How Trump reshapes the world for brands

KEY TAKEAWAYS:

- The new Trump administration promises a blitz of change, and the impacts to business and the reactions of the public are deeply uncertain

- Americans are likely to remain deeply polarized, not just in their opinions but if/how they want brands to react

- The most important insights will be at the intersection of different trends and are just as likely to come from outside your sector

The Trump administration campaigned on a pledge of a higher degree of disruption than any in recent memory. And regardless of party, many Americans want change: They are largely in agreement that the system is broken even if they are highly polarized on how to fix it.

It’s plausible that little changes: that the administration’s political goals will run up against a federal government that is, by design, slow to change. It’s also plausible that changes will be rapid and sweeping as the administration, with both legislative chambers and a majority on the Supreme Court will move swiftly using all means possible to enact change, reduce regulations and reduce the overall size of government. Both of these scenarios have potential consequences for the domestic and global economy.

One thing is likely, it will be a time of upheaval and uncertainty.

Using the framework developed in Ipsos Global Trends as a starting point, we examined macro forces across several spheres of influence to explore trends and the future. Drivers of change can come from societal shifts, or economic headwinds. They can come from advances in technology or impacts from the environment. But often tying all of these together is the political sphere where policy and regulation can cause big shifts in all of the other areas.

Here are some broad and sector-specific thoughts on doing business in and with the new administration. You might find the implications for other sectors even more provoking than those for your own.

Note, as a shorthand, we’ll note the difference between parties like this: (D +32), meaning 32 percentage points more Democrats agreed than Republicans, but if we also give the total, (65%, D +16) we mean that the split is 16 points, not that D is 81%. Except where noted, data is from the Ipsos Consumer Tracker, fielded Dec. 10-11, 2024 among 1,085 adults.

Globalization Fractures

Trend: Perceptions of globalization have improved in many markets around the world over the past decade. While the world remains highly interconnected, the geopolitical environment has grown more contested. Increasingly, political leaders are asserting the primacy of their nation and its allies.

Election implications: Economic relations with China are already showing signs of escalating strains. But President Trump has made it clear he intends to upend current U.S. diplomatic and economic policy with a firm focus on a nationalist agenda. That includes potentially stiff tariffs on friendly (Canada) and rival (China) economies alike. Tariffs against Denmark (in an effort to acquire Greenland) would upset the entirety of the European Union. Further, Trump has never been a fan of global institutions like the United Nations, NATO, or the World Health Organization, which have served as vehicles for post-war stability in the western world but also a drain on U.S. resources.

Auto sector: The U.S. auto industry is highly complex with a global supply chain. Even vehicles manufactured here rely on components from all over the world, but especially Chinese electronics. Tariffs would likely shrink margins, raise prices for consumers and induce instability in supply chains — unless domestic manufacturing of electronics can ramp up quickly. That kind of shift has usually required massive government investments and incentives, which aren’t likely to be part of the package this time.

Retail and Consumer Packaged Goods: Cost of living remains U.S. consumers’ top concern, even though technically the rate of inflation is easing. Tariffs would clearly create even more pricing pressure. For global CPG companies headquartered in the U.S., China has long been a key growth market; a potential trade war, added to China’s macroeconomic situation and the continued rise of cheap, local competitors, will put continued pressure on many of them. Discretionary goods such as apparel and electronics experienced a soft 2024, and that outlook will only get worse in 2025 if tariffs go into effect. Recent revenue growth has been driven by price increases more than organic growth, but that can only work for so long as they are forced to pass along cost increases to stretched consumers. The fashion industry, heavily reliant on imports, is particularly vulnerable. Over 80% of clothing sold in the U.S. is imported. While some retailers might benefit, others could lose market share due to shifts in demand.

