The Lloyds Bank Lending Report

The Lloyds Bank Lending Report provides a robust and representative sample of the entire UK market and its essential lending behaviours amongst UK bank account holders aged 18 - 75 who hold at least one type of unsecured debt.

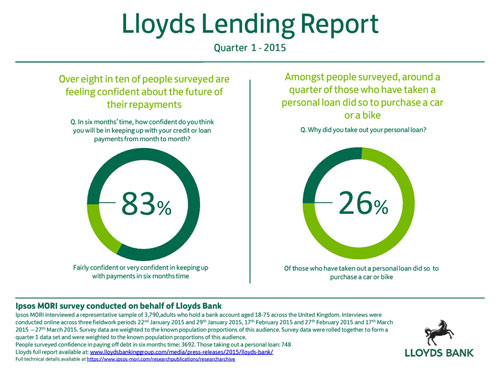

The Lloyds Bank Lending Report is derived from independent consumer research. This provides a robust and representative sample of the entire UK market and its essential lending behaviours amongst UK bank account holders aged 18 – 75 who hold at least one type of unsecured debt. The survey is run by Ipsos on behalf of Lloyds Bank.

- Total interviews = 3790 (Male interviews = 1819, Female =1971)

- Participants aged 18-75

- Ipsos Omnibus Nationally representative sample

Download Quarter 1 Topline Tables PDF

Technical note:

- Ipsos interviewed a representative sample of 3,790 adults aged between 18-75 who hold at least one type of unsecured debt

- Interviews were conducted online between three fieldwork periods, 22nd January 2015 - 29th January 2015, 17th February 2015 – 27th February 2015 and 16th March – 27th March 2015. Survey data were rolled together to form a quarter 1 data set and were weighted to the known population proportions of this audience.

- Where results do not sum to 100, this may be due to computer rounding, multiple responses or the exclusion of don't know/ not stated answers.

- All interviews were conducted online and survey data are weighted to the known population proportions of this audience, including age, gender, region, working status and social grade.