Hard to call: The next election and the private sector

2015 looks set to be riddled with uncertainty for the UK’s private sector. With none of the main parties enjoying a convincing lead as they kick off their election campaigns, British business will need to pay close attention to the polls to see which party (or parties) are likely to be in power come May - and anticipate the policy decisions that could affect their ability to grow in the near future.

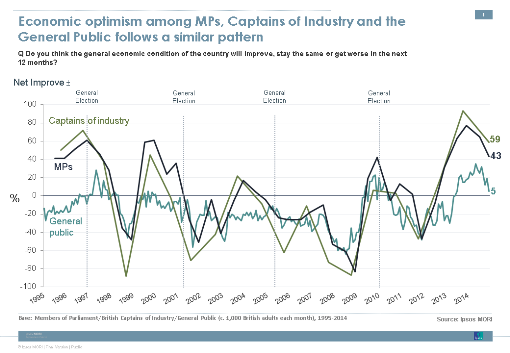

Towards the end of 2014, Westminster politicians, Captains of Industry and the public alike were still largely buoyant about the UK’s economic prospects, albeit entering 2015 with a slightly more cautious take on the state of play than a year ago.

This economic confidence, although now somewhat muted compared to the wave of optimism which followed the end of the recession, should in theory lead the private sector to expect growth in 2015 and beyond. However, despite this relatively positive outlook, the UK private sector faces myriad challenges and potential barriers to expansion. From geopolitical instability and falling oil prices to an upcoming general election with no clear outcome, growth in 2015 is far from certain. With election campaigning underway, businesses will be keen to see which policies are most likely to foster or stifle the climate for sustained growth. Back in the summer, Ipsos spoke with a representative cross-section of MPs to understand their perspective on the issues facing British businesses. While opinion often follows the traditional party divide, there are some useful indicators of where policy priorities may lie for the main parties.

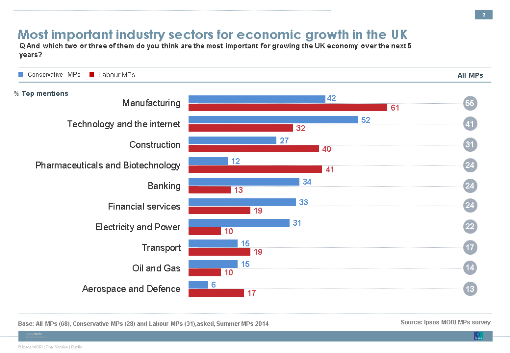

For instance, looking at the industry sectors which MPs see as most important to economic growth sheds some light on potential policy targets in the run-up to May 7.

Overall, over half of MPs (55%) regarded manufacturing as key to growth in the next five years, with Labour MPs notably more bullish than their Conservative counterparts (61% of Labour MPs saw manufacturing as important, compared with 42% of Tory MPs).

The IT sector has evidently caught the eye of the Tory party, with over half (52%) of its MPs citing the industry as important to the UK’s economic growth in the next five years. Many Conservative politicians also expect the financial sector to contribute to future growth, with one in three (34%) Tory MPs citing banking as important to the economy and a third (33%) regarding financial services as integral to the economy. Interestingly, electricity and power generation is also seen by many Conservatives (31%) as a key motor of economic growth. This suggests that energy policy might be a fairly prominent battleground in the run up to the election – perhaps unsurprising given Ed Miliband’s proposal to freeze energy prices last year, and the ongoing debate around privatisation and national infrastructure/utilities.

Priorities on the Labour benches are somewhat different. Manufacturing is clearly front and centre in their thinking, with three in five (61%) Labour MPs seeing this as the most important sector to economic prosperity. Interestingly, Labour MPs have high hopes for the pharmaceutical and biotech sector; two in five (41%) saw this sector as important to the economy over the next five years. With many UK businesses in the sector being involved in the wave of large scale mergers and acquisitions in 2014, Labour MPs may be expecting the recent growth in the UK pharma sector to continue. Labour MPs also have an optimistic view of the construction industry, with two in five (40%) seeing this as important to the UK, suggesting that Labour policy announcements in the coming months could be sympathetic towards construction projects around infrastructure and housing.