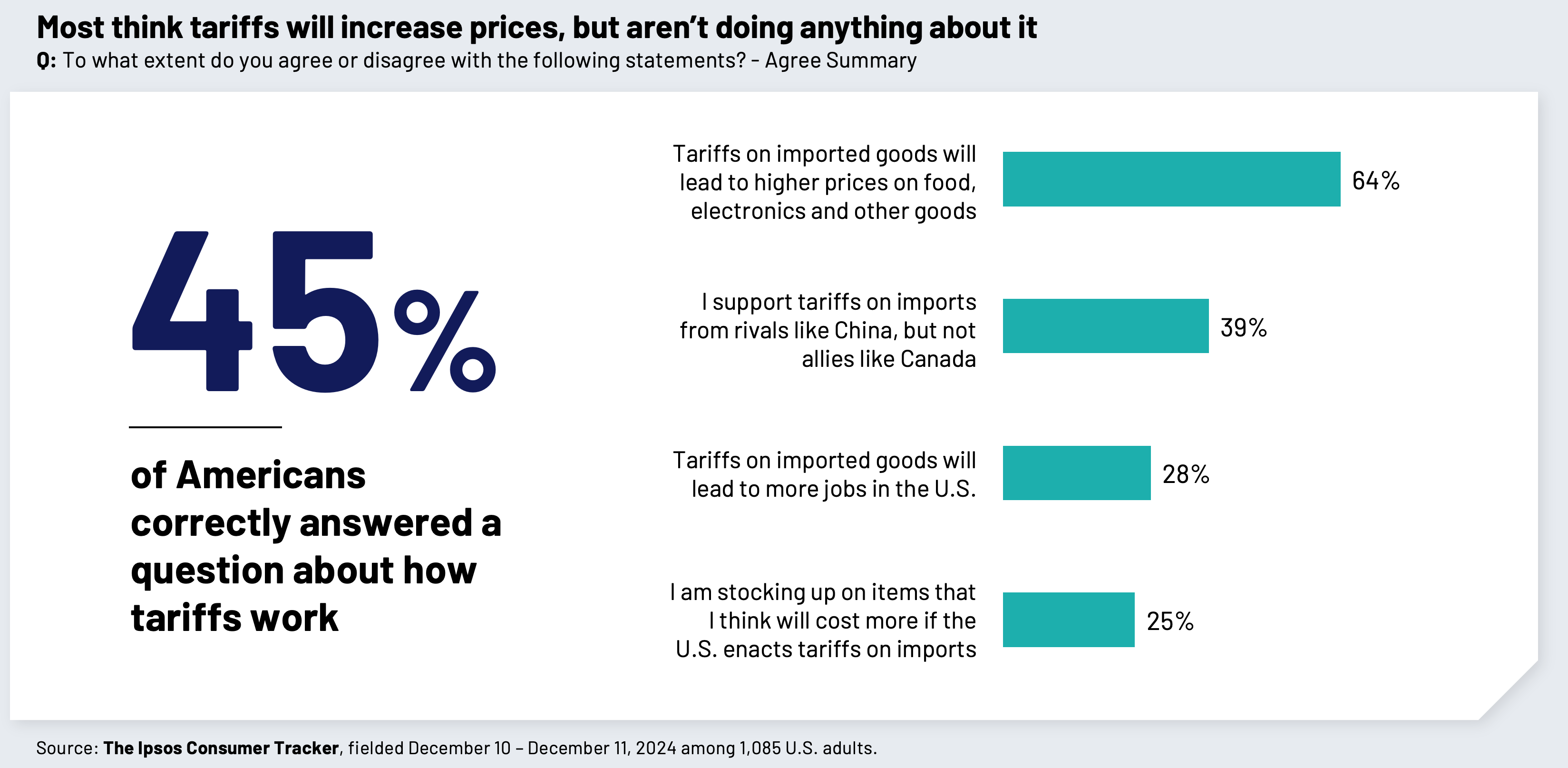

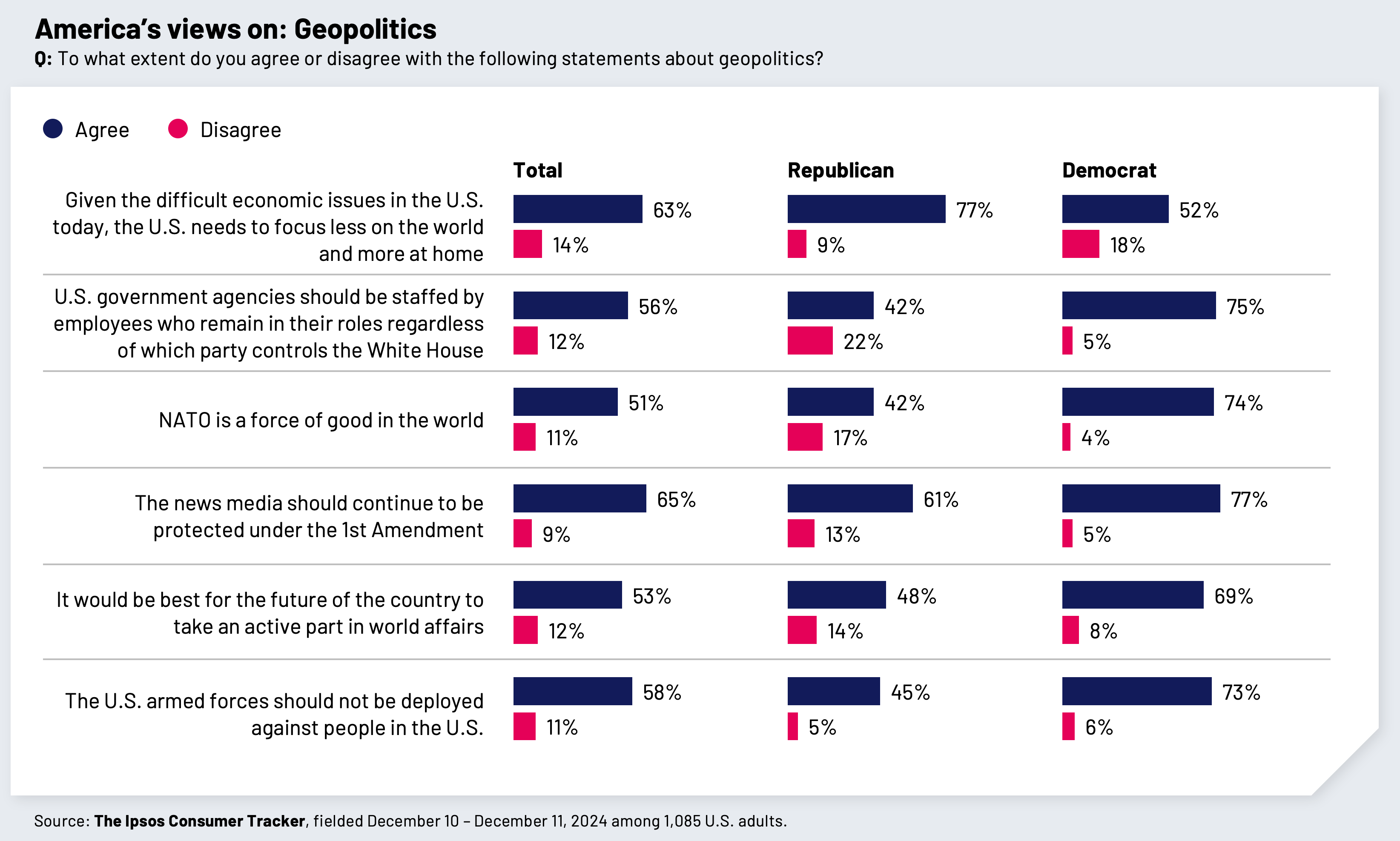

Only 45% of Americans understand how tariffs work, but most understand that they would lead to higher prices on a variety of goods. But that masks a huge party split. 86% of Democrats believe that, compared to just 46% of Republicans. Democrats therefore are twice as likely to say they are stocking up on items that they think will cost more (39% to 19%). But mostly, the threat of tariffs isn’t changing consumer behavior. If they are indeed implemented, attitudes and behaviors could shift dramatically as the implications ripple through. Meanwhile, America’s place in the world is deeply polarizing. About half see NATO as a force for good in the world (D +32) and while a majority agree that it’s important for the U.S. to play an active part in world affairs, a larger majority (63%, R+25) say that given the difficult economy in the U.S., the nation needs to focus on domestic issues.

Splintered Societies

Trend: Large income and wealth disparities are widely recognized as detrimental to society, yet in many countries they have widened over the past decade. The intensity of this feeling has resulted in heightened societal stress and a splintering of traditional structures, with new ideologies and political allegiances emerging.

Election : By most measures, the 2024 election was one of the closest in history. President Trump won the popular vote with the slimmest of majorities. The margin in the U.S. House of Representatives is just a handful of seats. Most people say brands should remain neutral on political issues, and a majority now say they should remain neutral on social issues as well, according to the Ipsos Consumer Tracker. But at the same time, there has been a 20-point uptick in the last 10 years of Americans saying they buy brands that align with their values. The incoming administration has indicated that it plans to roll back ESG, DEI and related programs as well as cutting programs that have bipartisan support such as Veterans’ benefits and Medicare, which could lead to divisions both within and across the political spectrum. It will continue to be a balancing act for companies to align themselves with values that are controversial. Mass-market brands can ill-afford to alienate half their potential buyers, but companies will need to continue to grapple with multi-stakeholder expectations. While they want to avoid alienating potential buyers, they also need to worry about alienating employees who have greater expectations for companies to address societal issues. And there are global regulations to adhere to, too.

