The anticipatory friction behind the vibe shift on Trump

Insights into the New America brought to you by Clifford Young and Bernard Mendez

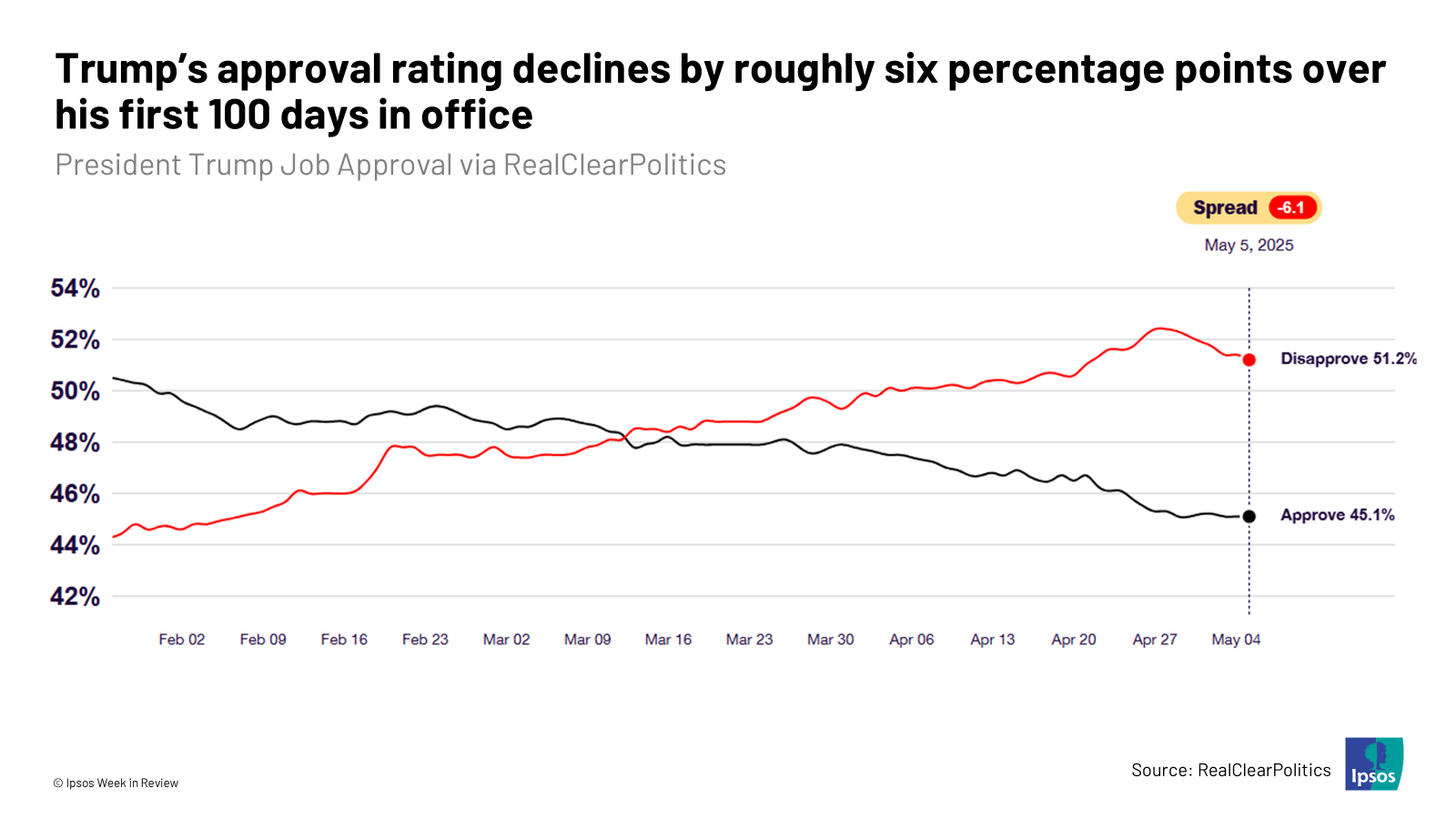

After their first 100 days in the White House, U.S. presidents typically watch their approval ratings decline by about three percentage points as their “honeymoon” period wanes and the impacts of their policies set in.

In his first 100 days, President Donald Trump has seen double that. Trump’s approval rating declined by roughly six percentage points over the first 100 days of his second term, according to RealClearPolitics.

