Inheritance tax seen as an unfair tax but others are prioritised for cuts

- Public most likely to see inheritance tax, fuel duty and council tax as the most unfair taxes.

- But when asked to prioritise which taxes should be cut, income tax for lower earners, council tax and VAT are the most preferred.

New Ipsos polling, conducted in June, looks in-depth at public understanding of tax and perceptions of which taxes are fair and unfair. The research also explores which taxes the public think should be prioritised for cuts if they are possible or increases if they are needed.

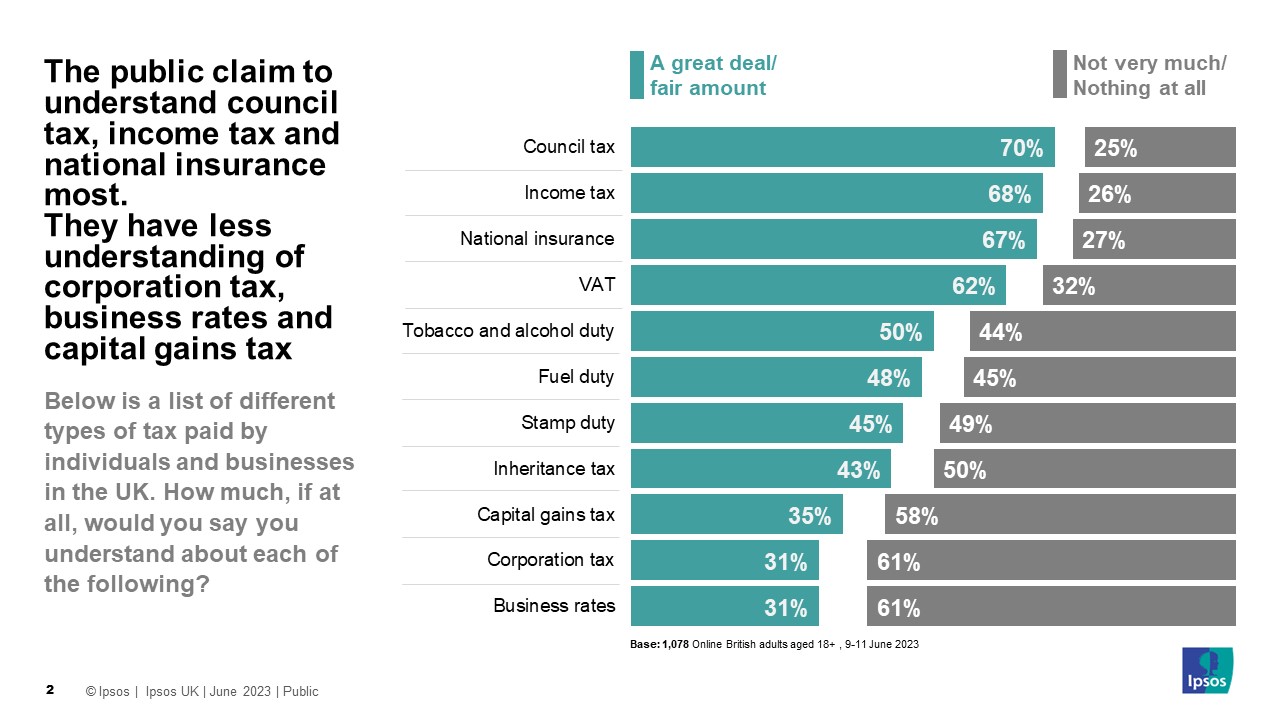

Understanding of tax

- Not all taxes are equally understood. Two-thirds or more claim to understand a great deal or fair amount about council tax (70%), income tax (68%) and national insurance (67%) but less than four in ten understand at least a fair amount about capital gain (35%), corporation tax (31%) and business rates (31%).

- When asked to rank which taxes raise the most and least money, public understanding is broadly accurate with a fair amount of confusion too.

- Respondents were asked to rank the 11 taxes above from most revenue raised to least.

- The average ranking was broadly correct but one in four (24%) said they didn’t know and some ranked different taxes well outside their correct position. For example, around one in five put fuel duty (22%) and tobacco / alcohol (18%) in the top three and around one in ten put income tax (9%) and national insurance (11%) in the bottom three.