Financial Services: With threats of tariffs and trade wars, price levels may continue to remain elevated and even rise further if they are implemented. Consumers are increasingly reliant on credit cards to help meet monthly expenses — balances hit a record $1.17 trillion in 2024. That could get worse, or we may see banks rein in credit lines and new account approvals in order to better manage their risk and exposure. This could reduce aggregate consumer spending and push us into a recession. While the more affluent segments of society will be able to manage their finances and absorb the continued elevated price levels, less affluent segments could fall deeper into debt. That could lead to further tension between the classes in America.

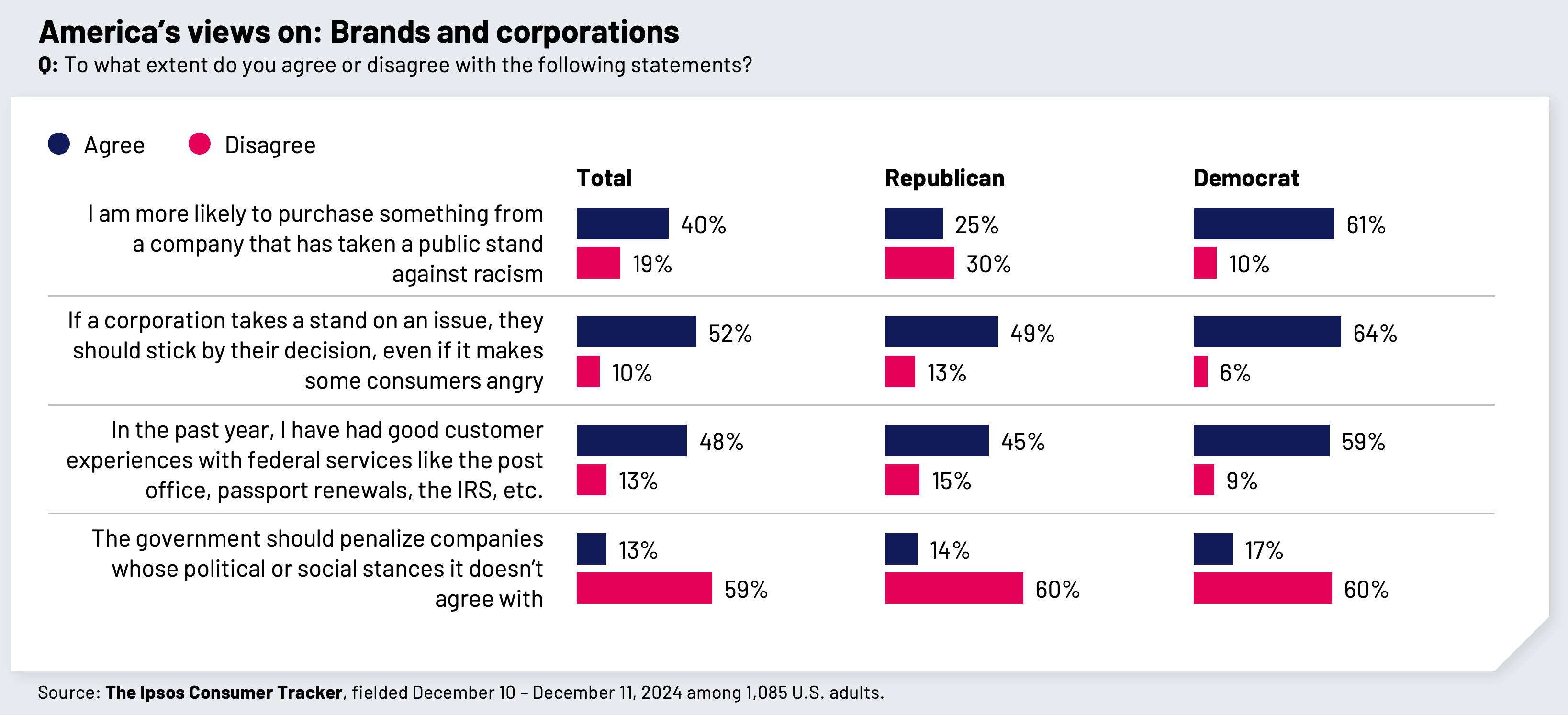

What the people say: An important call-out for brands is that four in ten (D +36) say they are more likely to purchase from a company that has taken a public stance against racism. Despite a lot of campaign rhetoric, very public “anti-woke” boycotts and high-profile DEI rollbacks, this stat hasn’t changed since we last asked a year ago. Even the party splits are consistent. Very few Americans (13%) feel that the government should penalize companies whose political or social stances it doesn’t agree with.

Climate Convergence

Trend: The macro environment for climate is changing rapidly as worldwide investment in renewables continues to rise and the impacts of global warming become more evident. Our data reflects this: Globally, views on the importance of climate action are converging, and have increased in intensity over the past ten years. The key question now is how far — and how fast — people are willing to change their daily lives to reach shared goals.

Election implications: The incoming energy secretary nominee, Chris Wright, is a fracking executive who was quoted in the Wall Street Journal as believing that there are as many positives to climate change as negatives. The administration has also indicated that it will move to overturn Biden’s last-minute expansion of protected waters from drilling and expanding what is already record domestic energy production. Transportation and food production are two other major sectors that drive climate change. Secretary of Health and Human Services nominee Robert F. Kennedy, Jr. has his sights set on reducing ultra-processed foods. Elon Musk’s role in the government will undoubtedly impact climate policy as it relates to the electrification of vehicles purchase and manufacturing. Incentives and fuel standards, are areas the administration can quickly change through executive orders. But as climate change continues to manifest, the federal government often has to respond to its aftermath, with storms, hurricanes, wildfires, etc. – in very public ways with very human impacts.