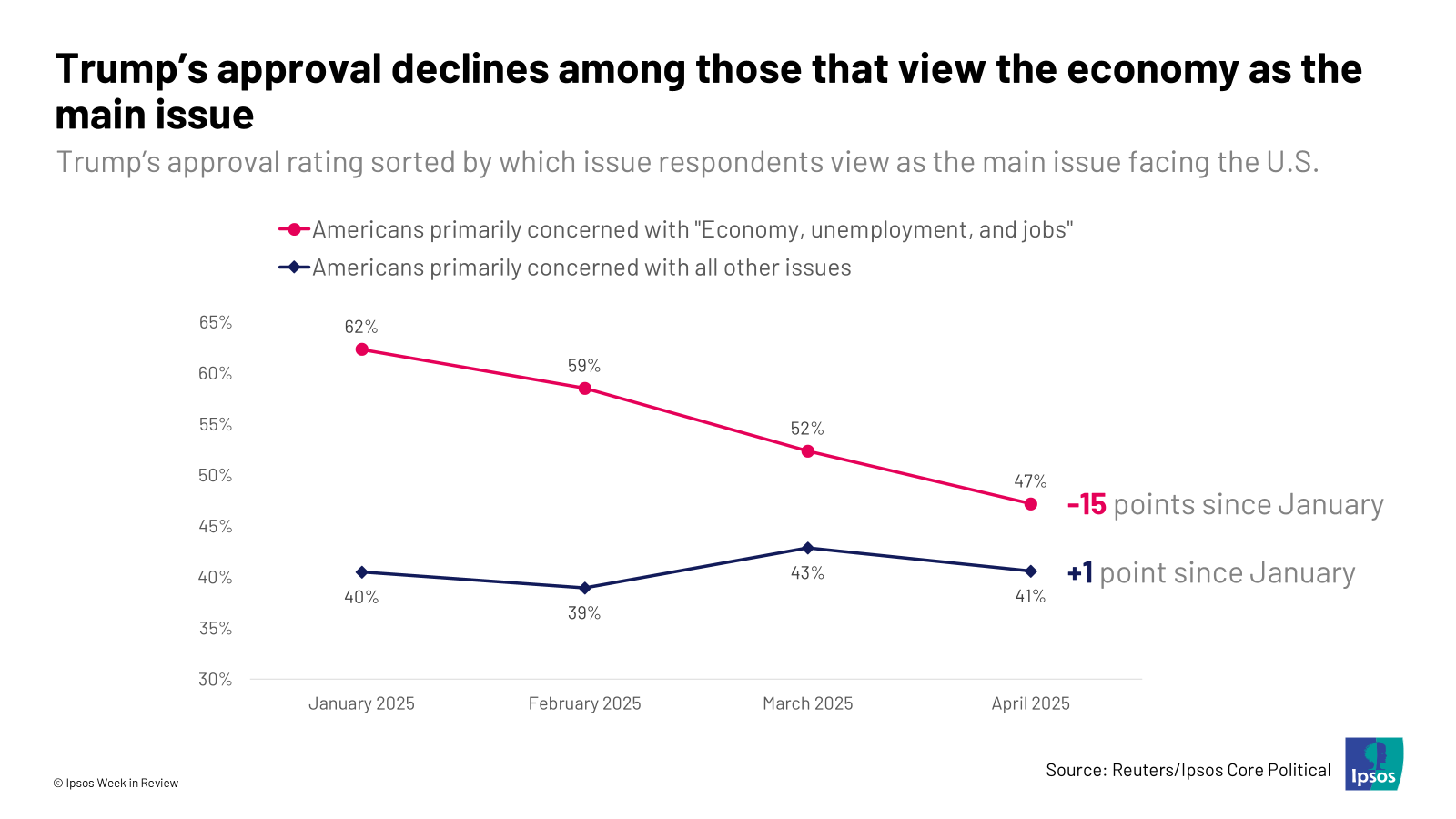

New analysis of Ipsos polling shows that much of this decline is driven by Americans that view the economy as the primary issue facing the country. But this presents a contradiction: unemployment and inflation have remained relatively stable under Trump 2.0. And historically, approval ratings don’t tend to decline until inflation crosses 5.9% or unemployment rises above 7%. What gives?

This looks like anticipatory friction. The public isn’t reacting to current pain—they’re reacting to what they think might happen. Anxiety is building around looming tariffs, rising inflation, and the threat of economic confrontation. Not because anything has been damaged, but because damage feels imminent.

Below are five charts on Trump’s approval rating, uncertainty, and the anticipatory friction behind it all.

- The honeymoon has ended. The drop in Trump’s approval rating has exceeded the average post-inauguration drop by about three percentage points. What’s behind this mood shift?

