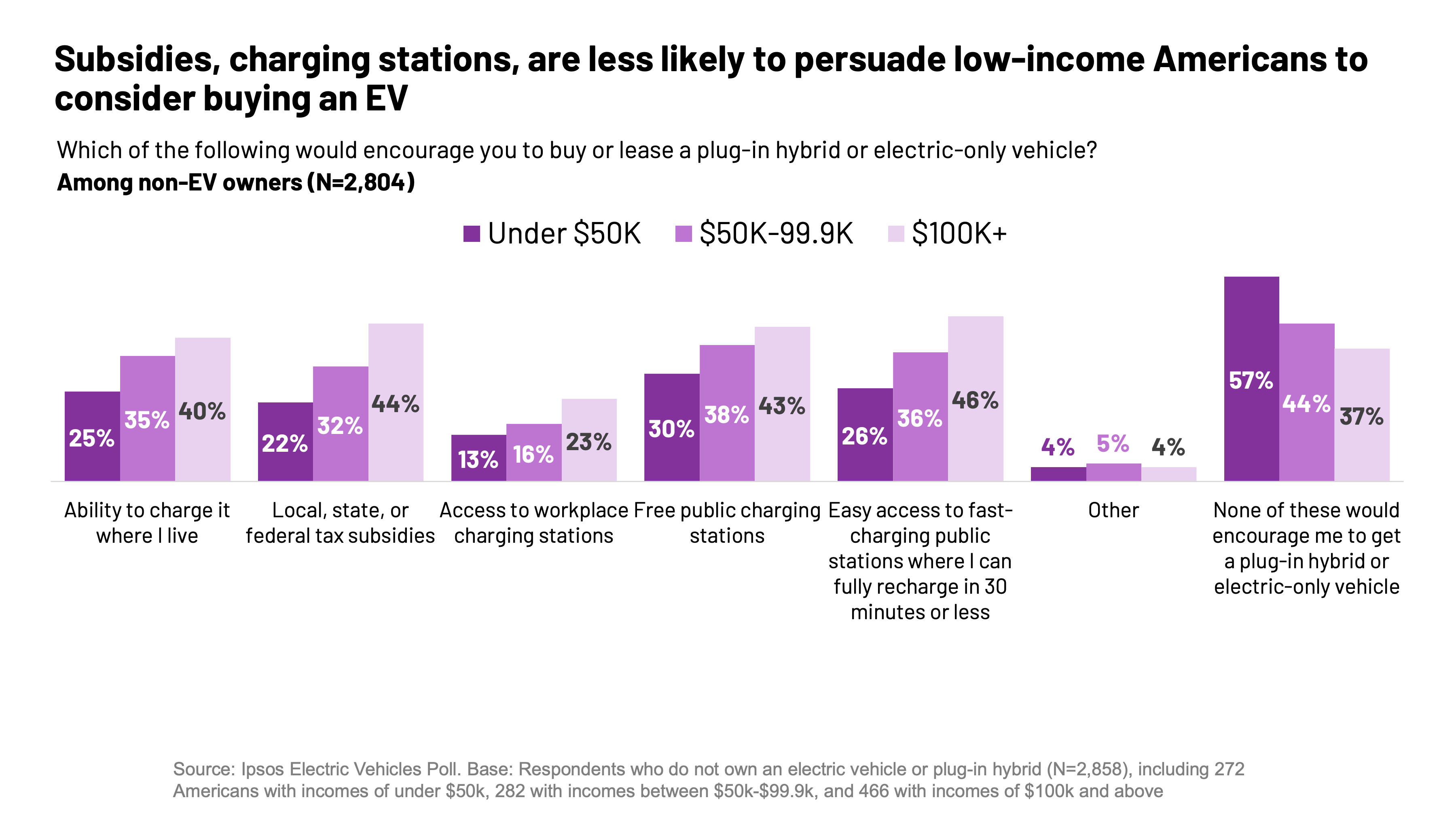

That said, there are some demographics that the EV industry may have trouble making inroads with, such as rural respondents, those making less than $50,000 per year, and Republicans. These groups tend to be far less likely to consider buying EVs and are far more likely to say that none of the benefits or incentives Ipsos tested would actually encourage them to buy an EV.