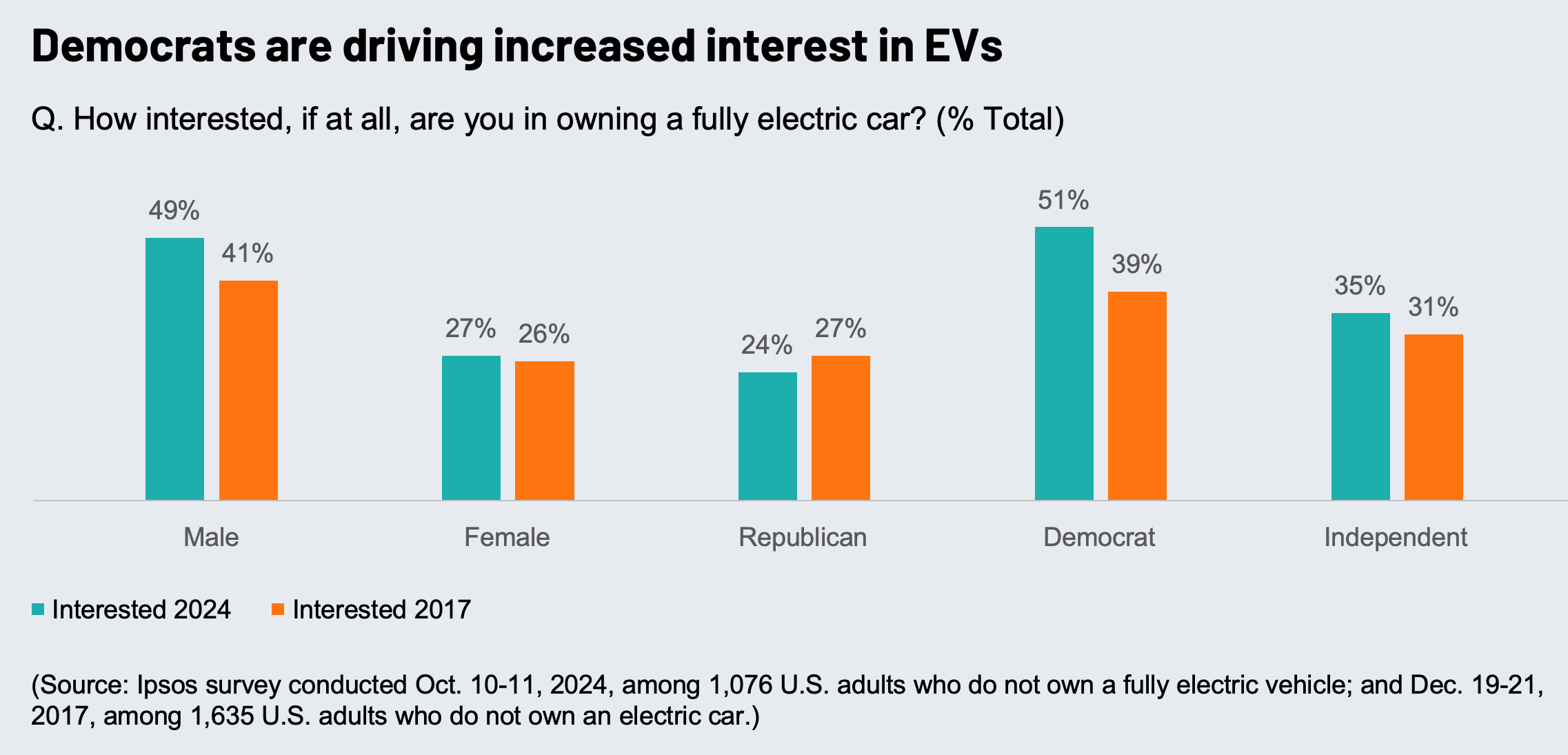

Auto sector: After a tough few years of supply chain issues and unclear post-pandemic commuting demands comes a new twist. Federal and state policy pushed automakers into enormous investments in building out electric vehicle capacity. Those investments hadn’t reaped returns yet as consumer demand was high, but not nearly high enough. Trump has indicated he will swiftly reverse as much of that policy as he can. While not popular with environmentalists, it will help OEMs rebalance their entire portfolio, including ICE vehicles, for better profitability.

Food and Consumer Packaged Goods: The election likely leads to a more conservative approach to addressing climate by the incoming administration. That said, many CPG companies will still work to drive their sustainability agenda because they operate in multiple countries many of which aren’t rolling back climate initiatives — at least not yet. Further, there can be positive top line and bottom line impact from water conservation, reduced packaging, renewable energy usage, responsible sourcing, etc. As James Quincey Chairman & Chief Executive Officer, The Coca-Cola Co. recently said, "It is an intersection of what’s important societally, but also what’s necessary for the business." Some brands will also feel they have a role to play in shaping public opinion as opposed to just responding to it.