- The economy-minded sour on Trump. Trump’s approval has slipped notably among Americans that view the economy as the main issue facing the country. But this comes even as factors like inflation and unemployment remain practically unchanged under Trump. Of course, the stock market has taken a slight tumble. But there’s more to this story.

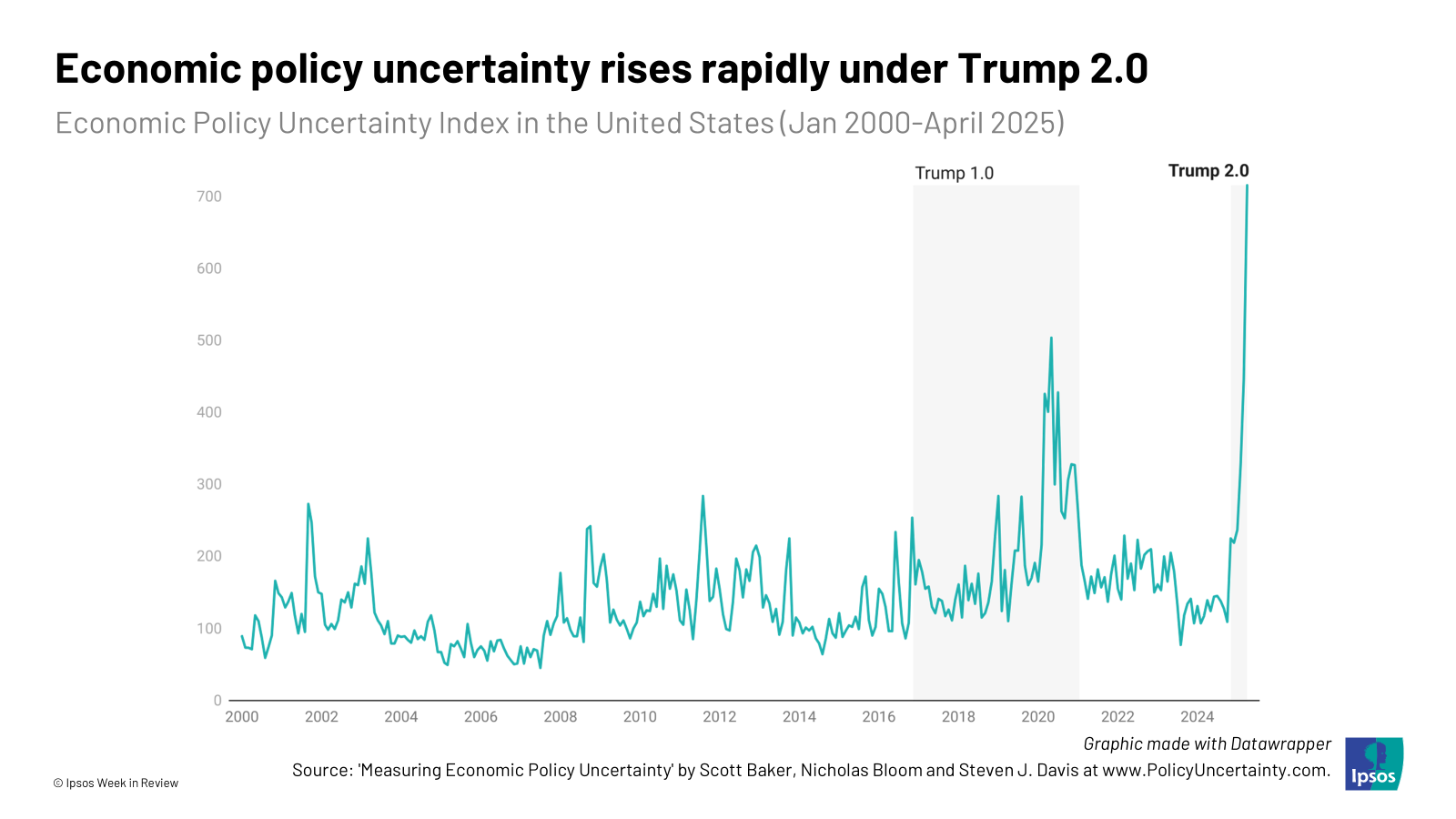

- Spike in uncertainty. The Economic Policy Uncertainty Index, which tracks how often newspapers mention terms related to both economic policy and uncertainty, has soared to unprecedented heights under Trump. The EPU Index can also be understood as a Friction Index, a real-time gauge of how much strain the political system is under, based on rising ambiguity and instability in elite signaling. And right now, it’s flashing red.