Policymakers should pay particular attention to car owning low-income Americans, who are just as concerned about purchase cost as their peers but are less incentivized by tax subsidies designed to bring down the cost of EVs. As policymakers work to make the EV market more accessible and equitable, bearing these trends and nuances in mind will be important in building and targeting effective policies and educational campaigns.

Changing landscape: How the EV infrastructure in California, Colorado and New York makes EV ownership more appealing

EV policy is being directed and driven by state legislators and agencies in important ways that change the landscape of what EV markets and consumer behavior looks like. For example, California, Colorado and New York are leaders in the EV space largely because they have effectively built out incentives for EV development, electricity and grid optimization, and EV infrastructure deployment and registrations, according to the ACEE, an industry leader in evaluating the legislation and implementation of energy efficient policy.

But how do these top-down policy decisions impact and influence the Americans in these states?

Unsurprisingly, people from these key states are more likely to own a fully electric or plug-in hybrid than the rest of America (9% CA/CO/NY vs. 4% of other states). People in these key states are also far more likely to consider buying an EV too. Over two in three prospective car buyers in California, Colorado and New York (68%) say they are definitely buying, are seriously considering, or might consider buying an EV within the next two years. Only 53% of Americans in the rest of the country say the same. This suggests that legislation matters as does infrastructure in supporting EV use and public education about incentives and infrastructure.

