The Economic Pulse of the World - September 2016

The local economic assessment is down one point since last sounding as three in 10 (30%) global respondents rate their local economy as “strong”. China (58%) takes over the leading position. Saudi Arabia (51%), who was the leader in this category last month, lost 11 points and fell to a fifth place behind Germany (55%), Israel (53%) and India (53%). Japan (11%) remains at the bottom of the assessment, sharing the lowest rating this time with Spain (11%).

The future local economic assessment is the only bright spot this month. This average is up one point since last sounding, with over one quarter (26%) global respondents expecting their local economy to become stronger. Despite losing four points since last sounding, Peru (65%) remains atop of this assessment category. All four Latin American countries have made the “highest this month” list (Brazil 59%, Argentina 53%, Mexico 32%), pushing the LATAM regional average up one point to 52%.

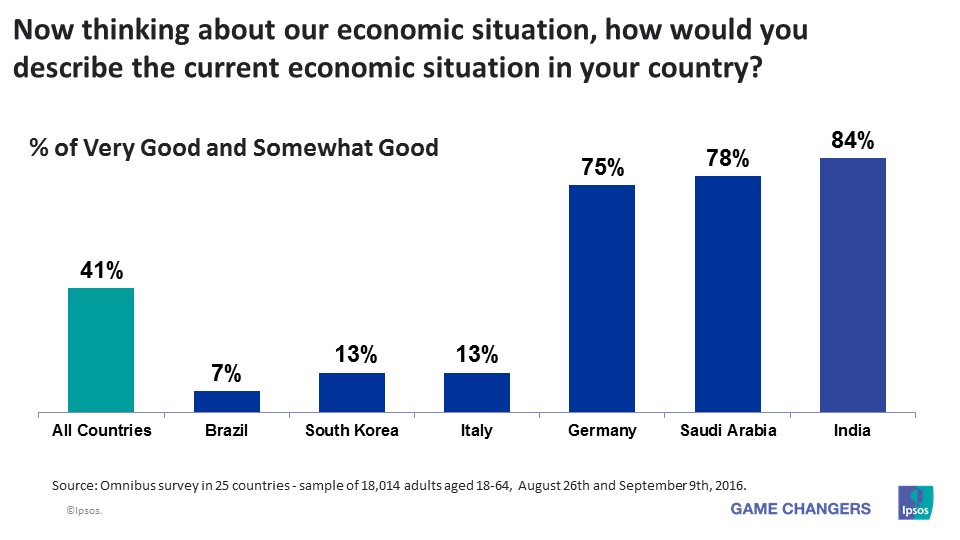

Global Average of National Economic Assessment Unchanged: 41%

The average global economic assessment of national economies surveyed in 25 countries remains unchanged with 41% of global citizens rating their national economies as ‘good’.

India (84%) moves into the top position in the national economic assessment category, followed by Saudi Arabia (78%), Germany (75%), China (72%), Sweden (70%), Peru (69%), Canada (56%), Australia (55%) and Israel (52%). Brazil (7%) hold the lowest spot in this months assessment, followed by South Korea (13%), Italy (13%), France (13%), Spain (16%), South Africa (17%), Argentina (18%), Mexico (20%) and Hungary (21%).

Countries with the greatest improvements in this wave: Peru (69%, +7 pts.), South Africa (17%, +5 pts.), Israel (52%, +4 pts.), Turkey (43%, +3 pts.), Japan (26%, +3 pts.), Great Britain (45%, +3 pts.), Sweden (70%, +2 pts.), Hungary (21%, +2 pts.), Poland (42%, +1 pt.) and India (84%, +1 pt.).

Countries with the greatest declines: Saudi Arabia (78%, -9 pts.), Brazil (7%, -5 pts.), Canada (56%, -3 pts.), France (13%, -3 pts.), Mexico (20%, -3 pts.), the United States (50%, -3 pts.), Belgium (37%, -2 pts.) and Italy (13%, -1 pt.).

Global Average of Local Economic Assessment (30%) Down One Point

When asked to assess their local economy, three in 10 (30%) of those surveyed in 25 countries agree that the state of the current economy in their local area is ‘good’. The local economic assessment is down one point since last month.

China (62%) takes over the top spot in the local assessment category, followed by Germany (55%), Israel (53%), India (53%), Saudi Arabia (51%), Sweden (48%), the United States (43%), Canada (39%), Peru (36%) and Turkey (36%). Spain (12%) and Japan (12%) are the lowest ranked countries this month, followed by Brazil (13%), South Korea (13%), Italy (13%), Argentina (14%), France (15%), South Africa (15%), Russia (17%), Mexico (17%) and Hungary (17%).

Countries with the greatest improvements in this wave: Turkey (36%, +7 pts.), South Africa (15%, +4 pts.), Peru (36%, +4 pts.), Germany (55%, +4 pts.), Canada (39%, +3 pts.), Hungary (17%, +2 pts.), Great Britain (30%, +2 pts.), Japan (12%, +1 pts.), Italy (13%, +1 pts.) and France (15%, +1 pts.).

Countries with the greatest declines in this wave: Saudi Arabia (51%, -11 pts.), Sweden (48%, -10 pts.), Israel (53%, -5 pts.), the United States (43%, -5 pts.), Spain (12%, -4 pts.), Brazil (13%, -3 pts.), Russia (17%, -3 pts.), Australia (34%, -2 pts.), Belgium (22%, -2 pts.), India (53%, -2 pts.), Mexico (17%, -2 pts.) and South Korea (13%, -2 pts.).

Global Average of Future Outlook for Local Economy (26%) Up One Point

The future outlook is up one point since last month, with over one quarter (26%) of global citizens surveyed in 25 countries expecting their local economy to be stronger six months from now.

Despite losing four points since last sounding, Peru (65%) is once again in the lead in this assessment category, followed by India (60%), Brazil (59%), Argentina (53%), China (52%), Saudi Arabia (47%), Turkey (32%), Mexico (32%), the United States (31%) and South Africa (20%). France (5%) has the lowest future outlook score this month again, followed by Belgium (8%), South Korea (9%), Japan (10%), Italy (10%), Great Britain (12%), Hungary (13%) and Australia (14%).

Countries with the greatest improvements in this wave: Sweden (15%, +4 pts.), South Africa (20%, +4 pts.), Mexico (32%, +4 pts.), Israel (18%, +4 pts.), Brazil (59%, +3 pts.), Russia (18%, +2 pts.), Japan (10%, +2 pts.), Italy (10%, +2 pts.), Hungary (13%, +2 pts.), Germany (15%, +2 pts.) and China (52%, +2 pts.).

Countries with the greatest declines in this wave: Saudi Arabia (47%, -5 pts.), Belgium (8%, -4 pts.), Peru (65%, -4 pts.), Poland (15%, -3 pts.), Spain (15%, -3 pts.), Australia (14%, -2 pts.), Great Britain (12%, -2 pts.) and the United States (31%, -2 pts.).

![[Webinar] KEYS: What can we learn from what happened in 2025?](/sites/default/files/styles/list_item_image/public/ct/event/2025-12/keys-webinar-what-happened-in-2025-carousel.webp?itok=1gJKCCxx)

![[Webinar] KEYS: THE MIDDLE CLASS: In Crisis?](/sites/default/files/styles/list_item_image/public/ct/event/2025-10/middle-class-family-dinner-food-carousel.webp?itok=iD1QyX8n)

![[Webinar] KEYS: Global Trends - The Uneasy Decade](/sites/default/files/styles/list_item_image/public/2025-09/image/minisite/keys0925.png?itok=3oAiYcxm)