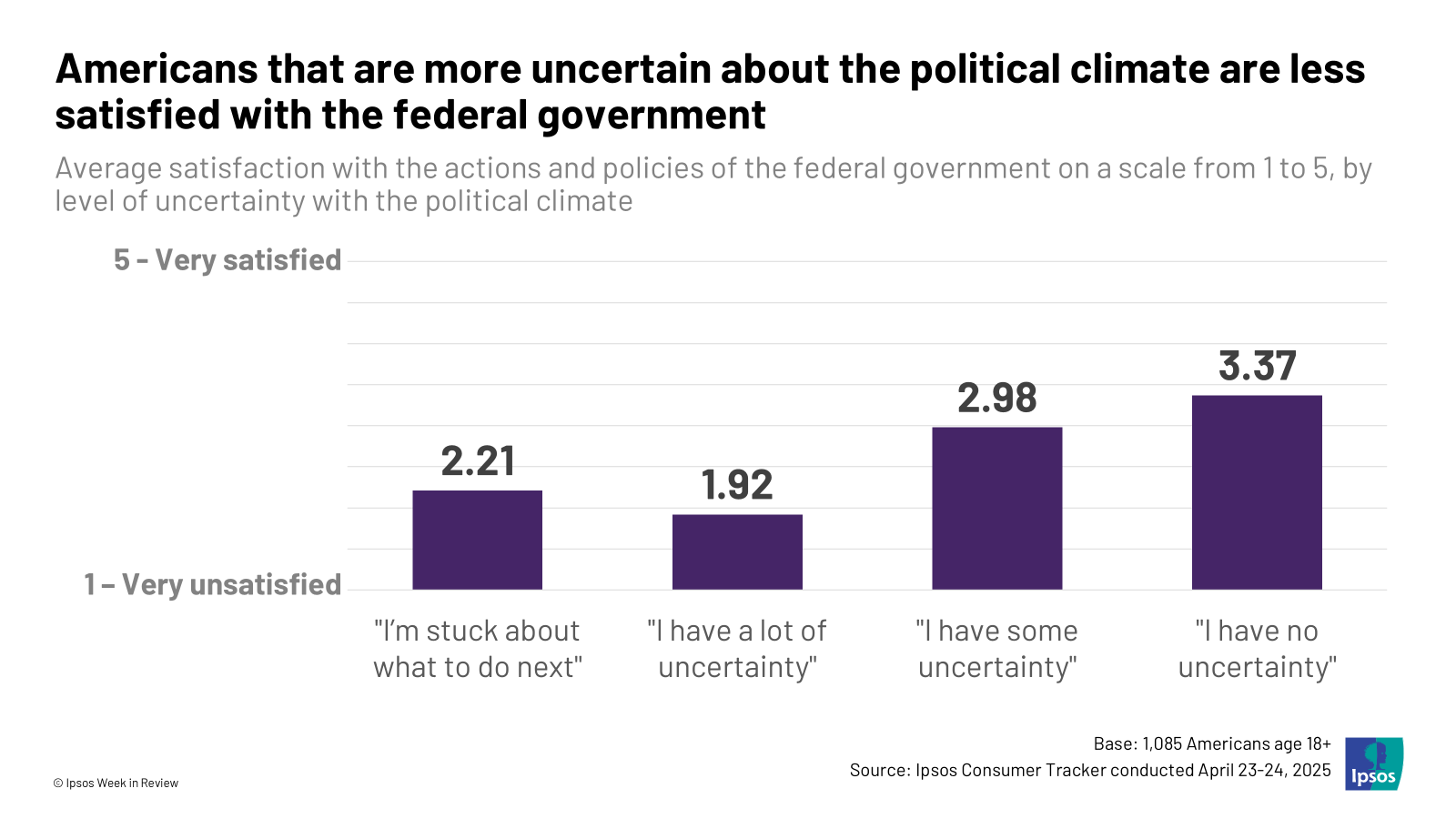

- Anticipatory friction. Evidence that uncertainty and approval ratings go hand in hand: Americans that express more uncertainty about today’s political climate are much less likely to be satisfied with the federal government’s policies. If Trump can reach a resolution on trade policy, can he win some of these Americans back?

