The Economic Pulse of the World - September 2015

Well, it looked promising, but after some optimistic summer months for many countries and the international average, the Economic Pulse enters the Fall season with a slump taking measures back to March, 2015. And the hurt is pretty much everywhere and with all three assessments losing ground. Especially notable is the downward outlook for the future local assessment which, in aggregate, is headed downward for the third month in the row.

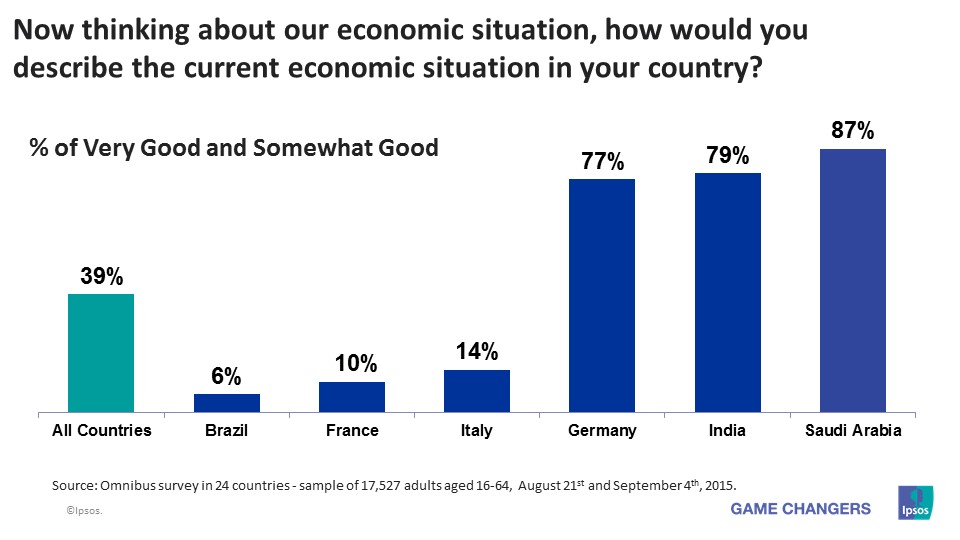

When asked to assess the current economic situation in their country, only 39% of global citizens rate it as “good”—with the aggregate score down two points since last month but falling back to where things were in March.. The biggest loser in this assessment category is Brazil. With their currency hitting an all-time low, only 6% of Brazilians assess their national economic situation as good—t he lowest score for that country since the inception of the Economic Pulse in 2010.

When asked to assess the economy in their local area, three in 10 (29%) global citizens rate it as “strong”, down one point since last sounding.

The outlook for the future local economy is down a point: only two in 10 (22%) global citizens expect the economy in their local area to be “stronger” in the next six months. This is the lowest average score in this category since October 2012.

Global Average of National Economic Assessment Down Two Points: 39%

Continuing its downward slide, the average global economic assessment of national economies surveyed in 24 countries is down two points as 39% of global citizens rate their national economies to be ‘good’.

Remaining at the top of the assessment despite losing points is Saudi Arabia (87%), followed by India (79%), Germany (77%), China (68%), Sweden (65%), and Australia (54%). For a second month in a row, Brazil (6%) has the lowest assessment score, followed by France (10%), Italy (14%), South Korea (14%), Hungary (16%), South Africa (16%), Spain (19%) and Mexico (21%).

Countries with the greatest improvements in this wave: Great Britain (53%, +5 pts.), Argentina (28%, +4 pts.), Italy (14%, +2 pts.) and Mexico (21%, +1 pts.).

Countries with the greatest declines: Turkey (28%, -11 pts.), the United States (42%, -6 pts.), Sweden (65%, -5 pts.), South Africa (16%, -5 pts.), Russia (34%, -4 pts.), Brazil (6%, -4 pts.), Saudi Arabia (87%, -3 pts.) Belgium (42%, -3 pts.), Japan (27%, -3 pts.) and Hungary (16%, -3 pts.).

Global Average of Local Economic Assessment (29%) Down Two Points

When asked to assess their local economy, 29% agree the state of the current economy in their local area is ‘good,’ on the global aggregate level. The local economic assessment is down two points since last sounding.

Down five points since last sounding, Saudi Arabia (60%) leads this assessment category with a narrow margin, followed by Israel (59%), Sweden (58%), Germany (56%), India (56%), China (49%), and Great Britain (36%). On the other end of the assessment, one in 10 (10%) rate their local economy as ‘good’ in Mexico, followed by South Africa (11%), Brazil (12%), France (12%), Hungary (13%), Italy (13%), South Korea (14%), Spain (15%) and Japan (15%).

Countries with the greatest improvements in this wave: Sweden (58%, +5 pts.), India (56%, +4 pts.), Israel (59%, +3 pts.), Canada (35%, +3 pts.), Italy (13%, +2 pts.), Great Britain (36%, +1 pts.), Spain (15%, +1 pts.) and South Korea (14%, +1 pts.).

Countries with the greatest declines: Mexico (10%, -13 pts.), South Africa (11%, -8 pts.), Turkey (23%, -8 pts.), Saudi Arabia (60%, -5 pts.), Russia (24%, -5 pts.), China (49%, -4 pts.), Brazil (12%, -4 pts.), the United States (35%, -3 pts.), Poland (21%, -3 pts.) and Hungary (13%, -3 pts.).

Global Average of Future Outlook for Local Economy (22%) Down One Point

The future outlook is down one point once again, as 22% of global citizens expect their local economy will be stronger six months from now.

India (62%) is the new leader in this assessment category, followed by Brazil (52%), Saudi Arabia (48%), China (47%), Argentina (35%), the United States (24%), Turkey (23%) and Mexico (22%). Remaining the lowest in this assessment again, a small minority in France (4%) expect their local economy to be strong six months from now, followed by Hungary (8%), Belgium (11%), Italy (11%), Sweden (11%), South Africa (11%) and Japan (12%).

Countries with the greatest improvements in this wave: India (62%, +6 pts.), South Korea (14%, +5 pts.), Israel (14%, +4 pts.), Canada (16%, +3 pts.), China (47%, +1 pts.), Great Britain (19%, +1 pts.) and Australia (16%, +1 pts.).

Countries with the greatest declines: Saudi Arabia (48%, -10 pts.), Russia (21%, -9 pts.), Mexico (22%, -8 pts.), Argentina (35%, -2 pts.), the United States (24%, -2 pts.), Poland (16%, -2 pts.), South Africa (11%, -2 pts.) and Hungary (8%, -2 pts.).

Citizens in 24 Countries Assess the Current State of their Country’s Economy for a Total Global Perspective

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)