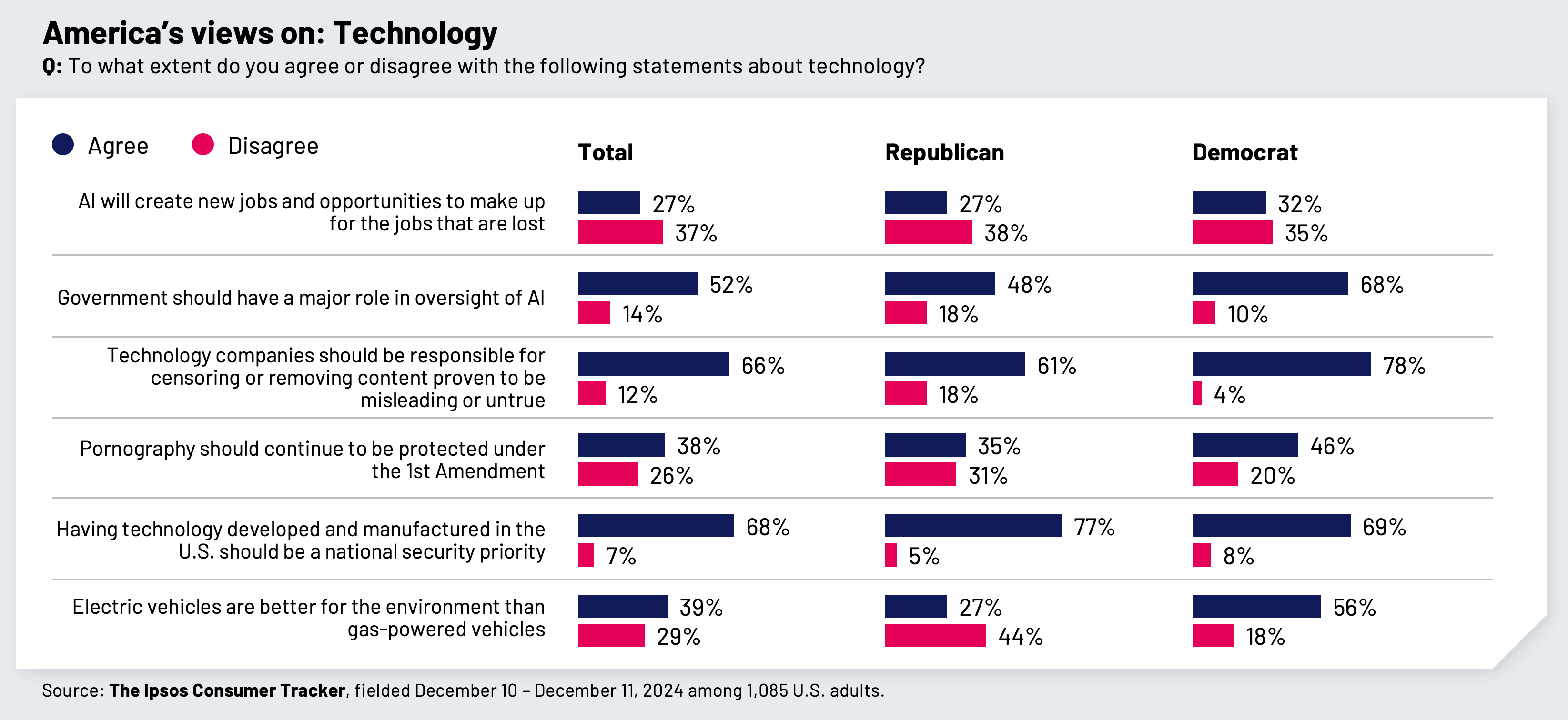

What the people say: Only 39% of Americans think electric vehicles are better for the environment than their gas-powered counterparts (D +29) as special interests push news stories suggesting that lithium batteries are worse for the environment than fossil fuels. Meanwhile, a majority (58% overall, but with a deep split along partisan lines, D +37) thinks the government should continue setting policy that reduces carbon emissions from fuel.

Technowonder

Trend: We are in awe of the technology around us and the role it plays in our lives. We live in wonder: 71% agree we need modern technology to solve future problems. But also, we worry: 57% think technical progress is destroying our lives — a feeling that has significantly risen over a ten-year period. We have very real concerns about our mental health and our careers and don’t always see the benefits of technology or tech companies.

Election implications: The incoming administration looks likely to be packed with tech executives who will take an industry-friendly, regulation-light, merger-encouraging approach to developments in everything from cryptocurrency to artificial intelligence. This could impact both the “wonder” side of Technowonder, as more and more tech rolls out at faster and faster paces, and the “worry” side as that tech rolls out with fewer brakes and guardrails.

Technology and Telecommunications: As expected, Trump chose Brendan Carr as his nominee to head the Federal Communications Commission. Deregulation will be the focus, with more access to spectrum put to use for satellite and infrastructure expansion, though there will be a tug of war for that spectrum between defense, space and telecoms. New mergers like the Disney/FuboTV venture will likely face less scrutiny. One other issue will be a focus. Carr, the author of the FCC chapter in the Project 2025 blueprint, posted on X, “We must dismantle the censorship cartel and restore free speech rights for everyday Americans.” Tech CEOs are signaling that they will broadly align with the new administration, including Meta’s recent announcements that it will follow Musk’s X platform by dismantling its fact-checking team and have the community monitor and moderate platform.

Financial services: With a crypto-friendly administration coming in, we may see a resurgence in overall crypto interest and popularity. Bitcoin hit record valuations shortly after Trump won the 2024 election. To date, cryptocurrencies have for the most part been viewed as a speculative investment. However, its original intent has always been literally, a currency, exchanged between people independent of governments and their monetary policies. If the new administration encourages the usage of crypto as an alternative currency for the exchange of goods and services, we may start to see its adoption as another form of payment competing with credit, debit, and cash.

What the people say: America’s relationship to technology sits along the tension between “wonder” and “worry” and the data bears that out time and again. Few think cryptocurrency is a safe investment (18%, R+7). Only one in four think AI will create more jobs than it replaces. But half of America (including half of Republicans) thinks government should have a major oversight role in the development of AI — and almost no one disagrees with that. Most agree that tech manufacturing rises to the level of a national security issue.

Conscientious Health

Trend: Health is becoming more holistic, as most of us globally feel that we need to do more for our physical as well as our mental wellness. Despite this, healthy living is a struggle for many and most people feel they need to lose weight. The interconnectedness of health with other systems, such as nutrition and technology, is also being examined. This is leading to an overall focus not on just living longer but ageing better.

Election implications: The selection of Robert F. Kennedy, Jr., Dr. Mehmet Oz and other outsiders for key health roles in the administration points to a major rethinking of public health. Kennedy is famously anti-big-pharma and has crusaded against vaccines around the world. His focus on impacts of everything from fluoride in the water to ultra-processed foods could put him at odds with both public sentiment and other priorities and stakeholders in the administration. But it also could build trust and shape opinion on the foods we consume and the role it plays in our health. Shifting away from popular programs like Medicare would up-end the entire heath and insurance space, and defunding the National Institutes of Health, as Elon Musk has suggested, could further destabilize related industries.

Healthcare: There are two main angles to how the healthcare space could change. First, the insurance space could face new challenges and opportunities depending on what cuts we do or don’t see to Medicare, the Affordable Healthcare Act and the NIH. Second, in the pharma industry, policies about what is or isn’t covered by Medicare, reduction in federal R&D and reduced oversight or regulation about how drugs are tested and come to market are all in the cards. Meanwhile, tariffs on Denmark, where Ozempic/Wegovy maker Novo Nordisk is based, are yet another variable with first, second, and third-order impacts.

Food and Consumer Packaged Goods: Even before this administration takes office, potential disruptions to the food system are coming from the legal realm as many large manufacturers face a novel lawsuit accusing them of marketing “addictive” food ingredients that lead to health complications like obesity and type II diabetes. The incoming administration could be further disruptive to food and beverage ingredients, and thus supply chain. Beyond that, consumers are in different places on their health journeys, and CPG companies should respect and address that. Some people may want to control portions. Some people may want to reduce or eliminate sugar, others may want indulgence.

