Open Banking – are consumers ready?

The European Union’s PSD2 directive and ‘Open Banking’ in the UK are touted to cause the biggest upheaval in the financial landscape for a generation. Banks, with a customer’s permission, will have to grant third-party providers access to online account and payment services data. The banks will no longer ‘own’ their customers’ data and both they and other companies will be able to use it to potentially provide new and innovative products and services. To examine what the public thinks about that prospect, Ipsos surveyed 14,852 adult bank account holders across 15 countries.

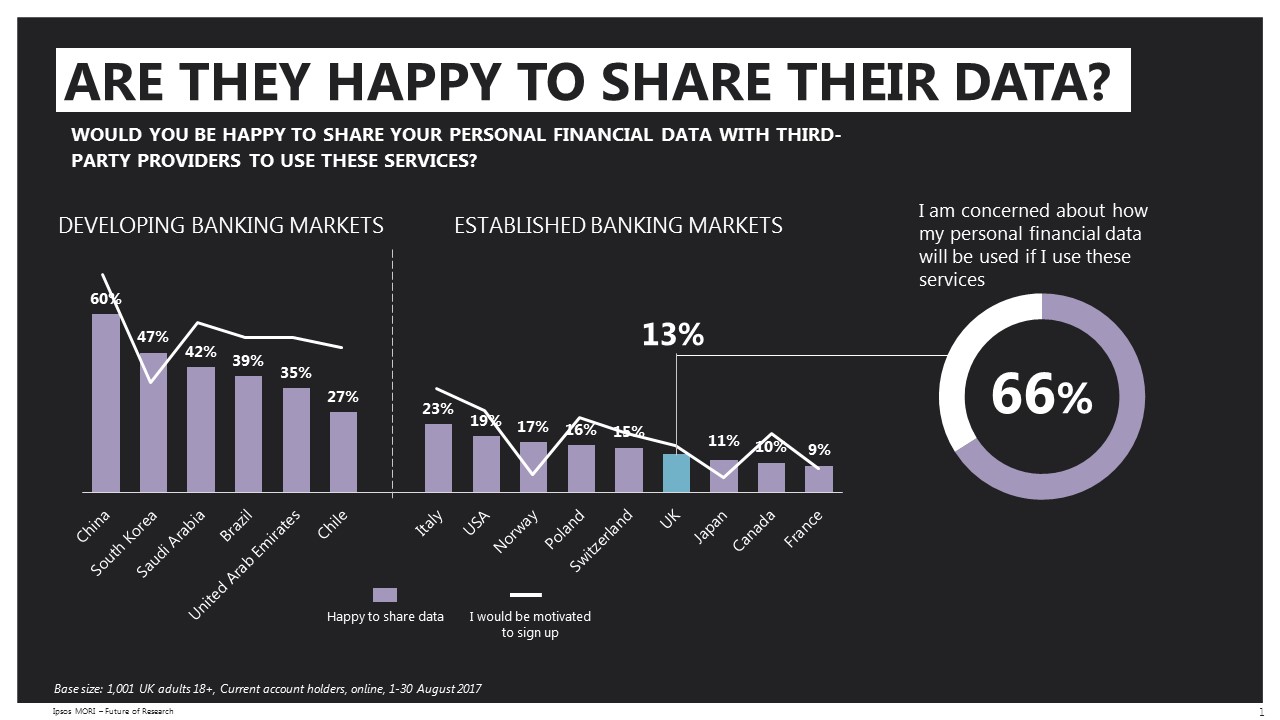

The survey showed that 63% of UK respondents see the forthcoming developments as ‘unique’ – or in other words new and promising – to them. However, it also indicated that while one in five (21%) people in the UK would be motivated to sign up to such platforms, just 13% would be happy to share data with third parties at this time. Only France, Canada and Japan were more cautious about the idea of sharing their data.

