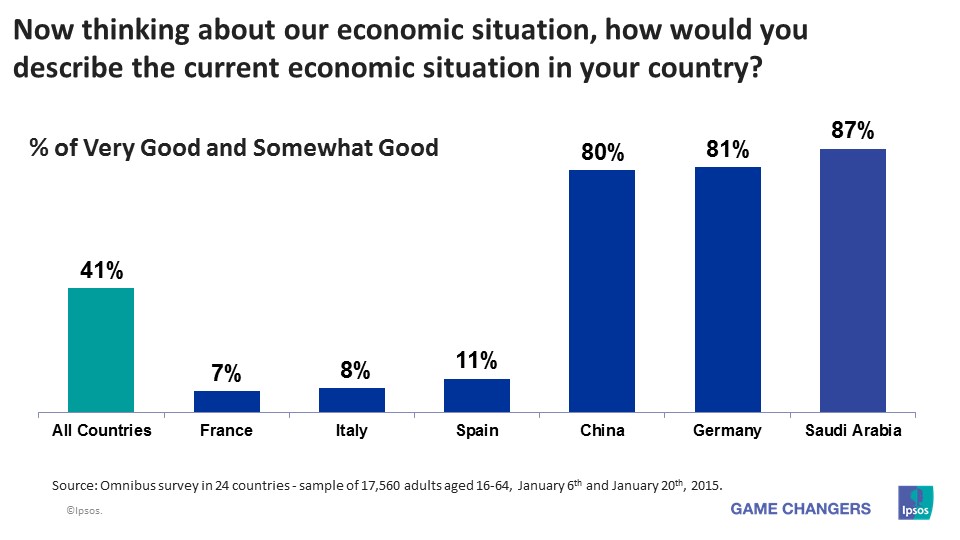

The Economic Pulse of the World - January 2015

The national economic assessment average is up 2 points to 41%, driven by notable gains among some major players including China (80%, up 9pts.), Germany (81%, up 6pts.) and Great Britain (46%, up 7pts.).

In North America, the United States improves for the third month in a row, posting gains in all assessment categories, most notably in the national average assessment– 51%, up 7 points since last sounding. Canada, on the other hand, has experienced a decline in the national category (63%, -3pts), with a large part of its economy still reeling from unstable oil prices.

A number of European countries show gains in the national economic category this month making Europe region surge 3 points up from the last sounding to 34% - the highest since August 2013.

As noted in the last month’s report, the national economic confidence in Russia is on the downward trend, losing another 10 points since the last survey, down to 23%. Although faced with the grim economic reality, Russians still look to the future with some optimism, as now one in four (26%) expect the local economy to be stronger in the next six months – up 6 points since last month.

Despite the 9 point gain in China, the BRIC countries have lost ground in the national category (51%, -1pts.), but experience improvement in local (44%, +3pts) and future local (48%, +1pts) assessments.

Middle East/Africa region countries experienced a decline in both local (32%, -2pts.) and future local (35%, -1pts.) assessments, most notably with the local economic average, down 5 points in Saudi Arabia (56%) and with Egypt losing ground in all 3 categories.

Global Average of National Economic Assessment Up Two Points: 41%

Starting the new year on a positive note, the average global economic assessment of national economies surveyed in 24 countries is up two points as 41% of global citizens rate their national economies to be ‘good’.

Despite ongoing uncertainty on the oil market, Saudi Arabia (87%) remains at the top of the national economic assessment, followed by Germany (81%), India (80%), China (80%), Sweden (72%) and Egypt (67%). The lowest average global economic assessment this month is in France (7%). Close behind are Italy (8%), Spain (11%), South Korea (13%), Hungary (16%) and Brazil (17%).

Countries with the greatest improvements in this wave: China (80%, +9 pts.), the United States (51%, +7 pts.), Great Britain (46%, +7 pts.), Germany (81%, +6 pts.), Turkey (45%, +6 pts.), Japan (23%, +4pts.), Saudi Arabia (87%, +3pts.) and South Africa (26%, +3pts.)

Countries with the greatest declines: Egypt (67%, -11 pts.), Russia (26%, -10 pts.), Poland (28%, -5 pts.), Brazil (17%, -5 pts.), Canada (63%, -3pts), Sweden (72%, -2 pts.), India (80%, -1pts.) and Mexico (19%, -1pts.).

Global Average of Local Economic Assessment (29%) Up One Point

When asked to assess their local economies, 29% agree the state of the current economy in their local area is ‘good,’ on the global aggregate level. The local economic assessment up one point since last sounding.

Surging up after last month’s decline, China (66%) is the new leader of the local economic assessment average. Three countries share the distant second – Germany (56%), India (56%) and Saudi Arabia (56%), followed by Canada (41%) and the United States (40%). Only one in 10 (10%) assess their local economy as ‘good’ in Italy and Spain, followed by South Korea (12%), France (12%), Japan (12%), Hungary (12%) and South Africa (16%).

Countries with the greatest improvements in this wave: China (66%, +6 pts.), the United States (40%, +6 pts.), Belgium (20%, +6 pts.) India (56%, +5pts.), Great Britain (33%, +5pts.), Turkey (30%, +3pts.), Russia (29%, +3pts.) and South Korea (12%, +3pts.).

Countries with the greatest declines: Egypt (28%, -7 pts.), Saudi Arabia (56%, -5 pts.), Poland (19%, -4 pts.), Australia (37%, -1 pts.), Brazil (25%, -1 pts.) and Hungary (12%, -1 pts.).

Global Average of Future Outlook for Local Economy (25%) Up One Point

The future outlook average gains one point, as one quarter (25%) of global citizens expect their local economy will be stronger six months from now.

With all the leading countries losing points this month, India (62%) remains in the lead, followed by Brazil (55%), China (51%), Egypt (50%), Saudi Arabia (47%), Mexico (33%) and Argentina (33%). Small minority in France (4%) expect their local economy to be strong six months from now, followed by Hungary (8%), South Korea (10%), Sweden (11%), Belgium (12%), Italy (8%), Japan (13%) and Poland (13%).

Countries with the greatest improvements in this wave: Argentina (33%, +6 pts.), Russia (26%, +6 pts.), Italy (14%, +6 pts.), Belgium (12%, +6 pts.), China (51%, +5 pts.), Turkey (26%, +4 pts.) and Spain (20%, +4pts.).

Countries with the greatest declines: Egypt (50%, -5 pts.), Poland (13%, -5 pts.), Saudi Arabia (47%, -4 pts.), India (62%, -3 pts.), Australia (15%, -3 pts.), Sweden (11%, -3pts.), Brazil (55%, -2pts.), Canada (18%, -1pts.), South Africa (15%, -1pts.) and Hungary (8%, -1 pts.).

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)