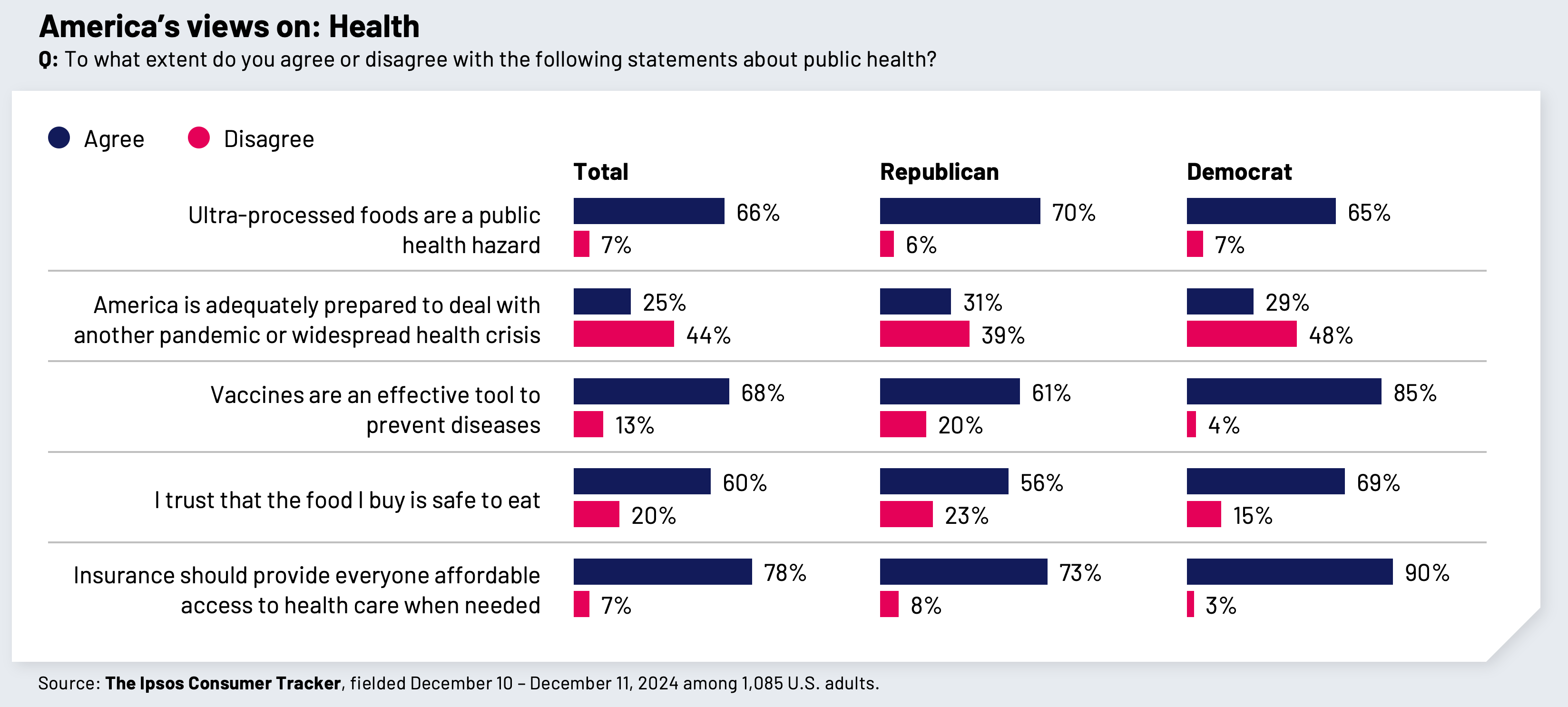

What the people says: Americans think insurers should provide everyone with affordable healthcare. Americans also agree on three things related to public health: that vaccines are an effective tool to prevent diseases, that the food they buy is safe to eat, and that ultra-processed foods are a public health hazard. Finally, given the appointment of outsiders to run key agencies and a stated desire to replace a much larger part of the federal workforce than is typical with staffers who are ideologically aligned with the new administration, it’s worth noting that Americans feel government agencies should be staffed by experts in their field and a majority thinks it should stay that way, but that’s a highly polarized statement (53%, D +33).

Retreat to Old Systems

Trend: An escape to nostalgia appeals to many people around the globe, at least half in 40 of our markets would like their country to be the way it used to be. Even if the past we are nostalgic for is imagined as a sanitized one, this can lead people to push back against trends that are seen to challenge existing systems. This can be a clamor for a "return" to historical power structures, religious practices, employment patterns, gender roles, and more.

Election implications: In the U.S., this trend has played out in everything from the “Barbie” movie to the rise of women identifying with the focus on what some consider traditional values of gender roles expressed in the #TradWife movement. But following an election where younger men and women moved in vastly different sociopolitical directions, these issues are likely to surface and resurface. The Trump administration has proposed plans to dismantle many old systems, from existing regulations to defunding the entire Department of Education. Regardless, nostalgia is a consistent human value — the question will be what time period people are nostalgic for, and how that varies from person to person and group to group.

While many women and many men are leaning into a #trad view of gender roles, that doesn’t necessarily mean that women want to give up their financial independence. For instance, many older women today can remember how when they got married they needed their husband to co-sign in order to get a credit card. That said, continuing to evolve products and services to respond to changing and broadening consumer landscape. But for some the banking industry itself is an “old system,” and there’s a tension between wanting to retreat to its safety, not entirely trusting its stability, and also a desire to explore new systems represented by fintech.

Brands: The warm and fuzzy side of this trend is a core human value, and one brands have leaned on over time: nostalgia. The use of nostalgia in ads helps meet viewers’ emotional needs, while also tapping into brand heritage, making it a particularly effective tactic. In CPG and other industries, many brands have reverted to older logo treatments, even bringing back updated versions of old campaigns, or rebooting old stories we love as a way to gain immediate attention and relevance. For long-tenured brands, their longevity gives them the opportunity to leverage their well-earned equity against this trend.