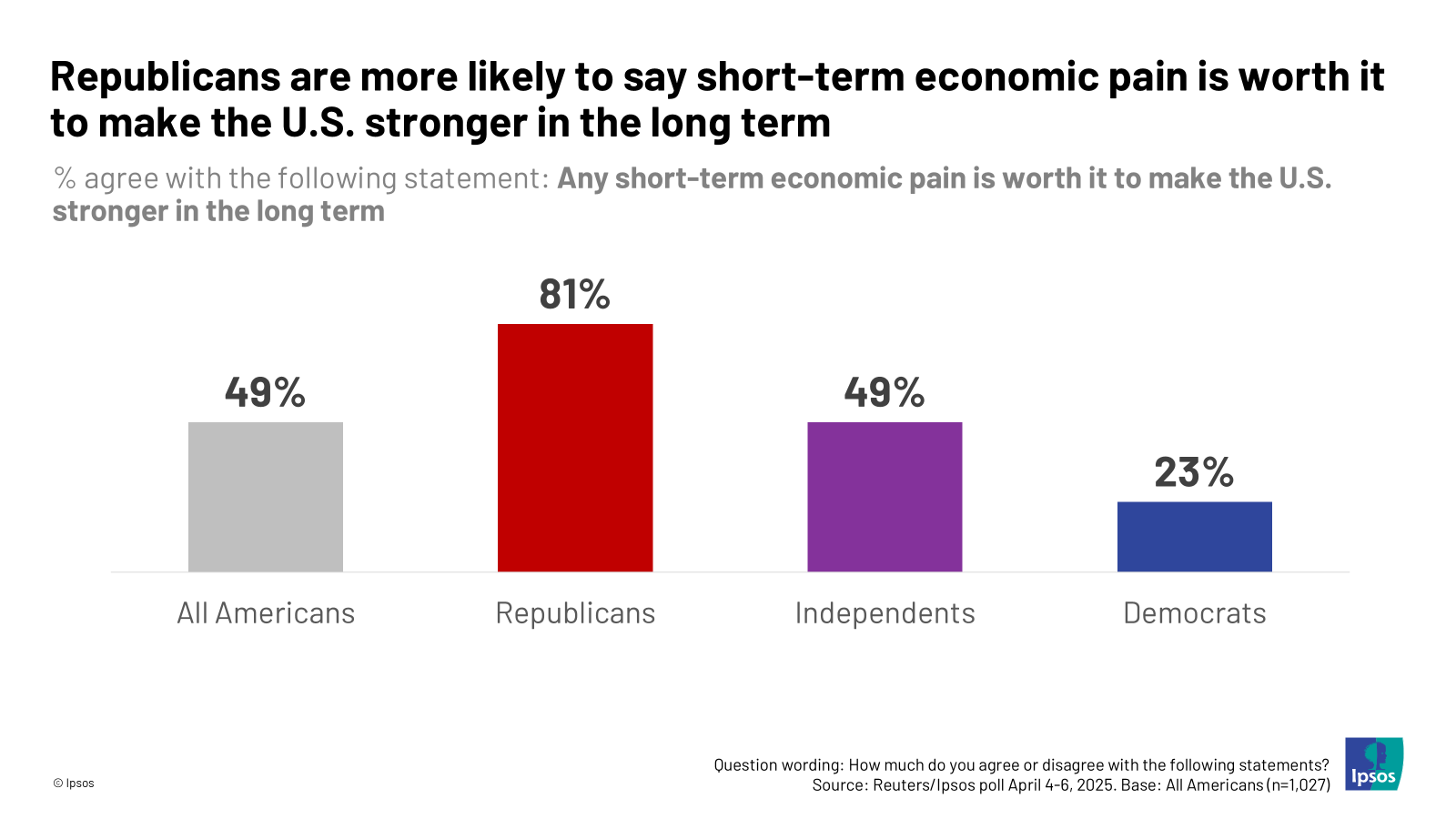

- Not everyone is ready for this ride. Trump, for his part, has been clear that his quest to reshape global trade might be bumpy. For Trump’s base, this is par for the course. The other side of the political aisle isn’t as ready to accept short-term hardship. Ultimately, this is the root of the friction.

Trump is pushing hard on trade. But in doing so, he’s testing the limits of public tolerance. Some Americans may accept some short-term hardship if they believe in long-term benefits. But that willingness has a ceiling. And right now, it’s being tested.

That said, this period of heightened uncertainty likely won’t last forever.

What comes next? Well, that’s uncertain. But we can make an educated guess that the nation’s mood will likely track closely with the direction of the economy. If tariffs lead to an economic downturn, even if temporary, expect the mood to continue to sour. If Trump is able to negotiate his way through his tariff battles and come out ahead, he may be able to reverse the losses of his first 100 days.