Many people reported using products spread across multiple banks, while 41% of global respondents hold more than one financial product with their main bank. These factors possibly contributed to the all-in-one platform being considered the most popular scenario. In total, 57% of all respondents to the survey found the idea appealing. However, UK respondents were more uneasy than average about the idea of having everything accessible from a single point, with more than half (55%) finding the idea unappealing. This fits with the UK’s wider opinion of the Open Banking concept, where two-thirds (66%) of people would be concerned about how their personal financial data might be used.

Many people reported using products spread across multiple banks, while 41% of global respondents hold more than one financial product with their main bank. These factors possibly contributed to the all-in-one platform being considered the most popular scenario. In total, 57% of all respondents to the survey found the idea appealing. However, UK respondents were more uneasy than average about the idea of having everything accessible from a single point, with more than half (55%) finding the idea unappealing. This fits with the UK’s wider opinion of the Open Banking concept, where two-thirds (66%) of people would be concerned about how their personal financial data might be used.

Paul Stamper, UK Head of Financial Services, Ipsos, said:

January’s new legislation is set to have a meaningful and long-lasting impact. It may take longer to become fully embedded in countries with more traditional, entrenched banking systems, such as the UK, France and Italy, where it seems people are less likely to immediately embrace change. However, the sorts of products and services which Open Banking makes possible will provide financial consumers with improved services and exciting new products.

This data suggests that, although the nation tends to be more tentative at first, once appealing innovations become reality and early adopters take the lead, the theoretical interest shown should translate into more widespread adoption.

Take, for example, mobile contactless payment, which topped £370m in the first six months of 2017, a 336% year-on-year rise. This giant leap in usage suggests people need both time and exposure to adjust to new financial innovation. A large part of this might be having ‘second-hand’ experience of the technology, seeing early adopters who have already embraced it use the systems in the real world, rather than reading about the theory – and therefore associated risks.

While early adopters are likely to immediately embrace the new technology, it will take time for them to become as mainstream as online and mobile banking, for example.

Encouragingly for the traditional banks, 77% of all participants stated that they would see them as their most trusted provider for the four concepts tested, a far higher percentage than newer banks (19%) and fintechs (5%).

Stamper said:

In order for people in the UK to adopt the new opportunities offered by Open Banking, financial providers will have to convince them of the relevance and practicality of their innovative new services. Banks have been cautioning us for years about the need to keep our personal banking data secure. Open Banking means that message is going to need modifying and consumers will have to be persuaded to change their attitudes and behaviours. The potential is clearly huge but it will require effort to realise it.

-

For more information on the full report, please contact Michael Drinkwater.

Technical note

An online quantitative study was carried out between 1 August and 31 August 2017.

The total number of participating countries was 15:

UK / US / Brazil / Canada / Chile / China / France / Italy / Japan / Norway / Poland / Saudi Arabia / Switzerland / South Korea / United Arab Emirates.

The study consisted of 14,852 interviews in total, with a target of 1,000 in each market through an online questionnaire, with a nationally representative sample of consumers aged 18+ and who hold an active current account, either personally or jointly. Data is weighted in Switzerland, UAE and Saudi Arabia to the known profile of the population in each country. For the remaining countries a quota sample was interviewed with quotas set by age, gender, region and income by country.

Respondents were introduced to four Open Banking use cases that may be available in the future, and we asked questions surrounding the appeal, concerns, as well as who they would trust and expect to provide these services. As part of the analysis, consumers have also been categorised into segments based upon their tech savviness, knowledge of digital payments and personal attitudes to life.

About Open Banking

The second payment services directive (PSD2) is a law set to revolutionise the payments industry in Europe. It will mean that banks must grant third-party providers access to a customer’s online account/ payment services data with the customer’s permission. The bank will no longer ‘own’ the customer’s data and companies will be able to use that data to potentially provide better products and services.

An API (Application Programming Interface) is a software intermediary that makes it possible for application programs to interact with each other and share data. APIs encourage third party developers to innovate and create new ways to use software products. APIs will facilitate Open Banking and allow for the development of new tools and services to help people manage their finances.