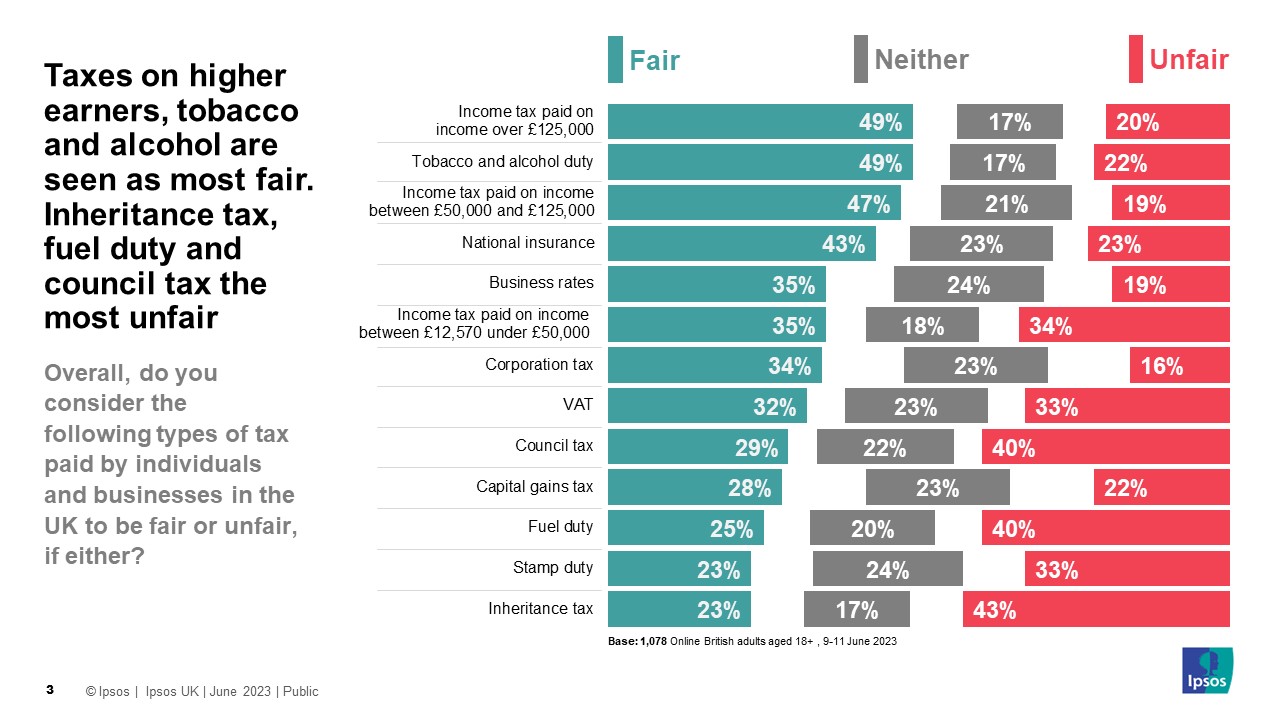

Which taxes are fair and unfair?

- Income tax for high earners (over £125,000) and tobacco / alcohol are most likely to be seen as fair (both 49%), followed by taxes on those earning between £50,000 and £125,000 (47%).

- The taxes seen as most unfair include inheritance tax (43%), council tax and fuel duty (40%) are seen as most unfair.

- In absolute ‘net’ terms e.g. subtracting the proportion saying unfair from fair, inheritance tax stands out with a score of -20. Reflecting that 43% find the tax unfair and just 23% fair. Fuel duty scores -15 and council tax -11.