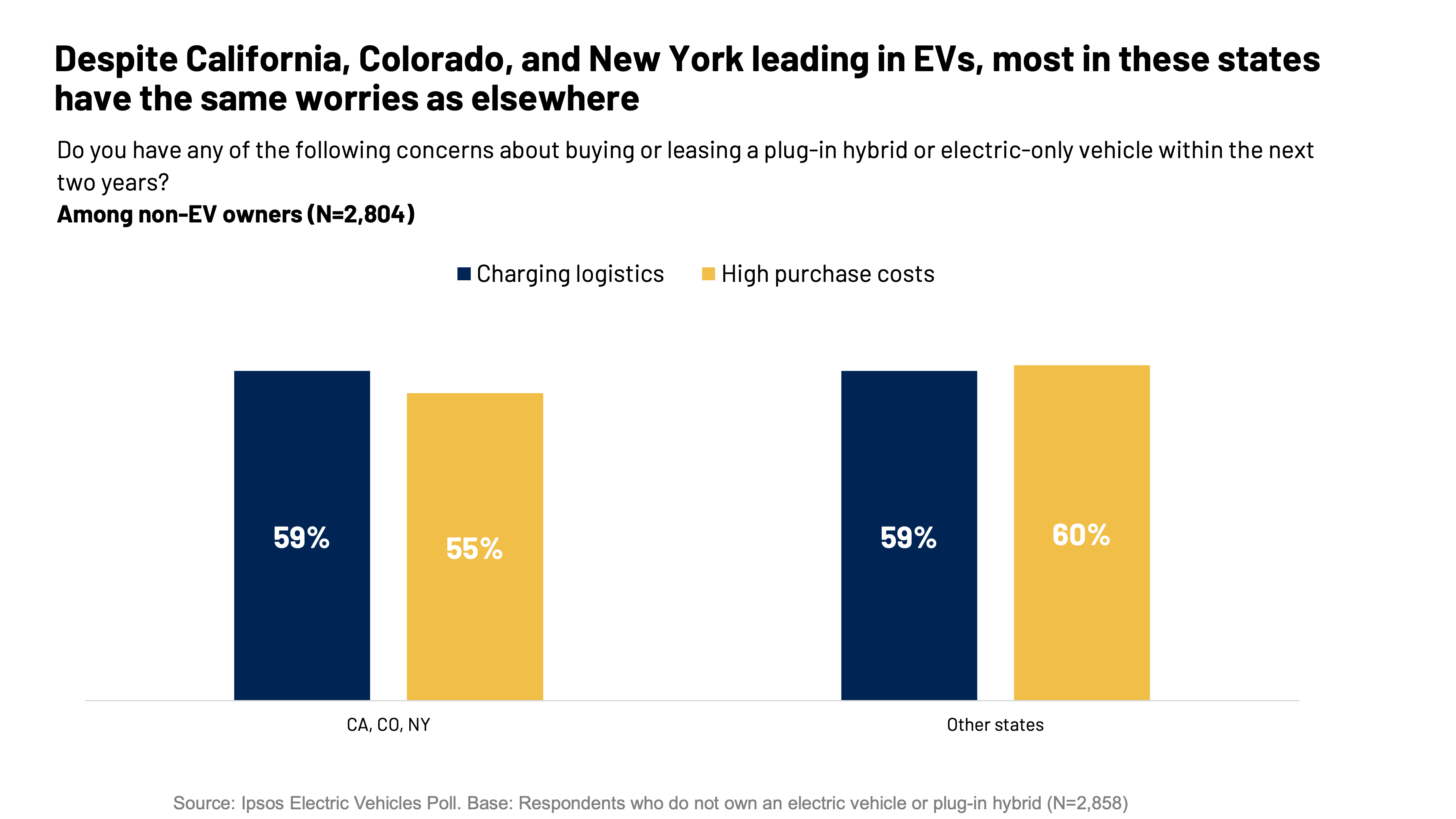

Yet, even in these states that lead legislatively and in ownership numbers, most continue to cite the same barriers to EV entry: cost and convenience. In fact, cost and convenience of charging are as big of a concern in California, Colorado and New York as they are across the rest of America.

Policy tools and advertising to nudge, educate and incentivize consumers continue to be important for these states leading on EVs. EV infrastructure and government subsidies are actually more – not less – important in California, New York and Colorado – which may suggest that current advertising campaigns are working for some demographic groups but not others.

Many Americans in California, Colorado and New York who don’t own an EV say that free public charging stations (45%), easy access to fast-charging public stations (43%), and local, state, federal tax subsidies (43%) are important for encouraging them to buy or lease an EV. In fact, more people in these states say that these changes and incentives would encourage them to buy or lease an EV than people in other parts of the country, suggesting that policymakers should pay attention to these incentives in these areas and continue efforts to build public knowledge of them to continue building out the EV market in these places.

Much like it is nationally, low-income car owners in California, Colorado and New York are less likely to be responsive to incentives Ipsos tested than their more affluent peers, opening up questions about what policies may make the EV market more equitable and accessible. Still, car owners making under $50K in California, Colorado and New York are more likely than car owners making under $50K in other states to report that some policies, like public and private charging infrastructure and tax subsides, would encourage them to buy or lease an EV.

However, a plurality of car owners making under $50K in California, New York and Colorado (44%) and a majority of car owners under $50K in other states (56%) report that none of these incentivizes would encourage them to get an EV. To better understand and target policies toward these groups, more research is needed to explore the experience, attitudes and perspectives of less affluent car owners and their relationship to EVs.

What’s next

The EV market in the United States is still nascent and developing. States like California, Colorado and New York offer a roadmap for how other states across the country can think through the policies that can support their own growing market. While EVs expand, it is essential that legislators and government agencies bring consumers along with them on their EV journey, centering people’s concerns about purchasing EVs and understanding what incentives and policies work with, not against, the public.

Understanding how to make the EV market more equitable and accessible will be key in widening the adoption of this type of vehicle, a hurdle that Ipsos research suggests policymakers should work to explore further. As the EV legislative and market dynamics change, keeping up with where Americans are broadly will be crucial for targeting effective policy.

To sum up, policymakers and industry leaders should remember that:

- Nationally and in states leading in EV legislation, cost and convenience remain widely held concerns about purchasing an EV.

- Incentivizes and policies working to address cost and infrastructure encourage some to consider buying an EV, especially in markets with robust EV legislation, like California, Colorado and New York.

- Equitable access is an issue. Lower-income car owners are less responsive and encouraged by the policies and incentives Ipsos tested. More research understanding this demographic will be important in creating targeted, effective policy for this group.

![[WEBINAR] 2026 KEYS: Battle for Attention](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-keys-Battle-Attention_0.jpg?itok=ftV-emtI)

![[WEBINAR] How to build trust in the AI era](/sites/default/files/styles/list_item_image/public/ct/publication/2026-02/thumbnail-trust-ai_0.jpg?itok=n6Xc78CU)