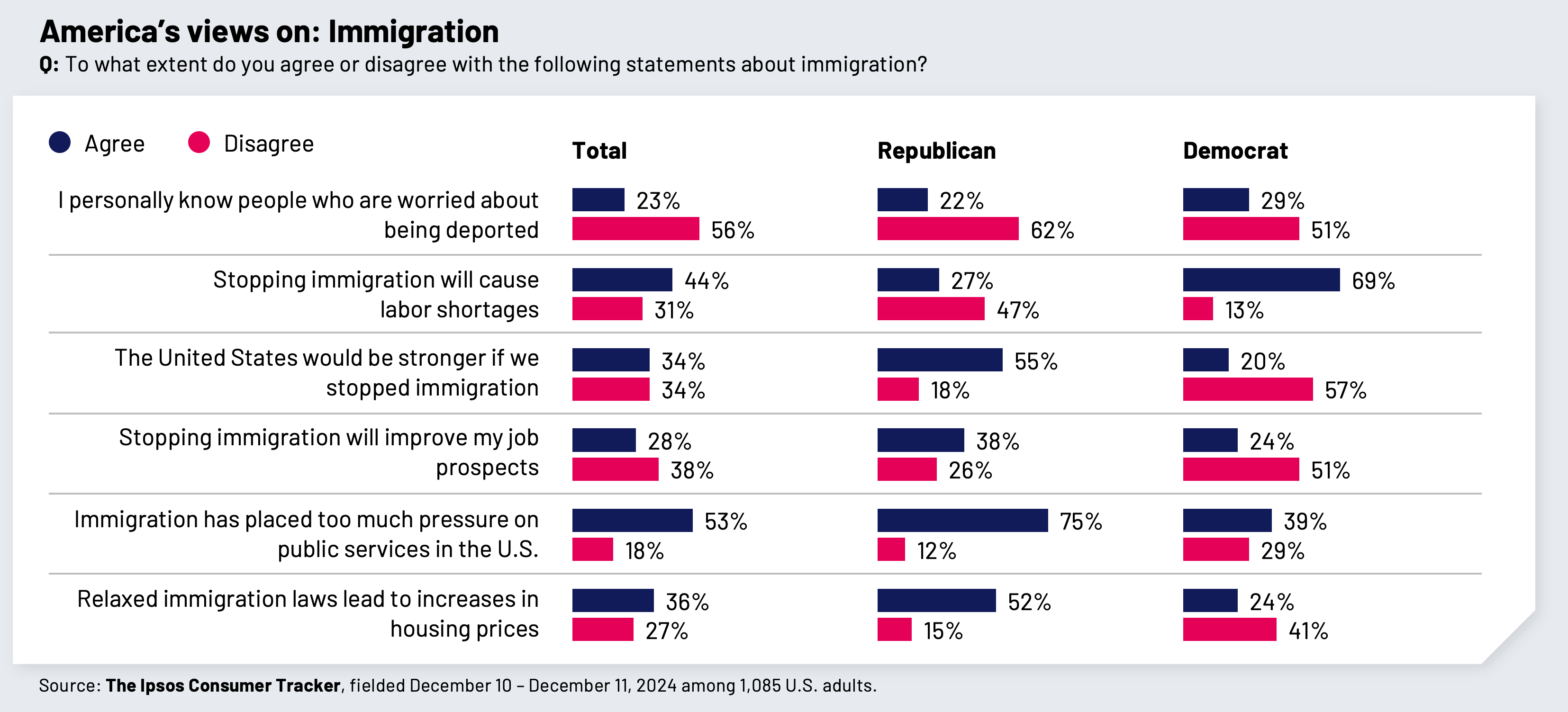

What the people say: One place we see this trend manifest is in the realm of immigration reform. Trump has promised that mass deportations will begin on day one of his second term. One in four Americans say they know someone who is worried about being deported. Republicans are much more likely to see negatives when it comes to immigration: that relaxed immigration leads to higher housing costs, that it has placed too much pressure on public services and that the U.S. would be stronger, and job prospects will improve if we stopped immigration. Democrats are much more likely to say that stopping immigration will cause labor shortages.

Nouveau Nihilism

Trend: There is now a generational disconnect when it comes to milestones like homes, getting married and starting families. Financial realities are keeping those dreams out of reach for many. This is feeding widespread sentiment that it’s better to live for today — either because tomorrow is uncertain, or that it will simply take care of itself, because individuals feel powerless to take personal control.

Election implications: At its heart, this trend is economic. It gets at core tenets of the American Dream — and our ability to afford them. But the economic situation drives socio-political and consumer attitudes, which are already diverging between younger men and younger women. That said, we see Nouveau Nihilism across generations. Retirees don’t know how they will afford their future any more than 20-somethings do. How the economy shapes up under the Trump administration could have an outsized impact on how this trend in particular plays out. Currently, there is disconnect between goals, ambitions and reality. That could narrow if a strong economy powers us towards milestones like homeownership or retirement. Or it could worsen if the economy slows and people find their dreams further and further from reach.

Retail: The prevailing mindset among young consumers especially is to “live for today” since the future (in terms of the economy, the climate, geopolitics…) is so uncertain. The implication for retailers and brands is to determine how to message to young consumers who are feeling frustrated, cash strapped, yet willing to splurge. It’s just a matter of what offerings are worth splurging for. Those indulgences can be small (a food treat in the moment) or large (a trip saved up for over time rather instead of a down payment on a home they don’t think they’ll ever be able to afford).