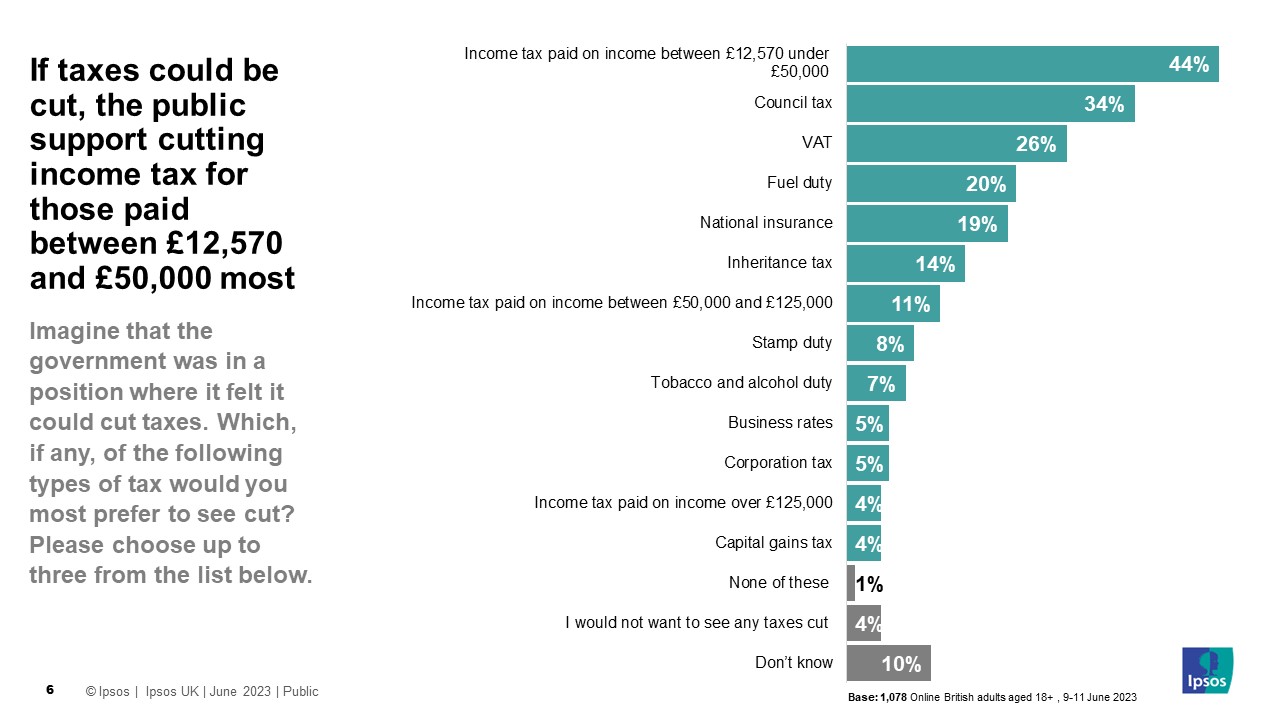

Which taxes should be prioritised for cuts?

- When asked to prioritise which taxes they would prefer to be cuit should the option be available the public’s preference is for income tax paid on incomes between £12,570 and £50,000 to be cut (44%). This is followed by council tax (34%) and VAT (26%).

- 2019 Conservative and Labour voters are broadly aligned on the subject in that both put taxes for low earners top of the list (46% and 47% respectively).

- However, 2019 Conservative voters put council tax second (36%) and fuel duty third (33%). 2019 Labour voters put council tax second (32%) and VAT (24%) and national insurance (23%) effectively joint third.

- Inheritance tax ranked 6th on the list overall (14%), with little difference in scores between 2019 Conservatives (16%) and Labour (12%) voters.

Which taxes should be increased if they had to be?

- In the event taxes needed to be increased, the public most prefer they were done so on higher income individuals e.g. those earning over £125,000 a year (41%). Corporation tax (24%) and tobacco / alcohol duty (22%) rank second and third.

- 2019 Conservative and 2019 Labour voters essentially prefer the same three taxes here. Although 2019 Labour voters are more likely to choose taxes on higher earners (48% to 41%) and 2019 Conservatives rank tobacco and alcohol duty (29%) ahead of corporation tax (24%).

- One in five 2019 Conservative voters would prefer to see no tax rises at all (21%).

Ipsos Director of Politics Keiran Pedley said:

These findings show the complexity of public opinion on inheritance tax. On the one hand, it is seen to be one of the most unfair taxes, along with council tax and fuel duty. On the other, when it comes to prioritising tax cuts, the public tend to prefer cuts to council tax and fuel duty than inheritance tax; and cutting taxes on lower earners most of all.

Technical note:

Ipsos interviewed a representative quota sample of 1,078 adults aged 18+ in Great Britain. Interviews took place on the online Omnibus between 9th and 11th June 2023. Data has been weighted to the known offline population proportions. All polls are subject to a wide range of potential sources of errors.

- View more economic and political trends from Ipsos.