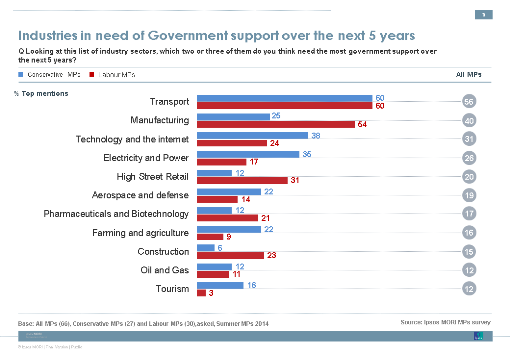

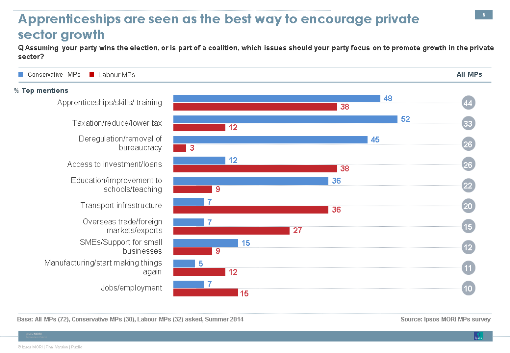

An expectation that a sector will boost the UK economy is one thing, but will a sympathetic audience in the House equate to support? Looking forward to the next parliament, the sectors that could expect support from the Government aren’t necessarily those that are seen as the most important to the economy. Given the importance of effective transport links as a catalyst for growth, it is perhaps unsurprising that transport is seen by over half (56%) as the industry sector most in need of assistance in the next five years – with no difference in opinion on this measure between the Labour and Conservative benches. That said, when asked what issues their party would focus on to promote private sector growth, Labour MPs are much more likely than Tory MPs to say they will focus on transport infrastructure (36% vs. 7% respectively). This suggests some very different outcomes on the horizon for the sector, depending on the form the Government takes in May.

There are signs that Conservative business and economic policy may primarily favour sectors they see as at the forefront of growth in the coming years. Nearly two in five (38%) see IT as in need of Government support, alongside electricity and power, which is cited by one in three (35%) Tory MPs. Interestingly, while not seen as vital to growth, two sectors are relatively prominent among the Tories as needing Government assistance. While just six percent of Conservative MPs saw aerospace and defence as one of the most important sectors for growth, one in five (22%) felt that the sector needs support. Furthermore one in five (22%) Tory MPs also expected to provide support for the farming and agriculture sector despite just one percent saying that it is an industry vital to growth. Clearly, Conservative MPs believe this is an industry in need of help in the next few years and are also keen to keep their constituents, many of them from rural areas, content.

Driven largely by Labour MPs, there is also an appetite for providing support to the manufacturing sector. Overall, two in five (40%) feel this sector needs support, rising to over half (54%) among Labour MPs, but just one in four (25%) on the Tory benches. High street retail, while not cited by Labour MPs as one of the most important sectors to the economy, is seen as in need of some Governmental care and attention by three in ten (31%) Labour parliamentarians. Nearly one in four (23%) Labour MPs also felt that the construction sector could do with Government support in the short term – which would certainly be a good move to woo a core segment of their traditional support base.

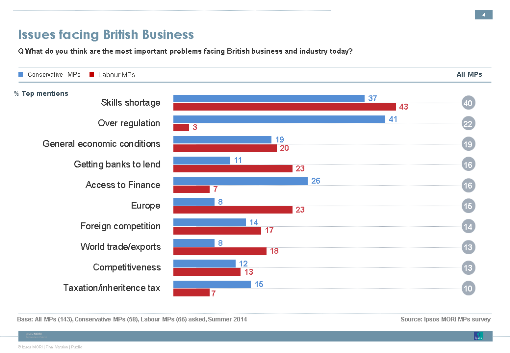

Overall, however, a skills shortage in the workforce was seen as the most pressing issue for British business. Two in five MPs (40%) said this was the most important problem facing businesses. Interestingly, there was little difference in opinion along party lines. Nearly two in five Tories (37%) and just over two in five Labour MPs (43%) felt this was the case. Just over two in five (44%) MPs overall suggested that a focus on apprenticeships, training and skills development would be a key part of their policy to promote private sector growth. Notably, over one in three (36%) Conservative MPs favoured steps to improve education and schools to boost private sector expansion, compared with just one in eleven (9%) Labour MPs.

Conservative MPs unsurprisingly saw over-regulation as the main issue affecting private sector business – two in five (41%) cited this as a leading problem. A similar proportion (45%) said that the Conservative party would focus on deregulation and the removal of red tape to help boost growth. However, reduced taxation was by far the most popular method of promoting growth in the Tory camp, mentioned by over half (52%).

In contrast, just under one in four (23%) Labour MPs regarded getting banks to lend as one of the most important problems for business and two in five (38%) cited access to investment/loans as their preferred means of giving the private sector a boost, alongside improvements to transport infrastructure (36%).

In conclusion, opinion is often aligned on both sides of the house in terms of the issues facing British business, as well as the sectors that are most important to UK economic growth and those that need support. However, there are also some key ideological differences. These relate particularly to regulation, taxation, government support for business and the availability of skilled workers. These differences (which may well be amplified with certain combinations of coalition governments) have the potential to exert a profound impact on policy and therefore the political, social and economic climate in which businesses operate after the election. All of this means that businesses will need to pay close attention to the election campaign and be ready to harmonise their strategy with government policy.

Ipsos’s MPs' survey runs twice annually, interviewing a representative sample of c.100 MPs from the UK House of Commons. Interviews are conducted face-to-face.