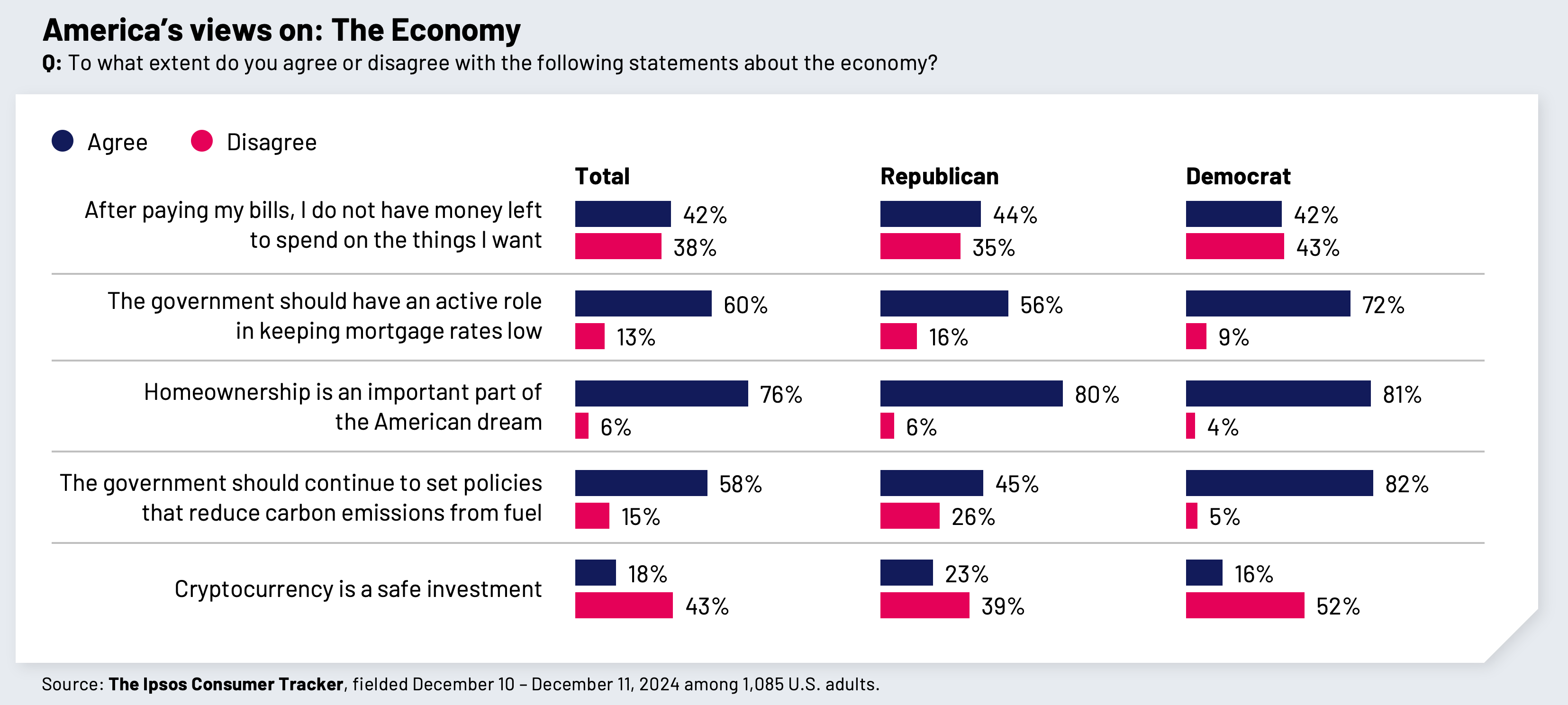

What the people say: Being cash-strapped is not a partisan issue. Four in ten of each party say they have nothing left to spend on the things they want after paying their bills. But a sizeable majority also still feel that homeownership is an important part of the American Dream and that the government should help people achieve that by keeping mortgage rates low. And consumers are looking for brands to understand this and talk to them about it. Four in 10 Americans, in an Ipsos survey from December 2024 would like to see more advertising addressing the challenges of achieving traditional life milestones (home ownership, marriage, starting a family, etc.). Almost half (46%) want to see more advertising giving a sense of comfort and reassurance in the face of an uncertain future. Brands that can credibly provide solutions to these challenges and strike the right balance of realism and optimism in their comms will be set up for success.

The Power of Trust

Trend: In a world flooded with information, misinformation and even disinformation, we crave authentic messages from trusted sources. In this context — and more dramatically so than in 2013 — brands assume greater importance, becoming extensions of our own worldview and values. But greater uncertainty now comes from changes in how and why we choose to trust some organizations and not others.

Election implications: The uncertainty will likely continue as will a bit of a trust vacuum as trust in the U.S. has been eroding in many professions and institutions. The question is, who will fill that void? President Trump has built a strong foundation of trust with his constituents that he will deliver on his promises. His opponents also think he will deliver, but they view that with more dread than optimism. The needle brands need to thread on demonstrating their values consistently and aligning those values with their customers is a tricky one indeed. But customers are only one audience. Employees have higher expectations of companies, and investors, regulators, journalists, also view companies and their initiatives through varying lenses. This further complicates how companies communicate and where they focus their efforts.

Brands: The “Citizen Consumer” has emerged. Many Americans are increasingly combining their behavior as consumers with their beliefs and political outlook as citizens. We want to feel more optimistic about our country and our world. Brands that think beyond purpose and focus on positive change can harness consumer optimism to inspire real action and give us the sense that we are making things better. Effective marketing in the positive change space harnesses the power and potential of optimism. For some sectors like CPG, their strength is the brands in consumer minds. Trusted brands weather controversies better than others, unless the controversy is mismanaged. What takes decades to build can disappear in a few days. Brands have to reinforce their trustworthiness by consistent messaging and execution across all touchpoints of the consumer journey.

What the people say: In an Ipsos survey, 79% told said that the feelings they want to get most from advertising are “reassurance and positivity.” Three in four Americans think that businesses have a duty to contribute to society, not just make profit. But when it comes to “who and what to trust,” in the U.S., very few professions and institutions (such as doctors and teachers) enjoy trust from a majority of Americans, according to the 2024 Ipsos Global Trustworthiness Index.

Escape to Individualism

Trend: In the face of a world that feels threatening and overwhelming, people are focusing on one thing they can control — themselves. While this focus on individualism has been high over the past decade, this year, personal autonomy is the most powerful value. But this is, by definition, a multifaceted trend. We see the draw of simplicity, social status and seeking new experiences all as ways of developing ourselves.

Election implications: This trend is driven by identity, its importance, and how people express themselves. For many younger Americans, that can take the form of deprioritizing work status in favor of more balance — but could a federal return-to-office mandate shift that? For some LGBTQ+ Americans, there is reemerging fear about expressing their identity. Conversations around gender roles are a shifting landscape as what many viewed as too fluid of a definition potentially becomes more binary again and the new administration (and many states) reign in what many feel is an overly-permissive culture of gender care for children, but many also feel is a way to allow children to live their “true selves.” And again, how we use the things we wear, or drive or the platforms we communicate on to express ourselves and exert our autonomy will likely be in flux.

Technology and telecommunications: One key place this trend will play out is in the platforms we use to communicate and even before the administration takes office things are rapidly evolving.

What the people say: There is bipartisan agreement that the news media in the U.S. should continue to be protected under the First Amendment (65%, D +16). Incidentally, pornography (another First Amendment target of Project 2025) saw less support for continued First Amendment protections with only 38% supporting (D +11, but still not a majority). Americans also think tech companies should remove misleading and untrue content from their platforms.

Conclusion:

In times of uncertainty, people look for comfort. So do brands. The inclination will be to stay out of the fray, but also find ways to curry favor with the new administration. Not since the early days of the pandemic have we seen a landscape so ripe for large shifts in public opinion, laying a virtual mine field for brands. And yet, an era of decreased regulation and a focus on re-shoring could lead to opportunities for growth.

We will likely see a disruption that Americans say they want, but might not actually be ready to live and work through. We’ve presented nine trends to watch and measure the response to. We have talked about impacts to various sectors.

The next step, is to think through the intersection of trends and implications. What would reduced incentives for electric vehicles, and likely tariffs on auto imports, mean for tech platforms or the housing industry? What would easier pharmaceutical clinical trials mean for packaged goods? Will the people who voted for the administration face any sort of sticker shock as policy impacts are felt through the economy? Will those who voted against it get on board?

The good news, is that the unknown unknowns are pretty clear. We will likely get some answers in a flurry of actions President Trump plans to take in his first hours and days in office. So stay tuned, but also stay close to your customers, patients, audiences and citizens.

For more on this topic, join us on January 29 for Ask Us Anything: What the new Trump administration means for business.

![[WEBINAR] 2026 KEYS: Battle for Attention](/sites/default/files/styles/list_item_image/public/ct/event/2026-02/thumbnail-keys-Battle-Attention_0.jpg?itok=ftV-emtI)

![[WEBINAR] How to build trust in the AI era](/sites/default/files/styles/list_item_image/public/ct/publication/2026-02/thumbnail-trust-ai_0.jpg?itok=n6Xc78CU)